Deep Dive: Duolingo (DUOL): Is now the time to consider owning the stock?

The owl that prints cash (and never sleeps). "Hoot!"

New to The Atomic Moat? This analysis of Duolingo ($DUOL) is a prime example of how we dissect high-quality compounders. If you want these deep dives sent to your inbox, join 900+ other investors below.

I remember the first time I ever tried the Duolingo app. It was to learn Italian back in 2019 when me and my girlfriend went to Rome one hot summer. I thought the app was a new and exciting way to learn the language back then.

And my Italian knowledge today is, ehm…

…alright, alright, I have forgotten every single word I learned, except “pane” (bread) for some reason.

But that’s not the point.

I recently picked it up again to learn Spanish, and I was really impressed with their new functions and how much it has improved since last time.

But do you want to know what is even more impressive? Their cashflow. And when I discovered this, I thought the company might deserve a thorough deep dive.

So, here I present; The Duolingo deep dive.

It looks to me that Duolingo is what happens when a consumer app quietly figures out how to act like a serious cash-generating business, without losing its sense of humor (or that owl-shaped menace that haunts your lock screen).

If You’re In a Rush

What they actually do: Duolingo sells language learning (and now they’re branching into other “subjects”) primarily through subscriptions. They sprinkle in a smaller mix of ads, in-app purchases, and the Duolingo English Test.

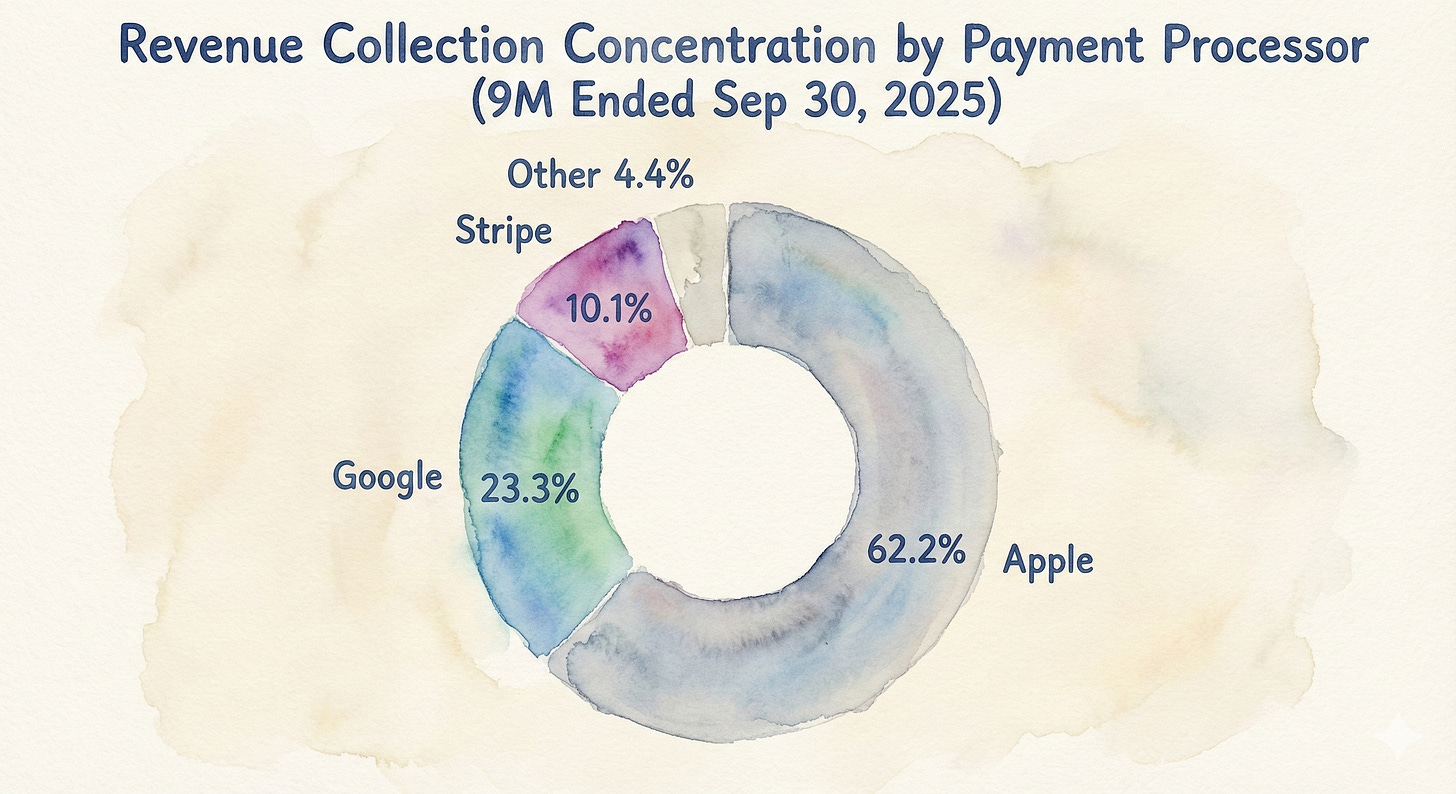

Why people hate it: The whole story sits on two fragile things that don’t show up neatly on a balance sheet: user engagement and distribution control. They live on rented land: Apple, Google, and Stripe processed 62.2%, 23.3%, and 10.1% of total revenues respectively. That’s a lot of power in someone else’s hands.

What fixes it: They need to keep those Daily Active Users (DAUs) and paid subscribers compounding while keeping a lid on AI and hosting costs. We don’t want those costs eating the lunch.

Atomic Take: Duolingo’s operating machine looks real. The only question is whether the engagement engine stays “unfair” as AI costs rise and that dependence on the app stores gets louder.

Falsifier: If DAUs fall below 30% YoY for two consecutive quarters (metric: company-reported DAUs YoY %), the thesis is broken.

Disclaimer: I own shares in Duolingo (and be sure to have this in mind when you read the deep dive).

