They say “to the moon,” but looking at the financials of Intuitive Machines, the only thing defying gravity was the share count. This balance sheet isn’t just rocket science; it’s a masterclass in how to print enough paper to build a staircase to orbit.

The Setup

Welcome to Intuitive Machines (LUNR). If you like space exploration, lunar landers, and the romantic idea of putting hardware on the moon, this is the stock for you. If you like boring things like “profit” or “not having your ownership share pulverized,” you might want to grab a helmet.

We are looking at this because they are a key player in the new space race, effectively functioning as a celestial FedEx. But as we know in this sector, physics is unforgiving, and financial gravity is even worse. Let’s see if the financials are ready for liftoff or if we’re looking at a rapid unscheduled disassembly.

Balance Sheet (The Geiger Test)

Liquidity Check: Alright, I have to give credit where it’s due—they pulled a Houdini act. In Q4 2023, they were running on fumes with a terrifying $4.5M USD in cash. That is “check under the couch cushions” money for a space company. Fast forward to Q3 2025? They are sitting on a mountain of $622M USD.

Current Ratio: With Current Assets at $666M and Current Liabilities at $106M, their Current Ratio is a fortress-like 6.3.

Atomic Take: They are flush with cash. The bankruptcy alarm has been smashed with a hammer. They can pay their bills for a long time. But where did this money come from? (Spoiler: It came from you, the shareholder. See Section 5).

