The Atomic Moat FINS Analysis: Coupang (CPNG)

Cash-rich logistics brute with a growth habit: Korea prints, Taiwan eats, and the breach hangover may turn margins into legal fees for a while.

The Setup

Coupang’s Q3 2025 reads like a grown-up quarter: bigger scale, slightly fatter margins, and actual operating profit.

The business split matters. “Product Commerce” is the Korea machine. “Developing Offerings” is where they’re spending to build the next machine (notably Taiwan), and it’s currently a bonfire with a nice logo.

One calm truth: they’re throwing off cash while still funding new bets.

Separately, there’s an external overhang: Reuters reports fallout from a major data breach, including political scrutiny and a 1.69T KRW (~$1.18B) customer compensation plan.

[CPNG][REPORTED][Q3 2025] KEY STATS

TOTAL NET REVENUES (USD)...........9,267M

GROSS PROFIT (USD)..................2,720M

OPERATING INCOME (USD)................162M

NET INCOME ATTRIBUTABLE (USD)..........95M

DILUTED EPS (USD/SHARE)..............0.05Personal Stake: No position (watchlist).

What the market thinks right now (Bulls vs Bears)

Market: “Korea compounding machine” plus “Taiwan option” wrapped in cash generation.

Bull: Logistics scale keeps expanding margins while new verticals add upside.

Bear: Developing Offerings keeps eating profits long enough to reset the story.

This review is about whether Coupang’s core engine can keep widening its moat while the new reactor (Taiwan) is still unstable.

Atomic Take: $9,267M of revenue and $162M of operating income says the core is working; the question is how long they let Taiwan burn.

What breaks this? Product Commerce segment adjusted EBITDA margin dropping below 8% for two consecutive quarters (baseline 8.8% in Q3 2025).

Balance Sheet (The Geiger Test)

Coupang’s balance sheet looks like a company that’s not borrowing to survive.

Cash is real insulation. Net debt is basically not the story.

The liabilities stack is the usual retail plumbing: you want it funded, but you don’t want it to surprise you.

No drama is a feature here.

[AS OF 30 SEP 2025] KEY STATS

CASH & EQUIVALENTS (USD)...........7,229M

TOTAL ASSETS (USD).................18,668M

TOTAL EQUITY (USD).................4,741M

CURRENT LIABILITIES (USD).........10,193M

NON-CURRENT LIABILITIES (USD)......3,734MThe Audit: The “net debt” line is a nice headline, but it can hide meaningful lease-like obligations depending on definition—so don’t treat it as “no fixed claims,” treat it as “no net borrowing problem.”

Atomic Take: $7,229M of cash is oxygen; it buys patience for investment mistakes.

What breaks this?: Cash & equivalents falling below $5,000M while Developing Offerings losses remain near current levels (baseline segment adj. EBITDA loss $292M in Q3 2025).

