Deep Dive: Adobe Inc - The Most Hated Cash-Machine in Tech

The apps feel like the future, but the stock is priced for a funeral. Let's audit the fear.

New to The Atomic Moat? This analysis of Adobe ($ADBE) is a prime example of how we dissect high-quality compounders. If you want these deep dives sent to your inbox, join 900+ other investors below.

I have spent more Friday nights than I care to admit staring at a Premiere Pro timeline, fighting with keyframes and cursing at render times. I know the muscle memory of Photoshop shortcuts better than I know my own phone number. To me, these aren’t just “apps.” They are the language I speak. You don’t just “switch” languages because a new AI tool came out on a Tuesday.

But I’ve also seen the other side of the beast.

In a previous life, I worked at a European bank. We used Adobe Analytics (the old Omniture engine), not Google Analytics. Why? Because we had to.

In banking, you operate under a strict license. We couldn’t just pipe sensitive customer data to Google’s public cloud and hope for the best with GDPR. We needed a tool that was audit-proof, compliant, and guaranteed data sovereignty. Adobe was the only adult in the room.

So when I hear the Wall Street narrative that “Adobe is dead” or “AI is going to kill the moat,” I don’t just look at the spreadsheet. I look at my own scar tissue.

I see a Creative Cloud that is sticky by design, and an Experience Cloud that is entrenched by compliance.

The market thinks Adobe is a fragile painting. I know it’s a concrete bunker.

Let’s dig in.

If You’re In a Rush

What they actually do: Adobe sells subscriptions. They are the toll booth for the creative economy, documents, and enterprise experiences. We are talking about a massive $22.904B subscription revenue operation. That is not a startup; that is a sovereign state of software.

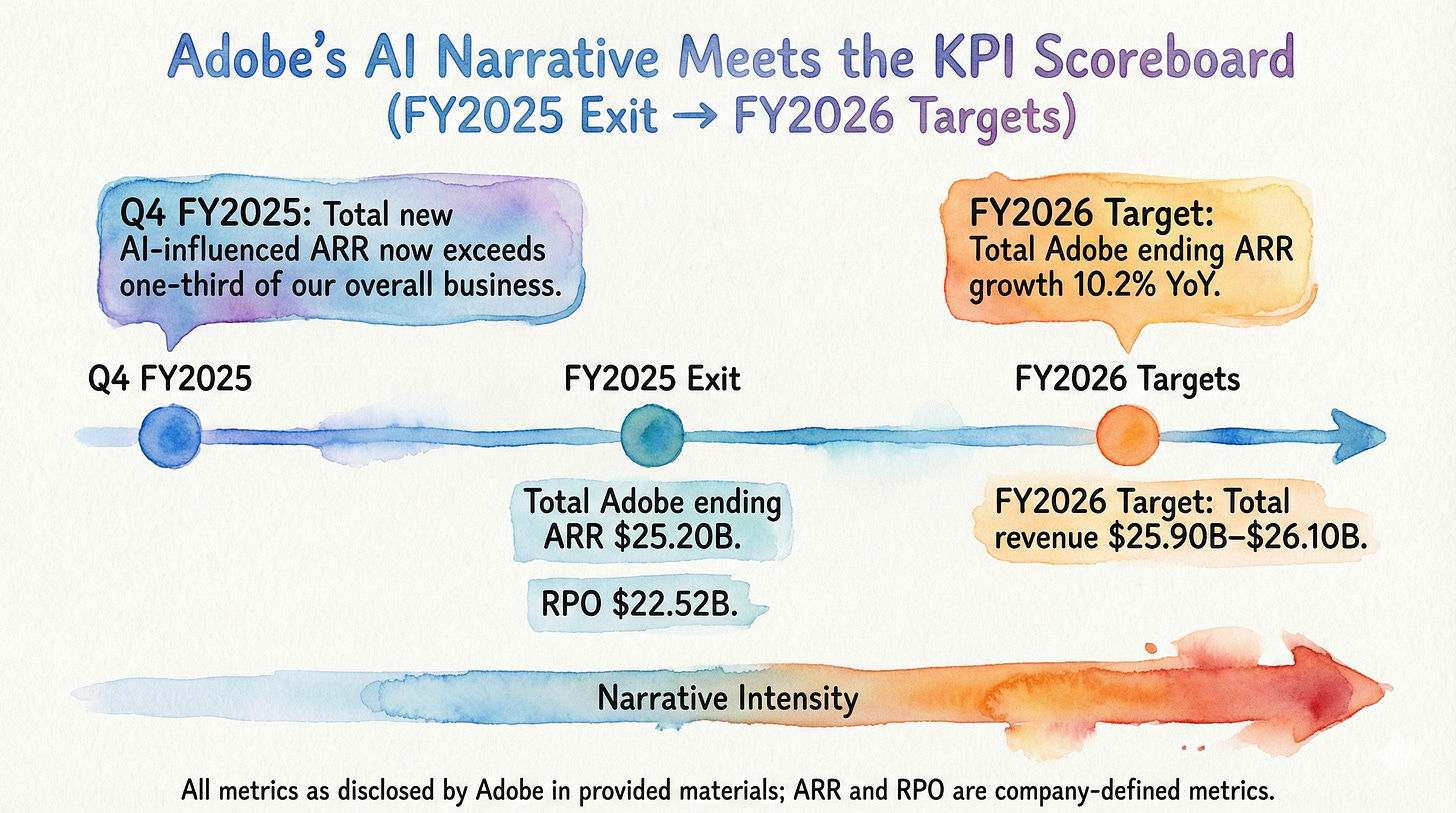

Why it’s hated: Wall Street is treating generative AI like a pricing grenade, and they think Adobe is running around the room waving the pin. The company recently disclosed that “Total new AI-influenced ARR now exceeds one-third of our overall business”. To an optimist, that’s adaptation. To a pessimist, that’s a sign they are running to stand still.

