The Atomic Moat FINS Analysis: Sezzle ($SEZL)

Sezzle is doing that rare thing in fintech: growing fast and throwing off real cash, while picking fights with Shopify and flirting with a bank charter.

New to The Atomic Moat? This analysis of Sezzle ($SEZL) is a prime example of how we dissect high-quality compounders. If you want deep dives and FINS sent to your inbox, join 700+ other investors below.

The Setup: what Sezzle is, and why this quarter matters

Sezzle runs a “buy now, pay later” checkout option, but the money is made less by vibes and more by:

Subscription products (Premium/Anywhere),

Fees tied to payment behavior, and (3) underwriting that’s tuned like a risk desk, not a brand campaign.

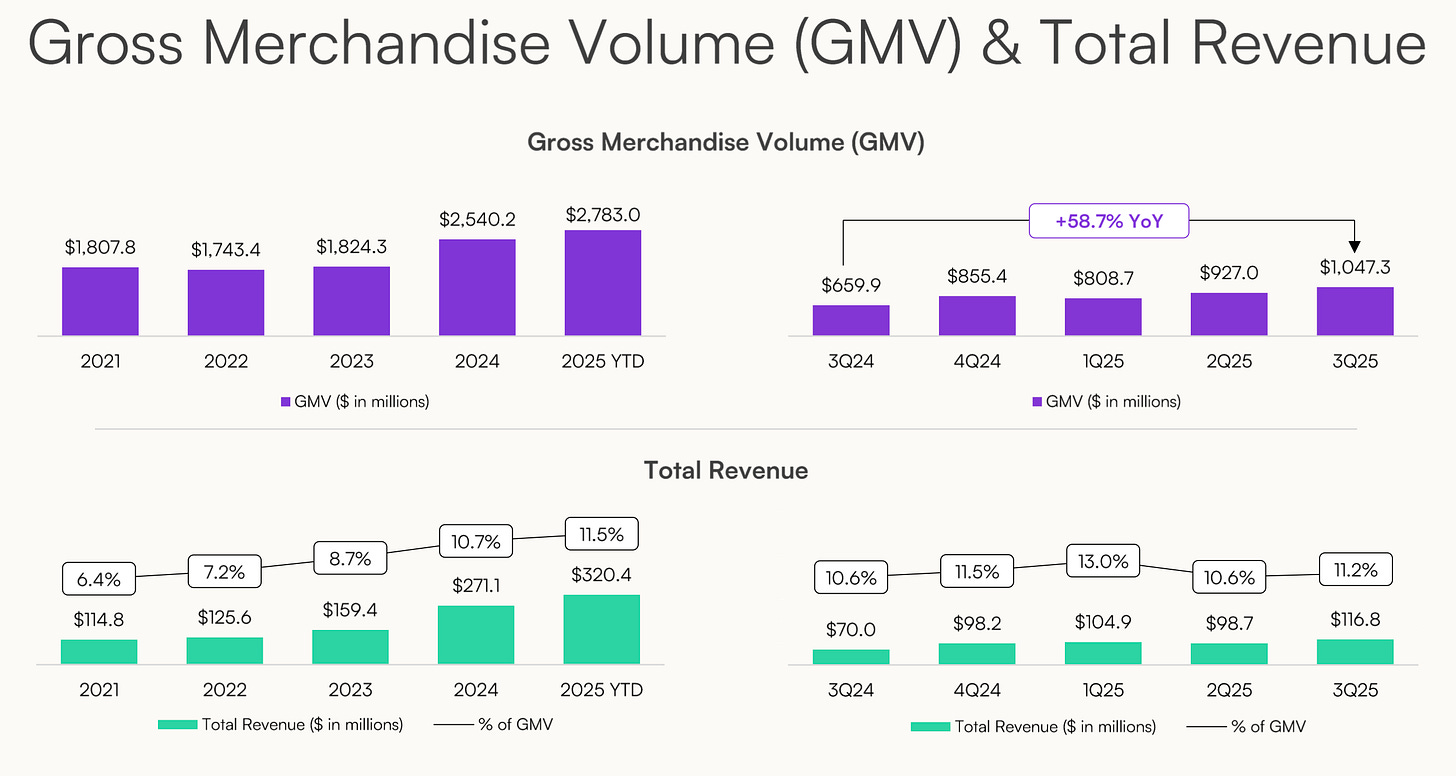

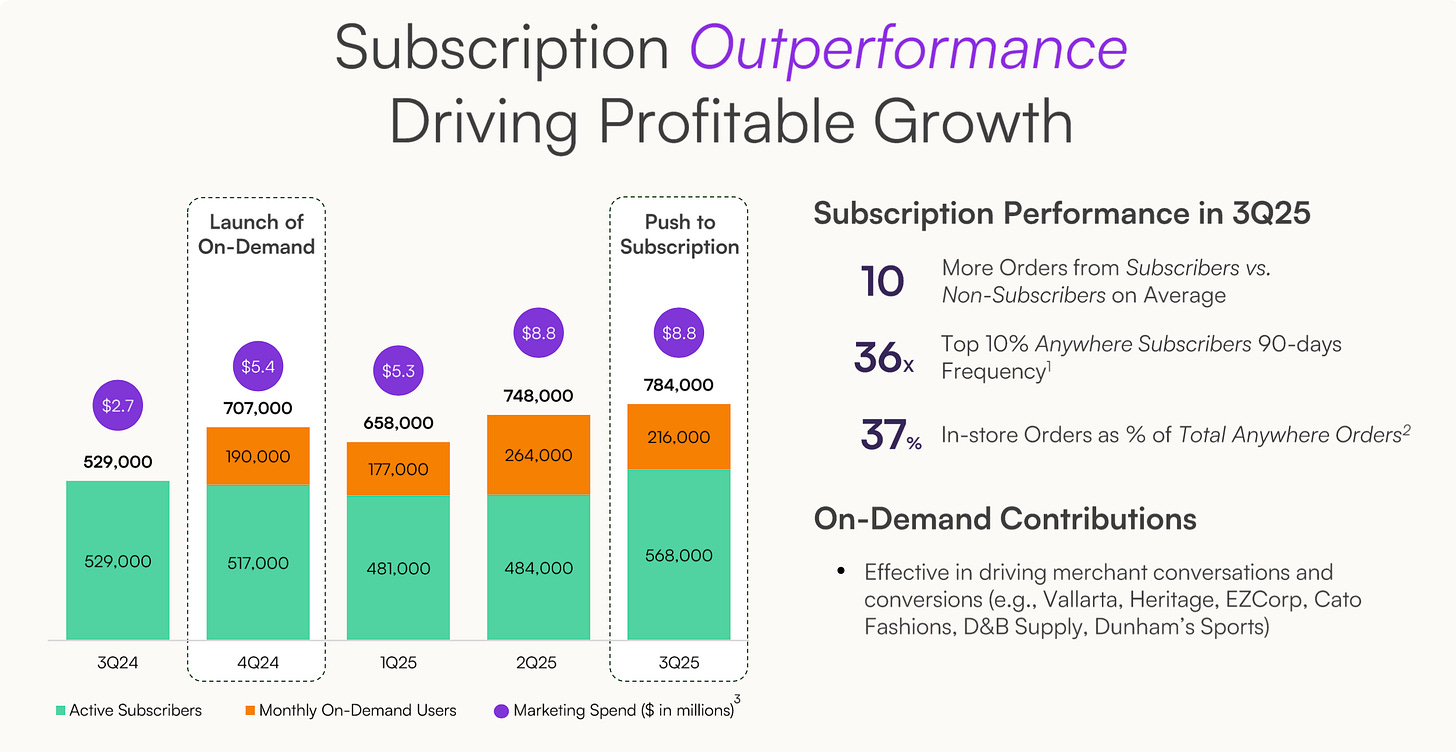

Q3’25 was the “first $1B GMV quarter” moment, with management explicitly pivoting marketing back toward subscriptions after learning that On-Demand brings users, but not the same profit profile.

