The Money Mind: How Floyd Odlum made $39,000 into $150 million in 12 years

How the original deep value hunter built a $150 million empire on the ashes of 1929.

If you had invested $39,000 in the S&P 500 in 1923, you might have done well. But if you were Floyd Odlum, that $39,000 didn’t just grow. It exploded into a $150 million empire in just twelve years.

The math is almost violent. Between 1923 and 1935, Odlum grew his assets by 384,515%. That is a Compound Annual Growth Rate (CAGR) of 32,042%.

And he did it during the Great Depression.

While the rest of Wall Street was paralyzed by panic, Odlum was quietly assembling one of the largest fortunes in American history. He wasn’t a gambler. He wasn’t a tech visionary. He was a lawyer who discovered a glitch in the market: a way to buy dollar bills for 60 cents.

Odlum is the greatest value investor you’ve never heard of. He was Ben Graham before Ben Graham. And his operating system is the ultimate masterclass in distressed investing.

The Lawyer Who Lost It All

Floyd Odlum wasn’t born a financial genius. In fact, his first attempt at the stock market was a total catastrophe.

Odlum started his career as a law clerk for the Utah Power and Light Company. With a decent income, he scraped together $40,000 in savings and threw it into the market as a speculator. He chased hot tips and tape action.

The result? He lost every single penny.

This total wipeout was his “Crucible.” It forced a hard reset. He realized he was gambling, not investing. Odlum retreated, licked his wounds, and returned to his day job as a lawyer.

But this legal work became his “unfair advantage.” Working at the Electric Bond and Share Company, he spent his days dissecting the complex structures of utility companies. He learned how to read the fine print that others ignored. He realized that the legal structure of a company often hid its true value.

In 1923, he pooled $39,000 with a friend, George Howard, and their wives to form “The United States Company”. This time, he wasn’t guessing. He was underwriting. And the results were instant: in two years, the partnership grew 17x to $660,000.

The Odlum Discount (Buying Dollars for 60 Cents)

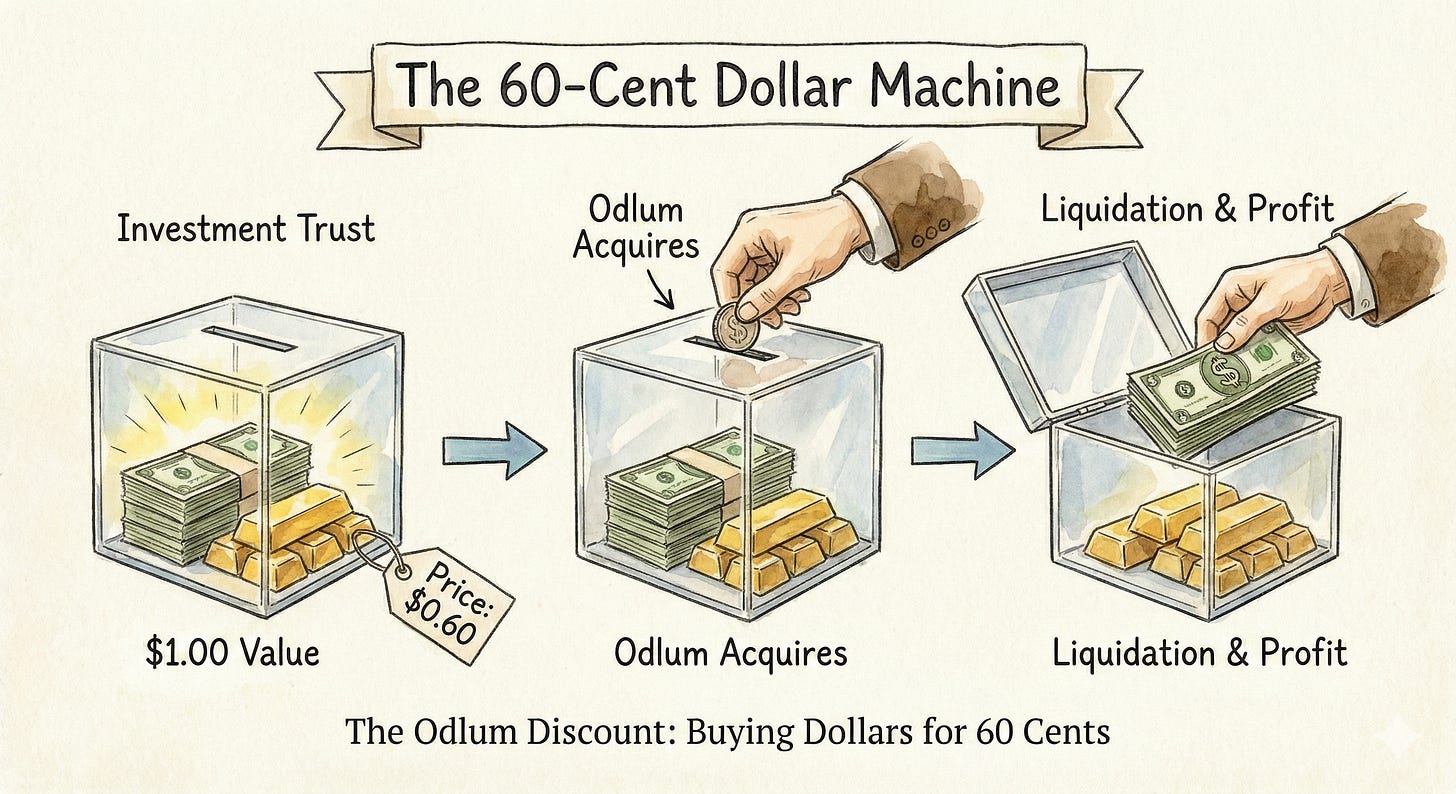

Odlum’s genius wasn’t just in picking good stocks; it was in structural arbitrage. His superpower was identifying Investment Trusts trading below their Net Asset Value (NAV).