The Setup

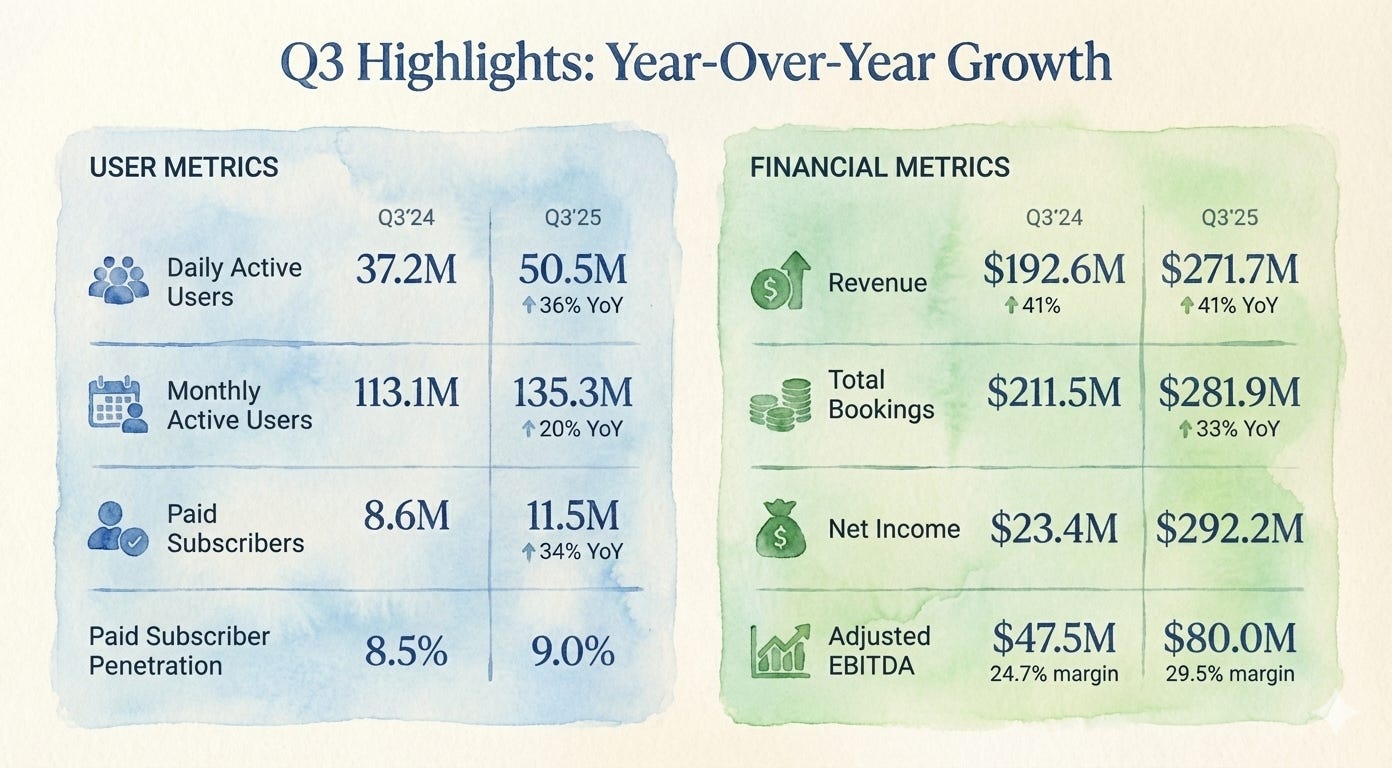

Here’s the “why now” in plain English: Duolingo crossed 50.5 million DAUs (Q3 2025, users) while printing $271.7 million of revenue.

Even better, they generated $77.4 million of free cash flow. That is a lot of cash for a language app.

Under the hood, the money-making side kept climbing, too.

Paid subscribers hit 11.5 million and the penetration rate (the number of monthly users who actually pay up) rose to 9.0% of LTM MAUs.

Stop & Think: Getting 9 out of every 100 casual users to open their wallet for a free app is harder than it sounds. That number is the pulse of the business.

Why Smart People Disagree

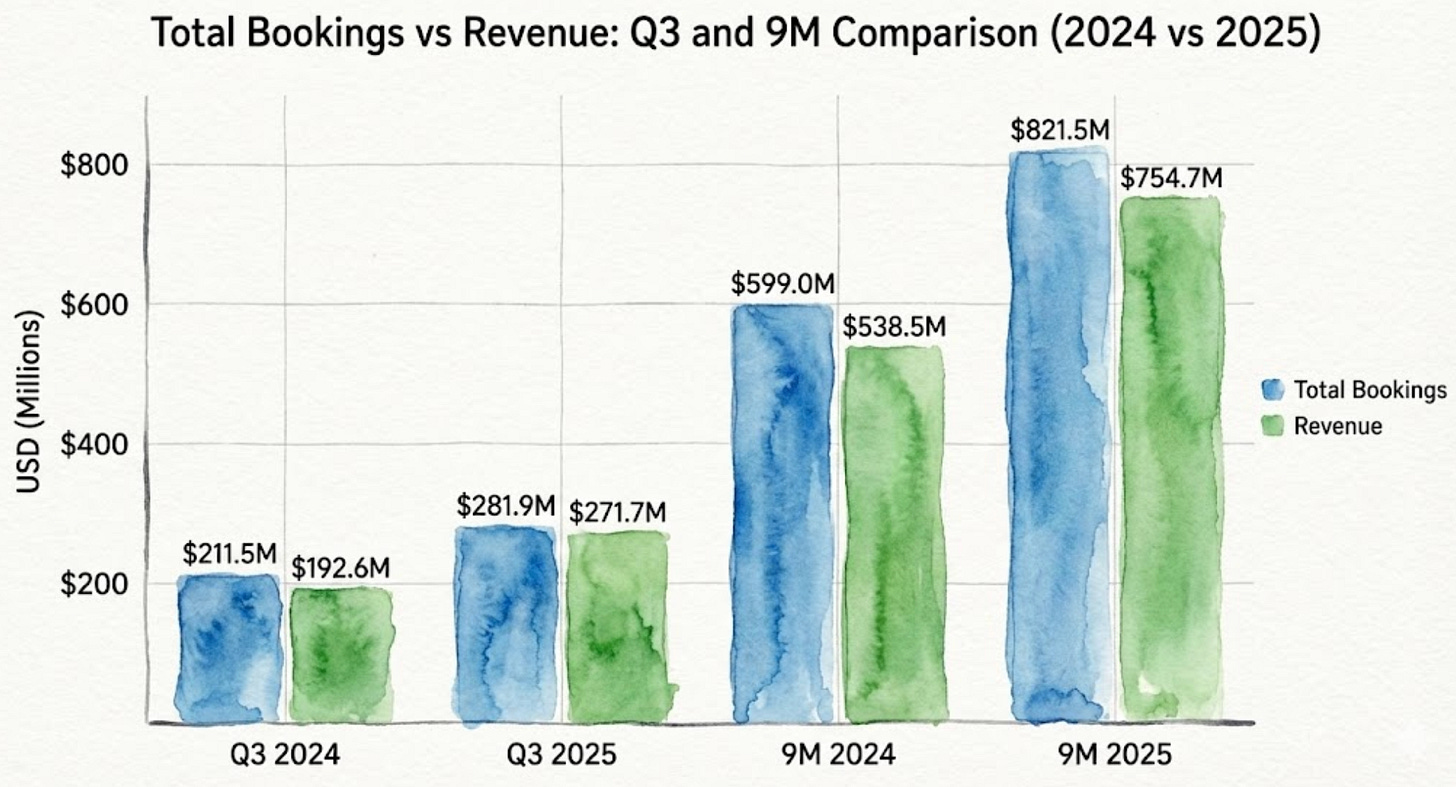

Revenue grew 41% YoY to $271.7 million and total bookings grew 33% YoY to $281.9 million.

