MercadoLibre: The Emperor of the Jungle

Welcome back to the Bunker, where today we are dissecting the only asset that qualifies as the true 'operating system' of an entire continent.

Charlie Munger always told us to “invert.” If you want to help India, don’t ask “how can I help India?” Ask “what is ruining India?” and stop doing that.

So, let’s look at Latin America. What kills commerce there? It isn’t a lack of demand. It’s the chaos. It’s the bureaucracy, the broken roads, the unbanked millions, and the hyperinflation that turns cash into confetti overnight.

In “The Wasteland” of the markets, everyone calls MercadoLibre (MELI) the “Amazon of Latin America.” But that sells it short. Amazon built a store on top of existing roads and credit card networks. MercadoLibre had to build the roads and the bank just to sell a toaster.

They didn’t just build a business; they civilized the market.

THE PLAIN ENGLISH CASE

Here in The Bunker, we like simple businesses. If you need a PhD to understand the balance sheet, it’s probably wise to start looking elsewhere. MercadoLibre is complex to build, but simple to understand.

It is the “operating system” of an entire continent.

Think of it as a three-headed monster:

1. The Scout (The Eyeball Test): The Only Game in Town

If you live in a favela or the Amazon rainforest, FedEx isn’t coming. But MercadoLibre is. They built their own air fleet (”Meli Air”), distribution centers, and last-mile networks because the local infrastructure was broken. This is a “hard moat.” Software can be copied by two guys in a garage in Silicon Valley. A logistics network covering the jungle cannot.

2. The Visionary (The Thiel Test): The Dual Monopoly

Peter Thiel says competition is for losers; we want monopolies. MELI isn’t just winning the physical economy; they are winning the financial one.

The Problem: Banks in LatAm are lazy. They ignore small merchants.

The Solution: MELI sees the merchant’s sales data. They know exactly how much a seller makes. So, they offer instant loans (Mercado Credito) when no one else will.

The Lock: If a merchant leaves MELI, they lose their storefront and their working capital. That is a “Credit Lock”.

3. The Architect (The Nick Sleep Test): Scale Economies Shared

Instead of taking profits now, MELI aggressively reinvests margins into free shipping and fintech rewards. This lowers the cost for everyone.

This isn’t just a list; it is a self-reinforcing loop. In the Bunker, we call this a “perpetual motion machine”.

The Cycle Breakdown:

1. Ignition: Faster delivery creates a superior customer experience, attracting more buyers to the platform.

2. Gravity: Increased buyer traffic acts as gravity, pulling in more sellers who need those eyeballs.

3. Density: As volume creates density in the delivery network, the cost to ship each individual package drops.

4. The Reinvestment: Instead of keeping the profit, they pour the savings back into subsidies and fintech perks (Meli+).

The Result: The ecosystem becomes undeniable.

