Deep Dive: Sezzle Inc. ($SEZL)

Why the Market Shaved More Than 60% Off the Price (And Why It Might Be Wrong).

Every once in a while, you stumble upon a situation that would make Peter Lynch sit up in his chair and reach for a yellow legal pad. Recently I did a FINS analysis of this company, and I got intrigued to say the least.

The business is growing like a weed, but it’s sitting in a sector the market currently treats like a skunk at a garden party. It’s fallen from the “glory days” highs, the “experts” have moved on to the next shiny object, and suddenly, you look at the price tag and realize you might be looking at a steak dinner for the price of a side of fries.

Sezzle it’s the rare fintech story that can look like a perfectly tuned, tidy little reactor one quarter... and a live-action demonstration of “risk appetite” the next.

I’ve seen this movie before. It’s the kind of business that makes you lean in closer to the screen, wondering if they’ve found the secret sauce or if they’re just playing with the dials.

Let’s find out which one it is.

If You’re In a Rush

What they actually do: Sezzle is in the business of saying “yes” at the cash register. They offer Buy Now, Pay Later (BNPL) credit, plus subscription goodies like Sezzle Premium and Sezzle Anywhere. They make money when you buy, when you subscribe, and—here’s the rub—from “other sources” (like fees).

Challenges: The profit recipe is a mix of credit, fees, and subscriptions. That’s a trio that usually gets regulators’ ears perking up. Plus, management just admitted they’re widening the net to find more customers. In plain English: they’re turning up the “growth” dial, and that means the “credit risk” dial is turning right along with it.

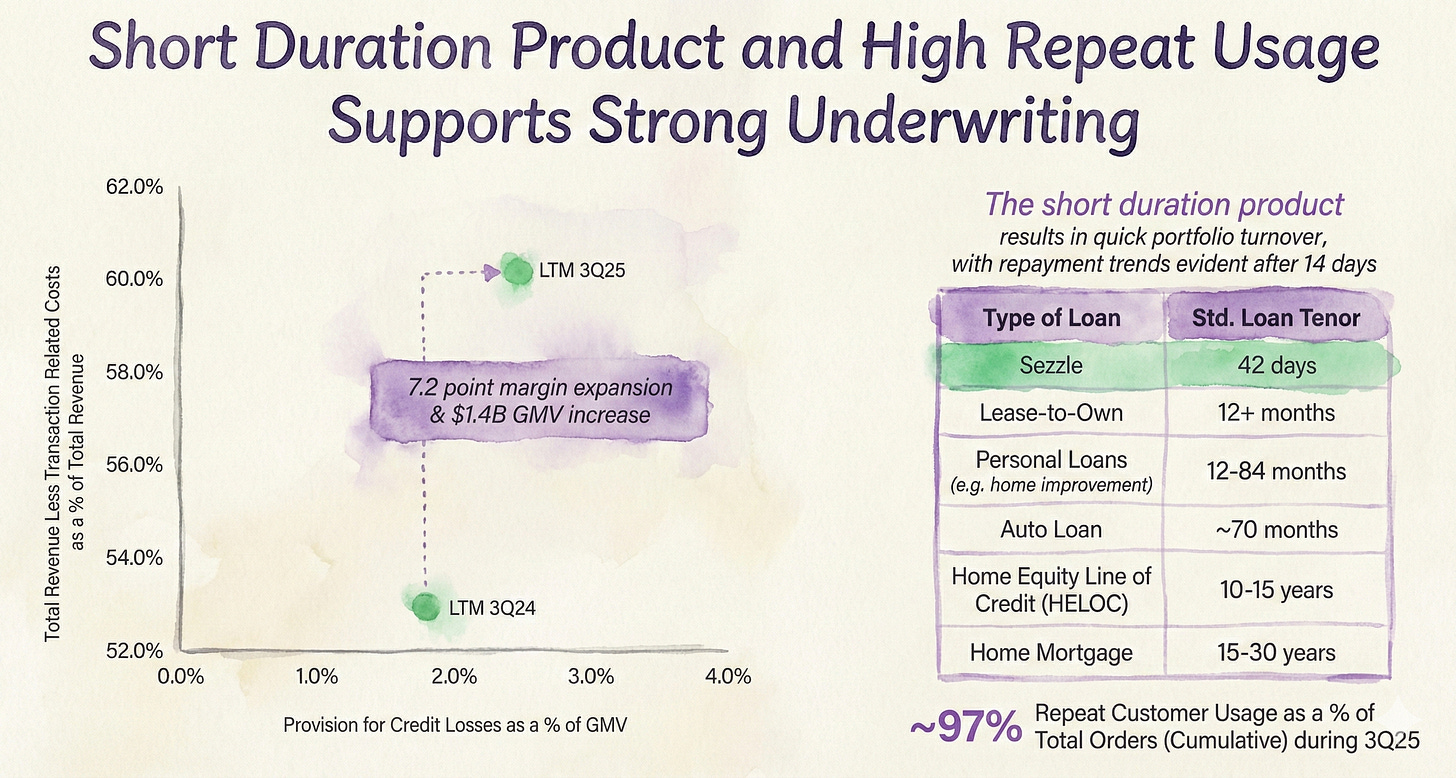

The “Fix”: For this to be a long-term winner, they need to keep their take rate at 11.2% (Q3 2025) while making sure the money they lose on bad loans stays in the neighborhood of 2.5%–2.75% of total sales (2025 management target).

