The Art of Going Against The Crowd

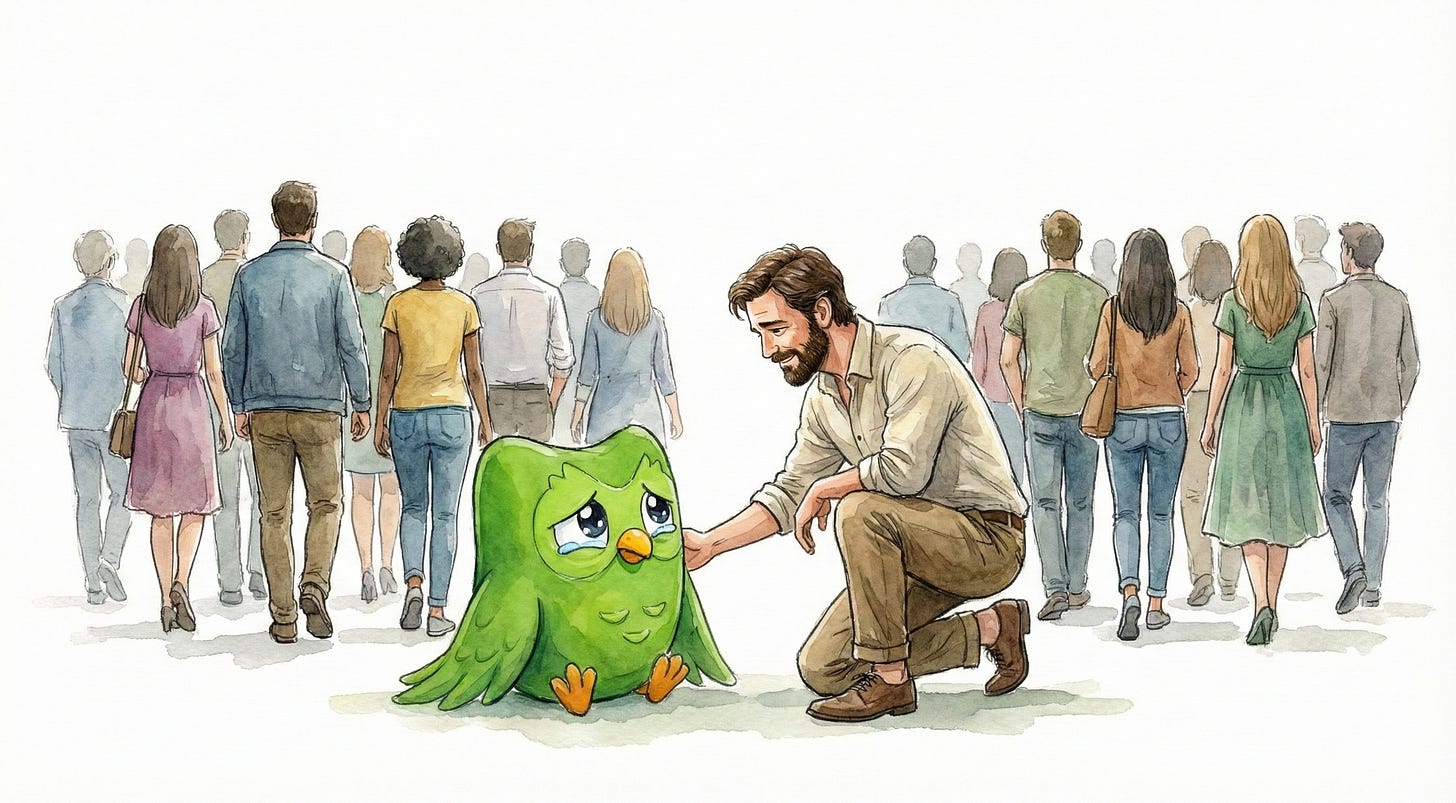

Why the "Duolingo Panic" is the perfect case study in Second-Level Thinking.

If you hold Duolingo ($DUOL), you are currently living through what Howard Marks calls “the uncomfortably non-consensus.”

The timeline is ugly. The stock is down. The headlines (CFO departure, slowing growth, AI threats) are relentless. Your brain, which evolved to keep you safe by following the herd, is screaming at you to sell and make the pain stop.

But before you click “sell,” I want to walk you through a mental exercise.

We are going to apply the framework of Howard Marks (co-founder of Oaktree Capital and arguably the world’s most grounded investor) to the current situation with Duolingo. This isn’t just about saving a trade; it’s about learning a skill that separates the great investors from the average ones: Emotional Discipline.

The “Second-Level” Test

In his book The Most Important Thing, Marks introduces the concept of Second-Level Thinking.

First-Level Thinking is simplistic and reactionary. It sees a headline and reacts instantly. It’s effortless, and because everyone does it, it leads to average results.