THE NUMBERS

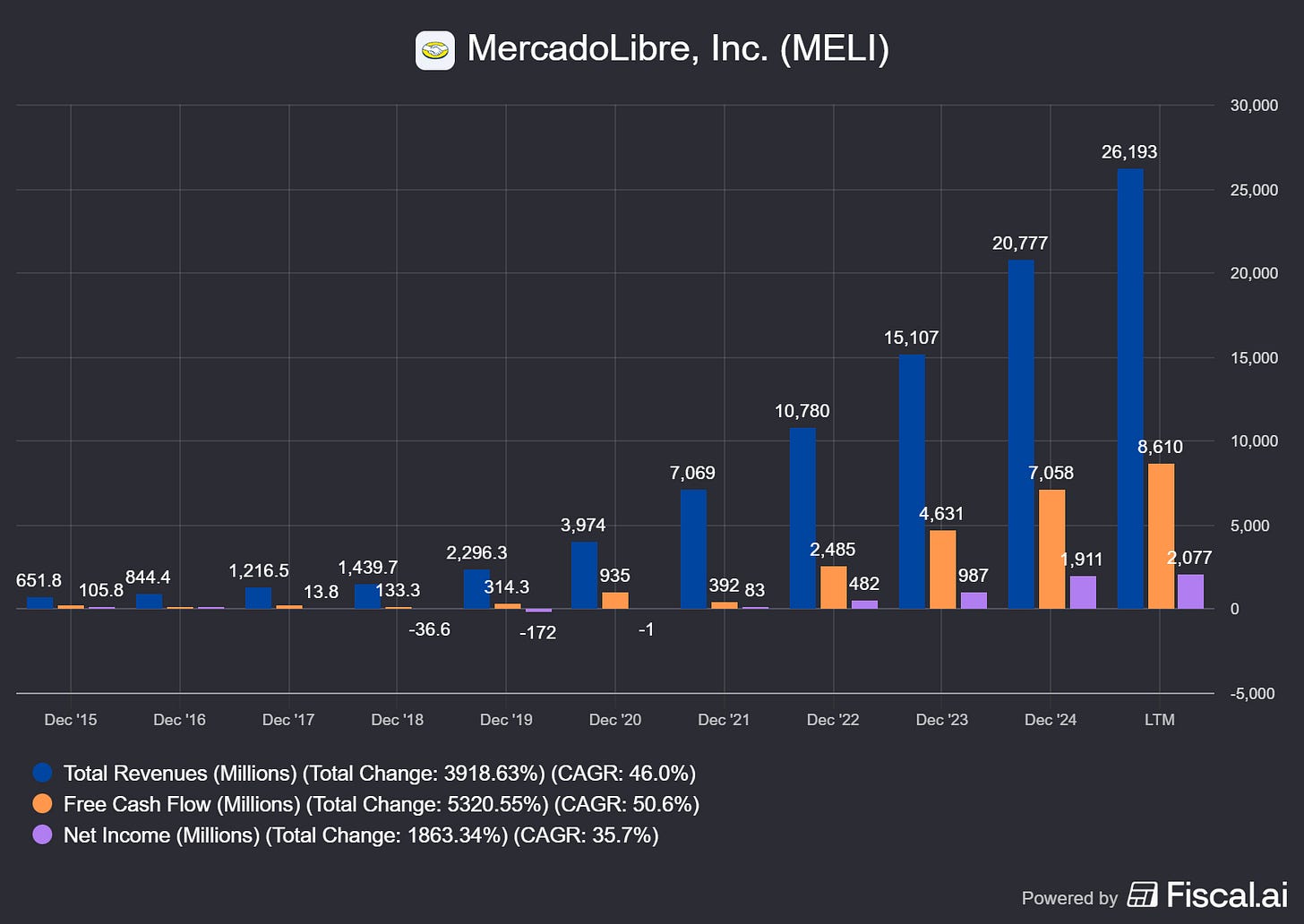

Let’s look at the scorecard. We don’t care about quarterly earnings noise; we care about the cash cannon.

The Sprint: Revenue has nearly quadrupled in four years, from $7.1B in 2021 to $26.2B today. This isn’t a startup; this is a giant sprinting.

The Cash Flow Anomaly: This is the part that makes value investors drool.

Accounting Profit: ~\3.1B

Operating Cash Flow: ~\9.8B

The Trick: They generate 3x more cash than profit. Why? Because of “The Float”. They hold cash from marketplace sales and fintech wallets before paying it out. Like an insurance company or a bank, they get to use this free capital to fund their own growth. They are funding their own destiny.

MELI generates massive cash flow thanks to 'The Float'—holding customer money before paying merchants. This is the exact same mechanism that makes Fairfax Financial (FFH) such a powerhouse in the insurance world.

THE PRE-MORTEM (INVERSION)

We are paranoid here. How does this investment go to zero?

The Macro Trap: MELI earns in Pesos and Reals but reports in Dollars. A catastrophic currency failure in Brazil or Mexico (like Argentina’s past) impairs the value of their earnings, no matter how many packages they ship.

The “Amazon” Awakening: Amazon decides to set money on fire in Brazil just to buy market share, forcing a margin-destroying price war.

Credit Blowup: They lend to the unbanked. If a regional recession hits, that loan book could turn toxic very fast.

THE VERDICT

MercadoLibre is the “LatAm Emperor”. It sits alone at the intersection of “Tech Capabilities” and “Local Street Smarts”.

We have a founder (Marcos Galperin) who has steered the ship through 25 years of coups and hyperinflation. The business is a cash machine that funds its own growth. It is a geographically concentrated bet, but it is the “aggressive growth anchor” for a portfolio.

The Decision: This is a fat pitch to us. As long as they keep the “Credit Lock” tight and the planes flying, we hold on.

Stay rational.

DISCLAIMER

The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author (Rob H.) is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

Disclosure: The author may hold positions in the securities discussed in this transmission. Specific holdings will be disclosed in the “Portfolio” section for paid subscribers. By reading this, you agree to do your own due diligence before deploying capital.