InPost: The Box That Ate the Last Mile

The 'Last Mile' of shipping accounts for 53% of the cost and 100% of the headache. One Polish company figured out that the solution wasn't to drive faster—it was to stop driving to your house.

In the “Wasteland” of e-commerce, the problem isn’t buying things. Buying is easy. The problem is getting the damn box.

We have all been there: You order a package, stay home all day, and still find a “Sorry we missed you” note stuck to your door. Or worse, the “Porch Pirates” get to it first.

The Last Mile is the most expensive, inefficient, and infuriating part of the global supply chain. It accounts for 53% of total shipping costs. It is a system built for a world where someone was always home (1950s housewives). That world is gone.

InPost (INPST) didn’t try to fix the courier; they fixed the destination. They are covering Europe in “Automated Parcel Machines” (APMs). They are building the physical internet. And right now, they are the undisputed kings of the locker.

THE PLAIN ENGLISH CASE

Here in the Bunker, we look for “plumbing.” We want the infrastructure that everyone else relies on. InPost is the plumbing of European e-commerce.

1. The “Lazy Courier” (Efficiency Moat) Traditional delivery is a nightmare: One driver, 100 stops, traffic, angry dogs, locked gates. InPost changes the physics. Instead of driving to 1,000 houses, the driver goes to one locker wall and drops off 1,000 packages.

The Math: An InPost courier delivers 1,000+ parcels per day. A traditional courier delivers ~150.

The Result: It is cheaper, faster, and greener. This is “Scale Economies Shared” in action.

2. The “Tetris” Problem (First Mover Moat) This is a land grab. InPost has already won Poland. They have over 24,000 lockers in Poland alone.

The Lock: Once InPost puts a locker at the local gas station or supermarket, there is no physical space for a competitor (DHL, Amazon) to put theirs. It is a “Real Estate Monopoly.” First one to density wins the game.

The Density: In Poland, 60% of the population lives within a 7-minute walk of an InPost locker. It’s not just a service; it’s a utility.

3. The Trojan Horse (International Expansion) InPost used its cash pile to buy Mondial Relay in France. This gave them an instant network of “PUDO” (Pick Up Drop Off) points in convenience stores. Now, they are converting those cheap shop counters into high-tech lockers. They are running the “Poland Playbook” in France and the UK.

THE NUMBERS (ON A NAPKIN)

The market hates this stock because it went public at a high price and crashed. We love “fallen angels” that are actually growing.