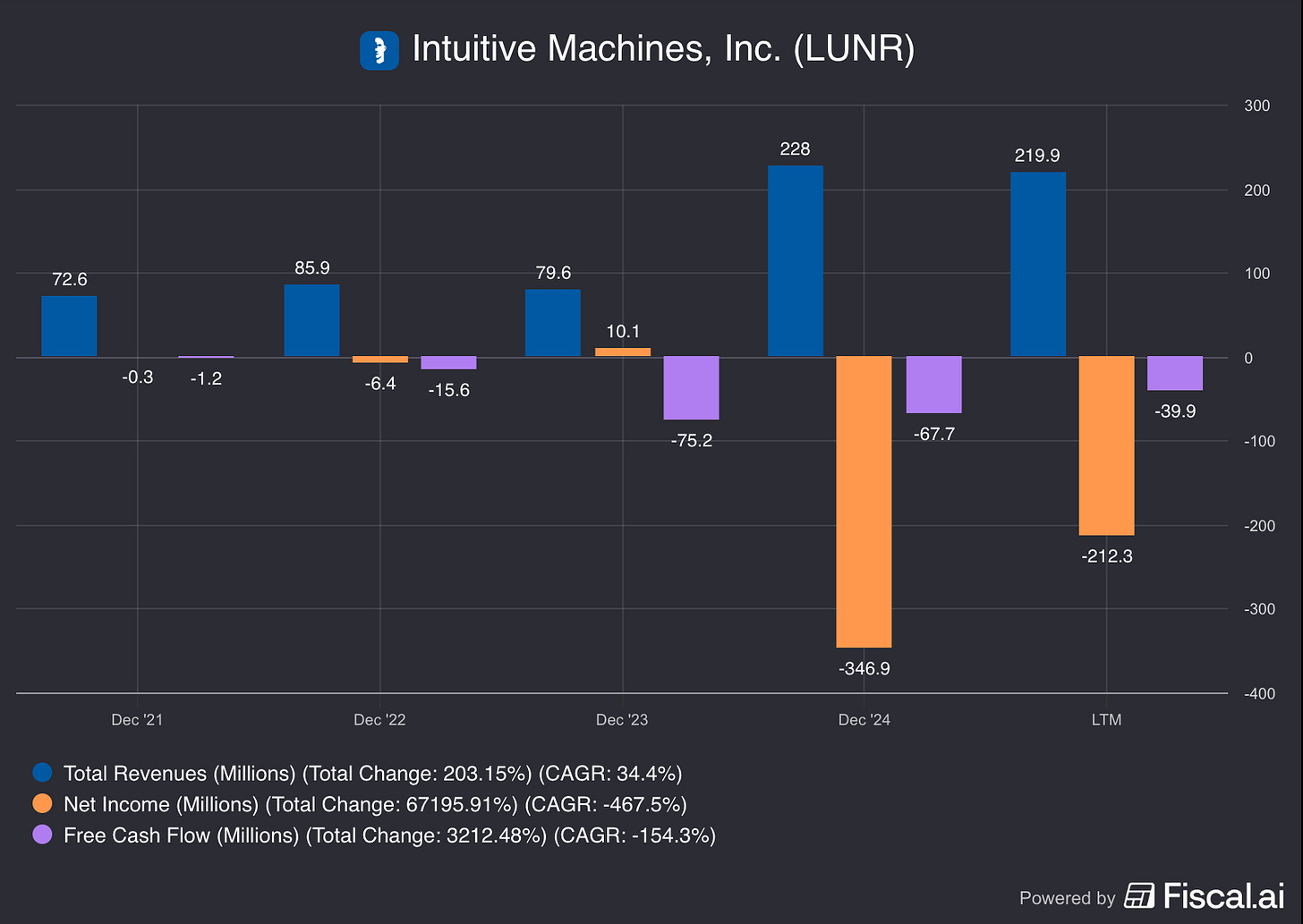

Cash Flow (Energy Output)

This is where the rocket fuel leaks. Despite the massive cash pile, the engine isn’t generating its own power yet.

Operating Cash Flow (OCF): In Q3 2025, they burned -$7.2M.

Free Cash Flow (FCF): Even worse at -$19M.

They are still in the “incineration” phase of the business cycle. They spend money to make rockets, but the rockets aren’t bringing back enough cash to cover the catering, let alone the engineering.

Atomic Take: This is a cash furnace. They have a big pile of wood (cash on hand) to keep the fire going, but don’t mistake heat for power. They are strictly burning, not earning.

Share Capital & Insiders (Nucleus Check)