The bull case? Bulls see a subscription-first consumer product with a widening moat built on “habit + brand + constantly tweaking the product.” They see a profit margin that can expand even while they invest in the future.

And let’s not forget the bear case: Bears see a platform-risk consumer app where three things go wrong:

Apple and Google take their heavy toll.

AI costs push that gross margin down.

Engagement is a fickle god that demands constant sacrifice. Users get bored.

What to MONITOR: Watch subscription bookings growth versus DAU growth. If the bookings momentum disconnects from the engagement, the “pricing power” story weakens. For the record, Q3 2025 subscription bookings were $240.3 million, up 36% YoY.

Atomic Take: This is a quality story with one rule: the KPIs are the product, and the product is the KPIs.

The Falsifier: If Paid subscribers decline sequentially (metric: period-end paid subscribers, company-reported), we have a problem.

How the Business Actually Makes Money

Let’s start with the boring truth: Duolingo is a revenue recognition story masquerading as a meme brand.

They generate cash primarily from subscriptions (monthly and annual; plus the family plan annual), plus advertising, in-app virtual goods, and the Duolingo English Test.

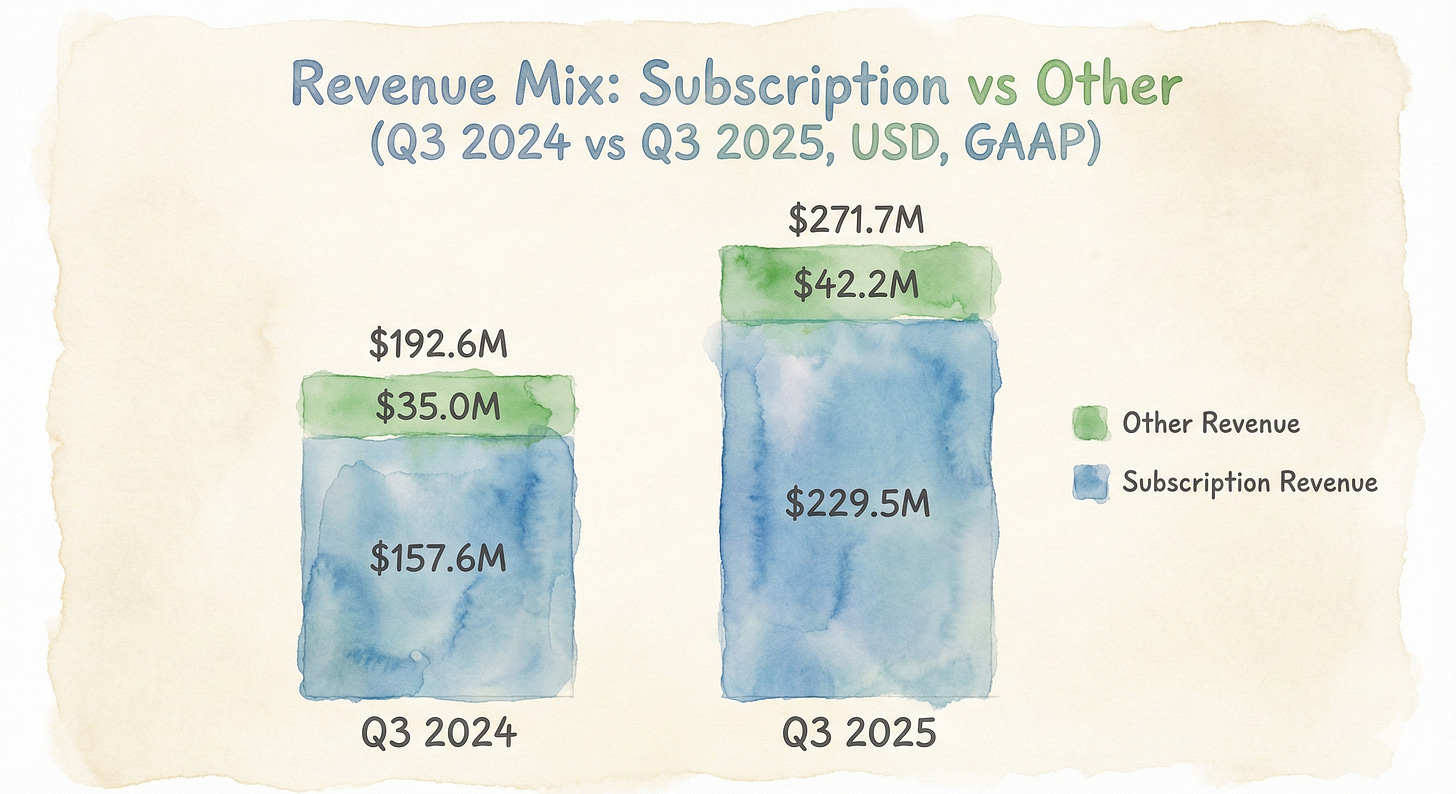

In Q3 2025, subscription revenue was $229.5 million out of total revenue $271.7 million. Do the math, and that’s roughly ~85% subscription by revenue mix.

“Other revenue” is real, but let’s be honest, it’s not driving the reactor:

Advertising revenue: $21.0 million

Duolingo English Test: $9.6 million

In-App Purchases: $11.1 million

So, what is “bookings” doing here?

It’s the cash signal that matters when you sell time-based subscriptions, especially annual plans. Deferred revenue is the accounting proof that cash is arriving before the GAAP revenue does. It’s the best kind of liability—money you’ve already collected for work you haven’t done yet.