Disclaimer: I have got high conviction here, and have initiated a large position, as you can see in my recent portfolio update. Have this in mind when you read, as I can be biased.

What is Sezzle, exactly?

Think of Sezzle as a “financial buffer” for your shopping.

You know when you find a great pair of shoes for $100, but you don’t want to drop the full hundred right now because you have other bills? Normally, you’d either have to wait until payday (and hope the shoes don’t sell out) or put them on a credit card and deal with high interest later.

Sezzle lets you take the shoes home today for just $25.

How it works in real life:

Today: You pay $25 (25%) at the register.

In 2 weeks: They automatically charge you $25.

In 4 weeks: Another $25.

In 6 weeks: The final $25, and you’re done!

The best part for you, the customer? As long as you pay on time, it’s totally interest-free.

Sezzle make their money by charging the store a fee for the privilege of having you as a customer, so you aren’t stuck paying extra just to wait a few weeks. It’s basically a modern way to “layaway” items, except you get the product immediately instead of waiting until the final payment.

The Setup: Dials, Knobs, and Big Numbers

The “why now” for Sezzle is pretty straightforward. Their Q3 report looked like a clean, well-oiled machine. They showed us scale, they showed us margins, and they showed us cash.

But (and there’s always a “but”) they got there by cranking up two knobs that investors usually love to fear: marketing and underwriting.

It’s like a restaurant that starts seeing huge lines because they started spending a fortune on flyers and decided to let everyone start a tab. It works great for the crowds, but you’ve got to make sure they eventually pay the bill.

