The Nick Sleep Test: Would He Buy Coupang Today?

The Amazon of South Korea vs. The Nomad Philosophy

New to The Atomic Moat? This Titan Test of Evolution ($EVO $EVVTY) is a prime example of how we dissect high-quality compounders. If you want these ‘Titan Tests’ sent to your inbox, join 900+ other investors below.

There is a quiet tragedy in modern investing: the obsession with “beating the quarter” often destroys the ability to “win the decade.”

I was recently revisiting the letters of the Nomad Partnership, written by Nick Sleep and Qais Zakaria. Between 2001 and 2014, they returned over 900% not by trading rapidly, but by doing almost nothing. They identified a specific business architecture, bought it, and went to sleep.

Their philosophy was simple yet radical. They believed most companies pursue Scale Economies Kept—they get big, achieve efficiency, and keep the extra profit for shareholders. This invites competition.

Sleep preferred Scale Economies Shared. These companies (Costco, Amazon) get big, achieve efficiency, and give the savings back to the customer. This builds a moat of loyalty so deep that competition becomes mathematically impossible.

Today, we apply this lens to Coupang (CPNG).

Often lazy analysts call Coupang “The Amazon of South Korea.” But titles are cheap. The real question is: Is CEO Bom Kim actually building a shared-scale engine, or is he simply running a cash-burning logistics firm with a growth multiple?

Let us walk through the fire.

The Titan: Nick Sleep

The Strategy: Scale Economies Shared.

In the office we have a whiteboard on which we have listed the very few investment models that work... The most important model is Scale Economies Shared. This explains the success of Costco, Amazon, and Geico.

— Nomad Investment Letters

Sleep looks for a “positive feedback loop.” The company lowers costs → lowers prices → drives volume → lowers costs further. It is a perpetual motion machine of value. To pass the Sleep Test, a company must demonstrate a willingness to look “optically expensive” today to secure dominance tomorrow.

Pillar I: The Core Engine (Is the Moat Widening?)

When Nick Sleep analyzed Amazon in the early 2000s, Wall Street was screaming about net income. Sleep ignored them. He looked at Revenue Growth and Cash Flow. He wanted to see if the “customer value proposition” was increasing.