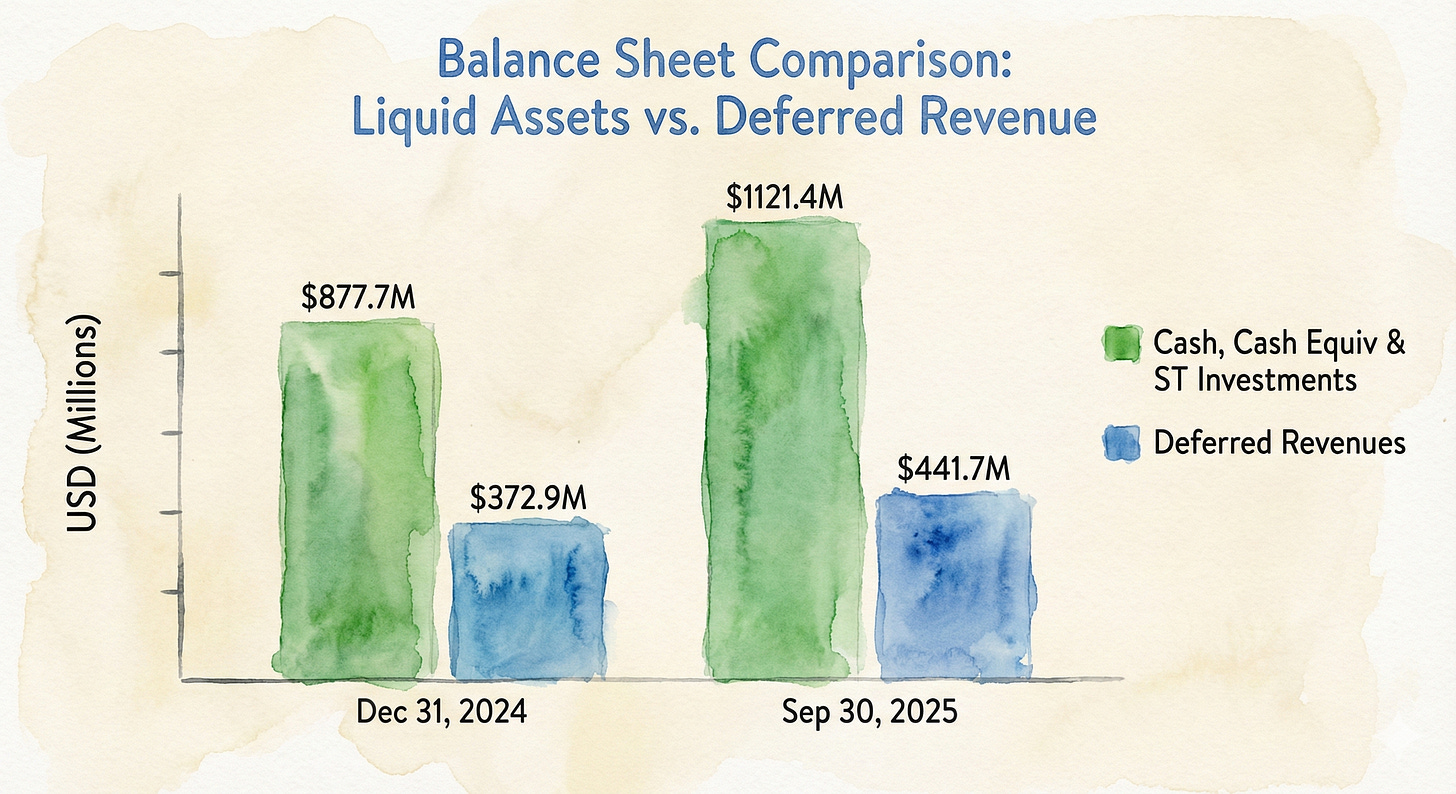

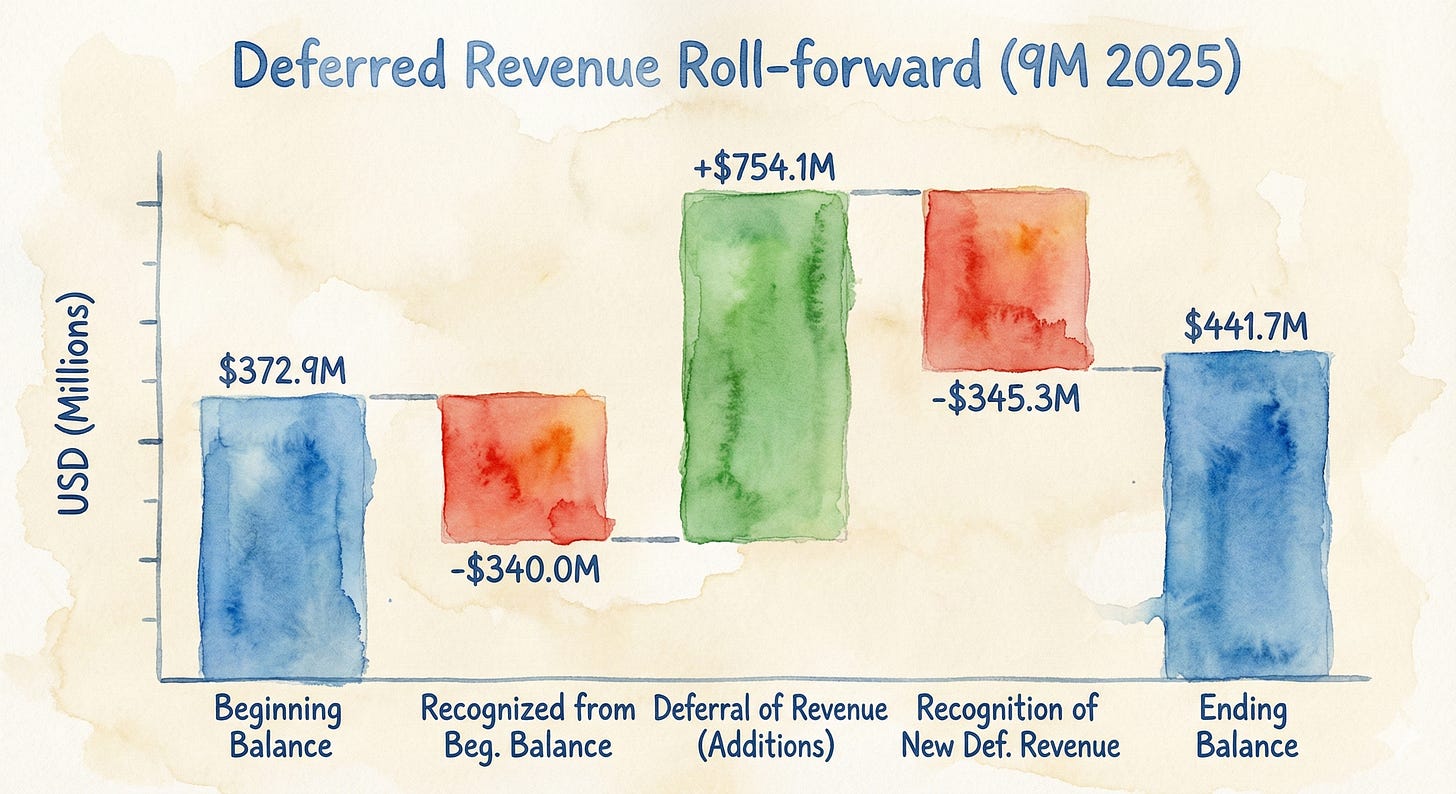

Deferred revenue ended at $441.7 million.

And the deferred revenue bridge shows just how subscription-heavy this business is: “Deferral of revenue” was $754.1 million while “Recognition of deferred revenue” was $(345.3) million.

They are stacking cash faster than they can recognize it.

Cost Structure Reality Check: The cost of revenues is heavily weighed down by payment processing + hosting + generative AI.

This is why the distribution “tax” matters:

Apple/Google/Stripe collectively process the majority of revenue. They are the toll booth collectors on Duolingo’s highway.

The Moat (What’s Actually Hard to Copy)

Engagement is scaling: 50.5 million DAUs on 135.3 million MAUs (Q3 2025, users).

That implies a ~37% DAU/MAU ratio, which is firmly in “habit product” territory. Most apps would kill for that ratio.

Also, monetization is scaling right alongside it: paid subscribers 11.5 million (period end Q3 2025) and paid subscriber penetration 9.0% of LTM MAUs.