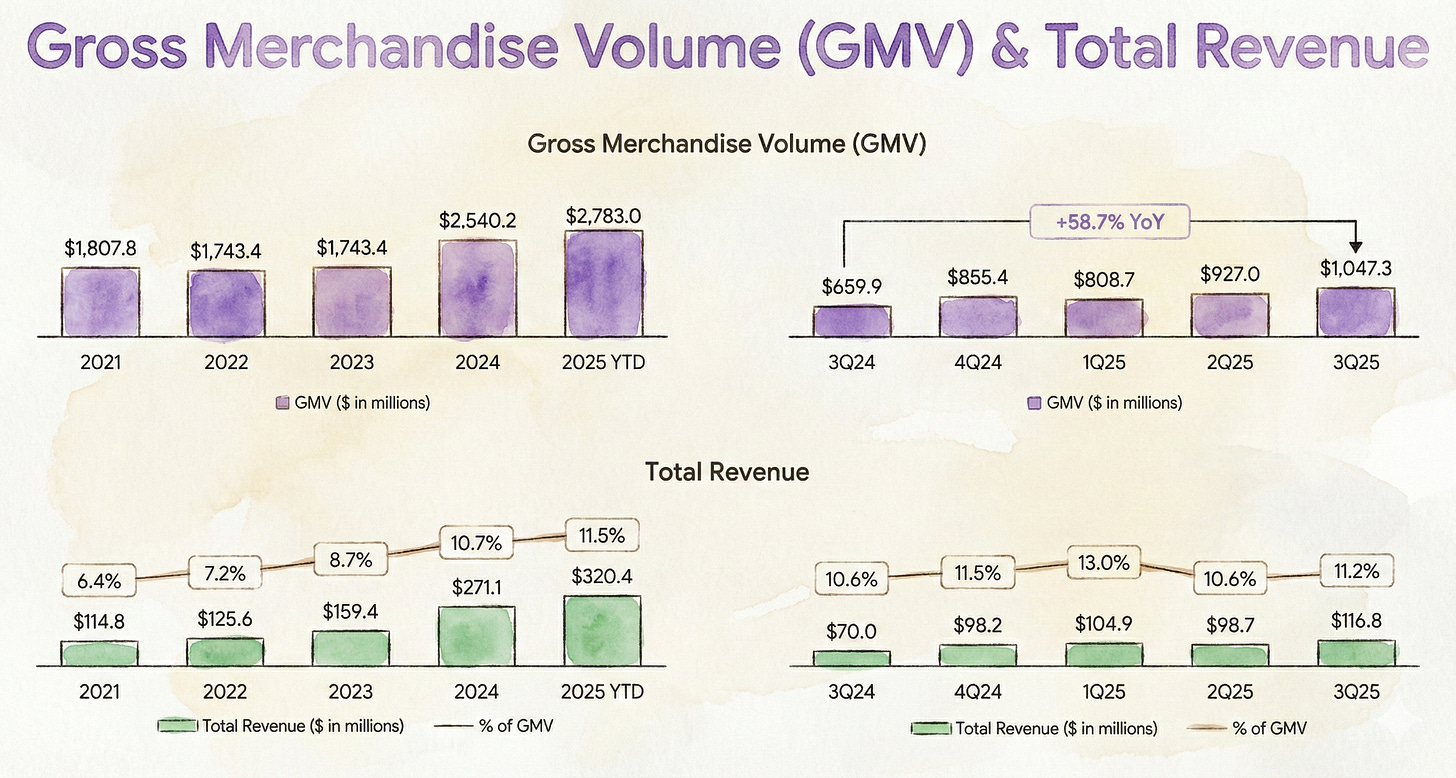

The baseline numbers aren’t exactly shy:

Total Revenue: $116.8 million (Q3 2025).

Total Sales (GMV): $1,047.3 million (Q3 2025).

That’s right, the company just had its first $1 billion sales quarter. That’s a milestone in anyone’s book.

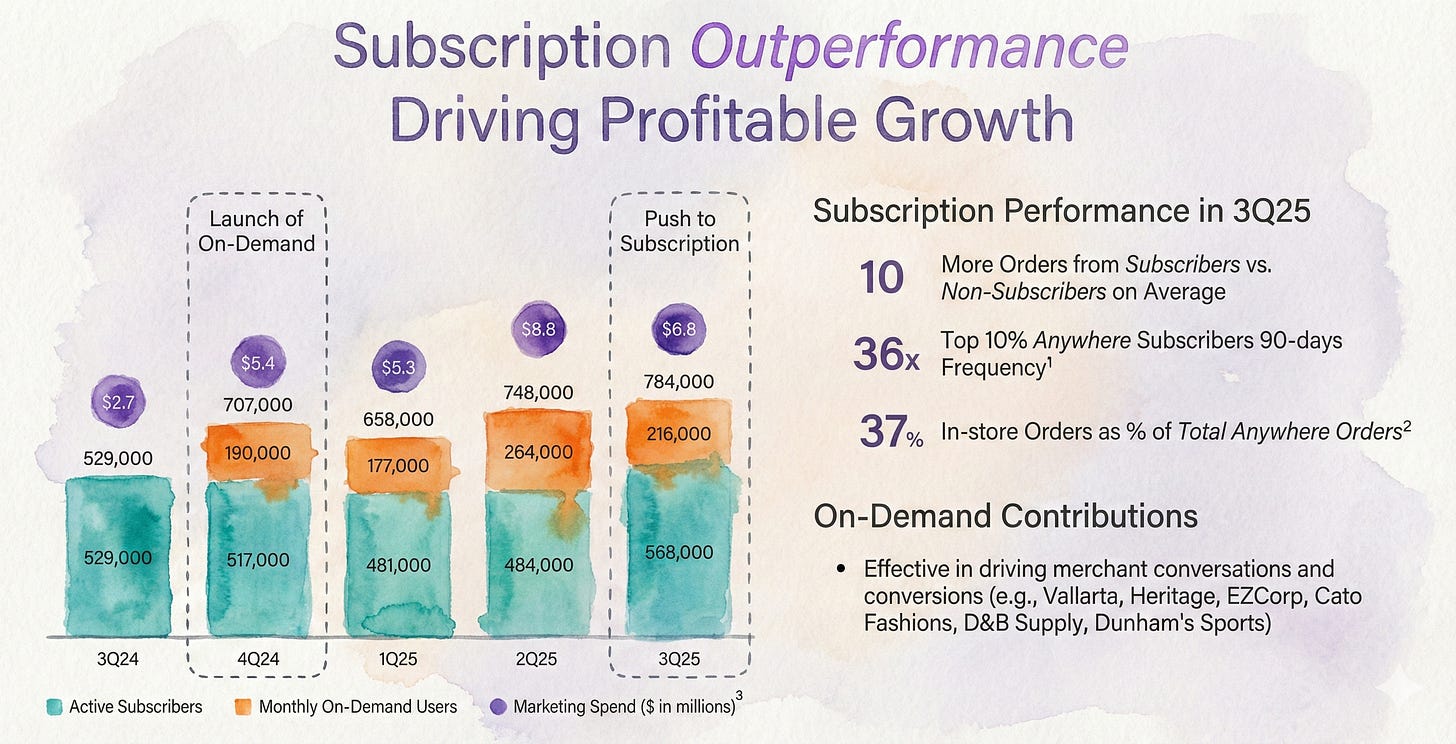

The “Engagement” side of the house moved, too. As of September 30, 2025, they had 2,971,000 Active Consumers and 784,000 Monthly Online Deep-divers (MODS). Inside that group, they’ve got 0.6 million Active Subscribers and 0.2 million On-Demand users.

Stop and think: If Sezzle were a local hardware store, these MODS would be the folks who come in every Saturday morning, rain or shine. You want those people.

