The Atomic Moat FINS Analysis: Life360 (LIF)

Life360 is what happens when a “where are you?” text turns into a subscription business with a cash register.

The Setup

Life360 runs a freemium family safety app (location sharing, driving safety, digital safety, emergency services), then extends that relationship into hardware (Tile, Jiobit, and now Pet GPS).

This quarter reads like a platform thesis getting paid in real money.

Not vibes. Not “community.” Money.

In Q3 2025, total revenue was $124.5m (GAAP).

The revenue mix was subscription $96.3m, hardware $11.3m, and other revenue $16.9m (GAAP).

On the user engine, management reported global MAUs of 91.6m and Paying Circles of 2.7m as of Sep 30, 2025.

[LIF][REPORTED (GAAP)][Q3 2025] KEY STATS

REVENUE (USD m)...........124.5

GROSS PROFIT (USD m)......97.1

GROSS MARGIN (%)..........78 (DERIVED)

NET INCOME (USD m)........9.8Personal Stake: No position (watchlist)

What the market thinks right now (Bulls vs Bears)

Market: “Sticky family utility graduating into a broader platform.”

Bull: “Recurring engine is scaling: AMR hit $446.7m, up 33% YoY.”

Bear: “Ads + devices + acquisitions can dilute focus, and privacy expectations don’t forgive mistakes.”

Atomic Take: Life360 looks like a rare consumer app that’s both growing up and growing profitably.

What breaks this: If Paying Circles stop compounding while sales & marketing keeps rising, the “freemium flywheel” turns into a treadmill.

Balance Sheet (The Geiger Test)

This balance sheet screams “optionality,” but it’s not a blank check.

As of Sep 30, 2025, Life360 had $455.7m cash and equivalents (GAAP).

Total assets were $787.5m (GAAP).

The new weight on the other side is the June 2025 convertible notes: $320.0m principal, carried at $309.8m net (GAAP).

Liquidity is strong, but it’s no longer “debt-free strong.”

[LIF][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

CASH & EQUIV (USD m)...........455.7

TOTAL ASSETS (USD m)...........787.5

CONVERTIBLE NOTES, NET (USD m).309.8

DEFERRED REVENUE, CURRENT (USD m).46.1

TOTAL LIABILITIES (USD m)......396.0The Audit:

Optical illusion #1 — “cash-rich” is paired with a meaningful convert stack, not just operating liabilities.

Optical illusion #2 — deferred revenue ($46.1m current) is great, but it’s also future service you already sold.

Atomic Take: The balance sheet supports investment, but it also tells you management is willing to lever the plan.

What breaks this: If they need another large financing move while already sitting on the convert, it implies either costs rose or growth slowed.