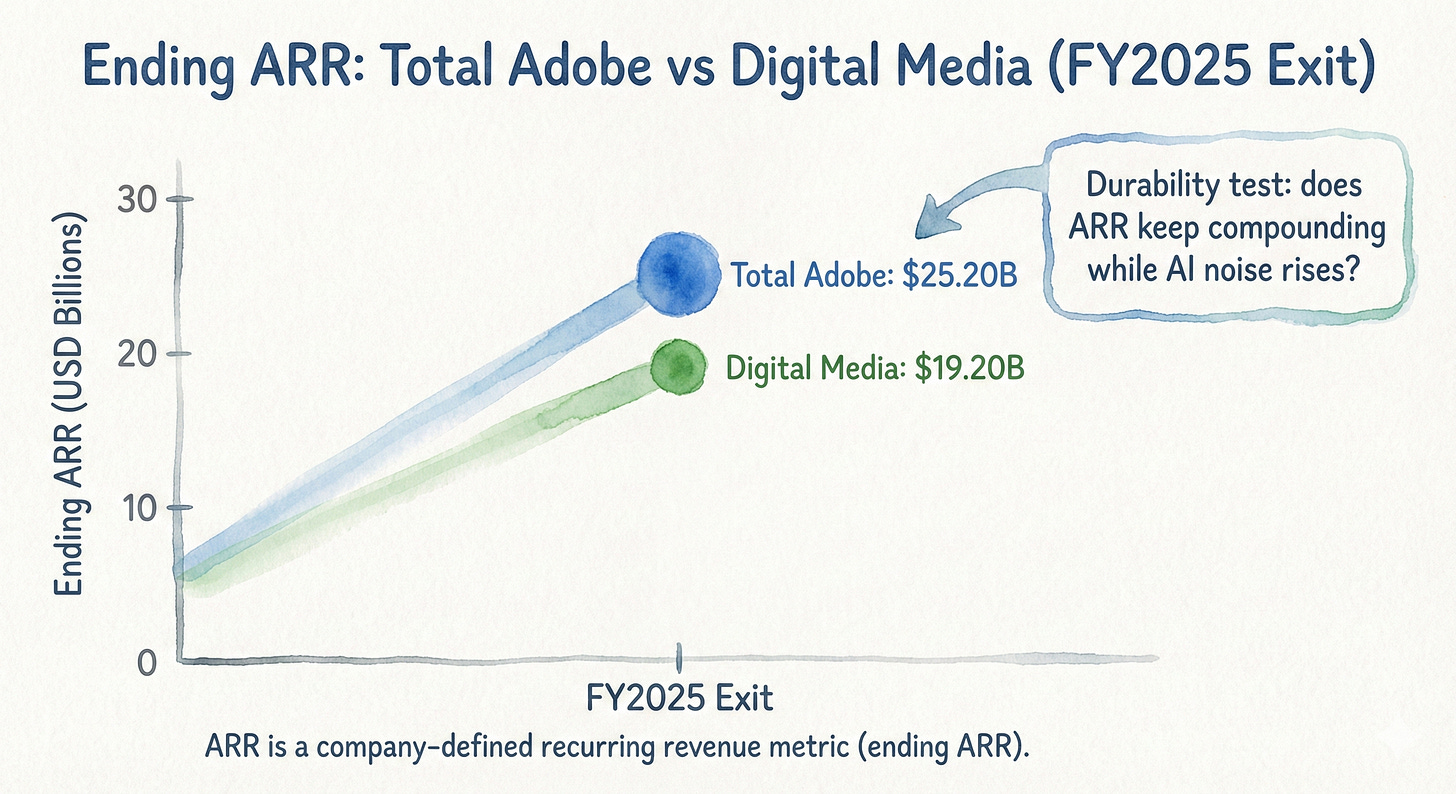

What fixes it: You fix the narrative by showing the money. AI monetization has to show up in the boring, beautiful recurring engine. Management has given us the scoreboard to watch: 10.2% YoY Total Adobe ending ARR growth. If they hit that, the story changes.

Atomic Take: Here is the plain truth: If the ARR engine holds up, the “AI hate” stops being about economics and starts looking like just bad sentiment.

Falsifier: If Total Adobe ending ARR growth prints below 10.2% YoY, the bears were right.

The Setup

Folks, the market’s argument right now isn’t “is Adobe a good business today?”

Anyone with eyes can see it is.

The argument is, “is Adobe’s business model about to get re-priced by AI?”

Look at the hard evidence:

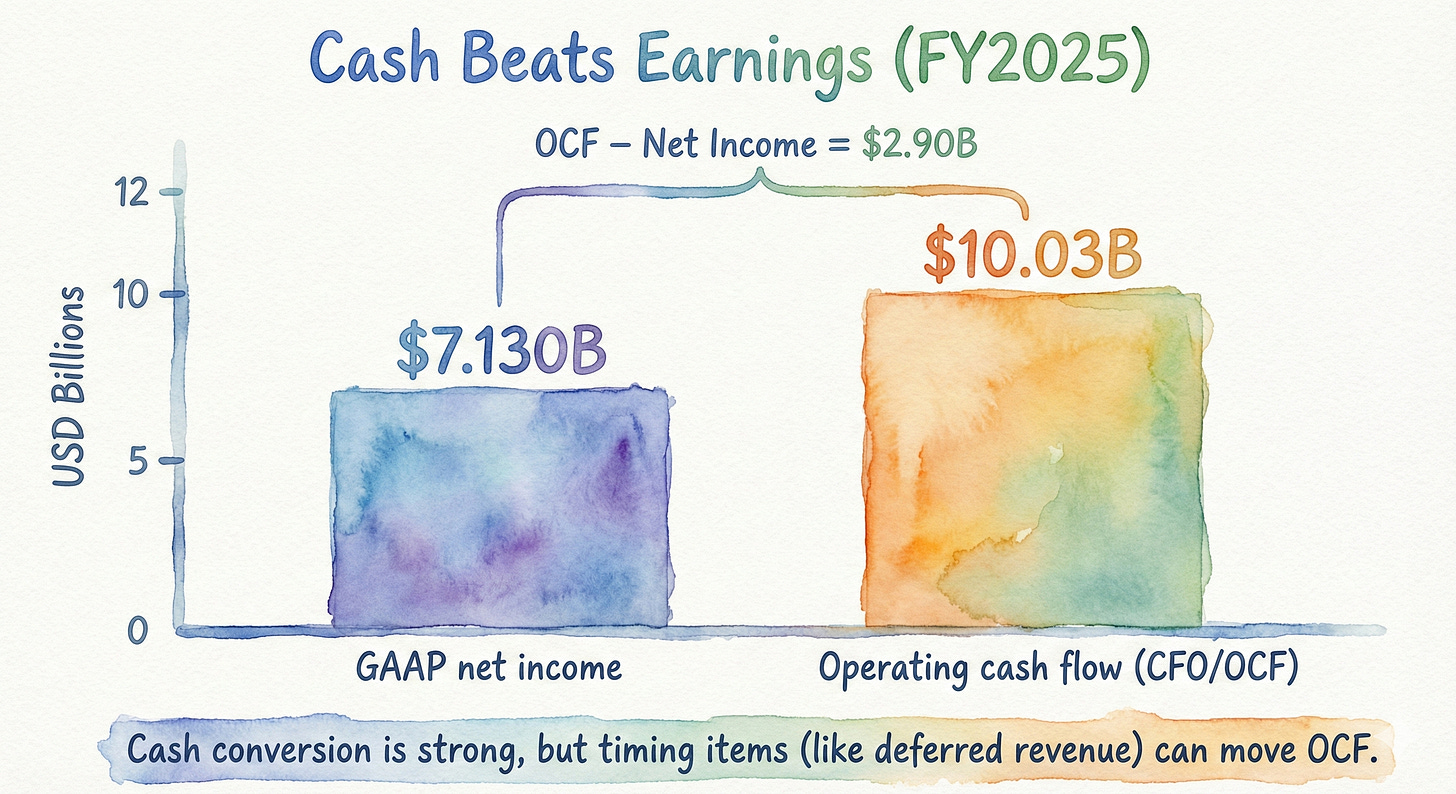

They delivered $23.769B total revenue and brought home $7.130B net income. That is real profit.