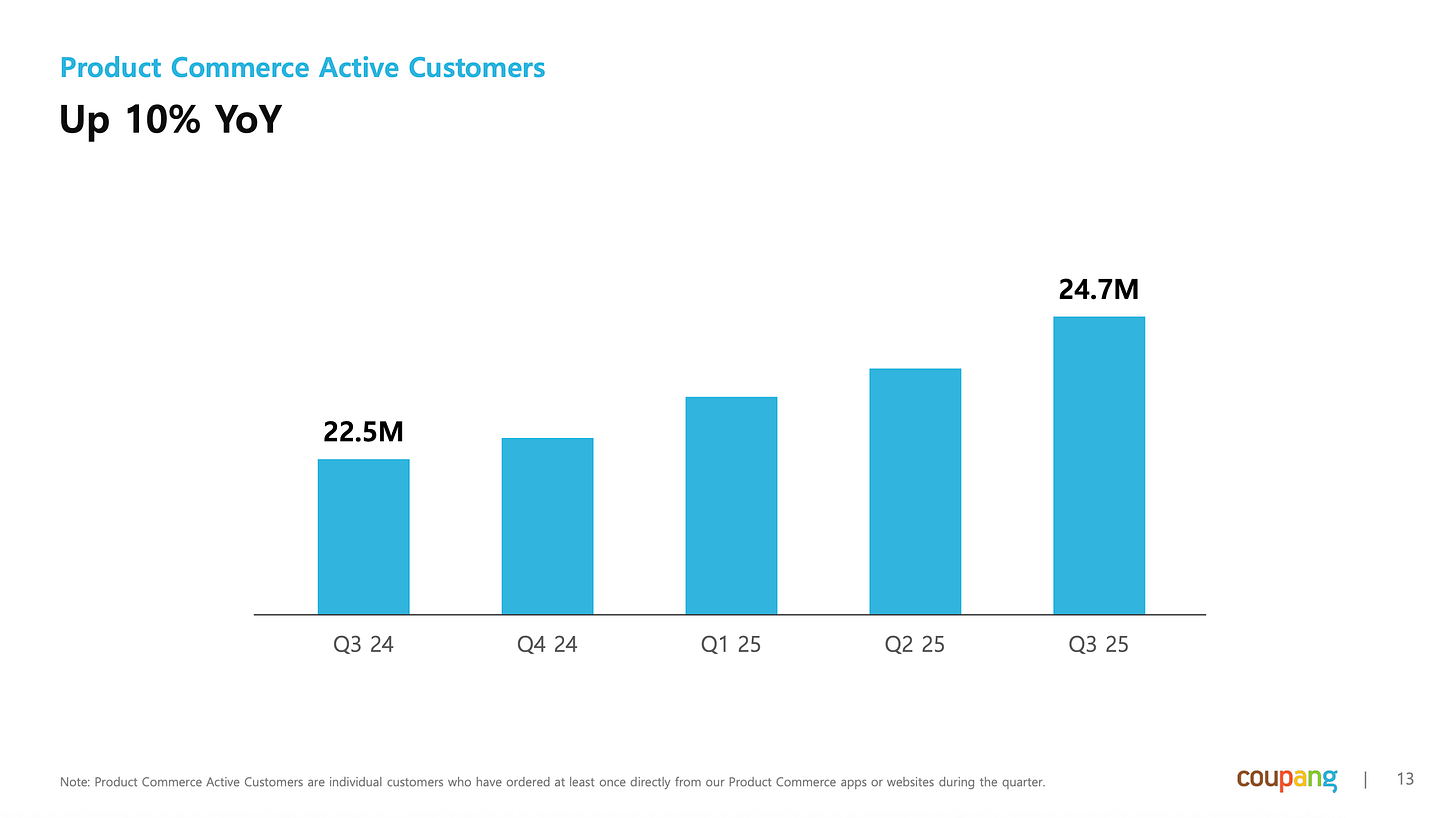

Looking at Coupang’s Q3 2025 data, we see a machine that is undeniably working.

The Hard Numbers:

Total Net Revenues: $9.27 billion (+18% reported).

Product Commerce Gross Margin: 32.1%.

Operating Income: $162 million.

The Sleep Interpretation:

A traditional analyst cheers the $162 million in operating income. It proves Coupang is “grown up.”

Nick Sleep would view this differently. He would look at the 32.1% Gross Margin in the Product Commerce segment and ask a provocative question: Is this margin too high?

Costco operates on razor-thin margins (often 11-13%) intentionally. Amazon Retail ran at breakeven for decades. If Coupang is taking a 32% cut at the gross level, are they truly “sharing” the economies of scale? Or are they beginning to “keep” them?