Also: three non-core strategic projects showed up as about $1.3M of costs in the quarter—an antitrust suit, capital markets work, and bank charter “discovery.” Small dollars, big narrative gravity.

[SEZL][REPORTED (GAAP)][Q3 2025] KEY STATS

TOTAL REVENUE (USD M)...........116.8

GMV (USD B).....................1.05

NET INCOME (USD M)..............26.7

ACTIVE CONSUMERS (M)............2.97 (as of 30 Sep 2025)

MODS (M)........................0.784 (as of 30 Sep 2025)

Personal Stake: I just bought a position in SEZL 0.00%↑ .

What the market thinks right now (Bulls vs Bears)

Market: “Profitable BNPL with momentum; what could go wrong?”

Bull: Subscriptions + higher take rate compound, and the model pivots fast if credit turns.

Bear: Underwriting expansion + fees + legal/regulatory projects = great until it isn’t.

This review is about whether Q3’s profitability is “engine-driven,” or “tailwind + timing.”

Atomic Take: Sezzle looks like a real operating business now, not a funding trick—but it’s adding story risk (lawsuit/bank charter) just as credit risk is being loosened.

What breaks this? Provision for credit losses rising above management’s implied comfort zone (watch provision as % of GMV).

Balance Sheet (The Geiger Test): does the company look fundable in a bad week?