HYPOTHESIS: The real moat is iteration velocity + brand distribution + personalization. AI becomes a retention amplifier here (not just a cost line).

MONITOR: Watch gross margin versus Max expansion. Management explicitly ties margin pressure to generative AI + hosting costs. We need to make sure the AI is worth the squeeze.

Atomic Take: Duolingo’s business model is “subscription first, everything else second,” and the compounding only works if engagement stays sticky enough to keep pushing users into paid.

Falsifier: If Subscription revenue growth falls below MAU growth for multiple quarters (metrics: subscription revenue YoY %, MAU YoY %, company-reported), the thesis is in trouble.

The Fly in the Ointment (What Went Wrong)

When I say “wrong” here, I am not talking about a collapse. The building isn’t on fire. But there are some choices and optical illusions here that can spook investors who want consumer apps to behave like boring, predictable electric utilities.

1. The Margin Narrative Got Messier

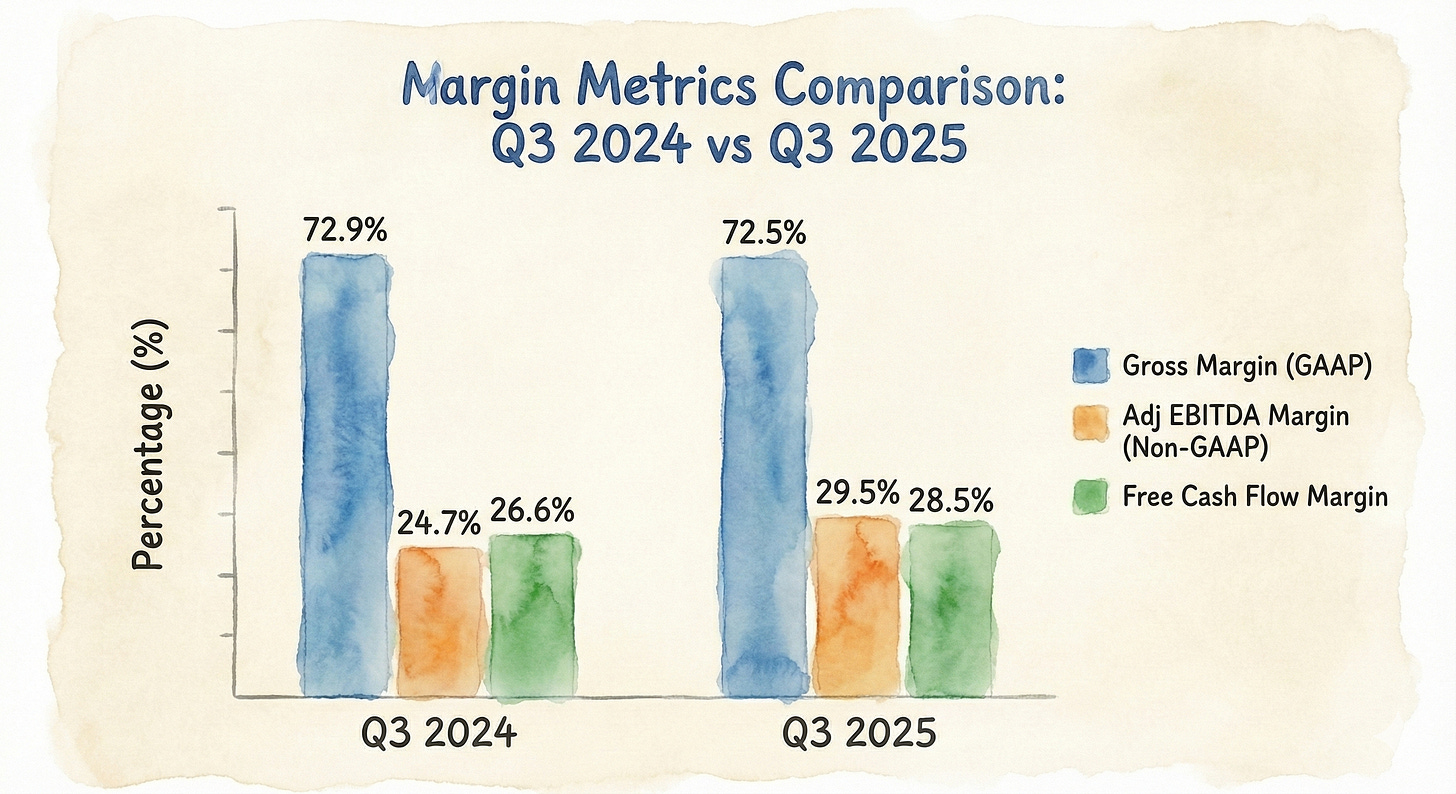

The gross margin declined ~40 bps YoY to 72.5% (Q3 2025, GAAP). Why? Management explicitly attributed this to increases in generative AI and hosting costs.

Here is the trade-off: You want the app to be smarter (AI), but brains are expensive.

2. The Long Game vs. The Quick Buck

The company told you point-blank that it is shifting priorities. Management described leaning more into longer-term initiatives—investing proportionally more in “teaching better,” and prioritizing user growth over monetization in A/B tests (Q3 2025 letter).

That is strategically coherent. It’s what you want a founder to do. But it is optically terrifying to anyone allergic to the phrase “we’re choosing long-term over short-term.” On Wall Street, “long-term” is often code for “we missed the quarter.” Here, it looks like a genuine pivot to product quality.

3. The “Unhinged” Lever

Growth is still strong, but the story admits it’s controllable. They said DAU growth was slightly slower than Q2 partly because they posted less “unhinged” social content. Then, in their Q3 letter, they said they started posting the crazy stuff again and saw impressions rise.

Translation: Their brand-driven top-of-funnel is a lever, not a law of physics. They can literally turn a dial labeled “Chaos” to get more users.

4. The Optical Illusion of Profit

GAAP net income is not “clean” this quarter. If you glance at GAAP net income ($292.2 million, Q3 2025) and conclude “profitability just went to the moon,” you are misreading the map. That number included a one-time income tax benefit of $222.7 million from releasing a valuation allowance on deferred tax assets.

Stop & Think: This is an accounting event, not a cash event. If you strip that tax benefit out, the business looks different. Do not value this stock based on a P/E ratio calculated using that $292.2 million figure.

The Audit: The operating story is better told through operating income ($35.2 million, Q3 2025, GAAP), Adjusted EBITDA ($80.0 million, Q3 2025, non-GAAP), and cash flow. Focus on those.

The “AI can change what’s possible” push is simultaneously the growth upside and the source of your margin anxiety.

Atomic Take: The “break” isn’t demand—it’s optics. AI costs are pressuring gross margin while management openly chooses longer-term product bets over near-term neatness.

Falsifier: If Gross margin declines more than 100 bps YoY in a quarter while bookings growth decelerates (metrics: gross margin %, total bookings YoY %, company-reported), run for the hills.

The Rebound Catalysts

The good news is that Duolingo has a lot of controllable knobs, and they just told you exactly which ones they are turning.