The cash machine is humming. They generated $10.03B operating cash flow and bought back about 30.8M shares. That’s shareholder yield, plain and simple.

They exited the year with $25.20B Total Adobe ARR and $19.20B Digital Media ARR

The backlog is thick. We are looking at $22.52B RPO

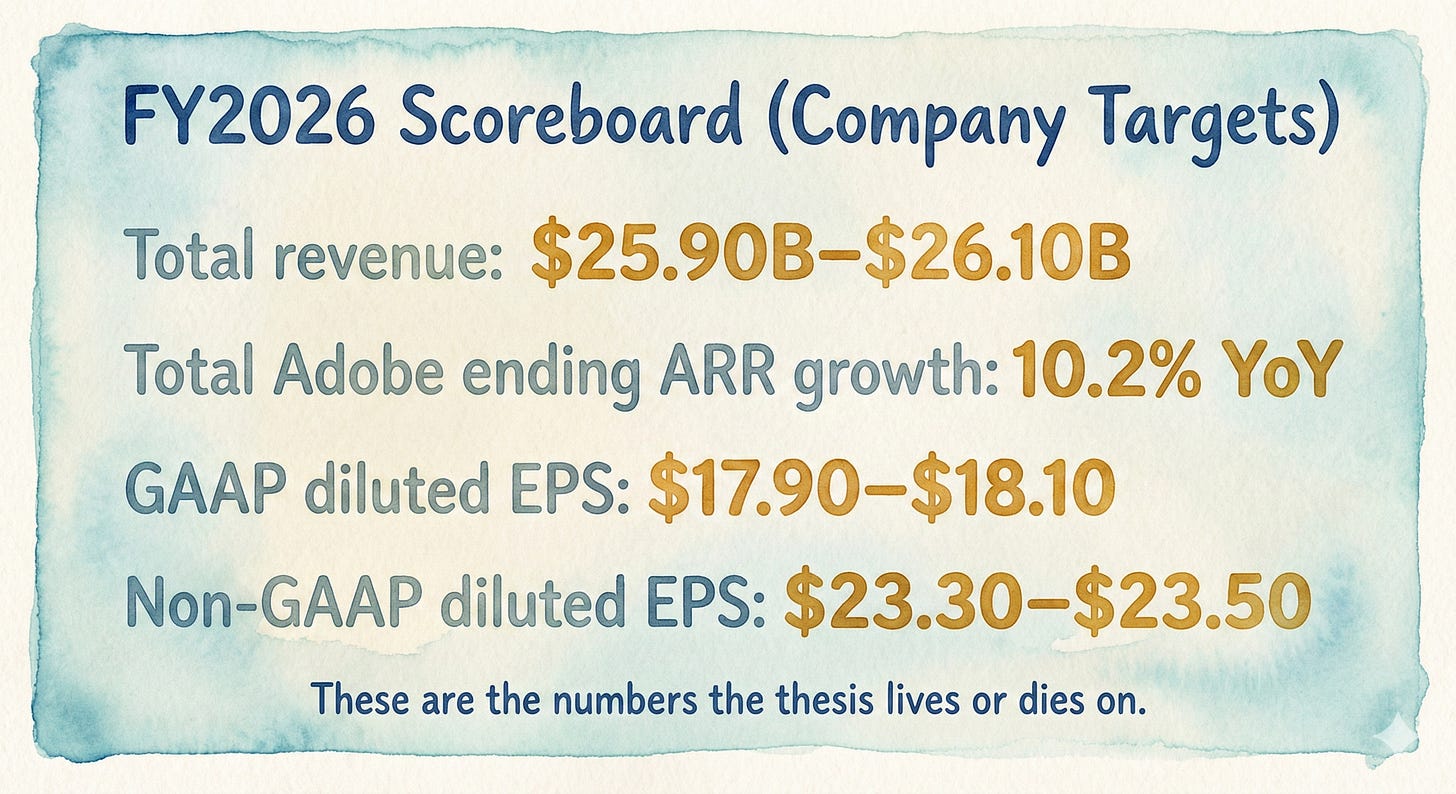

Management isn’t hiding under a rock, either. They are guiding for FY2026 total revenue of $25.90B–$26.10B and GAAP diluted EPS of $17.90–$18.10. They are explicitly telling us to watch the customer-group subscription revenue plus total company ending ARR growth. They want us to look at the recurring revenue.

The stock is being priced as if “creation becomes free” happens faster than Adobe can figure out how to package AI into their paid tiers.

But we need to watch three things like a hawk:

Total Adobe ending ARR growth vs 10.2% YoY (FY2026 target).

RPO growth off that massive $22.52B base.

The GAAP vs non-GAAP bridge. When the narrative gets shaky and the adjustments get heavy, that’s when investors get jumpy.

Atomic Take: The company is still throwing off recurring, high-margin economics. The bear case requires you to be a fortune teller (forward-looking), because the historian (backward-looking) sees a great business.

Falsifier: If RPO stops growing year-over-year (exiting-quarter YoY %, company-reported), the engine is stalling.

