The Atomic Moat FINS Analysis: BrainsWay (BWAY)

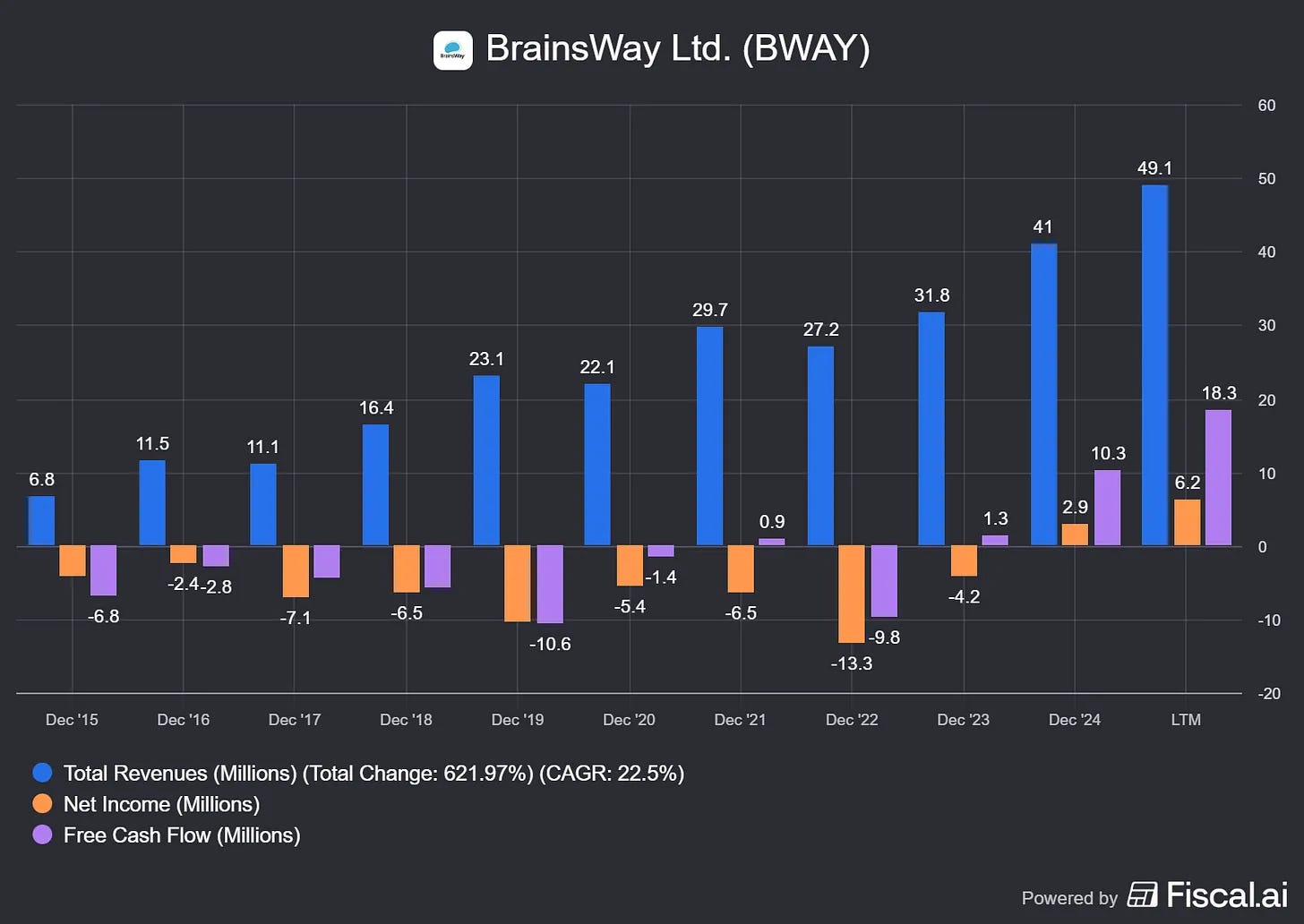

BrainsWay sells a brain zapper in a world that desperately needs one. The fun part: it’s starting to look like a real business, not a science project.

The Setup

BrainsWay is a transcranial magnetic stimulation (TMS) company selling “Deep TMS” systems and coils to clinics treating mental health disorders.

This is a reimbursement-powered flywheel: clinics get paid, clinics buy machines, patients show up, and everyone pretends the paperwork is “just admin.”

Q3 2025 showed $13.5m revenue and 75% gross margin (reported), plus $1.6m net profit (reported).

The story management is selling: a growing recurring base via multi-year leases, with $65m in remaining performance obligations (RPO) and $51–52m FY2025 revenue guidance (reported).

This is a “boring compounding” setup hiding inside a med-tech wrapper.

[GROUP][REPORTED][9M 2025] KEY STATS

REVENUE (USD '000)...........37,680

GROSS MARGIN (%).............75.02

OPERATING PROFIT (USD '000)..2,407

NET INCOME (USD '000)........4,700

ADJUSTED EBITDA (USD '000)...4,767 (NON-IFRS)Personal Stake: No position (watchlist).