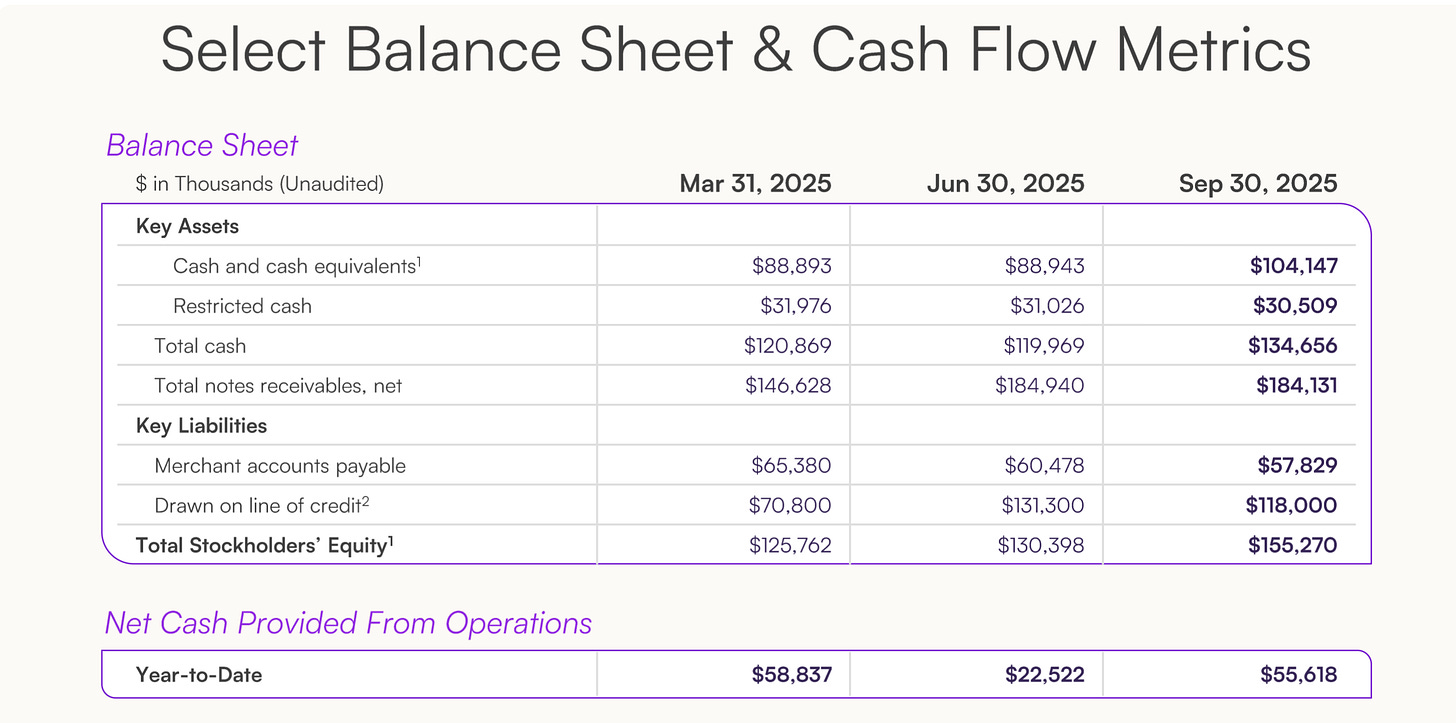

The balance sheet is basically: cash, short-duration consumer receivables, and a secured line of credit that’s explicitly tied to pledged receivables.

What I like: cash (including restricted cash) and equity both moved up meaningfully versus year-end, while the business stayed profitable through higher marketing and higher credit provision.

What I don’t ignore: merchant accounts payable is a real liability, and Sezzle also runs a delayed settlement program that pays merchants an incentive yield; functionally a “merchant-funded float” that can change behavior if merchants get nervous.

[SEZL][REPORTED (GAAP)][AS OF 30 Sep 2025] KEY STATS

CASH + RESTRICTED CASH (USD M)..134.7

NOTES RECEIVABLE, NET (USD M)...184.1

ALLOWANCE FOR CREDIT LOSSES (USD M)33.7

LINE OF CREDIT, NET (USD M).....117.3

STOCKHOLDERS' EQUITY (USD M)....155.3

The Audit: Two optical illusions

“Cash” includes restricted balances; it’s still cash, but not all of it is free to wander.

Merchant payables can look like operating leverage, but part of it is a program (DSIP) paying merchants an incentive rate—read it like a mini funding product, not just payables.

Atomic Take: This balance sheet is simple enough to stress-test, which is rare in fintech.

What breaks this? Unused borrowing capacity compressing while receivables keep growing (tightening funding headroom).

Cash Flow (Energy Output): are profits turning into spendable dollars?

Over nine months, reported net income was $90.4M and cash from operations was $55.6M—so yes, cash is real, but working-capital and receivables growth eat some of the accounting win.

Capital spending (using the clean proxy of purchases of property/equipment plus internal-use software/intangibles) was modest at $2.1M for 9M’25.

Management also disclosed Q3 cash flow from operations of $33.1M, which is the kind of number that makes “profitable growth” stop being a slogan.

[SEZL][REPORTED (GAAP)][9M 2025] KEY STATS

NET INCOME (USD M)..............90.4

CASH FROM OPS (USD M)...........55.6

PPE PURCHASES (USD M)...........0.6

INTANGIBLE ADDITIONS (USD M)....1.5

CASH AFTER INVESTMENTS (USD M)..53.5 (CFO - PPE - INTANG)

The Audit: timing tells

A big swing line is “notes receivable,” which moved cash by $(85.2)M in 9M’25—this is the cost of growing a receivables book, not “bad cash conversion.”

Atomic Take: The cash math supports the profit story, with low reinvestment needs showing up clearly.

What breaks this? Cash from operations falling while net income holds up (profit quality deterioration).

Share Capital & Insiders (Nucleus Check): who’s getting paid, and how?

Sezzle ended Q3 with 34.153M shares outstanding (as of Nov 3, 2025).

On dilution: Q3 diluted weighted-average shares were 35.675M versus basic 34.048M, so equity comp is present, but not cartoonish.

On buybacks: 9M’25 shows $34.6M spent on repurchases (cash flow statement). Separately, a board-authorized program allows up to $50M through April 2026, with $26.4M remaining as of the Q3 issuer-purchases table (and note: Q3 “purchases” listed there were employee tax-withholding share surrenders).

