The Atomic Analysis: Pagaya Technologies (PGY)

Lending money is easy; getting it back is the hard part. Doing it with an AI “black box” that promises to find gold in the credit-score dumpster? That’s either alchemy or the future of finance.

The Setup

We are looking at Pagaya Technologies, the Israeli fintech that claims its AI can underwrite loans better than FICO scores and banks combined. They operate a B2B2C model: banks use Pagaya’s AI to approve more borrowers, and Pagaya packages those loans into securities (ABS) to sell to investors. It’s a classic “middleman with a brain” strategy. Recently, they’ve managed to do the impossible for a former SPAC: swing to GAAP profitability.

Atomic Stake: I don’t own it. The volatility is enough to induce motion sickness (52-week range: $8 - $45).

Balance Sheet (The Geiger Test)

This is where the “Black Box” gets physical. And heavy.

Liquidity: They recently raised $500 million in corporate debt and expanded their credit facility to $132 million. This gives them a massive war chest, but it also adds leverage.

Risk Retention (The Glowing Rods): Unlike a pure software company, Pagaya has to eat some of its own cooking. They typically hold 3-5% of the loans/securities on their balance sheet (”skin in the game”) to prove to investors they aren’t selling junk.

Asset Quality: The risk here is macro. If the economy tanks and borrowers stop paying, those retained assets become toxic waste. However, they claim their AI has reduced delinquencies by 20-40% compared to previous vintages.

Atomic Take: The Geiger counter is ticking, but not alarming... yet. The recent debt raise buys them time and stability, but the “Risk Retention” assets mean they aren’t immune to a credit crunch. They are levered to the consumer economy.

Cash Flow (Energy Output)