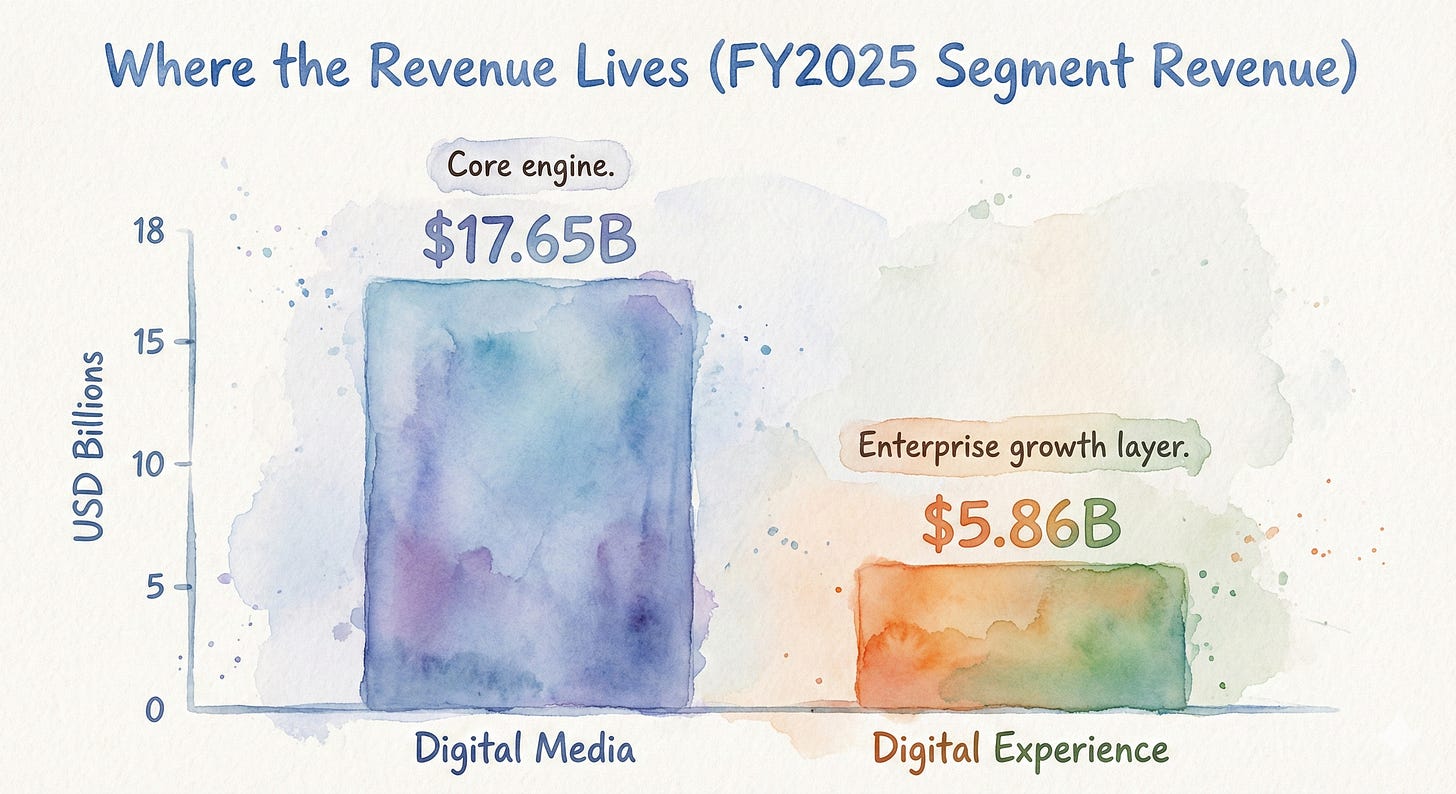

How the Business Actually Makes Money

Let’s start with the boring truth, because that’s usually where the money is. Adobe is a subscription company that masquerades as a cool creative culture icon.

On the P&L, subscription is the whole movie.

I mean it. $22.904B subscription revenue out of $23.769B total revenue. If you’re looking for license fees or one-time sales, you’re in the wrong decade.

Segment-wise, the center of gravity is still Digital Media. That’s the Photoshop and Premiere behemoth. It pulled in $17.65B segment revenue and sits on $19.20B ending ARR.

Then you have Digital Experience (the enterprise marketing side) at $5.86B segment revenue with $5.41B subscription revenue.

