The Atomic Analysis: Duolingo (DUOL)

Most apps want your attention so they can sell you ads. This owl wants your soul, and in exchange, it might actually teach you Spanish.

It’s the most aggressive, passive-aggressive notification system in history, and it’s printing money.

Let’s have a look.

The Setup

We are looking at Duolingo, the green owl that guilt-trips you into learning French. It is the “Sesame Street of the 21st Century” building an unassailable data moat. The thesis was simple: a “free-to-play” flywheel that scales better than any paid competitor. Well, fast forward to late 2025, and the flywheel is spinning so fast it’s generating its own gravity.

Atomic Stake: I own it in my core portfolio.

Balance Sheet (The Geiger Test)

This isn’t a balance sheet; it’s a doomsday bunker.

Liquidity: As of Q3 2025, the company is sitting on a massive $1.12 Billion in cash and equivalents.

The Debt: Zero. Net Debt is flat-out $0. They are funding everything from operations.

Asset Quality: Total Assets have swollen to $1.88 Billion, mostly cash. It’s a capital-light software business that accumulates cash faster than it can spend it.

Atomic Take: The Geiger counter is silent. This is one of the cleanest balance sheets in the SaaS universe. It’s stable, fortified, and ready for acquisitions (or just earning interest).

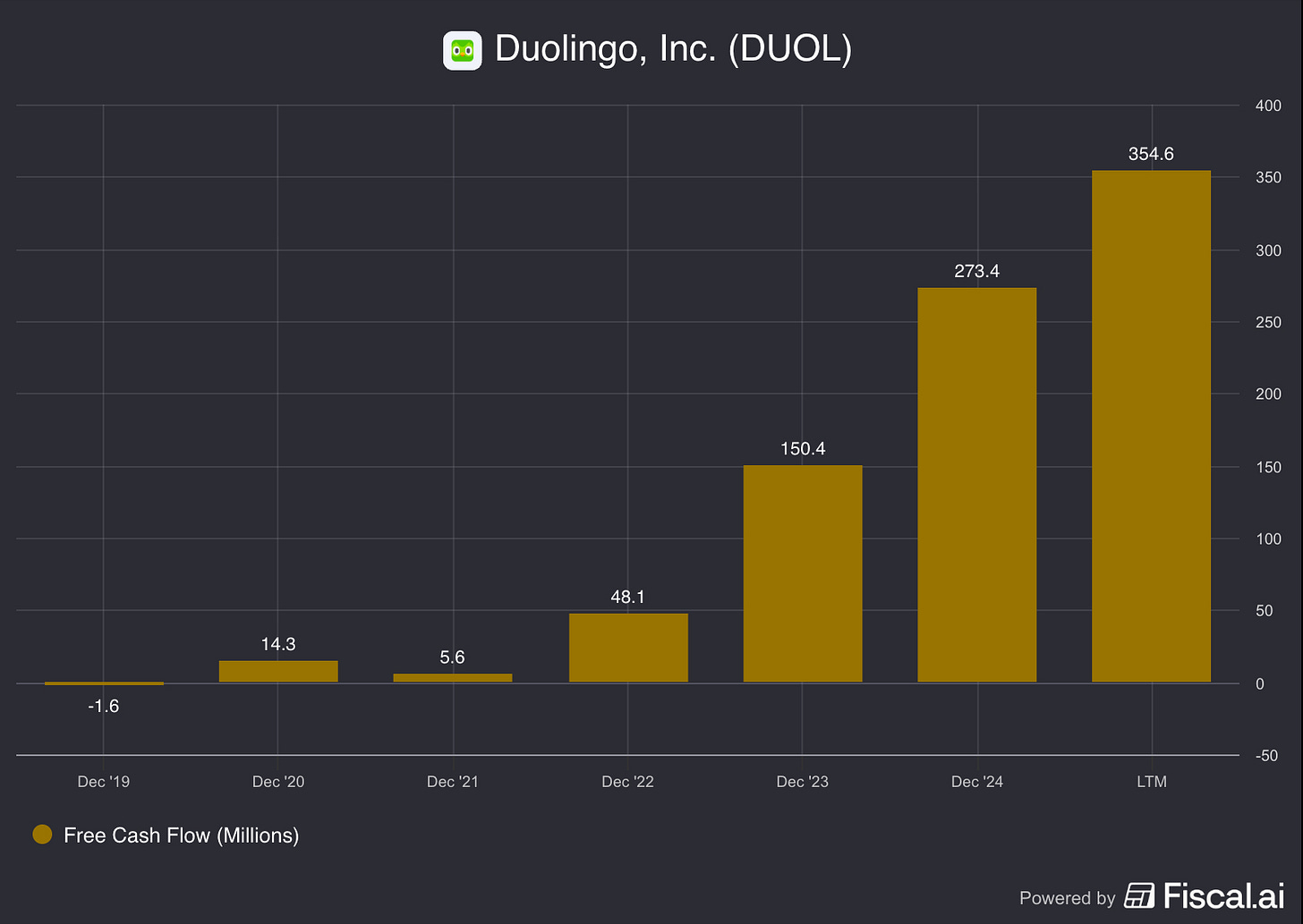

Cash Flow (Energy Output)

The owl is laying golden eggs.

