The Atomic Moat FINS Analysis: Innovative Aerosystems (ISSC)

ISSC is having one of those “overnight successes” that takes 30 years, a defense program ramp, and a factory move nobody wants to botch.

ISCC looks like a small company that accidentally wandered onto a big stage, and—so far—didn’t trip over the cables.

The Setup: What this company actually does

Innovative Solutions & Support (ISSC) is a U.S.-based avionics OEM doing cockpit automation, displays, sensors, flight control, and integration work (plus support/installation).

The story in 2025 is less “new gadget” and more “execution”: ramping an F-16 program, integrating product lines acquired from Honeywell, and migrating to an Exton facility.

If you like businesses that can turn engineering into manufacturing without outsourcing their soul, ISSC is at least interesting.

[ISSC][REPORTED][F3Q 2025] KEY STATS

REVENUE (USD MM)...........24.1 (105% y/y)

ADJ. EBITDA (USD MM)........4.4 (43% y/y)

ADJ. EBITDA MARGIN (%)......18.3

BACKLOG (USD MM)............72.4

DILUTED EPS (USD)...........0.14Personal Stake: No position (watchlist).

What the market thinks right now (Bulls vs Bears)

Market: “Small-cap avionics… but with a defense ramp and new facility—maybe this finally scales.”

Bull: “F-16 deliveries + backlog acceleration = operating leverage season.”

Bear: “Margins whiplashed down while revenue doubled—this is a program-timing sugar rush.”

Atomic Take: ISSC’s direction looks right; the question is whether margins and cash behave like a grown-up manufacturer as volume rises.

What breaks this: Backlog falls materially from $72.4m while revenue stays elevated (meaning the ramp was pull-forward, not demand).

Balance Sheet (The Geiger Test):

Leverage is low—until the cycle turns

They highlight liquidity (cash + revolver availability) and a fast drop in net leverage to 1.1x by F3Q25.

Net debt is still meaningful for a company this size, and it swung hard over the last year—exactly the kind of thing that happens when inventory, deliveries, and milestone timing dominate your life.

They also closed a new five-year, $100m credit facility, which is either “smart flexibility” or “you’ll be tempted to snack on acquisitions.”

Debt is a tool; it’s also a personality test.

[ISSC][REPORTED][AS OF 30 JUN 2025] KEY STATS

TOTAL DEBT (USD)...........23,258,511

CASH (USD).................601,759

NET DEBT (USD).............22,656,752

NET LEVERAGE (X)...........1.1The Audit: Two optical illusions to watch

“Low leverage” can be timing—net debt moved around a lot quarter-to-quarter, so don’t anchor on a single leverage snapshot.

“Liquidity > $12m” is comforting, but it’s also a reminder they’re still operating close enough to the ground that facility moves and ramps matter.

Atomic Take: Balance sheet looks serviceable today, but it’s not built to absorb a multi-quarter program stumble without drama.

What breaks this: Net leverage rises back above 2.0x while backlog is flat/down (debt up, demand not).