How the Business Actually Puts Bread on the Table

If I had to describe Sezzle over a cup of coffee, I’d say it’s a “money-making stack” built on people coming back again and again.

They don’t just take one bite of the apple. They take several small nibbles across three different buckets. Here’s how the $116.8 million in Q3 2025 revenue actually broke down:

The “Per-Usage” Bucket (Transaction Income): $59.5 million. This is the classic stuff—fees from merchants and the interchange fees when you swipe.

The “Membership” Bucket (Subscription Revenue): $24.3 million. This is the recurring “club” fee for Sezzle Premium. It’s steady and predictable—the kind of revenue I love.

The “Extras” Bucket (Income from Other Sources): $32.9 million. This is the spicy stuff: late fees and affiliate marketing.

Hey, wait a minute! Look at these two sub-lines very closely:

Consumer Fees: $33.5 million.

Late Payment Fees: $21.0 million.

This is why Sezzle doesn’t care as much if merchant fees get squeezed by competition. They aren’t just relying on the store to pay them; they’re layering on subscriptions and fees.

Management likes to point to their “Take Rate” of 11.2%. That’s basically how much they keep out of every dollar that flows through the system. After paying the direct costs of the transactions, they’re left with $63.3 million—or about 54.2% of their total revenue.

Is There a Moat Here?

I don’t think Sezzle has a “fortress” around the merchants. Instead, they’re betting on habit. They’ve moved their marketing budget toward getting people to subscribe—reaching 568,000 subscribers by the end of the quarter.

The idea is simple: if Sezzle is the first thing you think of when you’re about to buy a pair of shoes, they win. They get to monetize you over and over without having to “buy” your attention again.

The Fact: Sezzle makes money from everywhere; merchants, subscribers, and late fees.

The Theory: As long as people keep coming back (high usage) and staying subscribed, the business stays healthy even if the BNPL market gets crowded.

The Warning: Don’t confuse a “mix shift” with magic. If the revenue is growing because fees are going up rather than more people buying things, that’s a different story.

The “Atomic Take”: Sezzle’s engine is humming, and the diversification is impressive. But it’s only a “Moat” if this growth doesn’t lead to a massive credit hangover down the road. If those “Active Subscribers” keep going up but the revenue doesn’t follow, we’ll know the story has hit a snag.

The “What Went Wrong”

Now, this is the part where most fintech companies start pointing at the “macro economy” or “the Fed” like they’re reporting on the weather.

Not Sezzle. They did something much more refreshing—and a bit more nerve-wracking: they told us they changed their own behavior.

Look, two lines in the ledger tell the whole story here:

First, Marketing went through the roof: $8.775 million in Q3 2025, compared to just $2.726 million a year ago.