Free Cash Flow (FCF): This is the headline story. LTM Free Cash Flow has exploded to $347.6 Million.

The Conversion Anomaly: Notice something weird? FCF ($347M) is significantly higher than EBITDA ($120M). Why?

Deferred Revenue: Users pay for annual subscriptions upfront, boosting cash flow before revenue is recognized.

Stock-Based Compensation (SBC): A significant non-cash expense that gets added back to cash flow.

Efficiency: They are converting nearly 36% of Revenue into Free Cash Flow ($347M FCF on $964M Sales). That is elite software territory.

Atomic Take: The energy output is blindingly bright. The upfront subscription model acts like an interest-free loan from customers. Just be aware that a chunk of this “cash flow” is paid for by diluting shareholders (SBC).

Share Capital & Insiders (Nucleus Check)

The nest is getting a bit crowded.

Dilution: The share count has grown from 38.3M in 2021 to 45.2M in Q3 2025. That’s an ~18% total increase, or roughly 4-5% per year. This is the cost of that high FCF (paying engineers in stock).

Valuation: The stock has taken a beating lately, been trading around $180, giving it a market cap of roughly $8-9 Billion.

Insiders: The founders control the voting power. They are firmly in the cockpit.

Atomic Take: The nucleus is stable but expanding. The dilution is the “hidden tax” here. You are paying for the growth, but as long as revenue grows at 30%+, a 4% dilution drag is acceptable.