Catalyst 1: User Growth Momentum Persists at Scale

People are still showing up.

FACT: DAUs 50.5 million (Q3 2025) and MAUs 135.3 million (Q3 2025).

MONITOR: Watch if DAUs YoY stays in the 30s while MAUs keep compounding (Q3 2025 DAUs +36% YoY; MAUs +20% YoY). As long as the top of the funnel is wide, the machine works.

Catalyst 2: Monetization Outpaces the Funnel

They are getting better at squeezing juice from the orange.

Subscription bookings $240.3 million (Q3 2025, USD), up 36% YoY; paid subscribers 11.5 million (period end Q3 2025).

Management attributes a 7% YoY increase in subscription revenue per average paid subscriber (ARPU) to a mix shift toward higher-priced tiers including Max and the family plan (Q3 2025).

Keep an eye out for: Watch paid subscriber penetration (currently 9.0% of LTM MAUs, Q3 2025). We want this trending up without DAU growth falling off a cliff.

Catalyst 3: Operating Leverage (The Magic Trick)

They are spending more on AI, but still expanding margins elsewhere. That is discipline.

Adjusted EBITDA margin 29.5% (Q3 2025, non-GAAP) vs 24.7% (Q3 2024).

FY 2025 Adjusted EBITDA margin guidance midpoint 29.0% (FY 2025, non-GAAP).

Watch this, though: if GAAP operating expenses grow slower than revenue while product investment continues (Q3 2025 revenue $271.7 million; operating expenses $161.8 million, GAAP).

Catalyst 4: “Event-Driven” Growth (Q4 Seasonality)

New Year’s Resolutions are basically the Super Bowl for Duolingo.

Management called out Year in Review and the New Year’s Promotion as high-impact Q4 events (Q3 2025 letter).

But keep an eye on this: Q4 bookings and revenue land in the guided ranges (Q4 2025 bookings $329.5–$335.5 million; revenue $273–$277 million, guidance).

Atomic Take: The bull case doesn’t require miracles—it requires the boring continuation of DAU + subscriber compounding while AI costs stop widening as a percentage of revenue.

Falsifier: If FY 2025 revenue lands below $1,027.5 million or FY 2025 bookings land below $1,151 million (metrics: company guidance ranges), the thesis is broken.

Financial Quality Rubric (The Scorecard)

I like to grade my companies like a strict teacher. Here is the report card.

Growth Durability: 4/5

It is hard to grow fast when you are already big, but they are doing it.

DAUs +36% YoY to 50.5 million (Q3 2025) while lapping Q3 2024 DAU growth of 54% YoY per management commentary. That is impressive resistance to gravity.

Monetization Quality: 4/5

Subscription revenue $229.5 million (Q3 2025, GAAP), +46% YoY; subscription bookings $240.3 million (Q3 2025), +36% YoY.

Margin Structure: 3/5

Gross margin 72.5% (Q3 2025, GAAP), down YoY due to generative AI + hosting costs.

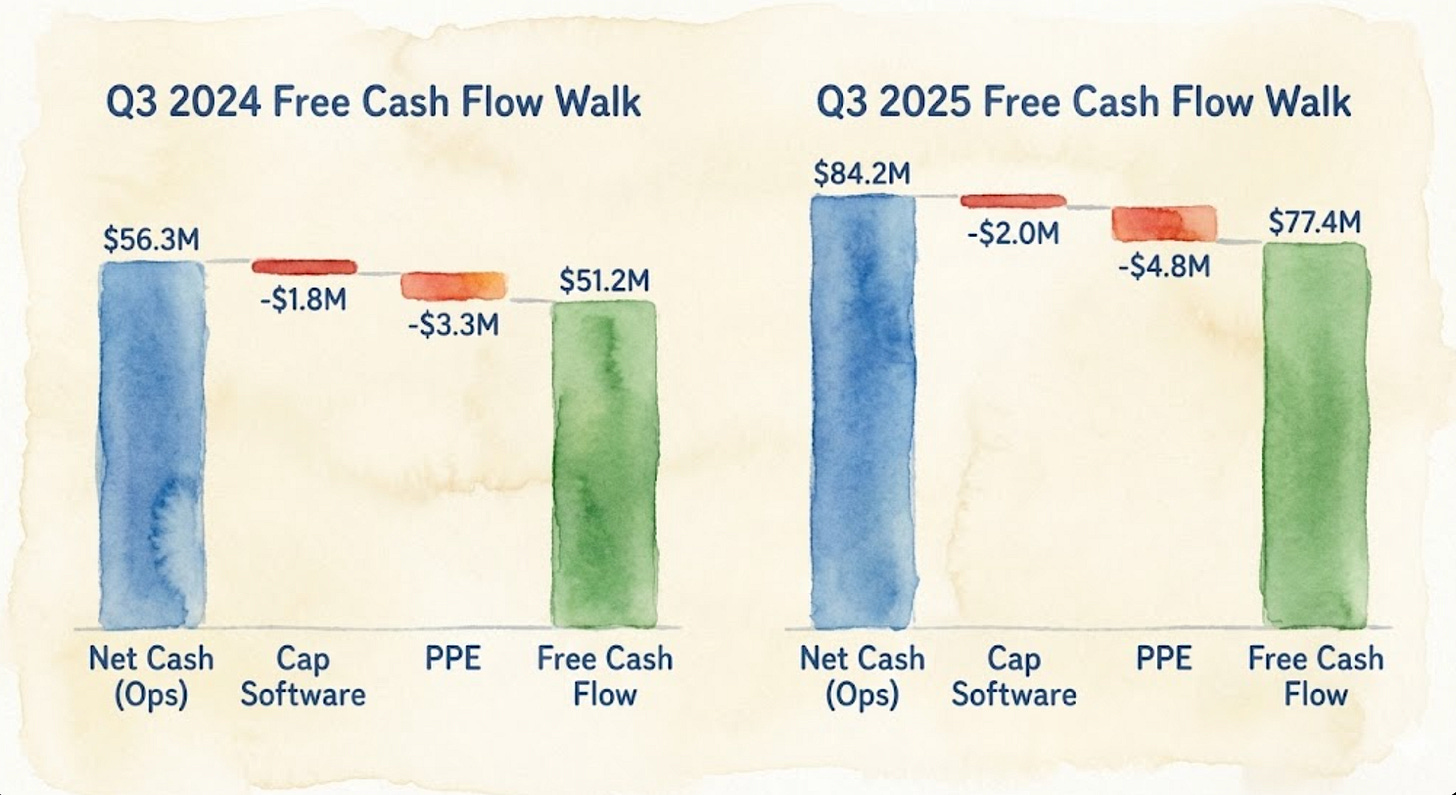

Cash Conversion: 5/5

This is where the rubber meets the road.

Free cash flow $77.4 million (Q3 2025) and free cash flow margin 28.5% (Q3 2025), company-defined non-GAAP.

Balance Sheet Resilience: 5/5

A fortress.