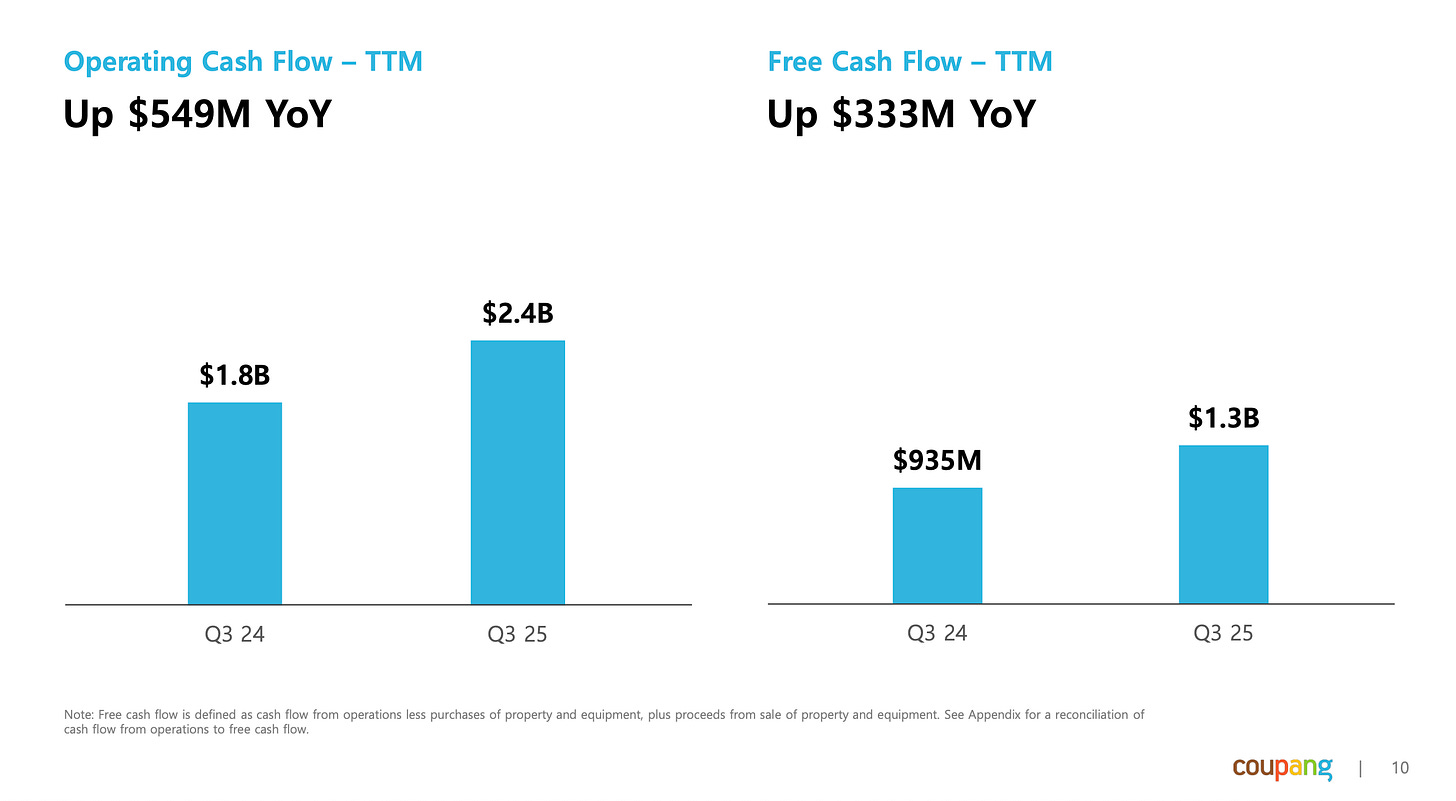

Cash Flow (Energy Output)

Coupang’s cash story is the adult in the room: operating cash flow is up, and capex is not trivial.