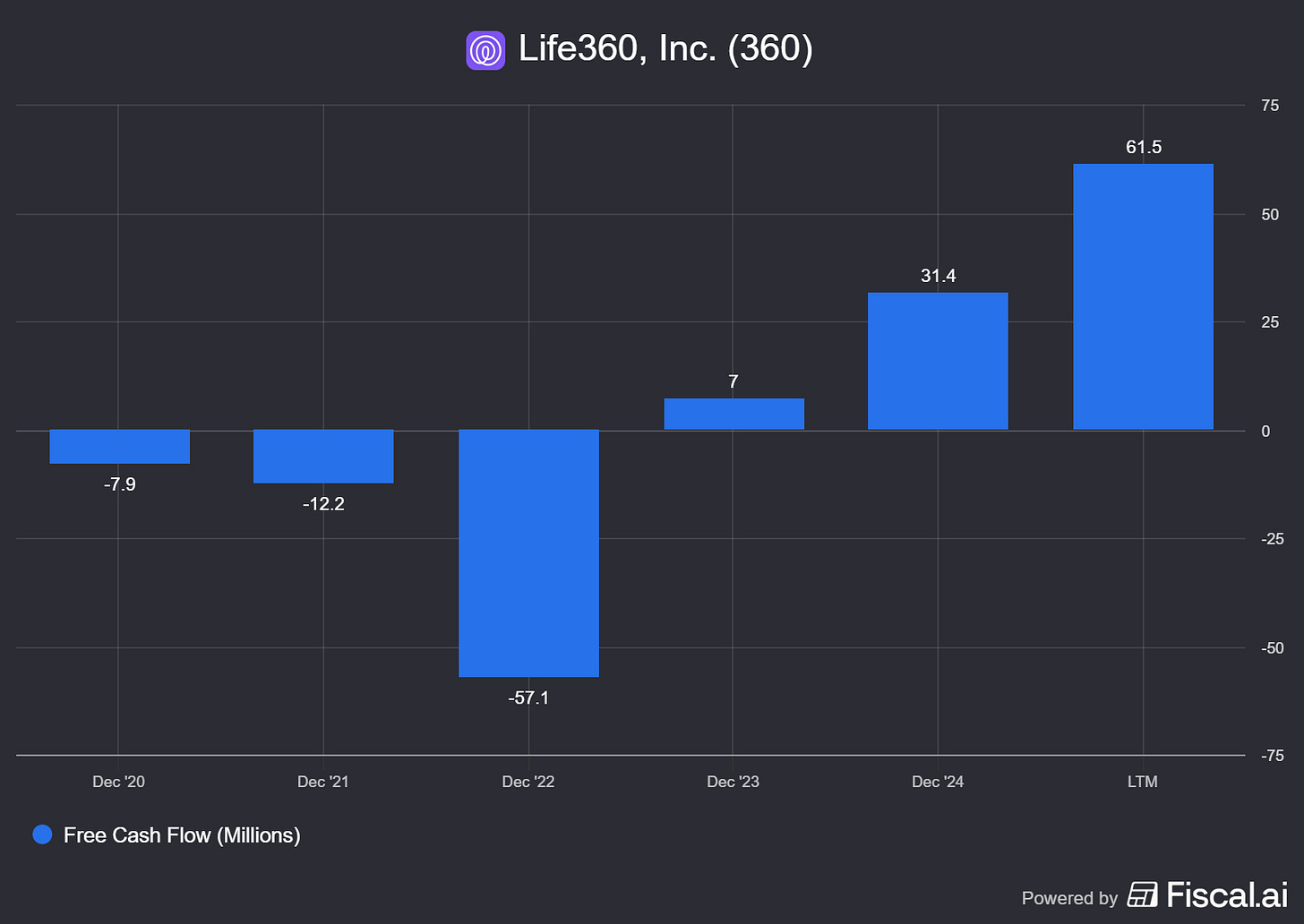

Cash Flow (Energy Output)

This is where the “platform” talk has to pay rent.

For the nine months ended Sep 30, 2025, net cash from operations was $51.8m (GAAP).

In prepared remarks, management also called out Q3 operating cash flow of $26.4m.

Capex-like spend shows up mainly as internal software and modest PPE purchases in the 10-Q cash flow.

It’s not a factory business. It’s a “keep shipping product” business.

[LIF][REPORTED (GAAP)][9M 2025] KEY STATS

CASH FROM OPS (USD m)...........51.8

CAPEX-LIKE (USD m)..............6.1 (PPE 1.6 + INT. SOFTWARE 4.5)

CASH AFTER CAPEX-LIKE (USD m)...45.7 (CFO 51.8 - 6.1)

NET CASH FROM FINANCING (USD m).278.9The Audit: This “cash after capex-like” proxy ignores acquisitions and investment cash outflows (because those aren’t maintenance). That’s the point, and also the limitation.

Atomic Take: The core model is now self-funding on GAAP cash from ops, which is the nicest kind of growth.

What breaks this: If operating cash flow turns negative while they scale ads + hardware, it’s a signal the model is getting more expensive per dollar of revenue.

Share Capital & Insiders (Nucleus Check)

This nucleus is active, but it’s not chaotic.