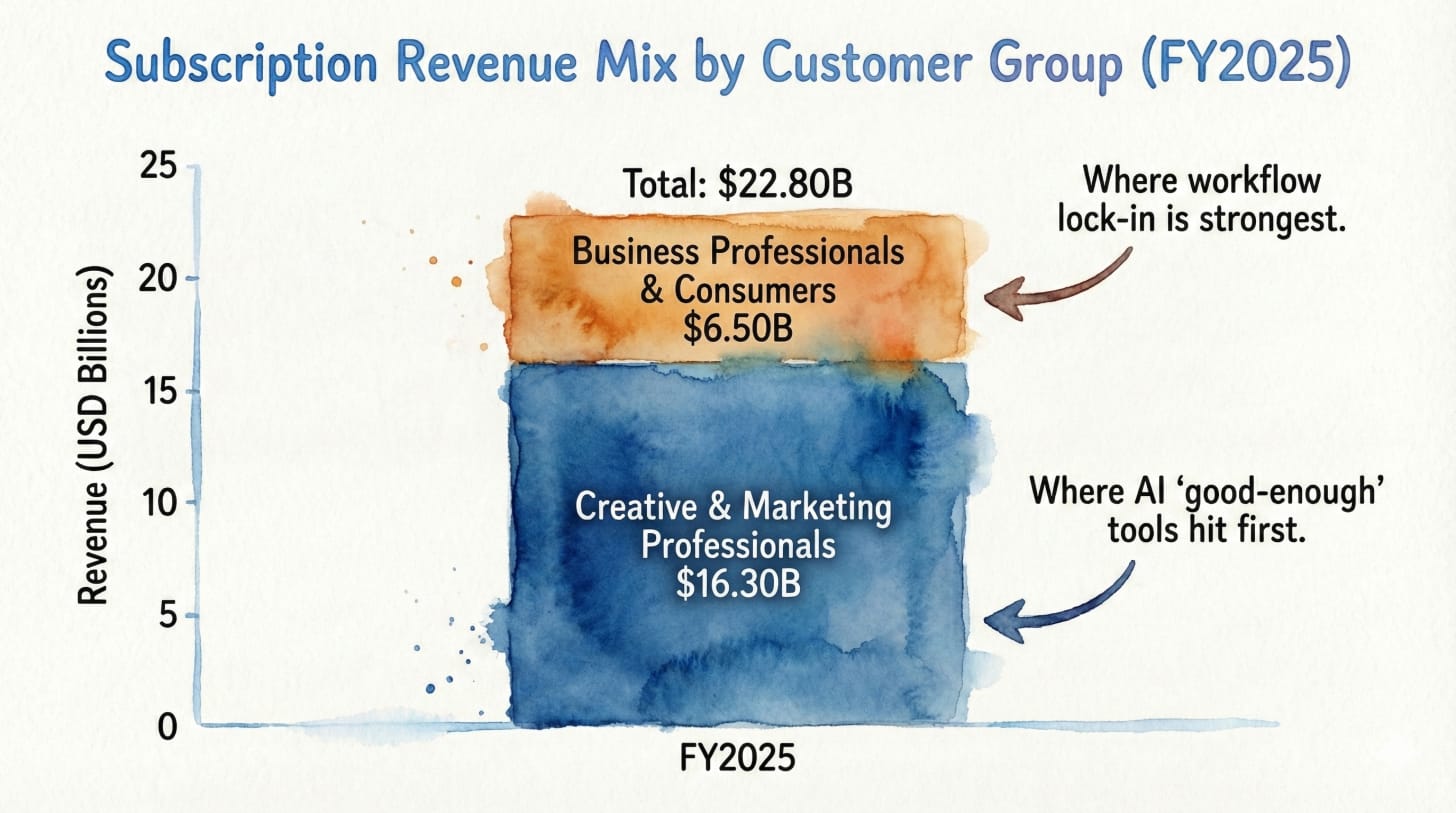

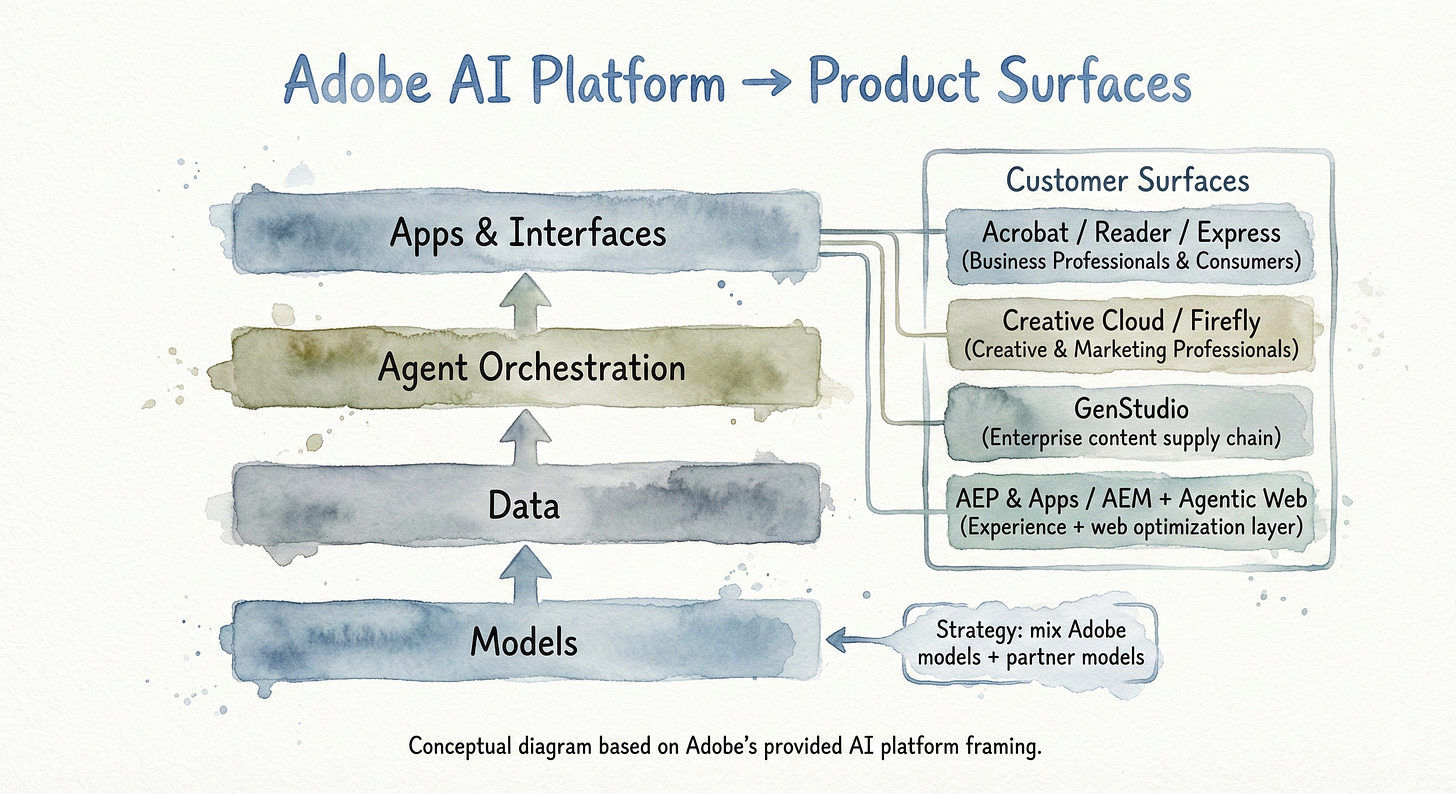

Now, here is what has changed (quietly, but it’s important): Adobe is reframing who it sells to. They now highlight two customer groups:

Business Professionals & Consumers subscription revenue: $6.50B.

Creative & Marketing Professionals subscription revenue: $16.30B.

Why does this matter? Because the AI panic attacks the low end first.

If generative tools make “good enough content” cheaper, the risk isn’t that the Hollywood editor cancels Premiere Pro tomorrow. The risk is that the next million casual creators never pay what they used to pay.

Adobe’s counter is obvious in the materials: put AI assistants inside Acrobat, Reader, and Express for the broad audience, while Creative Cloud and Firefly deepen the power workflows for the pros.

Stop and Think: Recurring revenue isn’t just about “users like the tool.” It’s about “teams store work in the tool.” It’s about “enterprises standardize workflows around the tool.”

That kind of switching cost doesn’t trend on X (formerly Twitter), but it tends to show up in the ARR and RPO lines.

Management also discloses that “over 75% of Digital Media net new ARR” was driven by subscription growth + cross-sell/up-sell.

That is organic demand, folks.

Atomic Take: Adobe’s moat is workflow gravity. Subscriptions are the toll booth, and AI is just the new express lane they’re trying to charge for.

Falsifier: If Digital Media ending ARR growth falls materially below 11.5% YoY for multiple quarters, the gravity is weakening.

What Went Wrong

Nothing “broke” in the financial statements. Read them again. They’re fine.

What broke was the market’s willingness to pay a premium multiple for durability when that durability is getting rhetorically challenged by AI every single day.

Adobe is explicitly integrating AI across products and measuring “AI-influenced” ARR. They state that “Total new AI-influenced ARR now exceeds one-third of our overall business”.

That sentence right there? That is the hate accelerant. It invites two competing interpretations:

Interpretation A (The Bull): “AI is a new paid layer on top of a sticky subscription base. It’s an upsell.”

Interpretation B (The Bear): “AI reduces differentiation, so Adobe is forced to bundle AI just to stand still. They are running on a treadmill.”

The materials show Adobe positioning itself as a platform that blends its own models with partner models across apps. This is where the “AI hate” splits into things we can debunk and things we can’t.

Hate Narrative #1: “AI makes creation free, so Adobe’s pricing power dies.”

FACT: Adobe is describing monetization mechanics (Generative Credits) and a path to higher-value offerings or add-ons as usage rises (prepared remarks).

HYPOTHESIS: If Generative Credits become a meaningful “value usage” meter, monetization becomes measurable. It stops being about “trust the demo” and starts being about the meter.

MONITOR: Management’s disclosed usage/monetization commentary. Does it translate into sustained ending ARR growth (total + Digital Media)? Note: This isn’t fully debunkable yet. AI can compress differentiation at the low end. The only honest way to fight that is to show the paid tiers still compounding.

Hate Narrative #2: “AI will blow up costs and crush margins.”

FACT: Adobe guides to non-GAAP operating margin assumptions around ~45% for FY2026 targets.

HYPOTHESIS: If AI compute costs were quietly eating the business alive, we’d expect pressure in operating profitability. We aren’t seeing it in the guide.

MONITOR: GAAP operating margin trajectory and operating cash flow vs net income (GAAP). Note: We don’t get a clean “AI compute” line item. This stays a watch item, not a victory lap.

Hate Narrative #3: “Adobe is behind in agentic workflows and new surfaces.”

FACT: The company points to integrations and “conversational platforms” surfaces (prepared remarks + deck). They disclose early traction such as “over 25,000 businesses” purchasing Express or Studio for the first time in Q4

Atomic Take: The hate is mostly a forward multiple debate disguised as a product debate. The only referee that counts is ARR.

Falsifier: If customer-group subscription revenue growth decelerates meaningfully while “AI-influenced” messaging intensifies, you have a problem. Specifically, watch Business Professionals & Consumers and Creative & Marketing Professionals subscription revenue (company-reported).