During the Depression, fear was so rampant that investment trusts (the mutual funds of their day) were being sold by panicked investors for less than the cash and stocks they actually held inside them.

Here is the mechanics of “The Odlum Discount”:

Identify the Trust: Find a trust holding marketable securities (stocks/bonds) worth $1.00 per share, but trading at a market price of $0.60.

Acquire Control: Buy enough shares to take control of the trust. If he didn’t have the cash, he used shares of his own company, Atlas, as currency.

Liquidate or Merge: Dissolve the trust to sell the assets at full market value ($1.00), or merge it into his own vehicle, The Atlas Corporation.

Pocket the Spread: Keep the difference as risk-free profit.

He repeated this process twenty-two times. He wasn’t hoping the market would go up; he was mathematically guaranteeing a profit by closing the gap between price and value.

But none of this would have been possible without his Cash Discipline.

In the summer of 1929, sensing the euphoria, Odlum sold half his assets. He sat on $14 million in cash. When the crash hit later that year, he was the only one with dry powder. As he noted, he had “more ready money than almost anybody in Wall Street except a few of the big banks”.

He used that cash to buy up the wreckage of the American economy—from Greyhound Bus and Hilton Hotels to Paramount Studios and uranium mines.@

Odlum’s ability to flip assets during the Depression was a masterclass in asymmetric risk, a concept deeply rooted in the probabilistic edges and Kelly Criterion strategies of Edward O. Thorp.

The Price of Obsession

Odlum’s strategy required immense patience and an iron constitution, but his body often failed him.

While he conquered Wall Street, Odlum battled rheumatoid arthritis for most of his adult life. The physical toll was severe. The pain became so intense that he was eventually forced to stop working in a traditional office setting. Later in life, the disease crippled his hands and feet.

His “Graveyard” wasn’t financial ruin (after his first loss), but the physical cost of his relentless drive. While he was managing a $150 million empire, he was often doing so through a haze of physical agony. Yet, even this didn’t stop him. It just changed how he worked.

Steal Their Brain: The Atlas Toolkit

You don’t need to buy a uranium mine or a movie studio to invest like Odlum. Here is his operating system adapted for the modern investor:

1. The “Dumpster Diver” Standard

Odlum didn’t just buy junk; he bought mispriced quality. He focused on “Special Situations”; investments that involved not just capital, but management responsibility.

The Concept: Markets often hate entire sectors without looking at the individual businesses.

Actionable Rule: Don’t just look for 52-week lows. Look for assets where the liquidation value is higher than the stock price. If a company dissolved tomorrow, would you get back more than you paid? If yes, buy.

2. Cash is a Call Option

In 1929, Odlum sat on $14 million cash while the market roared. He didn’t force trades.

The Concept: Most investors feel the need to be 100% invested at all times. Odlum treated cash as a weapon.

Actionable Rule: You do not need to be 100% invested 24/7. Cash is not “trash”; it is a call option on future distressed assets without an expiration date. When there are no deals, wait. When there is blood in the streets, attack.

3. Boring is Beautiful

Odlum’s first love wasn’t tech or fashion; it was utilities. He understood that boring, regulated industries often provided the most predictable cash flows.

The Concept: Flashy stocks get the headlines; boring stocks get the returns.

Actionable Rule: Ignore the cocktail party stocks. Look for the “toll roads” of the economy; utilities, infrastructure, and essential services that people pay for regardless of the economy.

The Poolside Tycoon

How does a man with crippling arthritis run a global empire? From a swimming pool.

Odlum retreated to his estate in Indio, California, where the dry heat soothed his joints. He was famous for conducting worldwide business while floating in his Olympic-sized pool, taking calls on a special rubberized telephone receiver.

But he wasn’t a hermit. His life was a whirlwind of high-profile connections:

The Power Couple: His wife was Jacqueline Cochran, a pioneer aviator who held more speed and altitude records than any living pilot. She was the first woman to make a blind landing and break the 2,000km speed record. Odlum financed her flights enthusiastically.

The Inner Circle: His guest list included Walt Disney, Bob Hope, and Howard Hughes.

The President: He was so close with President Eisenhower that he built him a “cottage” on his ranch. Eisenhower spent nine winters there writing his memoirs.

He was a man who financed moon shots because his wife thought they were “terrific”.

The Verdict

Floyd Odlum was the original “Deep Value” hunter. He viewed the market not as a casino, but as a grocery store where items occasionally get mislabeled.

Copy this style if:

You are a contrarian: You are comfortable buying when everyone else is selling (e.g., during a crash or recession).

You love analysis: You enjoy reading the footnotes to find hidden assets (NAV vs. Price).

You are patient: You are willing to sit in cash for years waiting for the “fat pitch”.

Run away if:

You need constant action: Odlum’s strategy involved long periods of “sitting on his hands”.

You follow the herd: If you need social validation for your investments, Odlum’s “dumpster diving” isn’t for you.

Odlum taught us that the greatest risk isn’t being out of the market; it’s being in the market at the wrong price. As James Grant said of him, “He was a member of that eccentric tribe that believes it’s better to underpay than to overpay”.