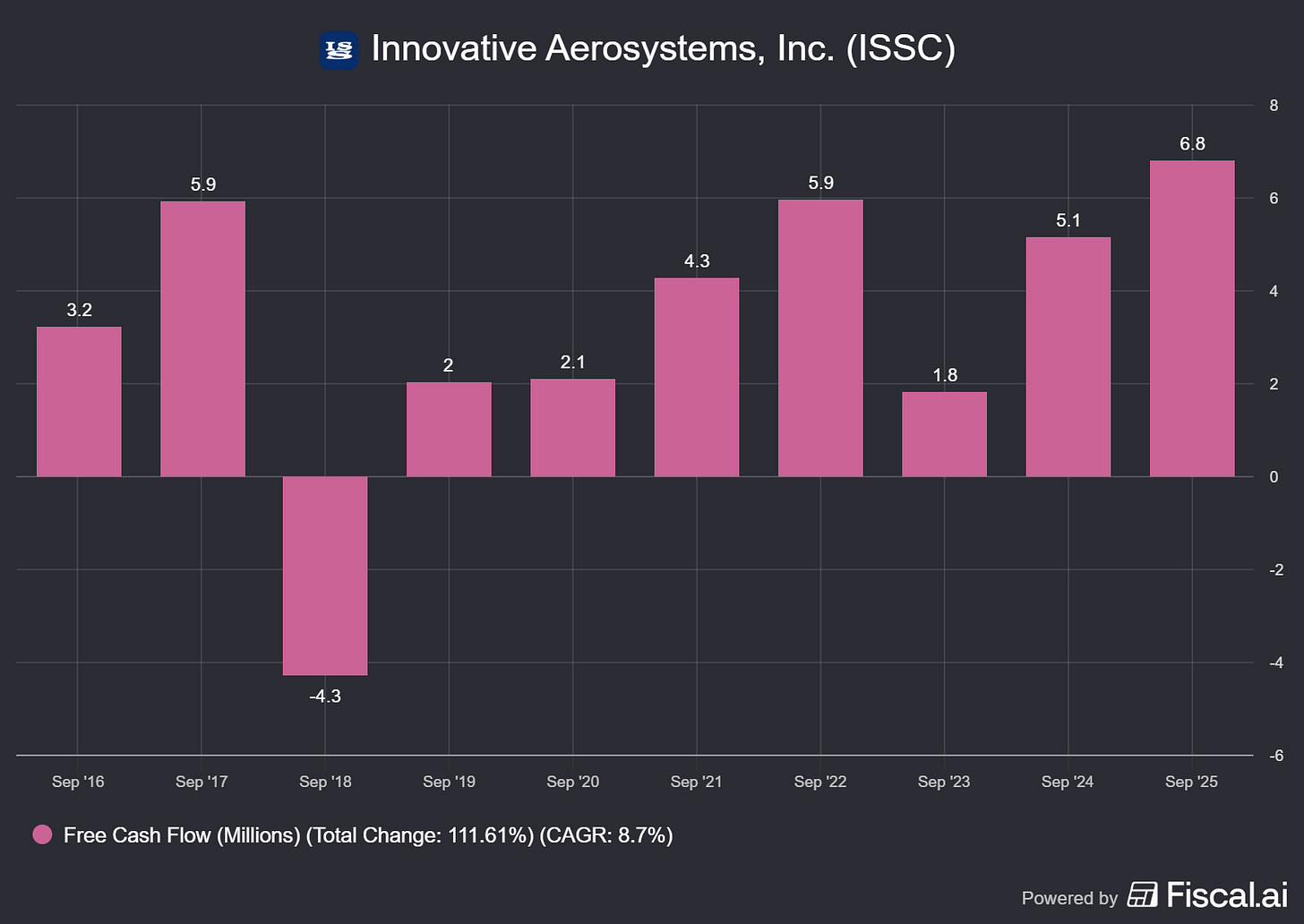

Cash Flow (Energy Output): Cash exists, but it’s lumpy by design

They define free cash flow as operating cash flow minus capex, and show trailing 12-month free cash flow for prior periods.

The pattern: decent cash generation across the last three trailing periods, but with real variability—classic “small manufacturer + program cadence” behavior.

Cash is the lie detector that doesn’t care about your slide deck.

[ISSC][REPORTED][12M ENDED SEP 2024] KEY STATS

OPERATING CASHFLOW (USD)...........5,796,222

CAPITAL EXPENDITURES (USD).........657,790

FREE CASHFLOW (USD)................5,138,432 (OCF - CAPEX)

ADJ. EBITDA (USD)..................13,672,081

ADJ. EBITDA MARGIN (%).............29.0The Audit: The big “cash question” is working capital

The presentation commentary explicitly ties revenue strength to delivery timing (including pull-forward ahead of the facility migration). That’s a working-capital and schedule story, not a software subscription story.

Atomic Take: ISSC can generate cash, but you should assume it won’t arrive on your preferred schedule.

What breaks this? Free cash flow turns negative over a full trailing year while net debt stays high (cash conversion stops working).