[SEZL][REPORTED][AS OF 03 Nov 2025] KEY STATS

SHARES OUTSTANDING (M)..........34.153

[SEZL][REPORTED][9M 2025] KEY STATS

SHARE REPURCHASES (USD M).......34.6

Atomic Take: Capital return is real in the cash flow statement, not just a slide.

What breaks this? Diluted share count accelerating while buybacks slow (net dilution reappears).

Income Statement (Reaction Chamber): what’s actually driving the margin?

Q3’25 revenue was $116.8M with operating income $35.6M and net income $26.7M (U.S. GAAP). That implies an operating margin around 30% and a reported net margin 22.8%.

The mix matters: Q3 revenue included $24.3M of subscription revenue and $32.9M of “income from other sources” (including late fees), which is why the take rate can rise even if the BNPL product itself looks commoditized.

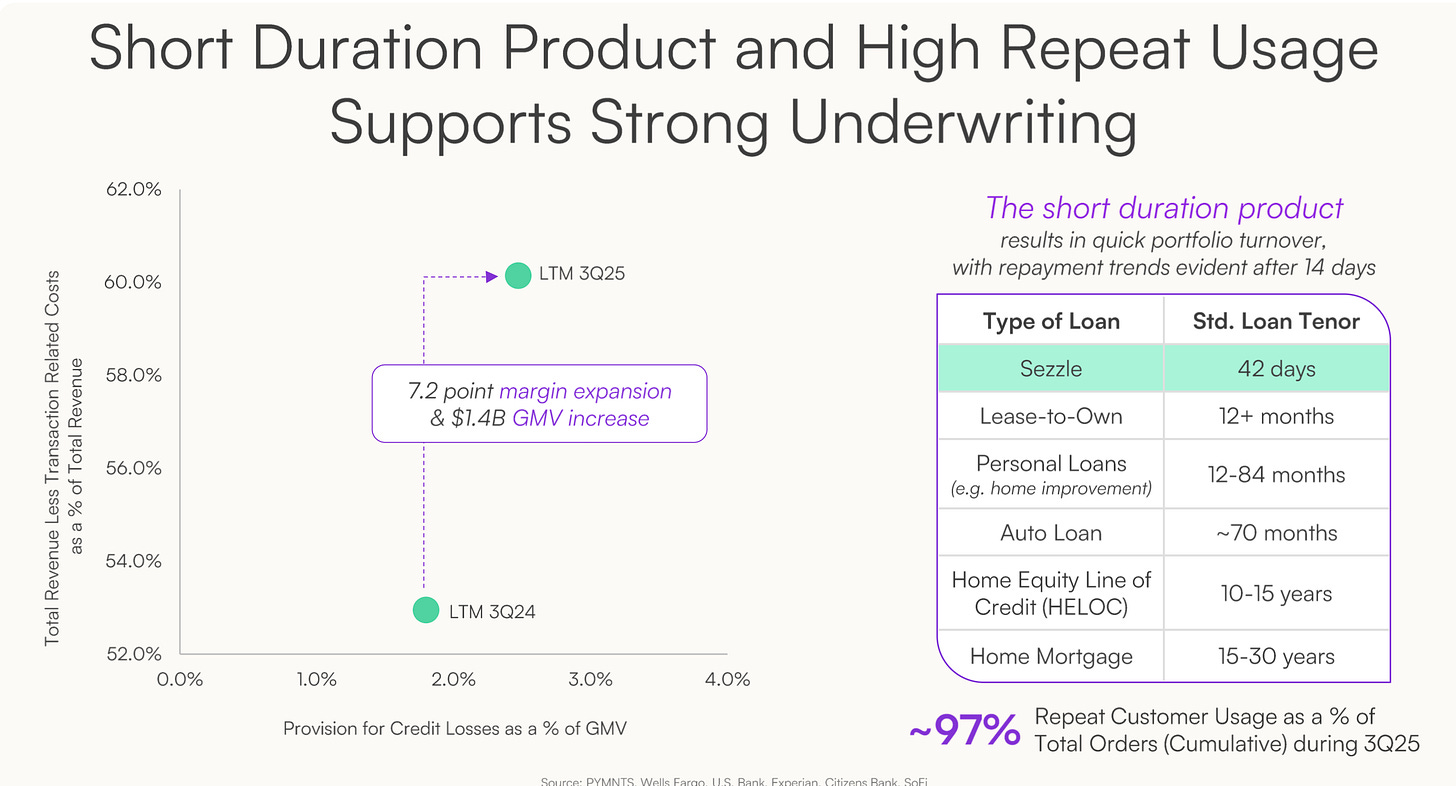

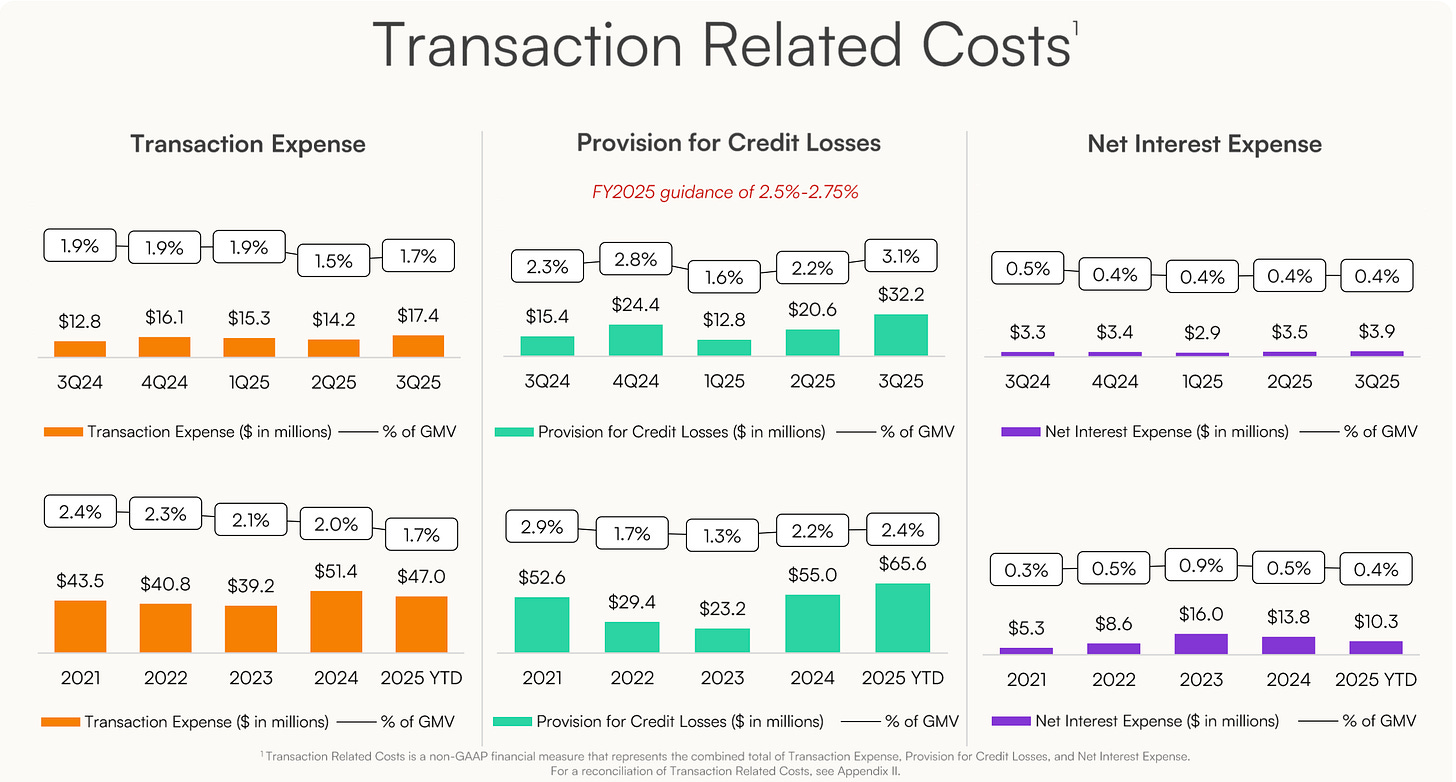

Credit is the throttle: provision for credit losses was $32.2M in Q3, and management said provision as % of GMV was 3.1% and expected to trend toward 2.5%–2.75%. That’s a big, explicit “watch this line” signpost.

One more thing: Sezzle’s short-duration notes (weighted average 34 days outstanding) mean the company can tighten underwriting quickly if losses jump.

[SEZL][REPORTED (GAAP)][Q3 2025] KEY STATS

TOTAL REVENUE (USD M)...........116.8

SUBSCRIPTION REVENUE (USD M)....24.3

PROVISION FOR CREDIT LOSSES (USD M)32.2

