Deep Dive: AVTECH Sweden AB

Inside the small, capital-light growth machine hiding in the Swedish aviation sector.

⚠️ MICROCAP ALERT: This is a MSEK 408 flyweight. Expect thin liquidity and wild swings. A single big trade can move the needle here, so don't bet the farm—size your position for the turbulence. This is not a buy recommendation; do your own research (DYOR).

Everyone seems to be looking for the latest flashy AI startup or the electric flying car or space company nowadays. But if you’ve followed my writing for a while, you know I have a soft spot for something a bit different.

I like the “picks and shovels”. The companies that don’t necessarily build the plane, but make the plane 10% more profitable just by existing.

That brings us to AVTECH.

I own this because it represents a specific kind of growth machine that is becoming increasingly rare in the microcap universe. Here’s why I’m holding this one for the long haul:

1. The “Invisible” Toll Booth

AVTECH has spent years embedding itself into the cockpit workflow. Once an airline like Wizz Air realizes they can save a fortune on fuel and hit their arrival times more consistently using this software, they don’t just “unplug” it.

It’s high-margin, mission-critical, and increasingly recurring. I love businesses where the customer would have a headache if they tried to leave.

2. A Fortress Built on Common Sense

A lot of small caps are “burning the furniture to keep the house warm”—they have massive debt and negative cash flow. AVTECH is the opposite.

They have a 91.8% equity ratio and zero long-term debt. This is a company that can survive a storm, which gives them the luxury of reinvesting when their competitors are just trying to keep the lights on.