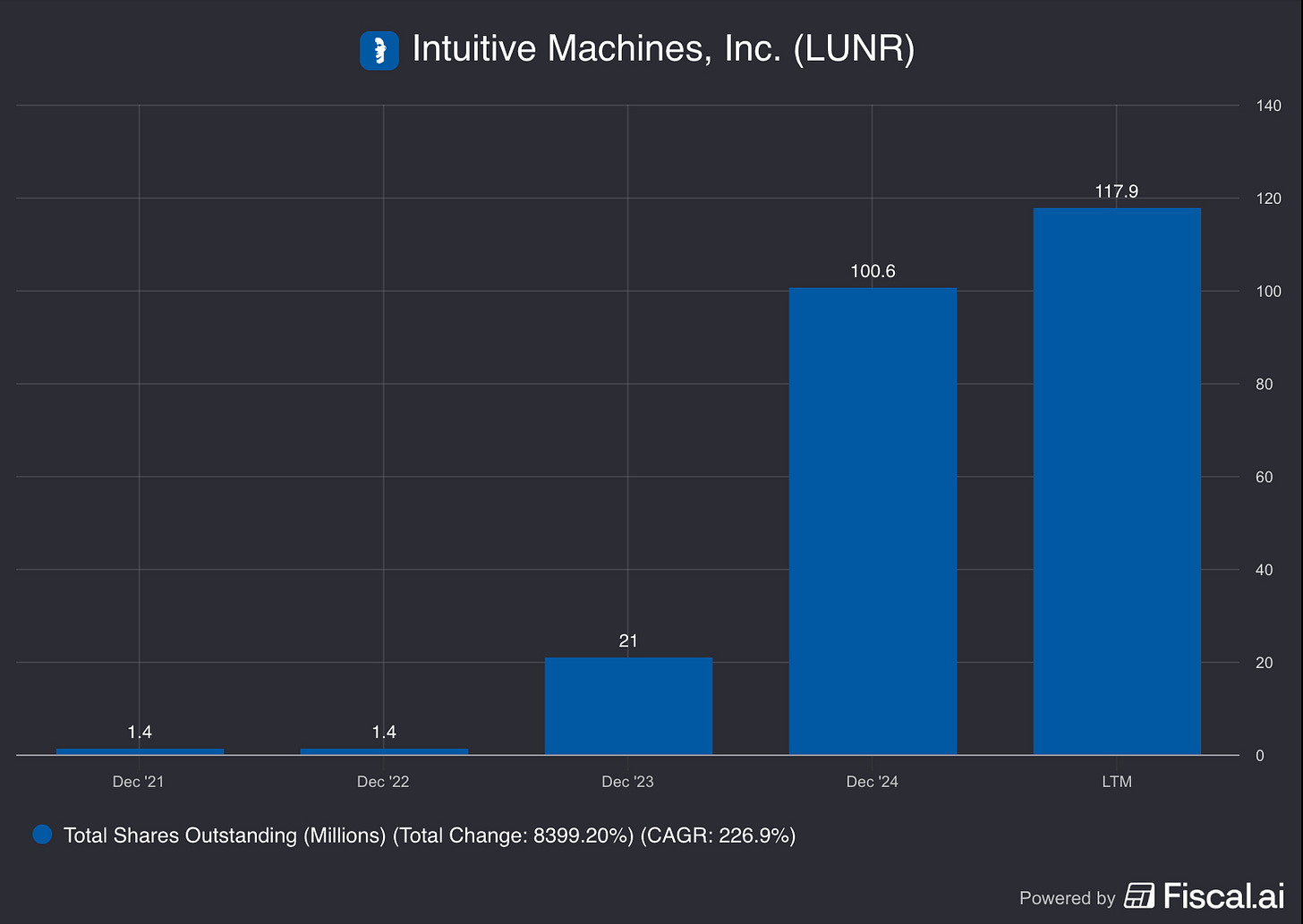

The Dilution Disaster. The only thing going to the moon is their share count.

If you owned this stock in 2022, I am so sorry. Look at these share counts:

Q4 2022: ~18 Million shares.

Q4 2023: ~21 Million shares.

Q3 2025: ~117.8 Million shares.

The Audit: That is a ~550% increase in share count in under three years. They didn’t just dilute shareholders; they put them in a blender and hit “puree.” That massive cash pile we celebrated in the Balance Sheet section? That’s the blood of early investors.

Atomic Take: The nucleus is unstable. Management has shown they will print shares aggressively to survive. If you buy now, you have to pray they are done printing.

LUNR isn't the only space stock with a terrifying share count chart. AST SpaceMobile (ASTS) shows a similar dynamic—massive ambition funded by your equity.

Income Statement (Reaction Chamber)

Revenue: Growth is actually visible.

2023: $79.5M

2024: $228M

Q3 2025 (Quarter): $51M They are booking revenue, which proves the tech works and people (NASA) are paying for it.

Margins: Gross Income for Q3 2025 was $4.2M on $51M sales. That is a Gross Margin of roughly 8.2%. That is... razor thin. For a tech/engineering company, you usually want to see high margins to cover the massive R&D. 8% leaves almost no room for error. Consequently, Operating Income remains deeply negative (-$15.4M for the quarter).

Atomic Take: They are growing the top line, but the bottom line is a ghost town. They are doing a lot of work for very little actual profit.

The Atomic Verdict

Intuitive Machines is a classic “Concept Stock.” The tech is cool, the mission is noble, and the balance sheet is finally safe (for now) thanks to a massive injection of cash. However, the business model currently involves burning shareholder equity to fly robots to the moon.

The dilution has been horrific. The margins are paper-thin. But, they do have $622M in the bank, which gives them a runway that stretches for years at the current burn rate. That buys them time to figure out how to actually make money.

Status: RADIOACTIVE ☢️ The Geiger counter is clicking. The balance sheet is safe solely because they sold the farm to fill the bank account. Until they show they can generate positive cash flow without printing 50 million more shares, this is a hazardous environment.

Rating: ⭐⭐ (2/5 Stars) (One star for the cool tech, one star for the cash pile. Zero stars for the dilution.)

Disclaimer: This is not financial advice. I am a blog on the internet, not a financial advisor. Do your own due diligence before you buy a ticket on this rocket.