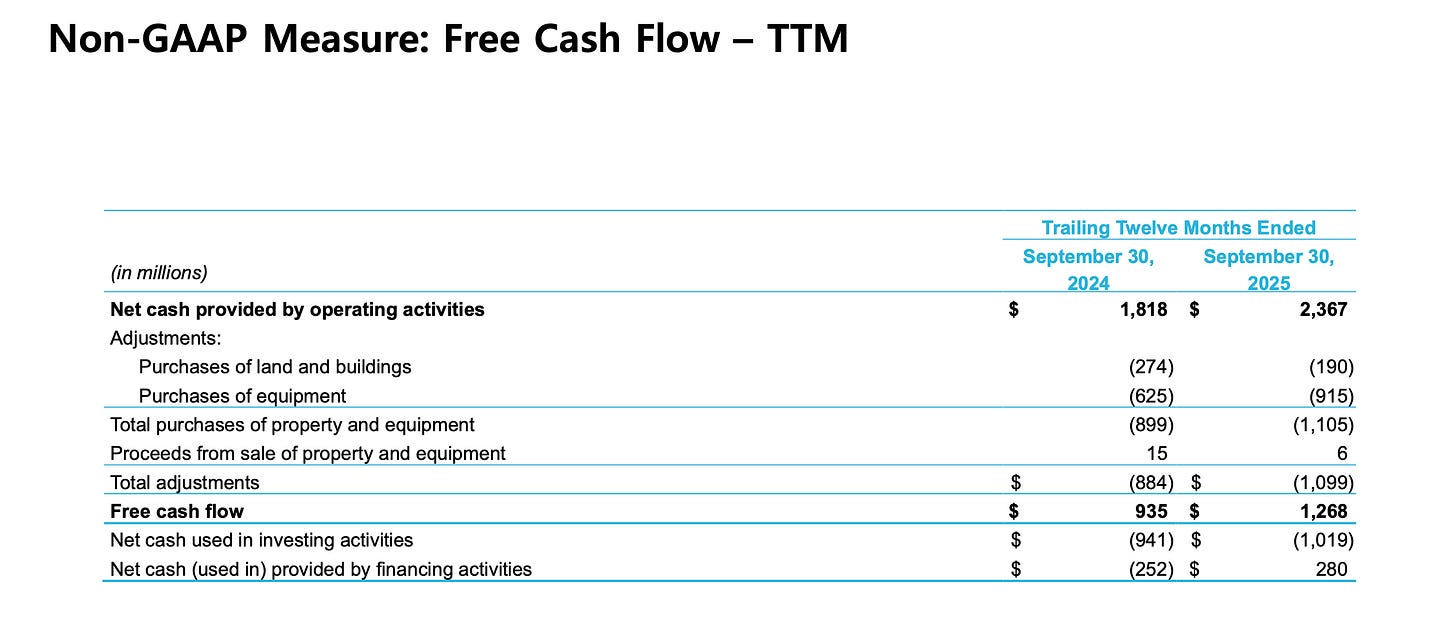

They define free cash flow as cash from operations minus purchases of property and equipment (land/buildings + equipment), plus proceeds from sales of property and equipment.

That’s a clean enough “cash-after-investments” proxy for a logistics-heavy operator—just remember that growth capex can look like “optional spending” right until it isn’t.

Cash is the scoreboard.

[CPNG][REPORTED][AS OF 30 SEP 2025] KEY STATS

CASH FROM OPS (USD).................2,367M (TTM ended 30 Sep 2025)

PURCHASES OF PPE (USD)..............1,105M (land/buildings + equipment)

FREE CASH FLOW (USD).................1,268M (CFO - PPE + PPE sales)

NET CASH INVESTING (USD)............1,019M (net outflow, TTM)The Audit: They also report adjusted EBITDA (a company-defined profit proxy excluding items like depreciation, interest, taxes, equity-based compensation, and certain one-offs). When adjusted EBITDA is $1,644M (TTM) and free cash flow is $1,268M (TTM), you’re seeing a business that converts—but not magically.

Atomic Take: $1,268M of trailing free cash flow gives them room to fund Taiwan without begging the capital markets.

What breaks this: Free cash flow turning negative on a trailing basis while capex stays elevated (baseline TTM FCF $1,268M, PPE purchases $1,105M).

Share Capital & Insiders (Nucleus Check)

Share count is quietly the tax you pay for “growth + stock comp.”

They show outstanding common stock at 1,823M in Q3 2025, with outstanding equity-based awards at 76M, and total dilution of 1.2% year-over-year (their framing includes awards).

Equity-based compensation is not rounding error: $474M in the trailing twelve months in their adjusted EBITDA reconciliation.

And yes, there’s a reminder from the filings universe: a Form 144 lists “shares outstanding” as 1,668,844,548 (as of the form’s date), which likely reflects a different definition/scope than the slide’s “outstanding common stock.” That gap is why you never mix sources without checking definitions.