Rebound Catalysts

This is one of the nicer setups in the land of the mega-caps. Why? Because management isn’t giving us vague poetry; they are giving us a scoreboard that we can actually check.

Here is the checklist. If these four things happen, the stock works.

Catalyst 1: Hit the “Magic Number” (ARR Growth)

Management targets 10.2% YoY Total Adobe ending ARR growth. This is the whole ballgame. If they hit that number while continuing to scream about “AI-influenced” offerings, the simplest bear framing—“AI breaks the subscription model”—gets very hard to defend.

Catalyst 2: Watch the Crystal Ball (RPO)

RPO exited FY2025 at $22.52B, growing 13% YoY. RPO (Remaining Performance Obligations) isn’t “revenue already earned,” but it is the backlog. It’s the proxy that tends to crack before revenue does if demand is actually drying up. Right now, the crystal ball looks clear.

Catalyst 3: AI Needs to Be Boring (Document Adoption)

We all look at the cool AI images. But the money is in the boring stuff.

Customer reception for Acrobat Studio is real: “nearly 50% of Acrobat commercial ETLA’s renewed in Q4 already upgrading.

Over 25,000 businesses purchased Express or Studio for the first time in Q4 alone. If AI monetization is real, it should show up in business-pro workflows first. Why? Because businesses pay for productivity. Consumers pay for vibes. We want productivity.

Catalyst 4: The Cash Shield

FY2025 operating cash flow was $10.03B. The market can stay irrational longer than you can stay solvent, but Adobe has $10B a year to buy time. That is a very expensive shield.

Atomic Take: Adobe doesn’t need to “win AI” in a philosophical sense. It needs to turn AI into a measurable subscription expansion story, quarter after quarter.

Falsifier: If FY2026 ending ARR growth misses 10.2% YoY (FY2026 actual vs target, %), even if they hit their EPS targets, run. An engine mismatch is the tell.

Financial Quality Rubric

Let’s grade the report card.

Revenue Durability (4/5)

Subscription concentration is extreme in the best possible way—$22.904B subscription revenue. They disclose growth across customer groups, so we can see where the money comes from.

Profitability Under Reinvestment (4/5)

They are spending money to make money, but they are still making a lot of money. GAAP operating income was $8.706B.

If you like the adjusted numbers, non-GAAP operating income was $10.986B.

Cash Generation Quality (5/5)

This is elite. $10.03B operating cash flow versus $7.130B GAAP net income.

Cash is doing the heavy lifting here.

Balance Sheet Resilience (4/5)

They can weather a storm. Cash & equivalents were $5.431B and short-term investments were $1.164B.

Compare that to $6.210B long-term debt (as of Nov. 28, 2025) It’s balanced.

Capital Allocation Discipline (4/5)

They are eating their own cooking. ~30.8M shares repurchased with $5.90B remaining on authorization.

Disclosure/Metric Integrity (3/5)

Here is the smudge on the report card. Management notes it will “periodically update” offerings included in Total AI-Influenced ARR. That is “definition drift” risk.

The Audit: Non-GAAP is useful, but it’s also where “AI optimism” and “adjustment optimism” hold hands. Adobe’s reconciliation shows stock-based and deferred comp is a material add-back inside operating income and EPS bridges. That isn’t a sin—everyone in tech does it—but don’t treat it as imaginary money. It dilutes you.

Atomic Take: The financial quality is real. The biggest fragility is narrative credibility around AI monetization definitions.

Falsifier: If GAAP operating cash flow falls below GAAP net income for a full fiscal year (FY basis, USD, GAAP), the cash conversion is breaking.

The Statements

Let’s open the hood and look at the engine block.

Balance Sheet (The Geiger Test)

Here is the adult version of “is this balance sheet safe?” We check for liquidity, leverage, and hidden obligations.

Liquidity: Cash and cash equivalents were $5.431B plus short-term investments of $1.164B.

Leverage: Long-term debt was $6.210B. Current debt was $0.

The Future Money: Deferred revenue (current) was $6.905B and deferred revenue (long-term) was $0.125B.

Stop and Think: Deferred revenue is the ghost of future earnings. It’s cash they have but haven’t recognized as sales yet.

This isn’t a “distress” setup. It’s a “durable subscription model with manageable leverage” setup. The real Geiger-test question isn’t solvency; it’s whether the subscription backlog signals (deferred revenue + RPO) keep pointing up.

Atomic Take: The balance sheet looks like a company built to absorb narrative volatility without being forced into financial contortions.

Falsifier: If Deferred revenue declines materially year-over-year while revenue still grows (FY basis, USD), you have a pull-forward or billing quality risk.