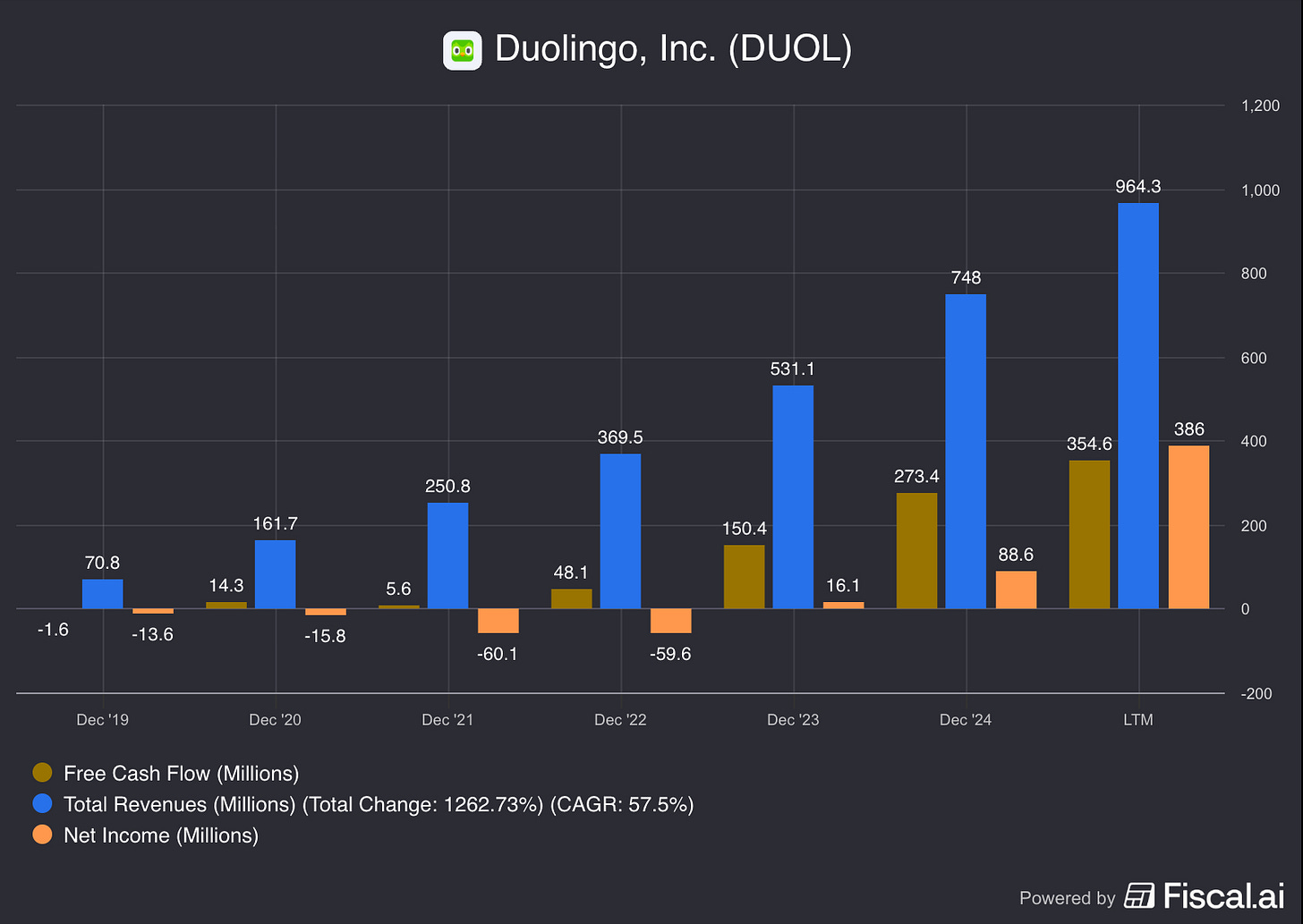

Income Statement (Reaction Chamber)

From “Growth at all costs” to “Profitable Growth.”

Revenue: LTM Net Sales have reached $964 Million, nearly touching the $1B milestone. The growth rate is robust (~30% YoY).

Profitability: They have swung definitively to GAAP profitability. LTM Operating Income is **$106 Million** (positive), a massive turnaround from the -$60M losses of 2021-2022.

The Net Income Spike: You might see a massive “Profit to Equity Holders” of $386 Million in the LTM data. Warning: This is likely distorted by a one-time tax benefit (releasing a valuation allowance) given that Pre-Tax income was only $150M. Do not value the company on a 23x P/E ratio; look at the Operating Income or FCF.

Atomic Take: The reaction chamber is self-sustaining. The operating leverage is kicking in—revenue is growing much faster than expenses. The business model works.

The Atomic Verdict

Duolingo has successfully gamified education and, in the process, gamified its own P&L. It has transitioned from a cash-burning startup to a cash-generating fortress. The “Free-to-Play” moat described in your thesis is real: they have the users, the data, and the cash to bury competitors.

The valuation (approx. 26x EV/FCF) is actually reasonable for a monopoly-like asset growing at this pace. The only radiation risk is the reliance on Stock-Based Compensation to pad the cash flow numbers.

Status:

CRITICAL MASS (High Momentum)

(Rating Justification: Elite cash flow conversion, fortress balance sheet ($1.1B Cash, $0 Debt), and rapid revenue growth. It has achieved escape velocity.)

The Bottom Line: The Owl is not just a meme; it’s a compounder. If you can handle the SBC dilution, this is one of the highest-quality assets in the consumer tech space.

Just don’t forget your daily lesson.

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.