Cash & cash equivalents $1,011.5 million and short-term investments $109.9 million (as of Sep 30, 2025, GAAP) with total liabilities $578.1 million (as of Sep 30, 2025). They have more cash than debt/liabilities.

Accounting/Definition Cleanliness: 3/5

A bit messy this quarter.

Adjusted EBITDA definition expanded beginning in Q3 2025 to include integration costs related to acquisitions (non-GAAP comparability note).

The Audit: The quarter’s GAAP profitability headline is radioactive with a smiley face—$222.7 million of one-time tax benefit (Q3 2025, GAAP) inflates net income, so “earnings quality” needs to be judged via operating income, Adjusted EBITDA, and cash flow instead.

Atomic Take: This is high-quality financially, but you must grade the core engine with operating metrics and cash—not the tax-boosted GAAP net income headline.

Falsifier: If Free cash flow margin drops below 20% for two consecutive quarters (metric: company-defined free cash flow margin), the cash machine is sputtering.

The Statements

You can listen to the story management tells you on the conference call, or you can look at the numbers. I prefer the numbers. The numbers don’t have a PR team.

Balance Sheet (The Geiger Test)

As of Sep 30, 2025 (GAAP), Duolingo shows the kind of balance sheet you want when you’re funding product ambition.

It’s what I call a “sleep well at night” balance sheet:

Cash & cash equivalents: $1,011.5 million (as of Sep 30, 2025, USD, GAAP).

Short-term investments: $109.9 million (as of Sep 30, 2025, USD, GAAP).

The Big Picture: Total assets $1,885.6 million against total liabilities $578.1 million (as of Sep 30, 2025, USD, GAAP).

The Secret Weapon: Deferred revenue $441.7 million (as of Sep 30, 2025, USD, GAAP).

Remember, deferred revenue in a subscription model is an obligation, sure, you owe them the service, but it’s also a demand signal. It’s cash in the bank that hasn’t hit the P&L yet.

The only “don’t be asleep at the wheel” note here is the lease obligations. They have to rent office space somewhere. Operating lease liabilities are $97.3 million total. It’s manageable, but it’s there.

Atomic Take: The balance sheet looks like optionality—cash-rich, liability-light, and fueled by deferred revenue instead of debt.

Falsifier: If Cash & cash equivalents fall below $500 million while deferred revenue falls YoY (metrics: cash line; deferred revenue line, company-reported), the fortress is crumbling.

Cash Flow (The Turbine)

Profit is an opinion; cash is a fact. Here is the clean bridge, using the company’s own definition:

Profit → CFO → “capex-like” → Free cash flow

Net cash provided by operating activities $84.2 million (Q3 2025, USD, GAAP).

Also, “capex-like” investments were capitalized software + intangibles $(2.0) million and PPE $(4.9) million (Q3 2025, USD, GAAP), per the company’s free cash flow reconciliation.

Free cash flow $77.4 million (Q3 2025, USD, company-defined non-GAAP) and free cash flow margin 28.5% (Q3 2025).

Stop & Think: A 28.5% free cash flow margin is elite. For every dollar that comes in the door, nearly 29 cents ends up in the owner’s pocket. That is rare.

Now, the footnote that matters: 9M 2025 net income includes that one-time tax benefit we talked about earlier.

The cash flow statement shows a large deferred income tax adjustment $(239.5) million (9M ended Sep 30, 2025, USD, GAAP).

That isn’t “bad” cash flow. It’s just a reminder that tax accounting can torque the profit-to-cash bridge in weird ways.

The tax benefit was a paper gain; the adjustment removes it to show you the real cash.

Atomic Take: Cash generation looks sturdy, and the capex-like spend is modest relative to CFO—just don’t confuse a tax-accounting inflection with a permanent profit step-change.

Falsifier: If CFO declines YoY while deferred revenue also declines YoY (metrics: net cash from operating activities; deferred revenue, company-reported), the turbine is stalling.

Income Statement (The Reactor)

Q3 2025 (GAAP) is the cleanest snapshot of what the model can do at scale, as long as you keep your hands off that tax headline.

Revenue $271.7 million, +41% YoY.

Gross profit $196.9 million and gross margin 72.5%.

Income from operations $35.2 million.

Adjusted EBITDA $80.0 million and Adjusted EBITDA margin 29.5%.

And here is the cost story in plain English: Gross margin pressure is explicitly tied to generative AI costs (Max expansion) and hosting costs (Q3 2025).

They are paying for brains.

Operating expenses grew, but management frames it as headcount-driven investment, while still delivering operating leverage (Q3 2025).

Atomic Take: The income statement is doing the rare thing in consumer: scaling growth and scaling profitability at the same time—while admitting the AI cost line is real.

Falsifier: If Operating income turns negative while revenue growth remains above 30% YoY (metrics: income from operations; revenue YoY %, company-reported), they are losing control of the spend.

What about the price tag? (Valuation)

You don’t need a complex spreadsheet to figure this out. You just need the current stock price and the promises the company made for the year. Let’s look at what Mr. Market is asking for this business as of today (January, 2026).

The Share Price: $173.87/share (as of January 8th 2026).

The Slice of the Pie: Total estimated diluted shares 49.9 million (as of Sep 30, 2025, shares).

The War Chest: Cash & cash equivalents $1,011.5 million + short-term investments $109.9 million (as of Sep 30, 2025, USD, GAAP). That is $1.12 billion in pure liquidity.

The Promise (Guidance): FY 2025 revenue $1,027.5 million–$1,031.5 million and Adjusted EBITDA $296.9 million–$300.2 million.

What You’re Actually Paying:

Implied Equity Value: ~$8.68 billion (Jan 9, 2026 price × 49.9M diluted shares).

Implied Enterprise Value (EV): ~$7.55 billion (equity value minus that massive pile of net cash).

The Multiples (The “Expensive” Meter):

If we measure the price against the midpoint of what they promised for 2025:

EV / FY 2025 Revenue: ~7.3x.

EV / FY 2025 Adjusted EBITDA: ~25.3x (company-defined non-GAAP).

The Audit: This is a very different conversation than we were having just a few months ago. With the stock trading at $173.87, the massive “premium” (that extra charge you usually pay for elite growth) has compressed significantly.

Is it significant enough?

Well, think about it: The business hasn’t changed, but the price tag for the operating engine has been cut effectively in half compared to just a short time ago. At ~25x EBITDA, the market is no longer pricing this for “absolute perfection.” It’s pricing it for “just don’t break it.”

I like this, and that is why I own shares in it at the time of writing, but if this is reason enough for you to consider it? That is your own responsibility to determine.

Atomic Take: The valuation just moved from “priced for miracles” to “priced for execution.” That is where the opportunity usually hides.

Falsifier: If FY 2025 Adjusted EBITDA margin lands below the guided midpoint range (metric: FY 2025 Adjusted EBITDA margin, company-defined), even this lower multiple will feel expensive.

The Meltdown List (Risks)

Every great business has a few trapdoors. Here are the ones that could swallow your capital.