OPERATING INCOME (USD M)........35.6

NET INCOME (USD M)..............26.7

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Credit stays tame while growth stays hot

🔒 FACT: Provision for credit losses was $32.2M in Q3’25 (U.S. GAAP).

🧠 HYPOTHESIS: Underwriting expansion keeps growth high without structurally lifting loss rates.

📈 MONITOR: Provision for credit losses as % of GMV, baseline 3.1% in Q3’25 (management commentary).

Signal 2: Subscriptions re-accelerate after the On-Demand detour

🔒 FACT: Subscribers rose to 568,000 at end of Q3’25 after shrinking earlier in 2025 (management commentary).

🧠 HYPOTHESIS: Marketing mix shift back to subscription lifts take rate and profit per user.

📈 MONITOR: MODS baseline 0.784M as of 30 Sep 2025, plus Active Subscribers baseline 0.6M as of 30 Sep 2025.

Signal 3: The “strategic projects” don’t become a permanent overhang

🔒 FACT: Shopify moved to dismiss Sezzle’s antitrust complaint; hearing is Dec 8, 2025.

🧠 HYPOTHESIS: Legal + bank-charter exploration stays optionality, not distraction.

📈 MONITOR: Court outcome events (dismissal vs continuation) and disclosed timeline for any ILC application (management said potential H1 2026 submission if pursued).

Atomic Take: The P&L is strong, but the margin stack is “credit + fees + subscriptions”—so you babysit credit metrics, not vibes.

What breaks this? Provision rate rising while take rate stalls (profit per dollar of GMV compresses).