Second-Level Thinking is deep, complex, and convoluted. It asks: What is the consensus missing? Is the bad news already priced in?

Let’s run the current Duolingo bear case through this filter.

The Headline: “Growth slowed to 30%. The hyper-growth phase is over.”

Level 1 Reaction: “Sell. Slowing growth means the company is dying”.

Level 2 Analysis: “Wait. Growing at 30% on a base of 50 million users is mathematically massive. It’s what we call “resistance to gravity.” Furthermore, management explicitly stated they dialed back marketing spend recently. This suggests growth is a controlled lever, not a broken engine. The consensus sees “failure”; the second-level thinker sees maturation and optionality.”

The Headline: “The CFO left.”

Level 1 Reaction: “Panic. Rats flee a sinking ship”.

Level 2 Analysis: “Check the books. A CFO leaving is terrifying if the company has debt or accounting irregularities. Duolingo has a fortress balance sheet with $1.01 Billion in cash and zero net debt. The “house” is in perfect order. The consensus assumes disaster; the second-level thinker verifies the foundation”.

The Headline: “AI will replace language learning.”

Level 1 Reaction: “Obvious. ChatGPT translates everything. The product is obsolete”.

Level 2 Analysis: “If translation was the product, Google Translate would have killed Duolingo in 2014. The product is motivation. AI cannot replicate the psychological hook of the “Streak” or the gamified engagement (which sits at an industry-leading 37% DAU/MAU ratio). In fact, AI lowers Duolingo’s content creation costs. The consensus sees an existential threat; the second-level thinker sees a cost-saving tailwind”.

The Pendulum of Psychology

Marks famously teaches that market sentiment swings like a pendulum; rarely resting in the rational middle, but swinging wildly between flawless perfection and hopeless despair.

Around six months ago, at ~$500 a share, the pendulum was at “Perfection.” Duolingo was priced for miracles. It was dangerous to buy then because nothing could go wrong.

Today, the pendulum has swung to “Despair.” The market is pricing the stock as if the AI death spiral has already begun.

Here is the irony, according to Marks: The safest time to buy is usually when it feels the scariest.

When the crowd hates a stock, the expectations are reset to the floor. Right now, Duolingo is trading at ~25x EBITDA (down from the stratosphere). The “optimism tax” has been removed. As Marks says, risk is not a function of the asset’s quality, but of the price you pay for it. At this lower price, the risk is significantly lower than it was at the highs, even though it feels scarier.

The “Margin of Safety” (The Sleep-Well-At-Night Factor)

Marks borrows heavily from Benjamin Graham regarding the “Margin of Safety.” You need a buffer in case your thesis is wrong.

Where is the safety in a tech stock? It’s in the cash.

Duolingo isn’t a speculative unprofitable tech company. In Q3 2025 alone, they generated $77.4 million in Free Cash Flow with a 28.5% margin. They are printing cash.

Even if growth slows further, that cash flow provides a floor. It allows them to buy back stock, acquire competitors, or simply weather the storm. A company with $1B in the bank and 28% cash margins doesn’t go bankrupt. That is your margin of safety.

The Investor’s Checklist: Are you being a Contrarian or just Stubborn?

Alright, time to do a mirror check: I do hold Duolingo. Am I biased? Am I just stubborn, not wanting to face an inevitable end of Duolingo?

How do you know if you are being a smart “Marksian” contrarian or just a stubborn bag-holder?

Use this checklist on Duolingo (or any stock in your portfolio):

The View: Do I hold a view that is different from the consensus?

Yes. Consensus says “Dead/Slow”; I say “Durable/Cash Machine.”

The Evidence: Is my view based on hope or data?

Data. I am looking at the $77M FCF and the 37% engagement ratio. The crowd is looking at the stock chart.

The Price: Is the pessimism already priced in?

Likely, but the share price can still go lower. The multiple has compressed significantly. The market is no longer paying for “miracles.”

The Emotion: Am I uncomfortable?

Yes. Good. If it felt comfortable, there would be no profit potential.

(You can see my full portfolio here)

Final Thought

The goal of investing isn’t to never feel pain. It is to behave rationally when everyone else is behaving emotionally.

Right now, the market is offering you a profitable, cash-rich, dominant category leader at what I think is a steep discount because it is worried about a slowdown.

What I hope you got out of this article in general:

You can choose to follow the First-Level thinkers and sell to relieve your anxiety. Or you can engage your Second-Level thinking. As for the case of Duolingo, look at the cash fortress, and realize that this discomfort is simply the price of admission for superior returns.

Disclaimer: This is for educational purposes, not financial advice. I own shares of $DUOL because I like the pain.

I like the stubborn check list!! Useful