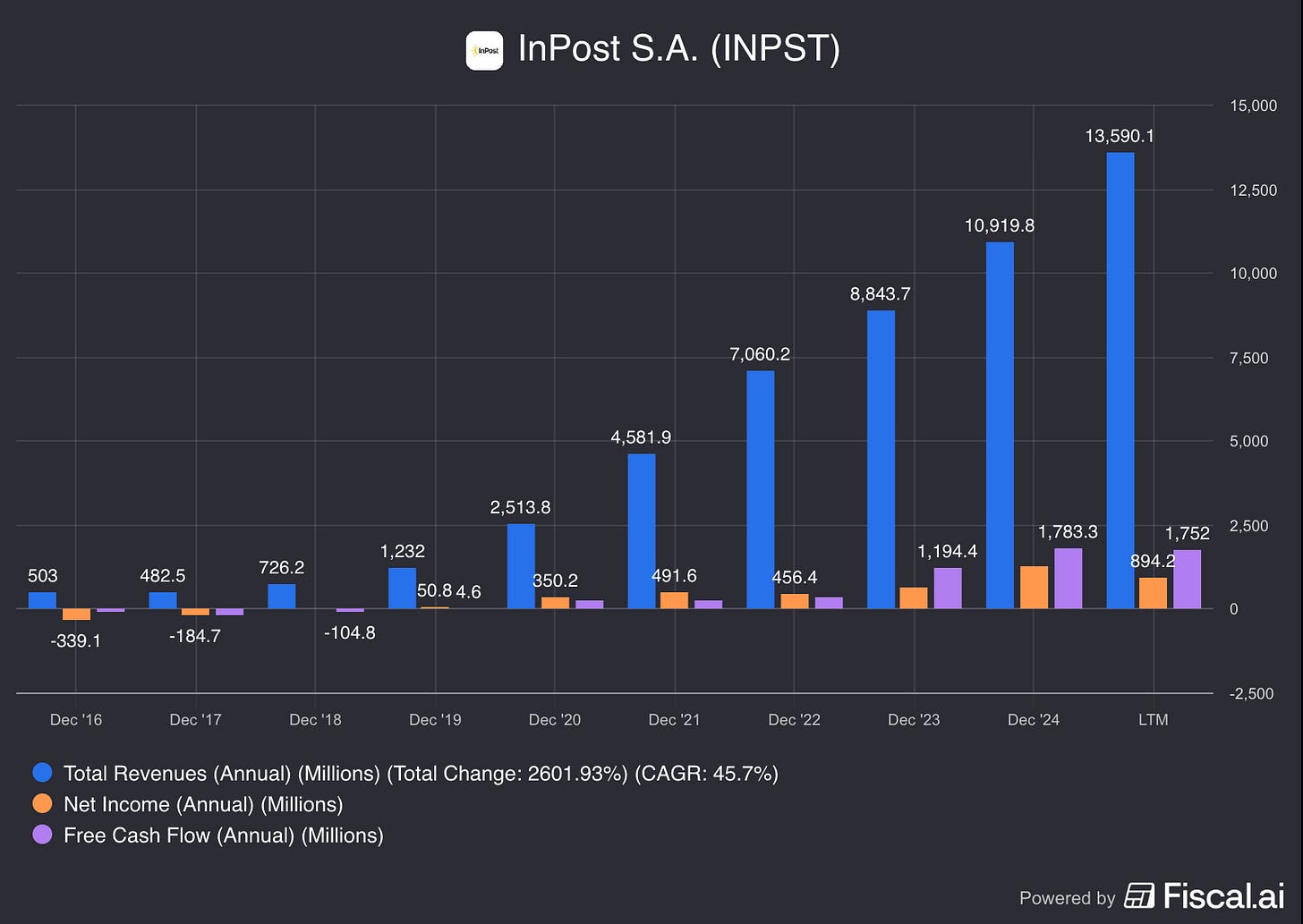

The Hyper-Growth:

Revenue Growth: They have compounded revenue at 57% CAGR since 2017.

2023 Revenue: ~8.8B PLN (approx €2B).

The Pivot: Poland is a mature cash cow generating huge EBITDA margins (~45%+). They are using this cash to fund the war in the UK and France.

The De-Leveraging:

The bear case was “too much debt” from the Mondial Relay acquisition.

Reality: Net Debt / EBITDA has dropped significantly as earnings exploded. They are paying down the mortgage with their own cash flow.

The Valuation:

It trades at roughly 12-14x EBITDA (depending on the day). For a company growing this fast with a monopoly in its home market, that is a reasonable price for a “Compounder.”

THE PRE-MORTEM (INVERSION)

How does the locker get jammed?

The Amazon Death Star: Amazon decides to burn billions to build its own locker network in Europe, locking InPost out. (Counter: InPost is “carrier agnostic”—they work with everyone, making them the Switzerland of shipping).

The “Ugly Box” Ban: City councils in Paris or London decide these metal boxes are eyesores and ban them from sidewalks. (This is a real risk; they rely on partnerships with private landlords like Tesco to mitigate this).

The UK Quagmire: The UK market is fiercely competitive. If they burn too much cash trying to win London without getting density, they could impair the balance sheet.

THE VERDICT

InPost is a “Geographic Monopoly” in Poland and a “High-Growth Speculation” in Western Europe.

They have solved the “Last Mile” problem with physics, not software. The locker network is a hard asset that gets more valuable the larger it grows (Network Effects).

The Decision: We are buying the “Infrastructure of the Internet” at a discount because the IPO investors got burned.

Stay rational.

DISCLAIMER: The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

Disclosure: The author may hold positions in the securities discussed in this transmission. Specific holdings will be disclosed in the “Portfolio” section for paid subscribers. By reading this, you agree to do your own due diligence before deploying capital.