[Q3 2025] KEY STATS

OUTSTANDING COMMON STOCK (SHARES)....1,823M

OUTSTANDING EQUITY AWARDS (SHARES).....76M

DILUTION (PCT)........................1.2% (YoY, stock + awards)

EQUITY-BASED COMP (USD)...............474M (TTM ended 30 Sep 2025)Atomic Take: The business is funding growth with cash, but shareholders are still paying a steady “stock comp rent.”

What breaks this: Dilution accelerating above 2% year-over-year while free cash flow stalls (baseline dilution 1.2%).

Income Statement (Reaction Chamber)

Q3 2025 is the story of two engines: one efficient, one intentionally inefficient.

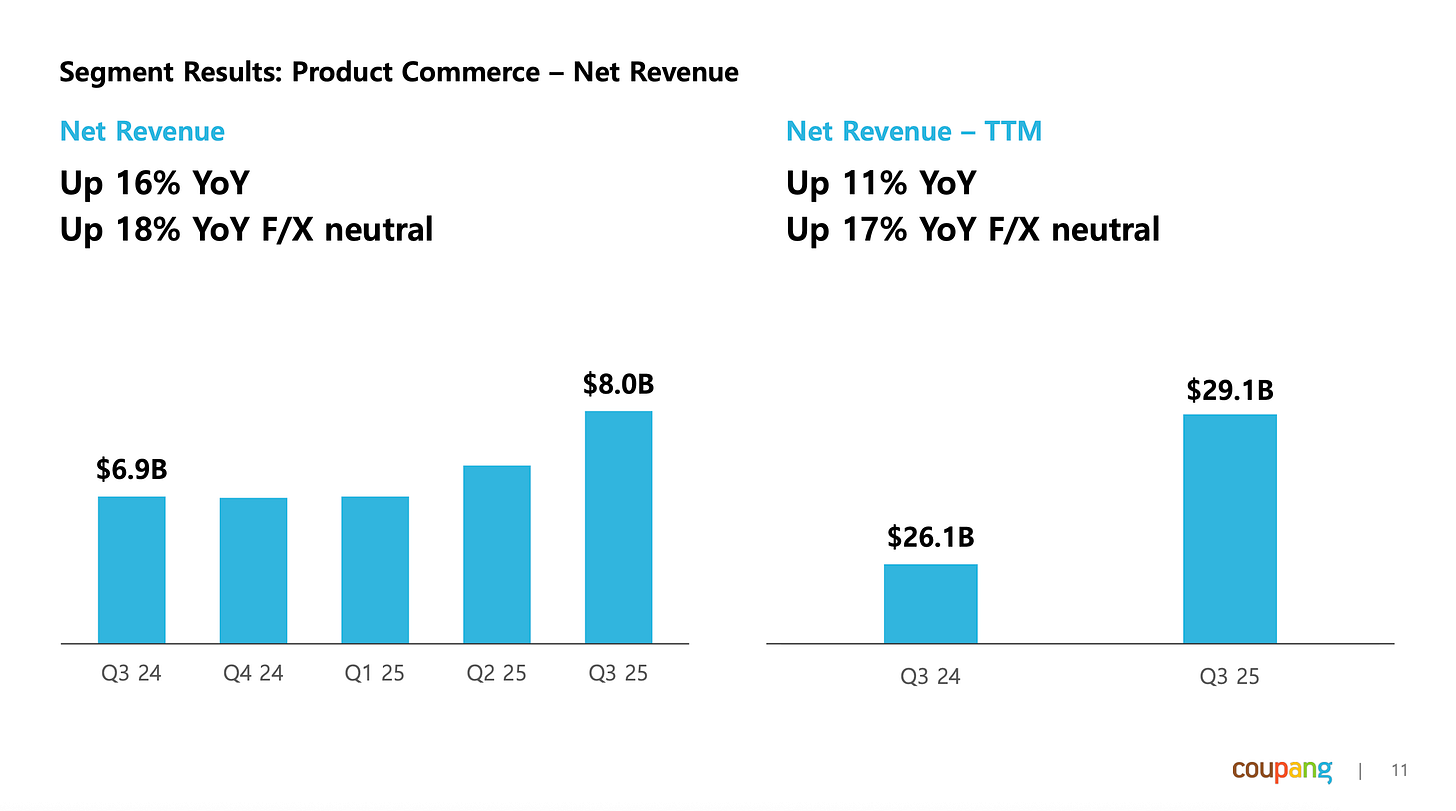

Consolidated net revenues were $9,267M, up 18% reported (20% constant currency). Gross profit margin was 29.4%, and operating income was $162M.