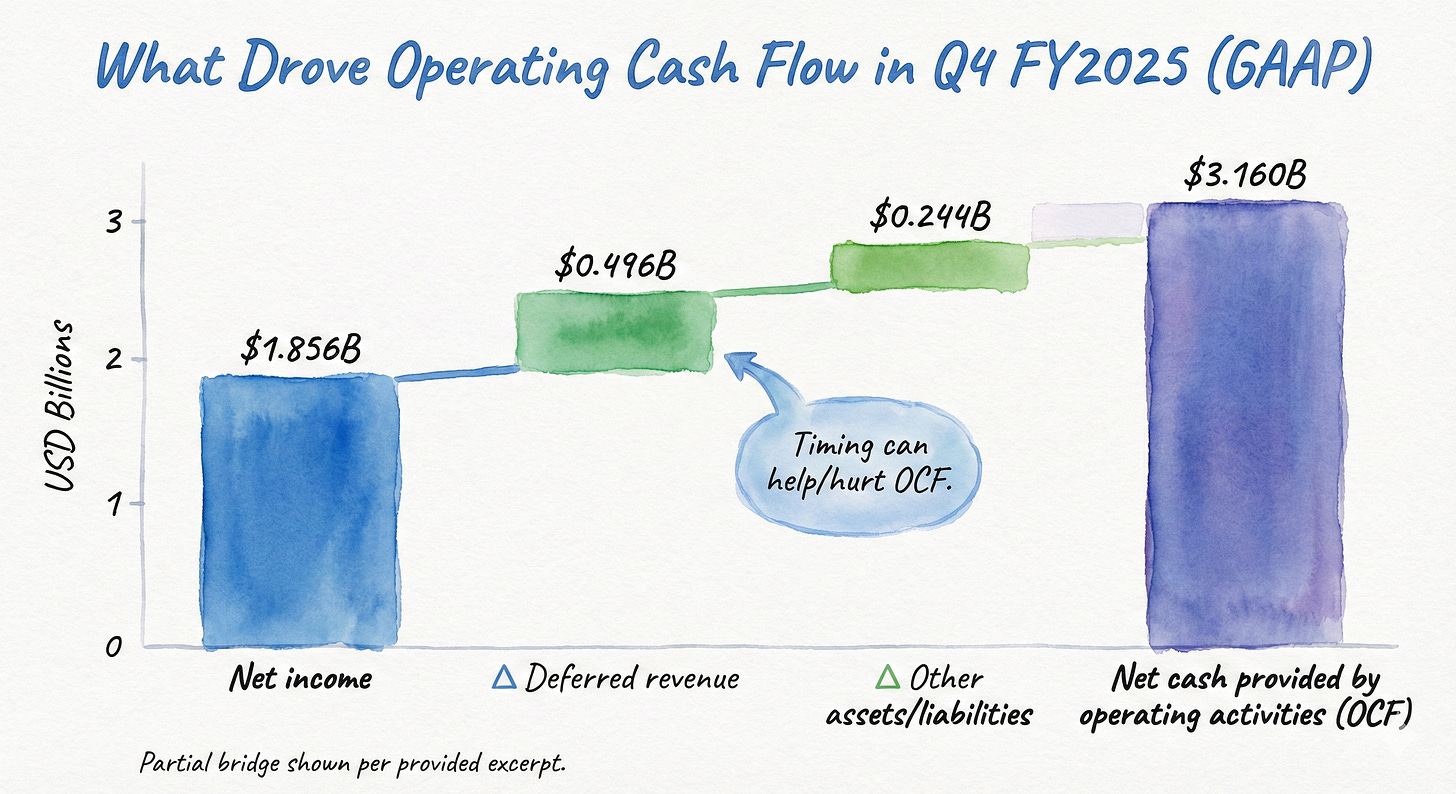

Cash Flow (The Turbine)

If the stock is hated, the turbine is the rebuttal: show me the cash.

Operating cash flow was $10.03B.

GAAP net income was $7.130B

That spread is meaningful. It means the business is generating more cash than accounting profits.

We have a clean look at Q4:

Q4 net cash provided by operating activities was $3.160B.

What drove it? Changes in deferred revenue of $0.496B and changes in other operating assets and liabilities of $0.244B.

Capex Hygiene: They run light. Purchases of property and equipment were $(34)M.

Capital Return: They are returning cash aggressively. Repurchases of common stock were $(2.474)B.

The Audit: We can keep watching whether operating cash stays strong as AI features scale, because if AI were a massive cost sink, cash is where it would leak first.

Atomic Take: The turbine is still ripping. Just don’t confuse “cash today” with “cash forever” without watching timing and reinvestment.

Falsifier: If Operating cash flow drops materially below $10.03B while repurchases remain large, they are stressing the coverage.

Income Statement (The Reactor)

If AI were already commoditizing Adobe, you’d expect to see it as margin decay. FY2025 doesn’t read like that.

Top Line: Total revenue was $23.769B

Gross Profit: Gross profit was $21.218B

The Bottom Line: Operating income was $8.706B

The Future: R&D expense was $4.294B

The reactor story is simple: high gross profit, substantial reinvestment, and still strong operating income. That’s the profile of a company funding its own transition.

Crucial Note on Trends: Don’t miss the FY2024 one-off buried in plain sight. Acquisition termination fee was $1.000B (FY2024, USD, GAAP operating expense line).

That was the Figma breakup fee. It distorts the Year-over-Year comparison, so keep that in mind when looking at growth rates.

Atomic Take: The income statement says “premium software economics still intact,” not “AI is eating our lunch.”

Falsifier: If Revenue grows while GAAP operating income declines year-over-year for a full fiscal year (FY basis, USD, GAAP), margin leakage is becoming visible.

Valuation

We are going to pin the stock to the wall.

The Price Tag:

ADBE last trade price: $296.12 (Jan 17, 2026, USD).

Market Cap: $123.96B (as of Jan 16, 2026, USD).

Enterprise Value: $124.01B (as of Jan 16, 2026, USD).

The Engine (What you get for that price):

GAAP Diluted EPS: $16.70.

GAAP Operating Cash Flows: $10.03B.

The Guide: FY2026 GAAP EPS guidance of $17.90 to $18.10.

The Growth Target: 10.2% YoY Total Adobe ending ARR growth (FY2026 target).

Now, let’s run the numbers. This is what “Hated Quality” actually looks like:

Trailing P/E (GAAP): ~17.7x (Price $296.12 ÷ GAAP EPS $16.70)

Forward P/E (GAAP): ~16.5x (Price $296.12 ÷ Forward Midpoint $18.00)

Operating Cash Flow Yield: ~8.1% ($10.03B OCF ÷ $123.96B Market Cap)

EV / OCF: ~12.4x ($124.01B EV ÷ $10.03B OCF)

Do you see what I see?

That is not a “tech bubble” valuation. That is a utility company valuation. The market is offering you a high-margin, subscription-heavy cash engine for a mid-teens multiple and a high-single-digit (8.1%) cash flow yield.

Stop and Think: An 8.1% yield means if the company stopped growing tomorrow and just paid out all its cash to you, you’d get an 8% return. In a world of 4% treasury bonds, that is a massive “skepticism premium.”

The skepticism isn’t subtle. The narrative is screaming that AI-native tools are going to destroy seat-based pricing. But the numbers are whispering that the business is on sale.

Atomic Take: At ~17.7x trailing GAAP earnings and an ~8.1% operating cash flow yield, Adobe is being valued like a durable cash machine with a PR problem; not like a broken business.

Falsifier: If FY2026 ending ARR growth misses 10.2% YoY, then the “durability” argument dies. At these multiples, durability is the only case.

Risks (The Meltdown List)

The valuation is forgiving, but it could be forgiving for a reason. Here is why the penalty box exists.

Risk #1: The Seat-Based Pricing Trap

FACT: The market thinks AI pushes software toward usage-based pricing (pay for what you generate) and kills the “seat” model (pay per employee).

MONITOR: Watch Total Adobe ending ARR growth and customer group subscription revenue trends. If seat growth stalls, the model is shifting under our feet.

Risk #2: The “Hidden Tax” of Compute

FACT: Adobe generated $10.03B operating cash flows while investing in AI.

HYPOTHESIS: “AI everywhere” increases the cost-to-serve. If I pay $20/month but generate $30 worth of AI images, Adobe loses money on me.

MONITOR: OCF stability vs FY2025’s $10.03B baseline. If margins dip while revenue grows, we have a leak.

Risk #3: The Moving Goalposts

FACT: Adobe explicitly states it will “periodically update” what’s included in Total AI-Influenced ARR.

MONITOR: Any redefinition that breaks comparability. If they change the definition, assume they missed the number.

Risk #4: The Low-End Squeeze

FACT: The narrative is full of fears about AI-native platforms.

HYPOTHESIS: Even if Adobe keeps the Hollywood pros, the “good enough” AI tools steal the casuals. This caps ARPU (Average Revenue Per User).

MONITOR: Compare Business Professionals & Consumers subscription revenue (FY2025: $6.50B) growth vs Creative & Marketing Professionals (FY2025: $16.30B). If the consumer side flatlines, the funnel is broken.

Risk #5: The Value Trap (”Cheap stays Cheap”)

FACT: The stock is at $296, ~$124B market cap. The market is already underwriting “slower, riskier duration.”