1. You Are Living on Rented Land

Duolingo doesn’t own the road; they just drive on it.

Apple/Google/Stripe processed the majority of revenues.

The Risk: If the landlord raises the rent (app store fees) or changes the rules, Duolingo pays the price.

Keep an eye on this: Any disclosure change in processor concentration or changes in cost of revenues.

2. Brains Are Expensive (AI Costs)

Management explicitly ties gross margin pressure to generative AI + hosting

The Risk: AI is the new electricity. If the cost of computing (Max expansion) rises faster than the price they can charge for it, margins get crunched.

Keep watching this: Gross margin trend; Max expansion versus margin.

3. The Fickle God of Engagement

DAUs and MAUs are the engine (Q3 2025 DAUs 50.5 million, MAUs 135.3 million).

The Risk: If people stop opening the app, the whole machine stops. There is no contract locking these users in.

And watch this: DAU growth and the DAU/MAU (derived) stability.

4. The Dollar Diet (FX Risk)

Over half of bookings come from outside the U.S.

The Math: Management estimates each 1% change in the dollar versus their currency basket is about a $1 million impact on bookings for the remainder of the year (Q3 2025 letter).

Watch: Reported vs constant currency growth deltas.

5. Optical Illusions (Bookings vs. Revenue)

Deferred revenue $441.7 million (as of Sep 30, 2025) and large “deferral of revenue” flows in 9M 2025.

The Risk: If bookings slow down, revenue might look fine for a while because of the backlog. Don’t be fooled.

Watch: Deferred revenue growth and the bookings trajectory.

6. The Dilution Drip

Stock-based compensation expense $101.2 million (9M ended Sep 30, 2025, USD, GAAP).

The Outlook: Management expects fully diluted share count to increase about 1% in 2025 (assuming Q3 quarter-end share price).

Keep an eye on this: Diluted share count and SBC as a % of revenue.

7. Moving the Goalposts?

Adjusted EBITDA definition expanded beginning in Q3 2025 to include integration costs related to acquisitions.

The Risk: Whenever a company changes how they calculate “profit,” you should squint a little harder.

And watch: Further changes to add-backs and reconciliation stability.

8. Sneaky Risk: Live by the Meme, Die by the Meme

Management explicitly described dialing back “unhinged” content and seeing growth effects, then resuming (Q3 2025 letter).

HYPOTHESIS: If brand/funnel tactics become a major driver, growth may get choppier than the market wants to tolerate.

Atomic Take: The risks are mostly about control: platform tolls, AI input costs, and whether engagement remains reliably compounding.

Falsifier: If Processor concentration rises above current levels while gross margin declines YoY (metrics: revenue processor %; gross margin %, company-reported), the business is losing leverage.

The Atomic Verdict

Status: ★★★★☆ (4.25/5)

I like this business. I respect the hustle. And I like the recent price drop. That does not mean it wont’t continue dropping, btw. As Peter Lynch said; “How much lower can it get?”. Well, sentiment and narrative are important short term drivers.

Reason 1 (The Good Kind of Boring)

The engagement engine is still compounding at scale—50.5 million DAUs and 135.3 million MAUs (Q3 2025), with 11.5 million paid subscribers (period end). That is a fortress.

Reason 2 (The Money Part)

The model is throwing off real cash—free cash flow $77.4 million and free cash flow margin 28.5% (Q3 2025), company-defined.

Atomic Take: Duolingo looks like a rare consumer compounder with legitimate cash output; the only “don’t get cocky” clause is that the valuation assumes KPI perfection.

Upgrade Triggers

I’m pulling the trigger if I see:

Paid subscriber penetration rises above 9.0% of LTM MAUs (metric: company-reported penetration).

Gross margin stabilizes or improves sequentially while Max continues expanding (metrics: gross margin %, management commentary on AI costs).

FY 2025 results land at or above the midpoint of Adjusted EBITDA margin guidance (29.0%, FY 2025, non-GAAP).

Downgrade Triggers

I’m selling if:

DAUs drop below 30% YoY growth for two consecutive quarters (metric: DAUs YoY %, company-reported).

Gross margin declines another 100+ bps YoY while subscription bookings growth decelerates (metrics: gross margin %; subscription bookings YoY %).

Free cash flow margin falls below 20% for two consecutive quarters (metric: company-defined free cash flow margin).

What Would Increase Confidence?

I need evidence that AI-driven features raise retention/ARPU without continuing to pressure gross margin (watch: subscription revenue per average paid subscriber commentary; gross margin).

I also need to see consistent delivery against Q4/FY 2025 booking and revenue guidance ranges (watch: Q4 and FY 2025 guidance versus actuals).

Final Falsifier: If FY 2025 bookings land below $1,151 million while FY 2025 Adjusted EBITDA margin lands below the guided midpoint (metrics: company guidance ranges; actuals), the thesis is invalid.

Duolingo has managed to do what very few apps do: become a utility that feels like a game. The financials back it up: cash rich, growing fast, and profitable.

Now, a little task for you: Go to the comments and answer me this:

Are you worried about the AI costs eating into the gross margin, or do you view that as the necessary cost of building a better moat?

References

Duolingo, Inc. — Form 10-Q for the quarter ended September 30, 2025 (SEC filing; file: “0001628280-25-049743.pdf”).

Duolingo, Inc. — Q3 FY2025 Shareholder Letter (as of September 30, 2025; file: “Q3FY25 Duolingo 9-30-25 Shareholder Letter Final.pdf”).

Duolingo, Inc. — Q3 FY2025 Press Release (as of September 30, 2025; file: “Q3FY25 Duolingo 9-30-25 Press Release.pdf”).

Duolingo model support file (provided spreadsheet; file: “DUOL-Duolingo Inc.xlsx”).

Market price reference (used only for the updated valuation section): DUOL last price on January 9, 2026 from the finance quote tool.

Disclaimer

This Deep Dive is an educational breakdown of a public company based on information available in the materials provided (e.g., annual/quarterly reports, investor presentations, earnings transcripts) and my interpretation of that information. It is designed to be a “bolt-on” intelligence layer to your own due diligence — not a replacement for it.

Independence: I do not accept compensation of any kind from the companies discussed. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author may hold a long position in securities mentioned. Any position creates bias — treat this as commentary, not gospel.

Not Financial Advice: Nothing here is investment advice, a recommendation, or a solicitation. I am not a financial advisor. You are responsible for your own decisions. The stars rating is not a buy recommendation, but meant as a guide to understand the quality of the financial statement of the respective companies.

Error & Update Risk: Financial statements change, companies restate, guidance evolves, and I can be wrong. Verify key figures in the primary filings and consider reading the footnotes before deploying capital.

Excellent piece! Thanks for sharing!

Excellent deep dive, Rob! This is a LOT of information that helps supplement my knowledge on the company. One thing I’m really banking on by the end of this year is the ongoing improvements on Lily the AI tutor. If this upgrade helps to boost their paid/free subs KPIs, then things start getting very interesting!