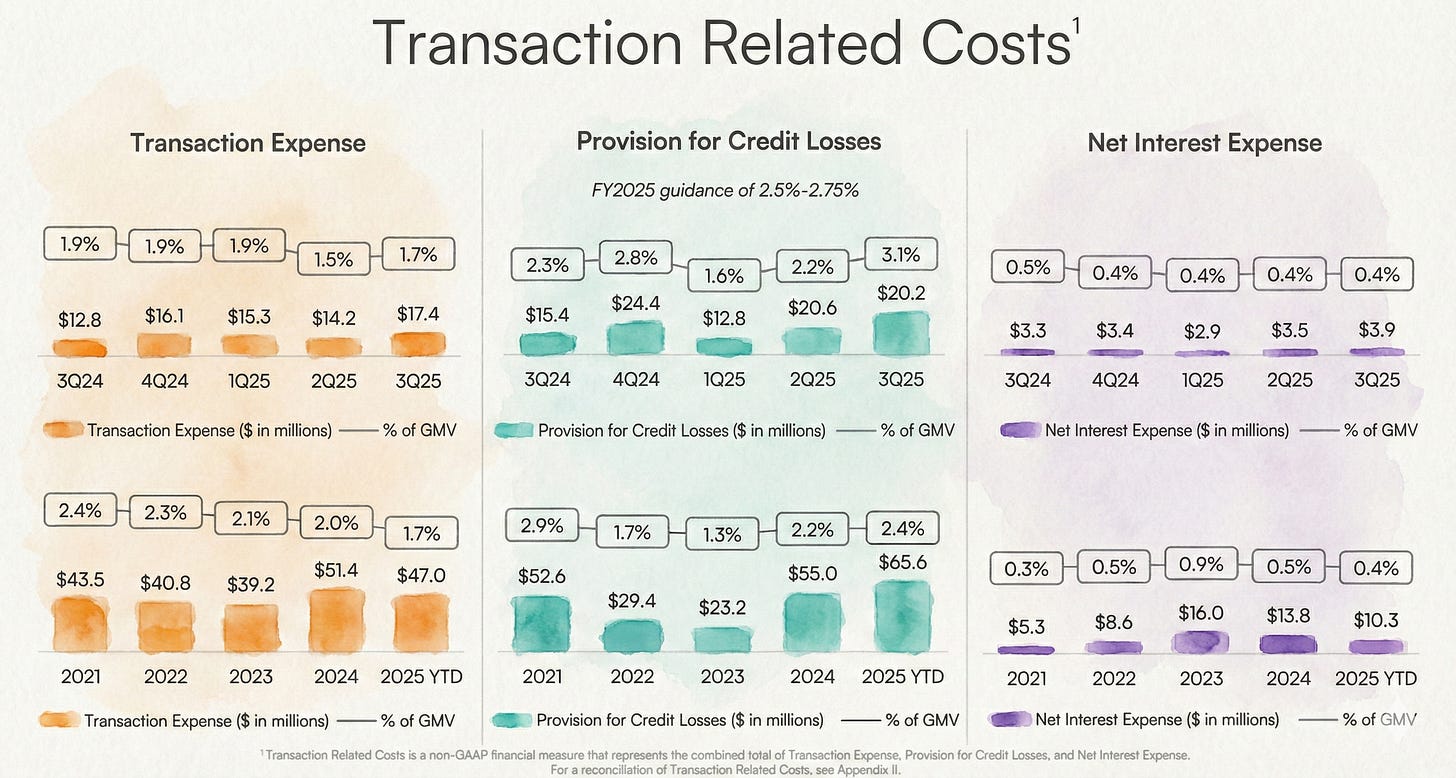

Second, their Provision for Credit Losses (the money they set aside for people who won’t pay them back) jumped to $32.177 million, up from $15.402 million last year.

Stop and think: If you spend more on ads and lower your standards for who gets a loan at the same time, you’re going to grow. That’s a given. The question is: are you buying high-quality customers or just renting a crowd?

Management is leaning into a classic growth playbook: pay more to get ‘em in the door and widen the funnel so more people qualify. They’re using Sezzle Premium as the main hook, and On-Demand as the backup for folks who aren’t ready for a subscription.

But there’s an uncomfortable truth here: levers work in both directions. If you turn up the heat right as you enter the “seasonal credit-heavy period” (Q4 is historically a bit of a mess for charge-offs), you’re running your reactor hot just as the cooling water starts to warm up.

The Atomic Take: The real risk isn’t some hidden line on the balance sheet; it’s the fact that they’ve got the Underwriting and Marketing dials cranked to “11” at the same time. If credit losses (as a % of sales) keep rising while their profit per sale stays flat, the story changes fast.

The Rebound Catalysts: No Magic, Just Math

We don’t need “AI buzzwords” to see the path forward here. Sezzle has given us a clear roadmap.

Credit Normalizes: This is the big one. Management says credit provisions hit 3.1% of GMV in Q3, but they expect that to trend down toward 2.5%–2.75% for the full year 2025. If they hit those numbers while sales stay strong, the profit machine gets a massive boost without needing a miracle.

The “Subscription-First” Pivot: They’ve got 0.6 million Active Subscribers now. If they can keep these folks around, it creates a “sticky” base that’s much cheaper to maintain than finding new customers every month.

Marketing Payback: Management claims they get their money back on marketing spend in six months or less. That’s a bold claim for an $8.775 million spend. We need to see if this is a “sugar rush” or real, durable growth.

Growth Room: They recently bumped their credit facility from $150 million to $225 million. As of Sept 30, they had $32.0 million in unused capacity. They have the “gas” in the tank to keep growing, provided the engine doesn’t knock.

Side Projects Stay Small: They spent about $1.3 million on “strategic projects” this quarter. The goal is to keep these from becoming a distraction or a money pit.

The Financial Quality Rubric (Scorecard: 1-5)

Profitability Quality (4/5): $26.7 million in Net Income (GAAP). This isn’t “funny money” or weird adjustments. This is real profit.