The Atomic Verdict:

Quality: High, because the model produced $55.6M cash from operations in 9M’25 and stayed profitable in Q3’25.

Health: Solid, with $134.7M cash + restricted cash as of 30 Sep 2025 and $155.3M equity.

Overhang: Elevated, due to Shopify litigation plus a bank charter exploration path.

What must happen next: Growth can’t be “bought” with looser underwriting that later detonates losses.

Status: High Conviction.

CRITICAL MASS

Stars: 4/5

Reason 1: Demonstrated profitability and cash generation in reported numbers.

Reason 2: Short-duration receivables give genuine ability to pivot risk quickly.

Upgrade Triggers

Provision for credit losses trends into the stated 2.5%–2.75% band while GMV growth remains strong (management framing).

Subscription momentum persists (e.g., Active Subscribers growing from the 0.6M baseline as of 30 Sep 2025).

Funding flexibility improves cleanly (e.g., expanded borrowing capacity to $225M without adverse terms).

Downgrade Triggers

Litigation outcome turns meaningfully adverse (e.g., injunction/claims path curtailed or costs escalate beyond “minor” framing).

Cash from operations weakens materially versus net income (profit quality slip).

Merchant-related funding behavior shifts (DSIP balances/yields change in a way that pressures liquidity perception).

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.

Nice article. I own Sezzle