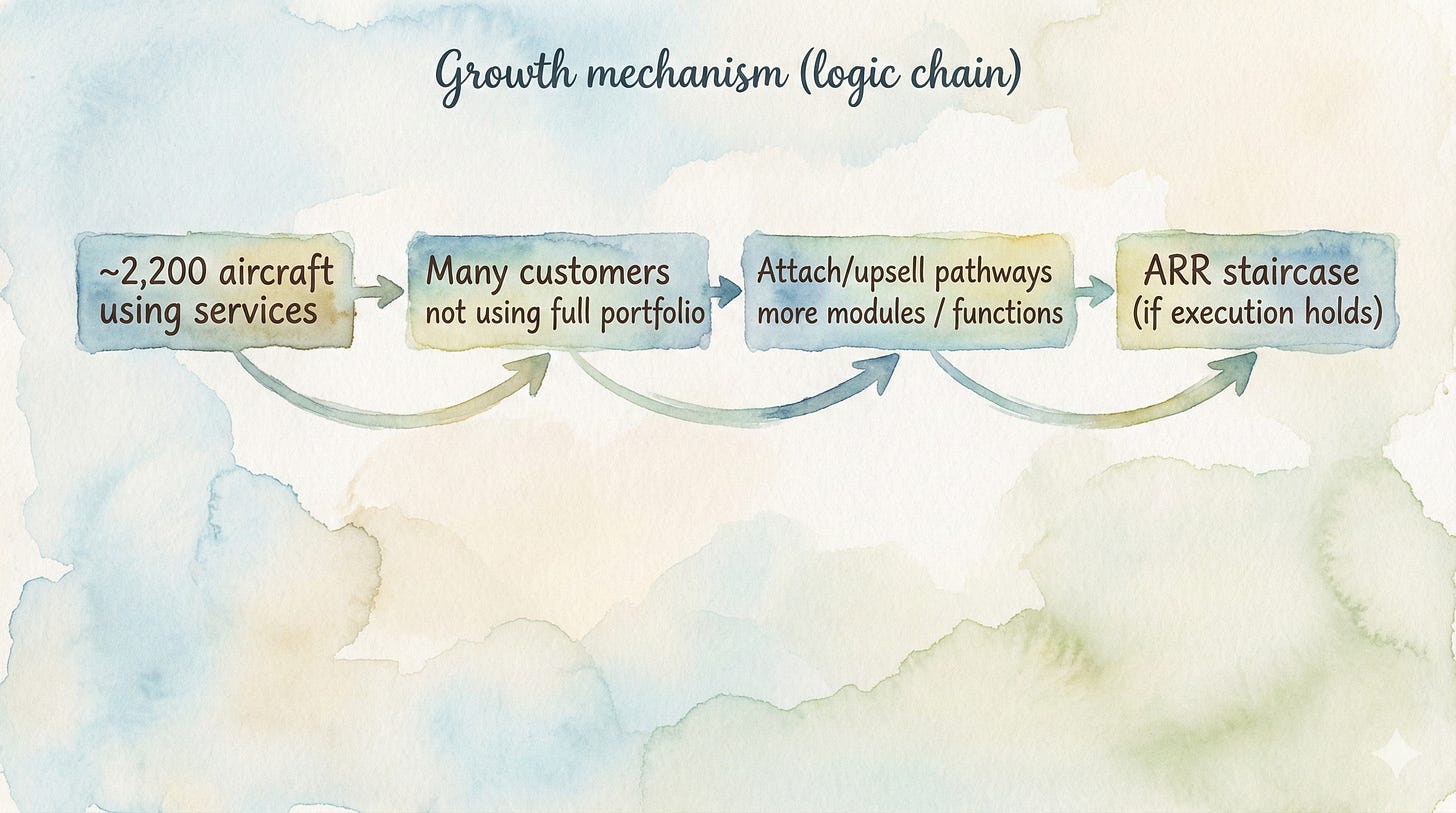

3. The “Land and Expand” Runway

They are already on 2,200 aircraft, but here’s the kicker: most of those planes aren’t using the full suite of tools yet.

We aren’t just betting on them finding new customers (though they are); we’re betting on them selling more to the friends they already have. That’s the cheapest kind of growth there is.

4. Discipline That’s Actually Discernible

It’s easy for a CEO to talk about growth. It’s much harder to grow sales by 38% year-over-year while remaining profitable and paying out a dividend. That tells me management isn’t just chasing “growth at any cost”; they’re chasing profitable compounding.

The Bottom Line: AVTECH is still a “tiny” company in a massive global industry. They have the balance sheet of a conservative grandfather and the growth engine of a hungry startup. That’s a combination I’m willing to wait on.

Let’s dig in.

If You’re In a Rush

The Gig: AVTECH builds digital tools that help airplanes talk to air traffic control. They optimize for the stuff that keeps airline CEOs awake at night: fuel costs, emissions, punctuality, and safety.

The “Ugh” Factor: It’s a microcap. That means low volume and price swings. Plus, selling to airlines takes forever, and currency swings (FX noise) can make a good quarter look messy on paper.

The Fix: As long as that Annual Recurring Revenue (ARR) keeps climbing like a plane on takeoff, and they don’t spend like drunken sailors to get it, the story stays intact.

Atomic Position: I hold shares in AVTECH at the time of writing. Please have this in mind when reading, as I can be biased.

Stop & Think: In aviation, “better” usually means “cheaper to fly.” If you can save an airline 1% on fuel, you’re their best friend for life. Is AVTECH that friend?

The Setup: Numbers That Make You Grin

AVTECH’s year-end report is the kind of document that makes a spreadsheet geek smile and everyone else look for a calculator. It’s a microcap in a complicated industry, but the numbers are starting to look very good.

Let’s look at the hard evidence from the Q4 2025 print:

Record Growth: Q4 2025 net sales hit MSEK 12.9. Management says that’s the highest quarterly revenue in their history. And get this: they did it even with a weak dollar working against them.