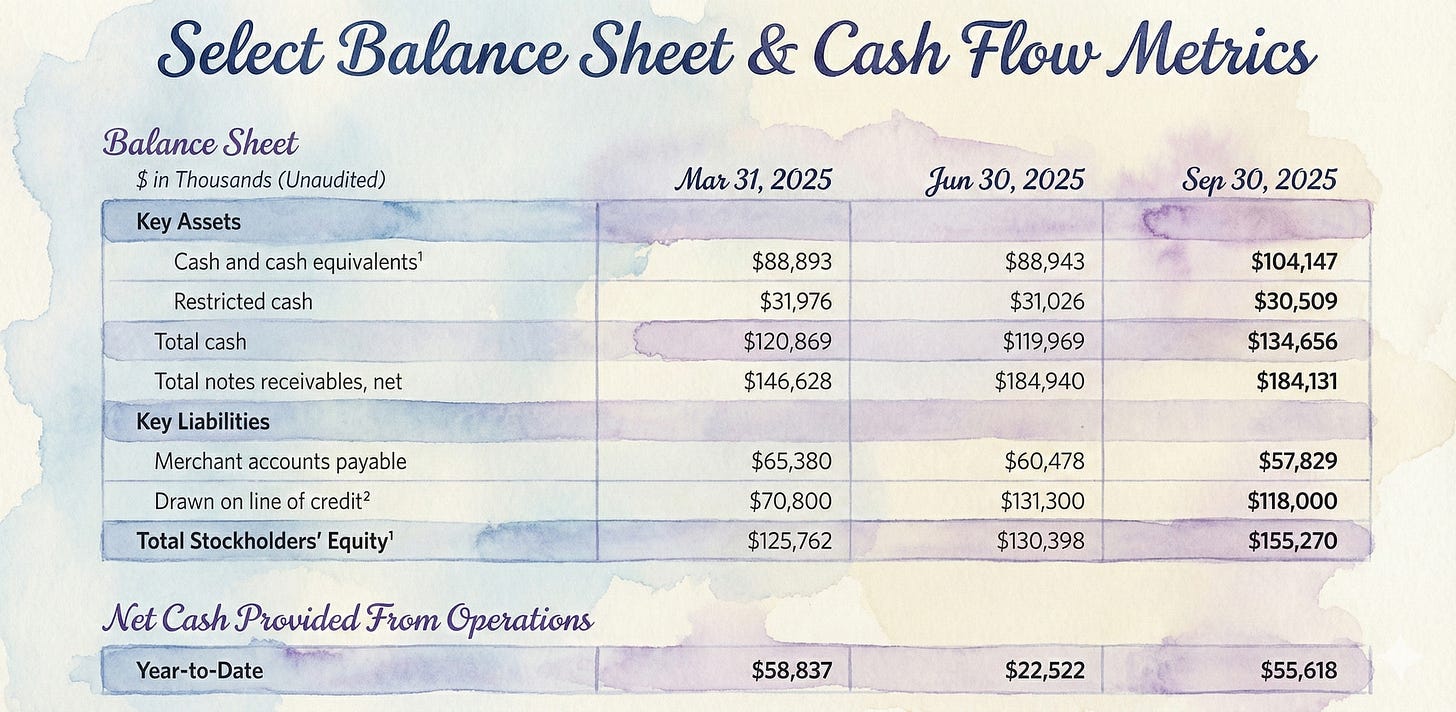

Cash Conversion (4/5): They brought in $55.6 million in operating cash over nine months, compared to $90.4 million in net income. Don’t panic—the gap is mostly because they’re using cash to fund new loans ($85.2 million went into notes receivable).

Reinvestment Intensity (5/5): This business is lean. They only spent $0.6 million on property and equipment. If the credit stays good, this thing is a cash-flow fountain.

Balance Sheet Simplicity (4/5): It’s mostly cash ($134.7 million) and receivables ($184.1 million). It’s easy to see what’s under the hood.

Risk Discipline (3/5): They intentionally lowered the bar to grow. That’s either a genius move to grab market share or the start of a slippery slope. We’re watching this closely.

Capital Allocation (4/5): They bought back $34.6 million worth of shares this year. I love seeing a company return cash to owners, as long as they don’t leave themselves short on liquidity.

The Audit: The biggest trick here is the “weak” cash flow. It’s not weak; it’s just being used to grow the loan book. If you think the loans are good, the cash flow is fine. If you think the loans are shaky, the cash flow is a red flag.

The Atomic Take: Sezzle is a high-quality machine right now, but you have to treat credit and growth as “first-class” risks. If operating cash drops while profits look good, it means the quality of those profits is starting to rot.

The Statements: Reading the Geiger Counter

Folks, if you want to know if a nuclear reactor is safe, you don’t just look at how much power it’s putting out; you check the radiation levels.

In a lending business, the Balance Sheet is your Geiger counter.

As of Sept 30, 2025, the “Big Five” numbers look like this:

Cash (the oxygen): $134.7 million.

Notes Receivable (the loans): $184.1 million.

Allowance for Credit Losses (the safety net): $33.7 million.

Line of Credit (the debt): $117.3 million.

Equity (the owner’s stake): $155.3 million.

One sneaky thing to watch is something called DSIP (Delayed Settlement). It’s basically merchants saying, “Keep our money for a bit, pay us interest, and we’ll use it as a float.”

Sezzle has $43.0 million sitting in that bucket. It’s not “toxic,” but it’s not a normal payable either. It’s helpful funding, but in a crisis, merchant behavior can change fast.

The Atomic Take: The balance sheet is simple enough to stress-test on a napkin. But watch that unused borrowing capacity ($32.0 million). If that starts to shrink while loans grow, the car is running out of gas right as it’s trying to speed up.

Cash Flow: The Turbine

In most businesses, “Cash is King.” In Sezzle’s world, Cash is a Turbine. They made $90.4 million in Net Income over nine months, but “only” saw $55.6 million in Operating Cash.