What the market thinks right now (Bulls vs Bears)

Market: “Mental health is big, but med device adoption is slow.”

Bull: “Recurring leases + high margins = stealth compounder.”

Bear: “Reimbursement giveth, reimbursement taketh away.”

Atomic Take: This looks like a real, scaled TMS operator—but the business is still downstream of payer mood swings.

What breaks this? A sustained drop in reported gross margin below 70%.

Balance Sheet (The Geiger Test)

A strong balance sheet is only useful if you don’t immediately do something weird with it.

As of 30 Sep 2025, BrainsWay reported $70.458m cash and cash equivalents (reported), plus $0.251m restricted cash (reported).

Total assets were $113.062m (reported), with equity of $70.065m (reported).

Non-current assets rose sharply versus year-end 2024 (reported), which matters because the deck also mentions “strategic investments” and a partner-backed scaling story.

Cash gives them time; time is what med-tech needs when the real boss is insurance policy committees.

[GROUP][REPORTED][AS OF 30 SEP 2025] KEY STATS

CASH AND CASH EQUIVALENTS (USD '000)....70,458

RESTRICTED CASH (USD '000)..............251

TOTAL ASSETS (USD '000).................113,062

TOTAL LIABILITIES (USD '000)............42,997

TOTAL EQUITY (USD '000).................70,065The Audit: Two optical illusions to watch:

“No debt” can still coexist with meaningful liabilities; here, non-current liabilities were $17.004m (reported), so read the footnotes before you declare victory.

A chunky shift in liquidity presentation happened quarter-to-quarter (short-term deposits existed at 30 Jun 2025 but not at 30 Sep 2025), which can hide timing games if you only eyeball “cash.”

Atomic Take: Balance sheet strength is real—and it buys optionality without forcing dilution right now.

What breaks this: A material step-down in cash with no matching increase in reported RPO or profitability.