MONITOR: RPO ($22.52B exiting FY2025). This is your forward-looking radar. If the backlog shrinks, the “value” is a trap.

Atomic Take: The risk isn’t bankruptcy. The risk is that AI changes the value capture model faster than Adobe can figure out how to charge for it. The multiple won’t re-rate until ARR proves the capture is intact.

Falsifier: If Total Adobe ending ARR growth stays at/above 10.2% YoY while OCF remains at/above $10.03B, the “AI kills economics” fear is proven wrong.

The Atomic Verdict

Status: ★★★★☆ (3.9/5)

This isn’t a debate about quality anymore. The statements ended that debate.

GAAP EPS: $16.70.

Operating Cash Flows: $10.03B.

Total Adobe Ending ARR: $25.20B.

The new element is the price. The market has stopped paying “love multiples.”

Stock Price: $296.12 (Jan 17, 2026, USD).

Trailing P/E: ~17.7x.

OCF Yield: ~8.1%.

So, the verdict tightens into a single underwriting question:

Can Adobe keep compounding ARR in a world where the market thinks AI makes creation free?

The Scorecard

Upgrade Triggers (The Green Lights):

FY2026 Total Adobe ending ARR growth meets/exceeds 10.2% YoY.

RPO ($22.52B exiting FY2025) continues to grow without sharp deceleration.

Operating cash flow stays near or above $10.03B. If cash stays high while AI scales, it means they are monetizing, not subsidizing.

Downgrade Triggers (The Red Lights):

FY2026 ending ARR growth falls below 10.2% YoY.

GAAP EPS meets guidance but RPO softens. That smells like financial engineering.

OCF meaningfully declines from $10.03B. If the cash drops while the AI hype rises, the economics are leaking.

Atomic Confidence Builder:

I want to see two to three quarters where Adobe hits the FY2026 “scoreboard” (ARR + RPO) and the bear narrative starts losing oxygen—not because the pundits get nicer, but because the KPIs refuse to cooperate with them.

Atomic Take: The stock is being treated like a credibility case, not a quality case. At today’s multiples, recovering that credibility is the lever that rips the stock higher.

Falsifier: Total Adobe ending ARR growth misses 10.2% YoY (FY2026 actual vs target, %, company metric).

Comment Below: We’re looking at an 8.1% cash flow yield on a software monopoly. Are you buying the “AI Death” narrative, or are you buying the cash? Let me know.

Reference notes

Adobe Reports Record Q4 and FY2025 Revenue (press release / earnings release; includes FY2025 GAAP EPS $16.70, FY2025 operating cash flow $10.03B, Total Adobe ending ARR $25.20B, FY2026 targets incl. Total revenue $25.90B–$26.10B and Total Adobe ending ARR growth 10.2% YoY) (Dec. 10, 2025).

Adobe Q4 FY2025 Earnings Script & Slides / Prepared Remarks deck (includes “Total new AI-influenced ARR now exceeds one-third of our overall business,” RPO $22.52B, and FY2025 highlights) (Dec. 10, 2025).

Adobe AI strategy / Investor presentation (Adobe AI Platform stack; partner model ecosystem; AI Assistants / Firefly / GenStudio / AEP + Apps / AEM + Agentic Web framing) (2025).

Adobe Q4 FY2025 earnings call transcript (CEO/CFO prepared remarks; AI model strategy; Creative Cloud / Acrobat / Express positioning) (Dec. 10, 2025).

Market data (web)

Adobe (ADBE) last trade price used for valuation math: $296.12, Jan. 18, 2026.

Yahoo Finance “Key Statistics” page for Adobe valuation measures (Market Cap, Enterprise Value, P/E, etc.) (Jan. 18, 2026).

CompaniesMarketCap page for Adobe market capitalization (January 2026 snapshot) (Jan. 18, 2026).

AI “hate” narrative / investor commentary (web, recent)

MarketWatch coverage of software stocks sliding amid AI fears (includes Adobe move and framing of investor concerns) (published Jan. 2026; Jan. 18, 2026).

Investopedia coverage summarizing analyst concerns about AI disruption and seat-based vs usage-based pricing dynamics (published Jan. 2026; Jan. 18, 2026).

Primary-source duplicates (web versions of the same company documents)

Adobe-hosted Q4 FY2025 earnings call transcript PDF (Adobe Investor Relations) (Dec. 10, 2025; Jan. 18, 2026).

Adobe-hosted Q4 FY2025 “Earnings Script & Slides” PDF (Adobe Investor Relations) (Dec. 10, 2025; Jan. 18, 2026).

Disclaimer

This Deep Dive is an educational breakdown of a public company based on information available in the materials provided (e.g., annual/quarterly reports, investor presentations, earnings transcripts) and my interpretation of that information. It is designed to be a “bolt-on” intelligence layer to your own due diligence — not a replacement for it.

Independence: I do not accept compensation of any kind from the companies discussed. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author may hold a long position in securities mentioned. Any position creates bias — treat this as commentary, not gospel.

Not Financial Advice: Nothing here is investment advice, a recommendation, or a solicitation. I am not a financial advisor. You are responsible for your own decisions. The stars rating is not a buy recommendation, but meant as a guide to understand the quality of the financial statement of the respective companies.

Error & Update Risk: Financial statements change, companies restate, guidance evolves, and I can be wrong. Verify key figures in the primary filings and consider reading the footnotes before deploying capital.

Great article!

Great article. Looking at the stock also. My thinking on your risks:

Risk #1: The Seat-Based Pricing Trap - With increased usage you get increased cost, so this is a problem only for weekend users which are probably not average customers. Fixed subscripion has a breakeven sooner or later (and here I think very soon)

Risk #2: The “Hidden Tax” of Compute: isn't this the same for everyone running ai?

Risk #3: The Moving Goalposts: that is why ADBE should behave as market leader and not look to make comparisons where not needed.

Risk #4: The Low-End Squeeze: I do not get this fully. So saas with implemented ai is technically behind native ai in a way that UI is obvisously less competative? Or is this cost related?

Risk #5: The Value Trap (”Cheap stays Cheap”) - For me this is a big risk. We should run a simple DCF with minimal growth and see where the value is.

What I do not like with adobe that they are behaving as a market participant instead of leader. Be ing afraid and trying to buy everything that seems to be a competition instead to focus more on evolving itself. Also with their business model they should not be a only a growth stock anymore, shareholders should see some dividends. If they can not pay them means their ROI is too terrible ot their moat is just not what we all think it is.

My biggest bull cases:

- where saas is cheap because of volume, how can pricing be an issue if different products are basically similar

- business is sticky and brand is strong, companies and serious user need a big incentive to switch - if not service (which I think it can not be, there is only price (and we are at point 1)

My general take-ADOBE valuations should be lower no matter the Saas crash. If their moat needs so much investments to be protected all the time, company will loose its primacy, it is only a question of time. That does not mean capitulation, it means having less, but still happy users. Cashflow should remain strong and some money should flow back to shareholders. So this AI is a serious test for ADBE.

Sorry for so much ramble, was not the plan:)

What is your take on Autodesk then?