Why the gap? Because they used $85.2 million to fund new loans.

Stop and think: If a baker spends all his profit buying more flour to bake more bread for tomorrow, is he “losing” money? No, he’s growing. But he better make sure people actually buy the bread.

The real “Free Cash” (Cash from Ops minus the tiny $2.1 million they spent on equipment and software) is about $53.5 million.

The Audit: The question isn’t “Where did the cash go?” It’s “Are these new loans high-quality?” If the loans are good, the cash flow is a coiled spring. If the loans are bad, the turbine is about to wobble.

The Income Statement: The Reactor Room

The reactor was humming in Q3:

Revenue: $116.8 million.

Operating Income: $35.6 million.

Net Income: $26.7 million.

Adjusted EBITDA Margin: A fat 33.9%.

But here’s the control rod: the Provision for Credit Losses was $32.177 million. Because they changed their underwriting to find more customers, they had to set aside more “just in case” money.

Unlike a software company that can just cut its travel budget to save money, Sezzle lives and dies by the “spread.” They have to make sure the 11.2% Take Rate stays comfortably above the cost of the loans going bad.

Here is the “Capital Efficiency” section, rewritten to match the Simple Truths style and tone.

The Radiation Test (Capital Efficiency)

If you want to understand why Sezzle looks “cheap” on a screen but feels dangerous in your gut, you have to look at how hot the reactor is running. The business is generating a massive amount of profit relative to the tiny amount of capital actually sitting in the bank.

That is great... until it isn’t.

The Metric: Return on Equity (ROE).

The Number: ~74% (First 9 Months of 2025).

The Translation: For every $1 of equity the owners have in the company, Sezzle generated $0.74 of profit in just nine months. If you annualized that, it’s nearly a 100% return.

The Reality Check: Net Income was $90.4M while the average equity was only ~$121.6M.

The “Audit” (Why This is Scary): The returns are sky-high not just because the business is good, but because the equity base is small.

Think of it like a sports car that has been stripped of its roll cage and bumpers to save weight. It goes incredibly fast (high efficiency), but if it hits a single bump (a spike in bad loans), it doesn’t just dent; it shatters.

The Atomic Take: Don’t admire the glow without checking the containment vessel.

The Good: They are printing money with very little capital required (ROCE is ~52%).

The Bad: This only works if the “credit dial” stays disciplined.

The Falsifier: Watch the Return on Capital (ROCE). If it drops below 30% in the next two quarters, the “capital-light profit machine” is broken, and the stock deserves to stay cheap.

Valuation

Alright, let’s address the elephant in the room. In July 2025, this stock hit $182. Today, as of writing this deep dive, it’s trading at $69.

That is a ~62.1% drawdown. Yikes.

That is not a “dip.” Not even the “dip of the dip”. That is a full-blown haircut. When a stock drops like that, you don’t just ask, “Is it cheap now?” You have to ask the harder question: “What did the market believe at $182 that it stopped believing at $69?”

The Math of the Fall

Let’s assume the share count hasn’t changed much (Sezzle told us they had 34,153,102 shares outstanding as of Nov 3, 2025). At $69, that gives us a market cap of roughly $2.4 billion.

Now, let’s translate that price drop into what actually changed: the valuation multiple.

Scenario A: The $69 Reality (Today)

If we look at the business right now, here is what you are paying for:

1. The Earnings Lens (GAAP):

Net Income (9 months): $90.4 million.

Run-Rate (Annualized): About $120.5 million (just taking the 9 months and adding a third).

The Price Tag: At a $2.4 billion market cap, you’re paying a P/E of ~19.9x.

The Yield: That’s an earnings yield of about 5.0%.

If you prefer per-share math:

Run-Rate EPS: ~$3.53.

P/E: Still ~19.6x.

2. The Cash Flow Lens (The “Truth Serum”): We can build a disciplined proxy for Free Cash Flow (FCF), not to take a victory lap, but to see how much cash actually hits the till.

Cash from Operations: $55.6 million (9M 2025).

Capex (Property + Intangibles): A tiny $2.1 million ($0.6m + $1.5m).

FCF Proxy: $53.5 million.

Run-Rate FCF: ~$71.3 million.

The Price Tag: A P/FCF of ~33.6x.

The Yield: An FCF yield of about 3.0%.

Stop and Think: Why is the P/E (19.9x) so much cheaper than the P/FCF (33.6x)? It’s the receivables, folks. Sezzle used $(85.2) million in cash just to fund new loans in the first nine months. Remember the baker? He’s showing a profit, but he’s spending his cash on flour to bake tomorrow’s bread. It’s not “bad,” but it’s expensive.

Scenario B: The Ghost of $182 (What Were We Thinking?)

Now, let’s hop in the time machine back to July. If the share count was roughly the same, that $182 price tag implied a market cap of about $6.33 billion.

Run those same earnings through that price, and here is what the market was paying:

Implied P/E: ~52.5x.