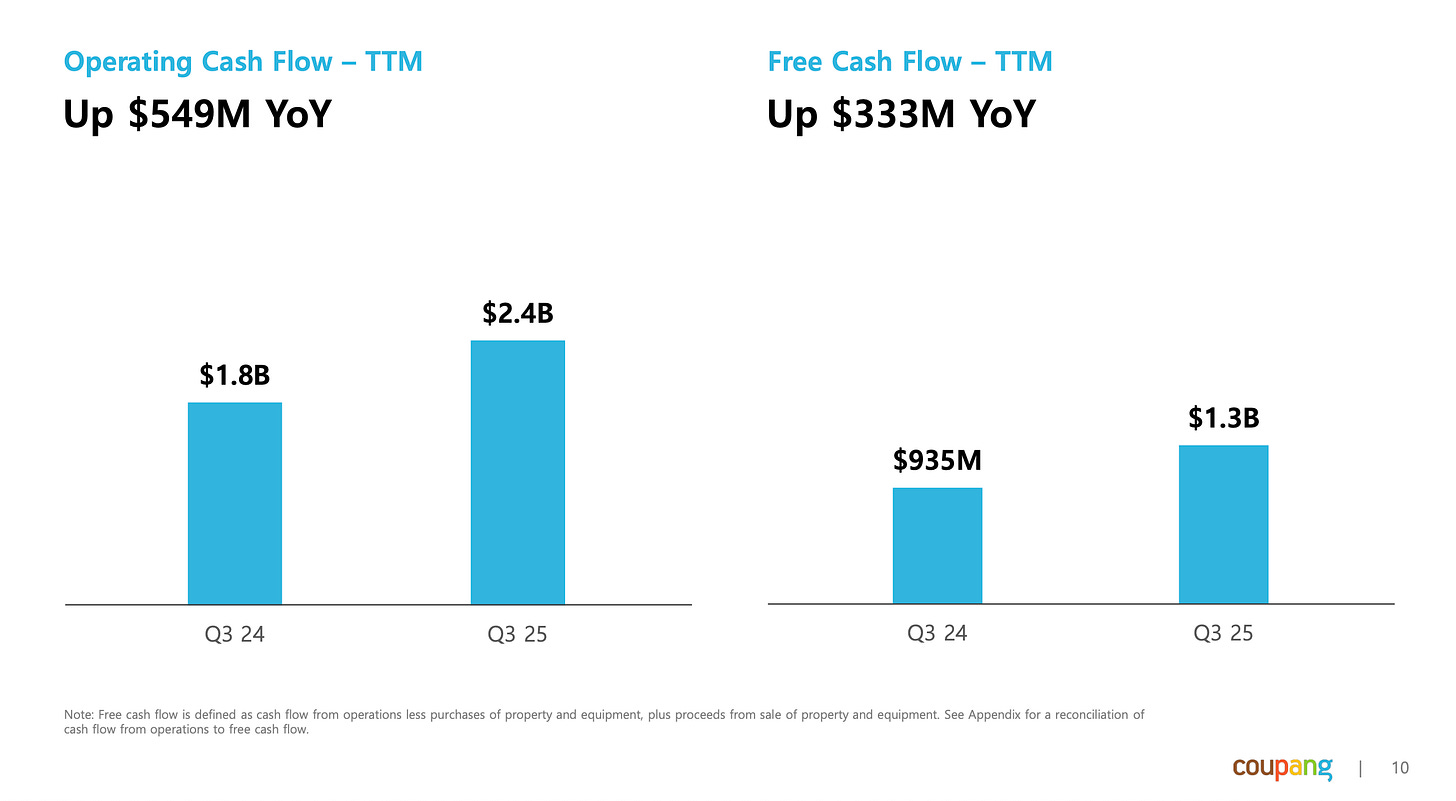

However, the revenue growth (20% constant currency) suggests the value proposition is still resonating. The moat is the logistics network—the “Rocket Delivery” infrastructure that no competitor in Korea can replicate. The fact that they generated $1.27 billion in Trailing Free Cash Flow (FCF) while investing heavily ($1.1 billion in PPE purchases) suggests the core business is self-funding.

The Verdict on Pillar I:

The engine is robust. The cash flow generation ($7.2 billion cash on hand) is the “oxygen” that allows for long-term thinking. Sleep would approve of the logistics dominance, but he would watch that gross margin closely. If it creeps higher without a corresponding increase in customer utility, the “Shared” part of the thesis breaks.

Pillar II: The Reinvestment (The “Taiwan” Bet)

Sleep famously held Amazon while they burned cash building AWS and Prime. He understood that Capex today is the moat of tomorrow, provided the capital is allocated intelligently.

Coupang is currently running a “two-speed” economy:

Product Commerce (Korea): The Cash Cow.

Developing Offerings (Taiwan/Eats/Play): The Cash Bonfire.