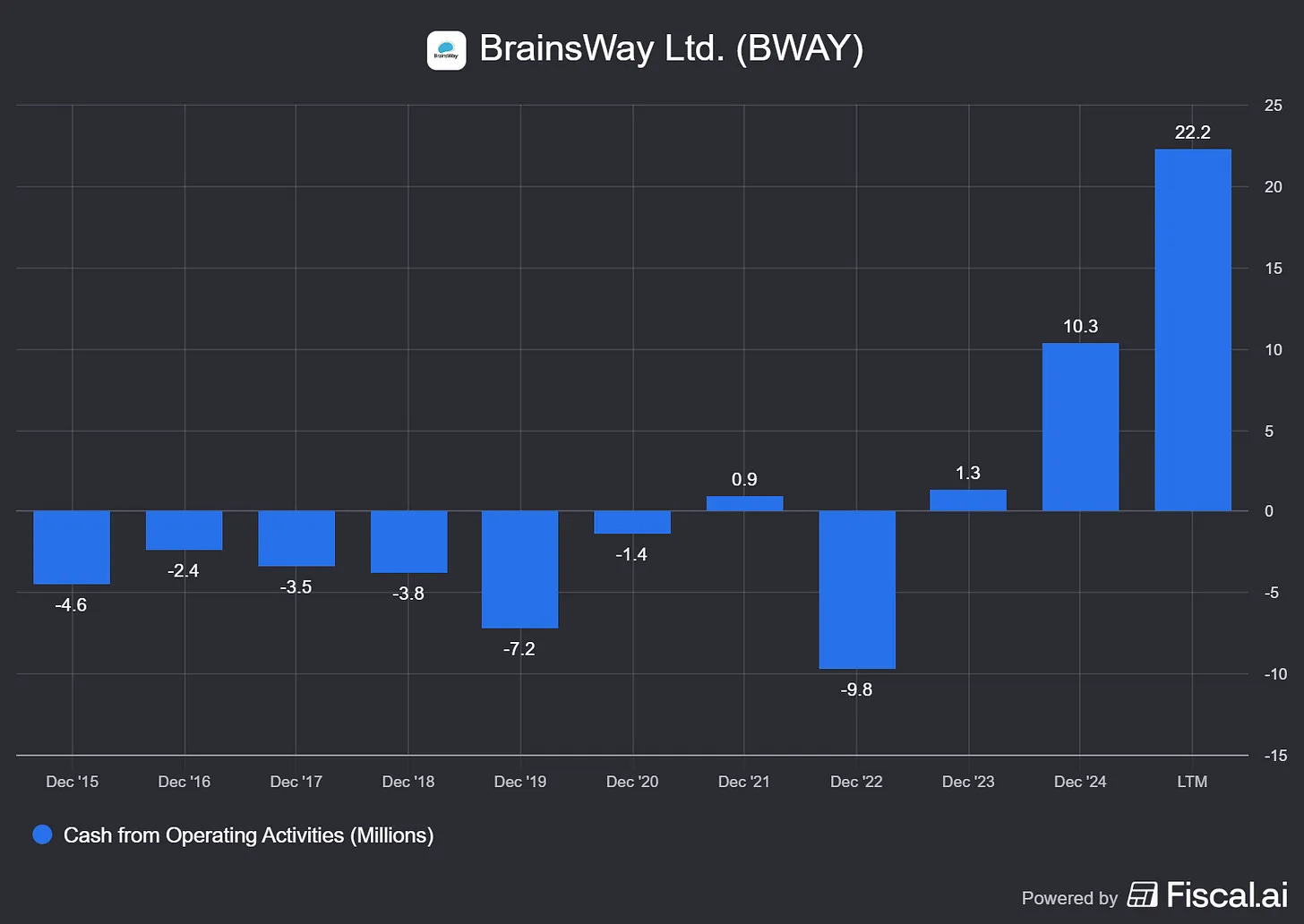

Cash Flow (Energy Output)

Profit is an opinion; cash is the sworn testimony.

Net liquidity barely moved from year-end 2024 to 30 Sep 2025 (reported), despite growth initiatives and “strategic investments.”

This is where “lease-heavy recurring revenue” can be a blessing or a timing trap, depending on collections and contract structure.

Cash is behaving, but I want the receipts.

[GROUP][REPORTED][9M 2025] KEY STATS

NET INCOME (USD '000)....................4,700

NET LIQUIDITY (USD '000)................70,709

NET LIQUIDITY (USD '000)................69,616

CHANGE IN NET LIQUIDITY (USD '000)......+1,093

CASH AFTER INVESTMENTS (PROXY)..........+1,093The Audit: Working capital timing is the usual villain in device land, and lease structures can smooth revenue while cash behaves differently.

What breaks this? If reported net income stays positive while reported cash declines for multiple quarters without a clear disclosed driver.

Income Statement (Reaction Chamber)

This is a high-margin business—when the machine is fed.

Q3 2025 reported 75% gross margin and $2.0m adjusted EBITDA (non-IFRS), with $1.6m net profit (reported).

On a nine-month basis, revenue was $37.680m (reported) with gross margin of 75.02% (reported).

Here’s the eyebrow-raiser: nine-month operating profit was $2.407m (reported), but net income was $4.700m (reported), helped by finance income of $2.762m (reported).

Operating performance is improving, but some profit is coming from below the operating line.

[GROUP][REPORTED][Q3 2025] KEY STATS

REVENUE (USD m).........................13.5

GROSS MARGIN (%)........................75

ADJUSTED EBITDA (USD m).................2.0 (NON-IFRS)

NET PROFIT (USD m)......................1.6

SYSTEM SHIPMENTS (SYSTEMS)..............90Quick Hits:

• ~70% of new engagements were structured as multi-year leases (reported).

• Customer retention was 93% (reported).

• RPO was $65m (reported) and book-to-bill was 1.3x (reported).

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Reimbursement stability (the real boss)

🔒 FACT: Reimbursement is supported by “3 well-established CPT codes” and the deck cites broad coverage figures (reported).

🧠 HYPOTHESIS: Coverage stays stable enough that clinic ROI remains compelling, sustaining placements and coil utilization.

📈 MONITOR: Any disclosed payer policy reversals—or a step-down in reported gross margin as pricing power weakens.

Signal 2: Indications expansion vs cost creep

🔒 FACT: BrainsWay highlights FDA-cleared indications and an accelerated protocol clearance for MDD (reported).

🧠 HYPOTHESIS: New indications and new care settings expand the addressable market without compressing economics.

📈 MONITOR: Timelines for non-cleared pipeline items (e.g., the home-use device noted as not FDA-cleared) slipping while operating expenses grow.

Atomic Take: The income statement is trending the right way, but the “quality of earnings” depends on keeping reimbursement and operating leverage intact.

What breaks this: Operating profit (reported) fails to expand even as revenue hits the company’s $51–52m FY2025 guide.

The Atomic Verdict

BrainsWay is building a repeatable clinic economics machine—just don’t forget who controls the “on” switch.

• Quality: High gross margins with a growing lease-like recurring mix (reported).

• Health: Cash-heavy balance sheet, with $70.458m cash (reported).

• Overhang: Reimbursement policy risk is existential, not theoretical (reported).

• What must happen next: Convert RPO and guidance into higher operating profit, not just “adjusted” slides (reported).

Status: STABLE ISOTOPE

⭐⭐⭐⭐★ (4/5 Stars)

Reason 1: High reported gross margin with recurring momentum.

Reason 2: Cash cushion reduces near-term financing risk.

Upgrade Triggers

• FY2025 revenue reported at or above $52m.

• Reported operating profit margin moves above 6% on a sustained basis.

• Reported RPO rises above $65m at the next disclosed update.

Downgrade Triggers

• Reported gross margin falls below 70% for two consecutive quarters.

• Reported net profit turns negative while revenue is growing.

• Reported cash drops below $60m without a clearly disclosed, value-accretive use.

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.