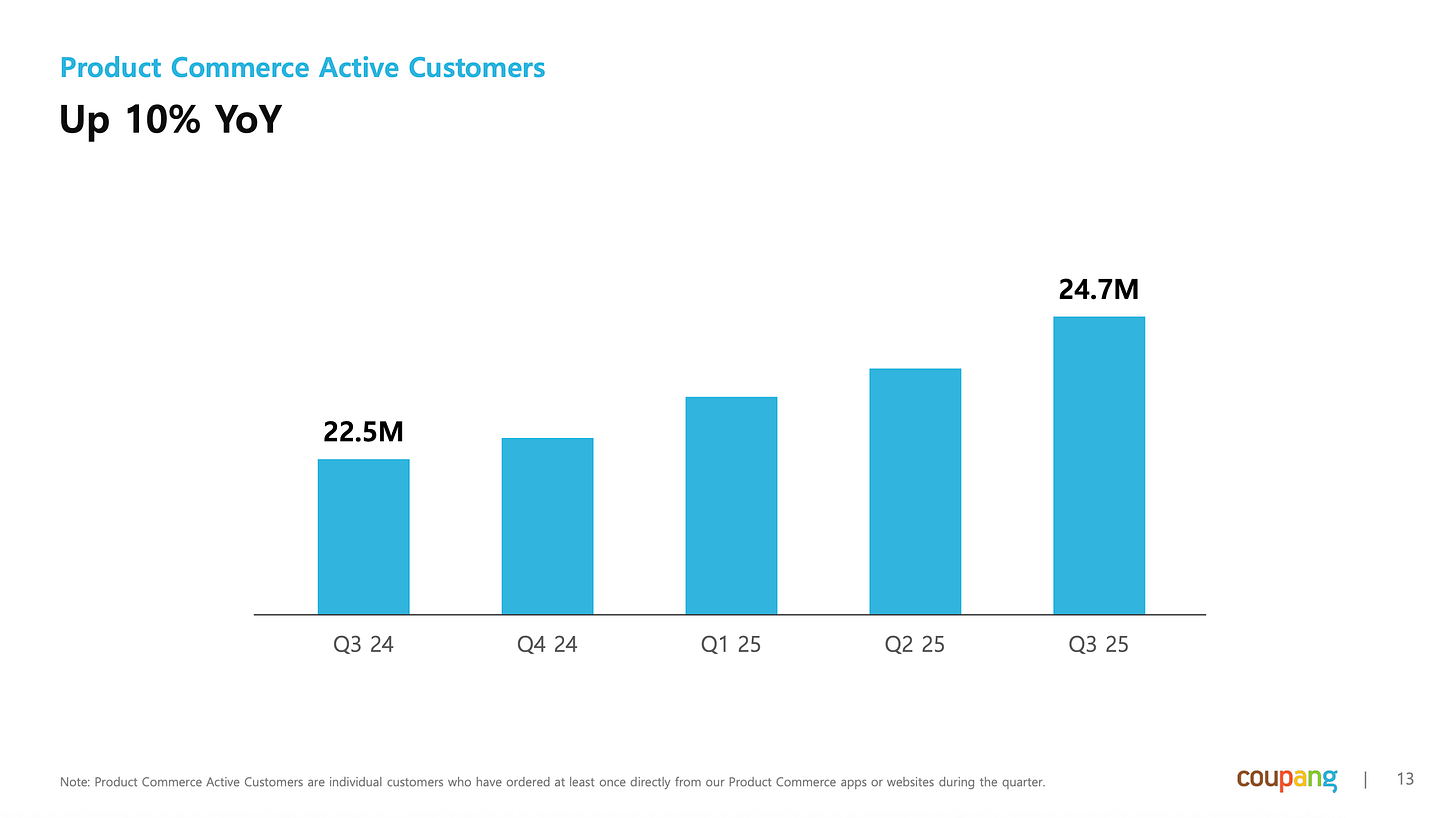

Product Commerce is the hero: segment net revenue $7,980M, gross profit $2,564M, and gross margin 32.1%. Segment adjusted EBITDA was $705M (margin 8.8%), and active customers were 24.7M.

Developing Offerings is the deliberate drag: segment net revenue $1,287M, gross profit $156M, and segment adjusted EBITDA loss $(292M). Management reiterated full-year Developing Offerings adjusted EBITDA losses of $900M–$950M, expecting the higher end due to momentum (especially Taiwan).

One-offs/comparability: they call out timing effects from Korea’s holiday calendar (Chuseok) affecting quarter-to-quarter comparability, framed as timing rather than demand deterioration.

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Taiwan burn rate

🔒 FACT: Developing Offerings posted segment adjusted EBITDA of $(292M) in Q3 2025 and management guided full-year losses of $900M–$950M.

🧠 HYPOTHESIS: Taiwan can scale into a second “logistics-led” engine before the burn forces slower investment.

📈 MONITOR: Developing Offerings segment adjusted EBITDA loss vs baseline $(292M) in Q3 2025.

Signal 2: Core margin durability

🔒 FACT: Product Commerce segment adjusted EBITDA margin was 8.8% in Q3 2025 and gross margin was 32.1%.

🧠 HYPOTHESIS: Mix shift (marketplace/FLC) plus ops efficiency keeps pushing Product Commerce margins toward management’s “past 10%” ambition.

📈 MONITOR: Product Commerce segment adjusted EBITDA margin vs baseline 8.8% in Q3 2025.

Atomic Take: Coupang is profitable and cash-generative, but the consolidated story is held hostage by how fast Taiwan stops being “exciting” and starts being “economically adult.”

What breaks this? Korea regulators/lawmakers successfully move penalties into a 10% of revenue regime for massive breaches (or equivalent applied outcome).