Shares issued and outstanding were 78.27m as of Sep 30, 2025 (GAAP).

The 10-Q cover notes 78.40m shares outstanding as of Nov 4, 2025 (including CDIs).

Stock-based compensation expense was $40.0m for 9M 2025 (GAAP).

They also spent $33.7m on capped calls alongside the June 2025 convert (GAAP).

This is dilution you can see, not dilution that sneaks up behind you.

[LIF][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

SHARES OUTSTANDING (m)..........78.27

SHARES OUTSTANDING (m)..........78.40 (AS OF 04 NOV 2025)

CONVERTIBLE NOTES PRINCIPAL (USD m).320.0

STOCK-BASED COMP (USD m)........40.0 (9M EXPENSE)Atomic Take: The nucleus is built for scaling, but stock comp plus convert math means per-share discipline still matters.

What breaks this? If stock-based comp keeps rising faster than operating income, shareholders are funding the party twice.

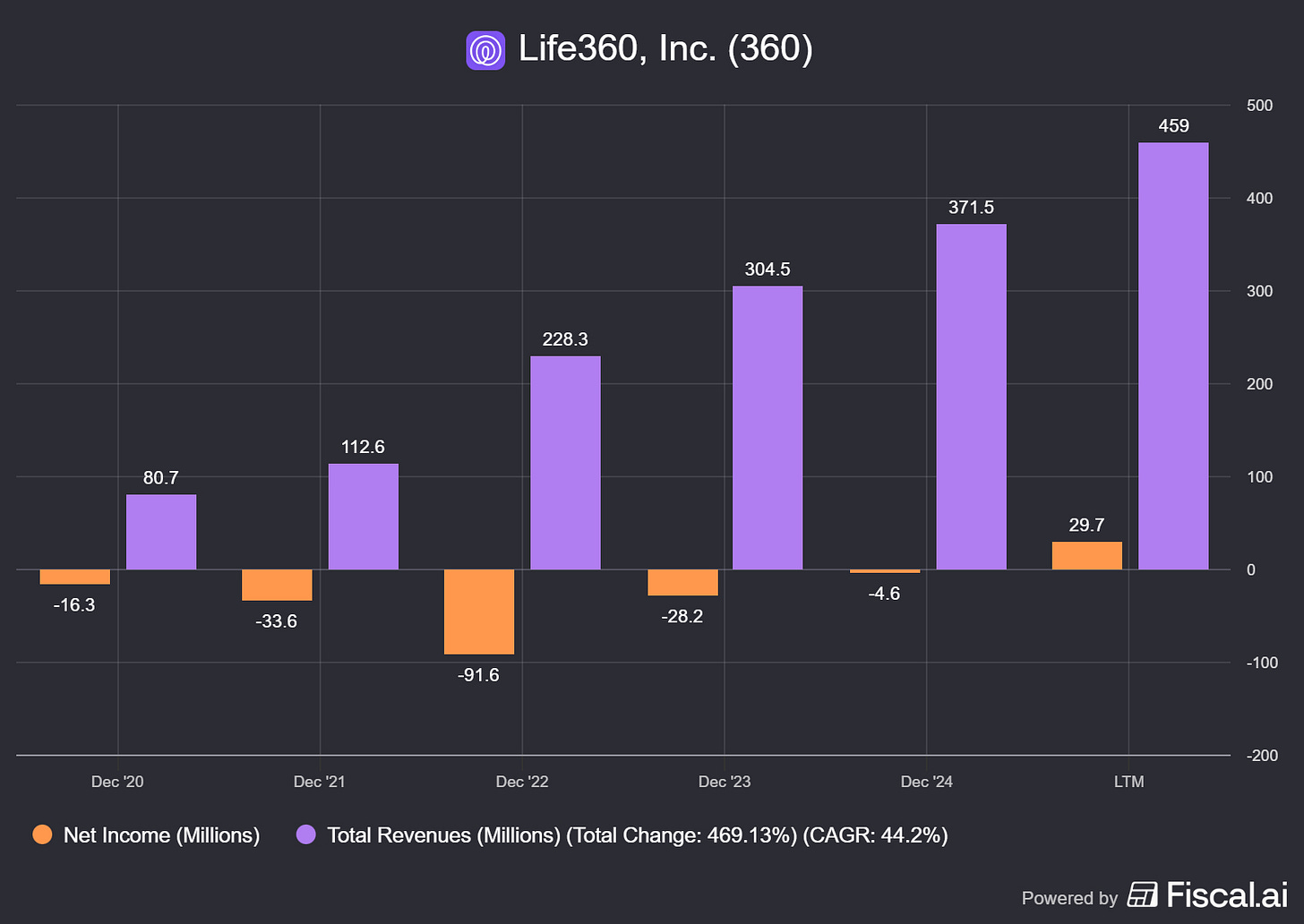

Income Statement (Reaction Chamber)

Life360 is quietly turning into a margin story.

In Q3 2025, gross profit was $97.1m and operating income was $5.7m (GAAP).

Net income was $9.8m (GAAP).

Other revenue is the “future optionality” line item, and it’s already moving: “Other Revenue” grew to $16.9m in Q3 2025, helped by advertising.

They also signed a definitive agreement to acquire Nativo for about $120.0m (cash and stock), expected to close in January 2026.

Ads are coming, and they’re buying tools to do it.

[LIF][REPORTED (GAAP)][9M 2025] KEY STATS

REVENUE (USD m)...........343.5

GROSS PROFIT (USD m)......271.2

INCOME FROM OPS (USD m)...9.9

NET INCOME (USD m)........21.2

STOCK COMP (USD m)........40.0Quick Hits

• FY25 revenue guidance was raised to $474m–$485m (company outlook).

• FY25 Adjusted EBITDA outlook is $84m–$88m (non-GAAP).

• Hardware margin took tariff-related costs in Q3 commentary; management said they mitigated earlier in the year.

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Ads expansion (trust vs monetization)

🔒 FACT: The company is leaning harder into advertising and expects Nativo to accelerate that roadmap.