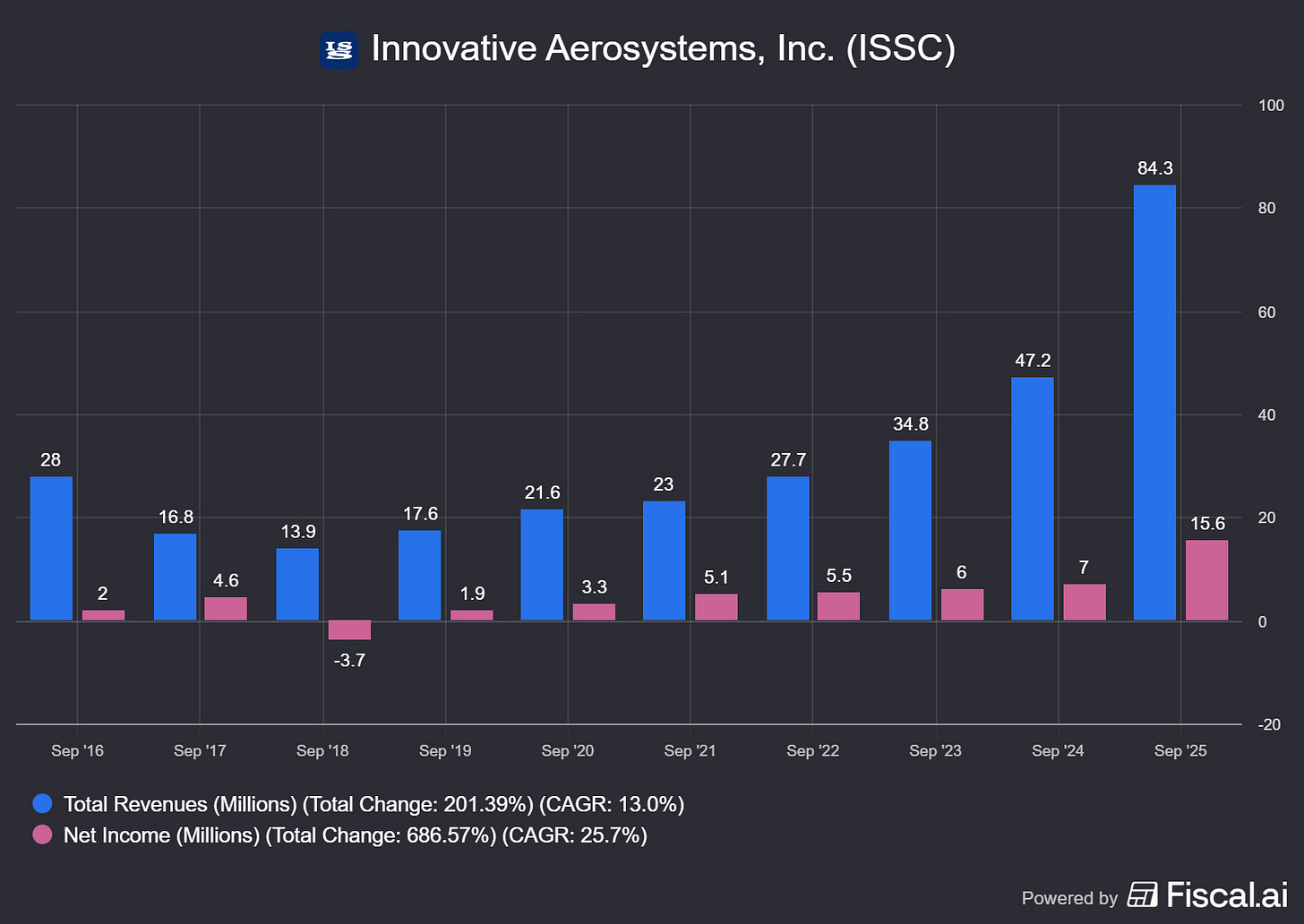

Income Statement (Reaction Chamber): Growth is real, but margin pressure is the tell

F3Q25 revenue rose to $24.1m from $11.8m, driven by F-16 deliveries (including pulled-forward deliveries).

But adjusted EBITDA margin fell to 18.3% from 26.1% year-over-year—even as adjusted EBITDA dollars rose to $4.4m. That’s not “bad”; it’s “pay attention.”

Over the trailing three years, they show revenue growth from $27.7m (2022) to $47.2m (2024) and adjusted EBITDA from $7.7m to $13.7m, with margin expansion to 29.0% in 2024.

Scaling is supposed to make life easier, not just louder.

[ISSC][REPORTED][FY 2024] KEY STATS

REVENUE (USD MM)...........47.2

ADJ. EBITDA (USD MM)........13.7

ADJ. EBITDA MARGIN (%)......29.0

FREE CASHFLOW (USD MM)......5.1This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: F-16 ramp vs margin snapback

🔒 FACT: Q3 strength was tied to F-16 deliveries and delivery timing around the facility migration.

🧠 HYPOTHESIS: As the military program scales and the Exton move completes, margins recover toward the historical high-20s adjusted EBITDA range.

📈 MONITOR: Quarterly adjusted EBITDA margin moves back above 25% while revenue stays above $20m.

Signal 2: Honeywell integration (synergy or spaghetti)

🔒 FACT: ISSC is integrating Honeywell-acquired product lines and says progress continues.

🧠 HYPOTHESIS: Integration drives cross-sell and better facility utilization rather than just adding complexity.

📈 MONITOR: Backlog holds near $72.4m (or grows) without leverage ticking up.

Atomic Take: The topline ramp is impressive; the margin drop is the smoke you watch to see if the fire is “growth pains” or “mix/timing problems.”

What breaks this? Revenue stays high but adjusted EBITDA margin remains stuck near ~18% for multiple quarters (scale without operating leverage).

The Atomic Verdict: A real ramp, still a proving ground

Quality: Engineering-heavy, vertically integrated avionics shop with OEM/retrofit positioning and long relationships (per company presentation).

Health: Net leverage at 1.1x and a new $100m five-year credit facility support flexibility—also temptation.

Overhang: Facility migration + defense delivery timing can distort both margins and working capital.

What must happen next: Margins rebound while backlog stays elevated, proving this isn’t just pulled-forward volume.

Status: Watchlist

STABLE ISOTOPE

Stars: 3.5 / 5

Reason 1: $72.4m backlog suggests real momentum.

Reason 2: Margin compression during a major ramp is the kind of thing that can either normalize… or linger.

Upgrade Triggers

Adjusted EBITDA margin back above 25% with revenue still above $20m (same time period).

Backlog sustains at or above $70m for another reporting point without leverage rising.

Net leverage stays near ~1x while capex/facility transition completes (no balance-sheet faceplant).

Downgrade Triggers

Backlog drops sharply from $72.4m while net debt remains elevated (demand fade + balance sheet risk).

Adjusted EBITDA margin stays near ~18% for multiple quarters (no operating leverage).

Net leverage rises back above 2.0x during a period of flat/down revenue (timing shock becomes structural).

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.