Implied Earnings Yield: ~1.9%.

Implied P/FCF: ~88.7x.

Implied FCF Yield: ~1.1%.

The Story in One Sentence: The market stopped treating Sezzle like a “Premium Tech Compounder” (where you pay 50x earnings for growth) and started treating it like a “Credit-Sensitive Cash Converter” (where you demand a discount because lending is risky).

So, Is It Cheap?

The market is basically saying: “I’ll buy it at 19x earnings, but I need you to prove you aren’t going to blow up.”

It all comes down to a simple spread trade:

The Take Rate: 11.2% (Q3 2025). This is the money coming in.

The Credit Losses: 3.1% (Q3 actual), trending toward 2.5%–2.75% (2025 target). This is the money leaking out.

If the Take Rate holds and the Credit Losses drop to that 2.5% range, then 19.9x earnings could be a bargain, in my view.

But if credit stays sticky or the take rate drops, the valuation compression wasn’t just a bad mood—it was math.

Atomic Take: The move from $182 to $69 was a massive “Multiple Reset.” We went from a ~2% earnings yield to a ~5% earnings yield. The market is now demanding proof that the profit margin is real and not just a temporary luck of the draw.

Falsifier: If the provision for credit losses doesn’t trend down to 2.5%–2.75% while the take rate stays at 11.2%, then the “Cheap P/E” narrative falls apart. The earnings aren’t durable, and the stock isn’t cheap—it’s just risky.

The “Meltdown” List (Risks)

The Seasonal Spike: Q4 is “Danger Zone” time for credit. They’re widening the net right as the shark-infested waters get choppy.

The “Fee” Optics: They made $33.5 million from consumer fees and $21.0 million from late fees. Regulators love to look at those numbers. It’s a headline risk.

The “Optional” Parasites: They’re spending $1.3 million on “strategic projects” like exploring a bank charter (ILC) and dealing with Shopify legal matters. It’s small now, but distractions can grow.

The Atomic Verdict: High Conviction

★★★★☆ (4/5)

(Star system is not a buy recommendation, only a judgement for the quality of the business based on my parameters)

Sezzle has earned the “Real Business” label. They make actual GAAP profit, and the balance sheet isn’t a house of cards. But it’s “Overhang-Heavy.” The next act depends on discipline, not just momentum.

Watch for the Upgrade: If credit costs drop toward 2.5% and subscribers keep growing past 0.6 million, I’m pounding myself on the chest.

Watch for the Downgrade: If cash from operations starts to look puny compared to net income, or if the “borrowing gas tank” hits empty, we’ve got a problem.

If you are pure numbers guy, and dont want anything else but the data,you can read the FINS analysis of Sezzle here.

Are you a believer in the “Subscription BNPL” model, or do you think the reliance on consumer fees is a regulatory ticking time bomb? Let’s hash it out in the comments below!

Sources

Sezzle Inc. — Form 10-Q (PDF): “10-Q_-Sezzle_INC-_11-06-2025.pdf”

Sezzle Inc. — Q3 2025 Earnings Call Transcript (PDF): “Q3_2025_Earnings_Call_Transcript.pdf”

Sezzle Inc. — Investor Presentation (3Q25) (PDF): “Sezzle_Investor_Presentation_3Q25.pdf”

Sezzle Inc. — IR Factsheet (3Q25) (PDF): “3Q25_IR_Factsheet_vFINAL.pdf”

Atomic Moat Research — FINS Financial Audit (PDF): “Sezzle ($SEZL) Stock Analysis_ FINS Financial Audit.pdf”

Sezzle Inc. — Financial Model / Dataset (XLSX): “SEZL-Sezzle Inc.xlsx”

Disclaimer

This Deep Dive is an educational breakdown of a public company based on information available in the materials provided (e.g., annual/quarterly reports, investor presentations, earnings transcripts) and my interpretation of that information. It is designed to be a “bolt-on” intelligence layer to your own due diligence — not a replacement for it.

Independence: I do not accept compensation of any kind from the companies discussed. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author may hold a long position in securities mentioned. Any position creates bias — treat this as commentary, not gospel.

Not Financial Advice: Nothing here is investment advice, a recommendation, or a solicitation. I am not a financial advisor. You are responsible for your own decisions. The stars rating is not a buy recommendation, but meant as a guide to understand the quality of the financial statement of the respective companies.

Error & Update Risk: Financial statements change, companies restate, guidance evolves, and I can be wrong. Verify key figures in the primary filings and consider reading the footnotes before deploying capital.

Strong analysis of the underwriting/marketing dual-lever risk. The reactor analogy is apt, especially for a lending business where capital efficiency cuts both ways. The gap betwen 19.9x P/E and 33.6x P/FCF tells the whole story - if receivables quality holds, that spread compresses fast. If not, the market already priced in the skepticism. Watching that 2.5-2.75% credit provison target will be key.

Good one, can help to cover the ROIC & ROE numbers analysis as well?