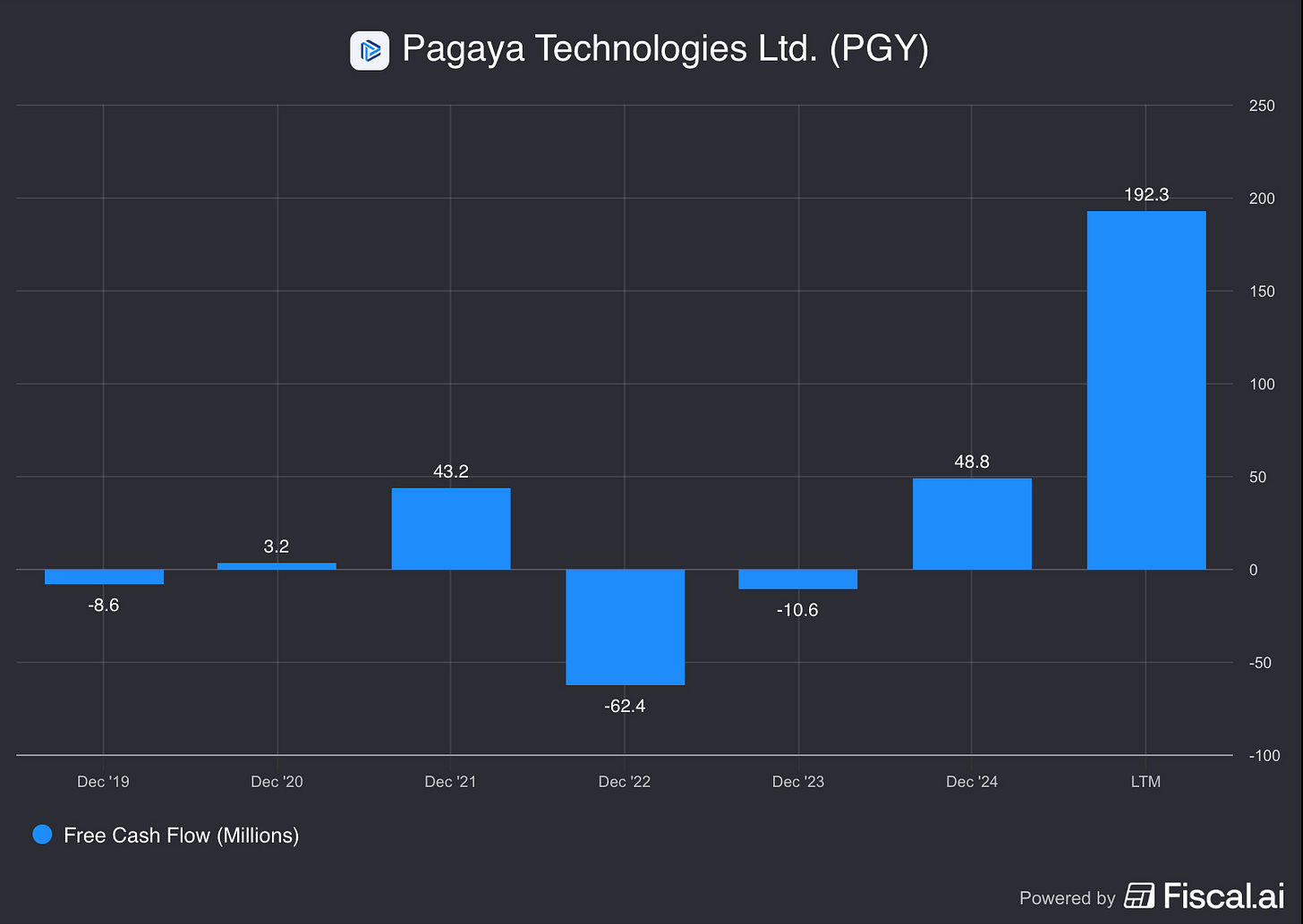

The reactor is finally generating power instead of just consuming it.

Operating Cash Flow (OCF): The narrative has shifted. They are now generating positive cash flow, with Fee Revenue Less Production Costs (FRLPC)—their favorite non-GAAP metric—hitting a record $139 million in Q3 2025.

Free Cash Flow (FCF): TTM Free Cash Flow is reported positive at roughly $185 million. This is a massive deviation from the cash-burning days of 2022-2023.

The Flywheel: They are using this cash to fund new “forward flow” agreements (buying more loans) and expanding into auto/POS lending.

Atomic Take: The energy output is positive. They have proven the unit economics work at scale. The cash burn narrative is dead; now it’s about cash conversion.

Share Capital & Insiders (Nucleus Check)

The scientists are selling, but they still own the lab.

Ownership: Insiders hold a significant chunk, roughly 16-24% of the company depending on the metric.

Selling Pressure: There has been some recent selling by key executives (CFO, President), totaling millions in stock. This is never great to see during a “turnaround,” but it’s often just housekeeping for founders.

Dilution: The share count has stabilized compared to the chaotic de-SPAC period. They are now focusing on “capital efficiency” rather than just issuing shares to survive.

Atomic Take: The nucleus is stable. The high insider ownership aligns incentives, even if the recent sales are a slight buzzkill. They aren’t treating shareholders like an ATM anymore.