The Atomic Verdict

Quality: The Korea machine is scaling with operating leverage and real cash conversion.

Health: Cash-heavy balance sheet and strong trailing operating cash flow reduce “financing risk.”

Overhang: Korea data-breach fallout is now a governance + cost cloud: Reuters reports a 1.69T KRW (~$1.18B) customer voucher plan and political escalation after Kim skipped a parliamentary hearing.

Overhang: Regulatory tail risk is non-trivial—Reuters cites fines up to 3% of revenue under current law and a proposal to raise penalties to 10%, plus a Korea-CEO change (Park Dae-jun out; interim named).

What must happen next: Developing Offerings loss trend needs to show a peak while Product Commerce stays near current margin levels.

Status: STABLE ISOTOPE

Stars: 3/5

Because:

The core still throws off real cash ($1,268M trailing free cash flow) and isn’t financing-dependent.

External breach fallout injects non-operating uncertainty (reported 1.69T KRW compensation plan; regulators/lawmakers discussing penalty escalation).

Upgrade Triggers

Developing Offerings segment adjusted EBITDA loss improves to better than $(200M) in a quarter (baseline $(292M) in Q3 2025).

Product Commerce segment adjusted EBITDA margin sustains >9% for two quarters (baseline 8.8% in Q3 2025).

Trailing free cash flow exceeds $1,500M with purchases of PPE not accelerating beyond the current run-rate (baseline FCF $1,268M, PPE $1,105M).

Downgrade Triggers

Developing Offerings guided losses expand beyond the current $900M–$950M range.

Trailing free cash flow drops below $800M (baseline $1,268M).

Product Commerce active customers turn negative year-over-year (baseline 24.7M in Q3 2025, up YoY).

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.