The Hard Numbers:

Developing Offerings Revenue: $1.29 billion.

Segment Adjusted EBITDA: A loss of $(292) million.

Guidance: Full-year losses of $900M–$950M for this segment.

The Sleep Interpretation:

Wall Street hates this. They see a nearly $1 billion drag on profits.

Sleep would likely love it—if the unit economics in Taiwan mirror Korea. This is “deferred gratification.” By suffering a $(292) million loss this quarter to build infrastructure in Taiwan, Coupang is depressing current earnings to build a larger future addressable market.

The “Atomic Moat” view is that this is the correct use of the $7.2 billion cash pile. A company that hoards cash is stagnant; a company that deploys cash into high-probability adjacent markets is compounding.

However, Sleep requires intellectual honesty. The “Developing Offerings” segment includes fringe bets. If Taiwan is the next Korea, it is a masterstroke. If it is a vanity project, it is value destruction. The “Scale Economies Shared” model only works if the new volume actually lowers costs for the entire system. Does shipping boxes in Taipei make shipping boxes in Seoul cheaper? That link is tenuous compared to Amazon’s global model.

Pillar III: The Governance & Trust (The Destination Analysis)

This is where the thesis faces its stiffest test.

Nick Sleep and Qais Zakaria placed immense weight on “Destination Analysis”—where is this company going, and are the people running it admirable?1 They invested in Jim Sinegal (Costco) and Jeff Bezos because they believed these founders were fanatically obsessed with customer trust.

The “Geiger Counter” Reading:

The Data Breach: Reuters reports a massive breach fallout, including a 1.69 trillion KRW (~$1.18 billion) customer compensation plan.

The Politics: CEO Bom Kim skipped a parliamentary hearing, leading to political escalation.

The Regulatory Risk: Potential fines rising to 3% (or even 10%) of revenue.

The Sleep Interpretation:

This is a siren-level red flag.

The “Scale Economies Shared” model is built entirely on reciprocity. The customer gives the company volume/loyalty, and the company gives the customer lower prices and protection.

A $1.18 billion compensation plan is not just a financial hit (though it is roughly equal to their entire trailing Free Cash Flow); it is a breach of the unspoken contract. If customers feel Coupang is careless with their data, the “flywheel” friction increases.

Furthermore, Sleep preferred “Nomad” founders—those who quietly built value. A CEO skipping hearings and inviting regulatory wrath suggests a hubris that is antithetical to the “humble operator” archetype of a Costco.

The financial strength is there:

“Cash & equivalents of $7,229M is oxygen; it buys patience for investment mistakes.”

But does it buy forgiveness for a breach of trust?

The Verdict

If Nick Sleep were looking at Coupang today, he would see a business with the architectural advantage of Amazon (logistics dominance) but the governance risks of a frontier market operator.

He would admire the discipline to invest $1 billion into the future (Taiwan) while the market clamors for dividends. He would respect the $1.2 billion in Free Cash Flow.

But the “Scale Economies Shared” model is fragile. It requires the customer to believe the company is on their side. The massive data breach and the subsequent political fallout create a crack in the moat.

The Decision:

Based on the Nomad Partnership criteria, Nick Sleep would likely WAIT.

I think he would probably wait to see if the management team treats the data breach as a “checklist item” to be paid off, or a cultural failure to be fixed.

Atomic Moat Rating: STABLE ISOTOPE (3/5)

Great business, clouding governance.

The most dangerous competitor to Coupang is not another retailer. It is their own arrogance. If they treat the customer as a data point rather than a partner, the scale economies will stop sharing, and start eroding.

Disclaimer: This article is a theoretical application of Nick Sleep’s “Scale Economies Shared” framework to Coupang ($CPNG). This analysis was conducted by The Atomic Moat and does not represent an actual investment decision, endorsement, or comment by Nick Sleep or the Nomad Partnership. Investing is risky; please do your own due diligence.