🧠 HYPOTHESIS: Advertising becomes a durable, high-margin “third engine” without damaging member trust.

📈 MONITOR: “Other revenue” growth versus subscription growth, plus any churn/engagement commentary tied to ad experiences.

Signal 2: Hardware as funnel (or trap)

🔒 FACT: Hardware profitability can get hit by tariffs, even when units ship.

🧠 HYPOTHESIS: Devices remain a funnel into subscriptions, not a margin trap.

📈 MONITOR: Hardware revenue trend and management’s gross profit commentary around discounts and tariffs.

Atomic Take: Life360’s income statement is starting to look like a real business, not a “growth company costume.”

What breaks this: If profitability depends on one-off items while operating expenses re-accelerate above revenue growth, leverage was temporary.

The Atomic Verdict

This is a consumer subscription company trying to become a family platform without becoming creepy.

• Quality: Strong recurring engine backed by 2.7m Paying Circles and rising ARPPC.

• Health: Solid liquidity at $455.7m cash with positive operating cash flow (GAAP).

• Overhang: Ads buildout + the Nativo deal introduce execution and trust risk.

• What must happen next: Keep compounding Paying Circles while “Other revenue” scales without weakening retention.

Status: High Conviction — STABLE ISOTOPE

Stars: ★★★★☆

Reason 1: Subscription scale is real and still growing.

Reason 2: Profitability and cash generation are no longer theoretical.

Upgrade Triggers

• Paying Circles keep rising while ARPPC holds its trend (company reports both).

• FY25 lands inside the raised revenue range $474m–$485m.

• “Other revenue” expands without management flagging trust/engagement damage.

Downgrade Triggers

• Paying Circles growth slows materially while sales & marketing continues ramping.

• Operating cash flow weakens for multiple quarters despite higher revenue.

• Nativo integration drags margins or focus (watch for rising operating expense growth vs revenue).

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.