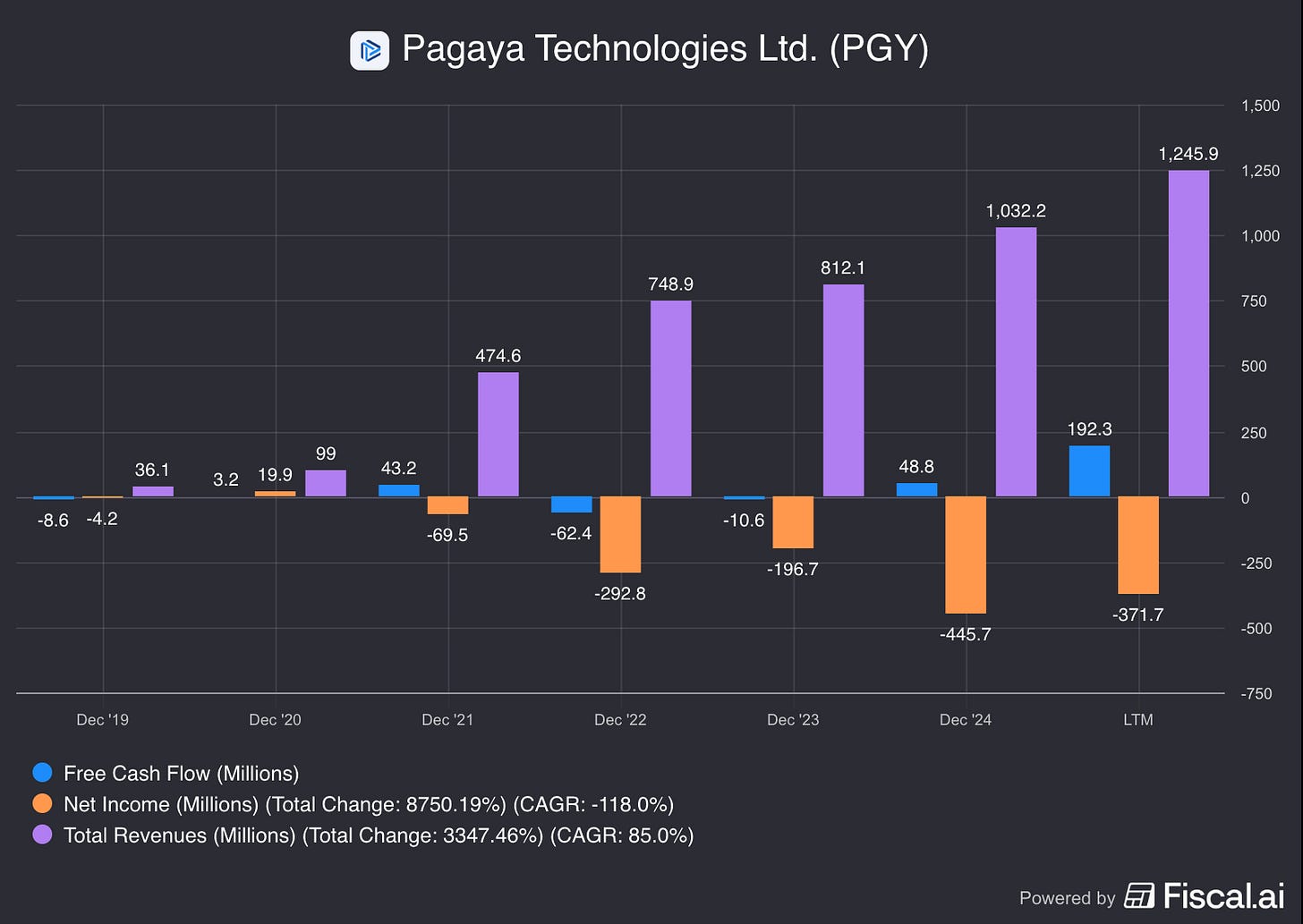

Income Statement (Reaction Chamber)

Fusion achieved. We have ignition.

Revenue: Growth is robust. Total Revenue for Q3 2025 was $350 million, up 36% YoY. They are defying the “fintech winter.”

Profitability: This is the headline. They posted $23 million in GAAP Net Income for Q3 2025. Not “Adjusted EBITDA” (which was a hefty $107M), but actual, real GAAP profit.

Margins: They are expanding. The “conversion rate” of applications to loans is steady at 1%, but they are monetizing it better with higher fees and lower costs.

Atomic Take: The reaction chamber is self-sustaining. Achieving GAAP profitability in this interest rate environment is a mic-drop moment. They have proven the model scales without exploding costs.

The Atomic Verdict

Pagaya has graduated from “speculative science experiment” to “functional power plant.” They have navigated a high-rate environment, achieved GAAP profitability, and raised capital to fortify the balance sheet.

The risk remains the “Black Box.” You are trusting their AI to predict the future behavior of millions of borrowers. If the AI hallucinates, the balance sheet implodes. But right now, the math is working.

Status:

CRITICAL MASS (Volatile)

(Rating Justification: High growth (36% YoY), GAAP profitability, and strong cash flow justify the “Critical Mass” label. However, the complexity of the securitization model and the sensitivity to macro credit risk keeps the “Volatile” warning label firmly attached.)

The Bottom Line: This is a high-beta play on the US consumer and AI adoption in finance. If you believe in a “soft landing,” Pagaya is a rocket ship. If you see a recession, it’s a submarine with screen doors.

Pagaya uses AI to price risk for banks. This is similar to the approach taken by MercadoLibre (MELI) in Latin America, where they use merchant data to offer credit where banks fear to tread.

DISCLAIMER

The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk. Disclosure: The author may hold positions in the securities discussed.