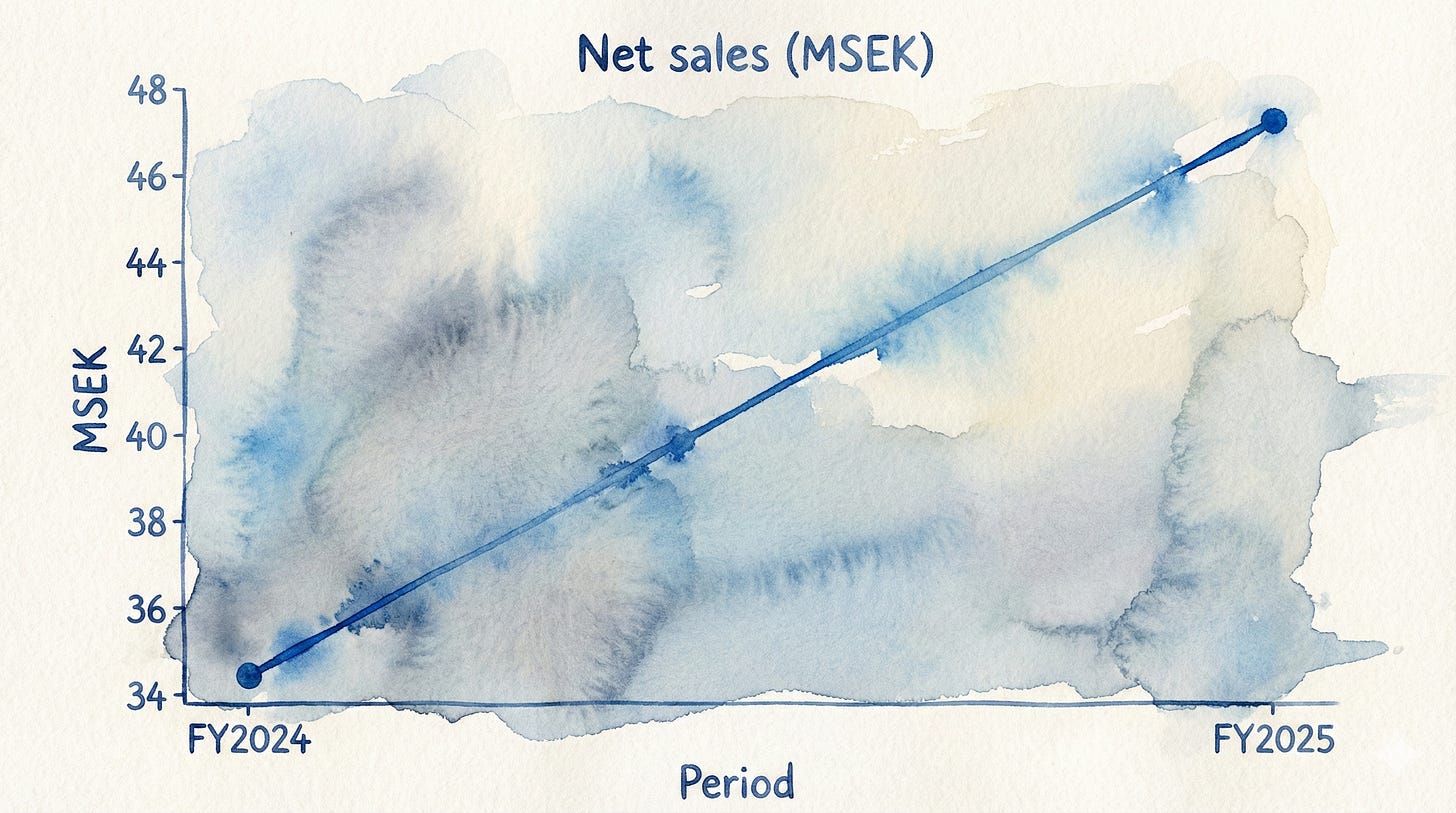

The Annual Scorecard: For the full year 2025, sales climbed to MSEK 47.4 (up from MSEK 34.3 in 2024). Net earnings followed suit, jumping to MSEK 17.0 from MSEK 12.6.

Now, here is the “Microcap Paradox.” Wall Street usually thinks a company this size is either too small to matter or too small to trust. Both can be true on a Monday and totally wrong by Thursday. That’s why we ignore the “vibes” and stick to the facts.

The Fact Base:

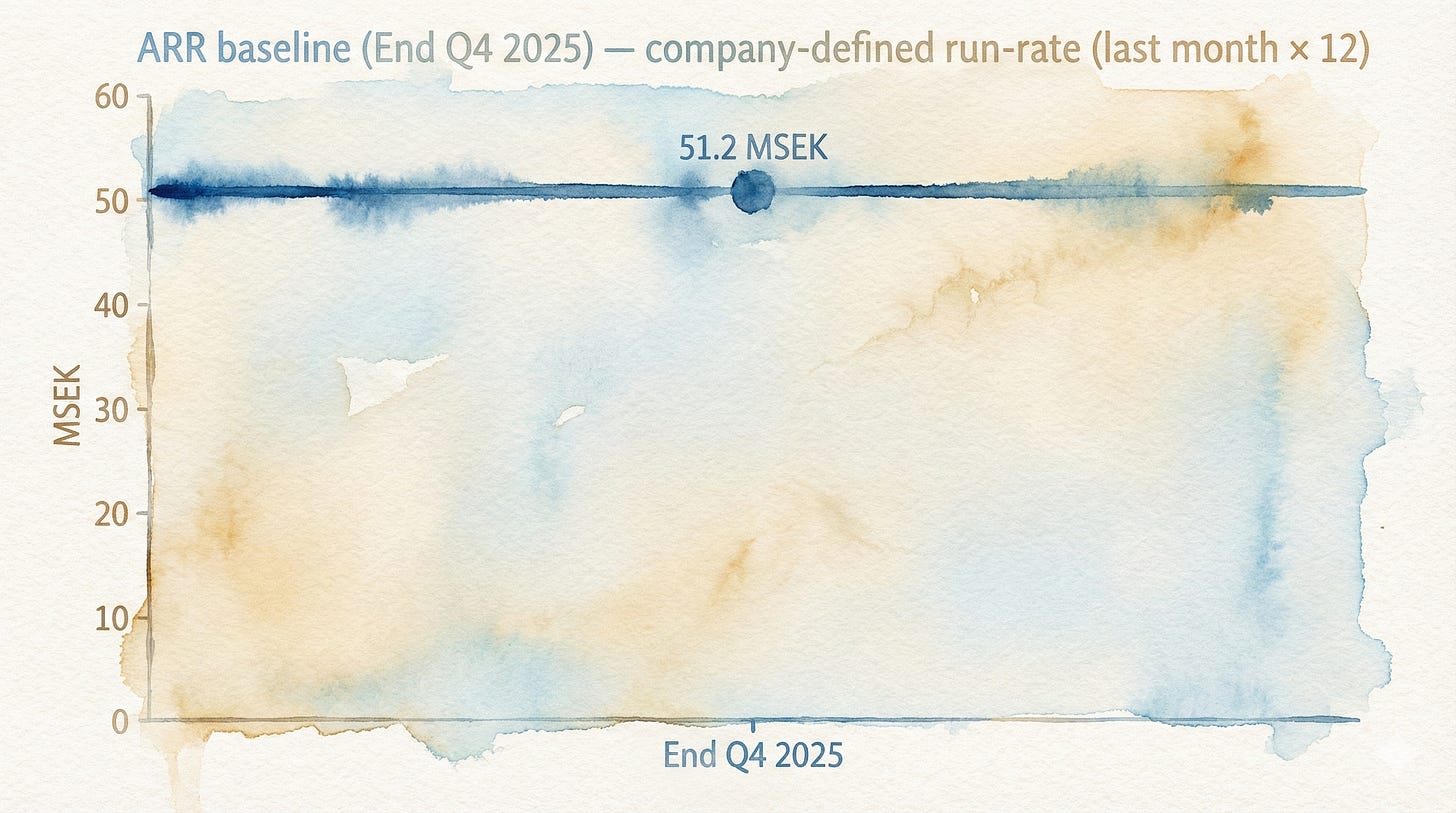

ARR: MSEK 51.2 (as of end of Q4 2025).

Rule of 40: 67.6% (Growth + Margin). In the software world, anything over 40% is an “A.” 67.6%? That’s “Valedictorian” territory.

This isn’t a “turnaround” story. It’s a “scaling” story. They aren’t fixing a broken plane; they’re trying to see how high this one can fly without the engines overheating.

The Atomic Take: The debate isn’t whether planes will keep flying. The debate is whether AVTECH’s adoption flywheel stays intact while they start spending more on staff and development in 2026.

The “Show Me” Metric (Falsifier): If that MSEK 51.2 ARR drops for two quarters in a row, the thesis is grounded. Period.

How The Business Actually Make Money

AVTECH says they do “digital air traffic management.” That sounds like jargon designed to put you to sleep.

Let’s translate: they sell software that helps pilots and ground crews make smarter decisions in real-time.

Here is what we know for sure:

It’s a Subscription Model (The Holy Grail): They track ARR by taking the last month of the quarter and multiplying by 12. It’s a proxy, sure, but it shows they are moving away from one-off projects and toward “renting” their genius.

They Are Already On the Planes: Management says about 2,200 aircraft use their services. The beauty here isn’t just finding new airlines; it’s selling more “add-ons” to the planes they already have.

The “Wizz Air” Proof Point: You want to see how they scale? Look at Wizz Air. They went from testing products on 20 planes to rolling them out to the whole group of 200 planes this past year. That is how you win in this business; start small, prove it works, and then take over the whole fleet.

The Strategy: Management is getting ready to launch new “on-time” and “dispatch” tools this spring. If those land, the “upsell” story gets a massive boost.

The Atomic Take: This is a “land and expand” play. They’ve already landed. Now we watch the expansion.

The “Show Me” Metric (Falsifier): If FY2026 sales don’t beat MSEK 47.4 despite management talking about a “growing pipeline,” we’ll know the talk is cheap.

What Went Wrong (The “No-Panic” Audit)

If you came here expecting a dramatic story of a company cratering into the earth, I’m going to have to disappoint you. This is the more irritating kind of story; a strong year where one quarter reminds you that microcaps don’t do “clean” narratives.

They’re messy, like a teenager’s bedroom.

Q4 2025 delivered record revenue, yet the bottom line didn’t do a victory lap. Why?

The Currency Bug: Management flags an unfavorable USD/SEK impact. When the exchange rates wiggle, your paper gains can shrink.

The Earnings Dip: Net earnings were MSEK 4.0 in Q4 2025, compared to MSEK 4.2 a year ago.

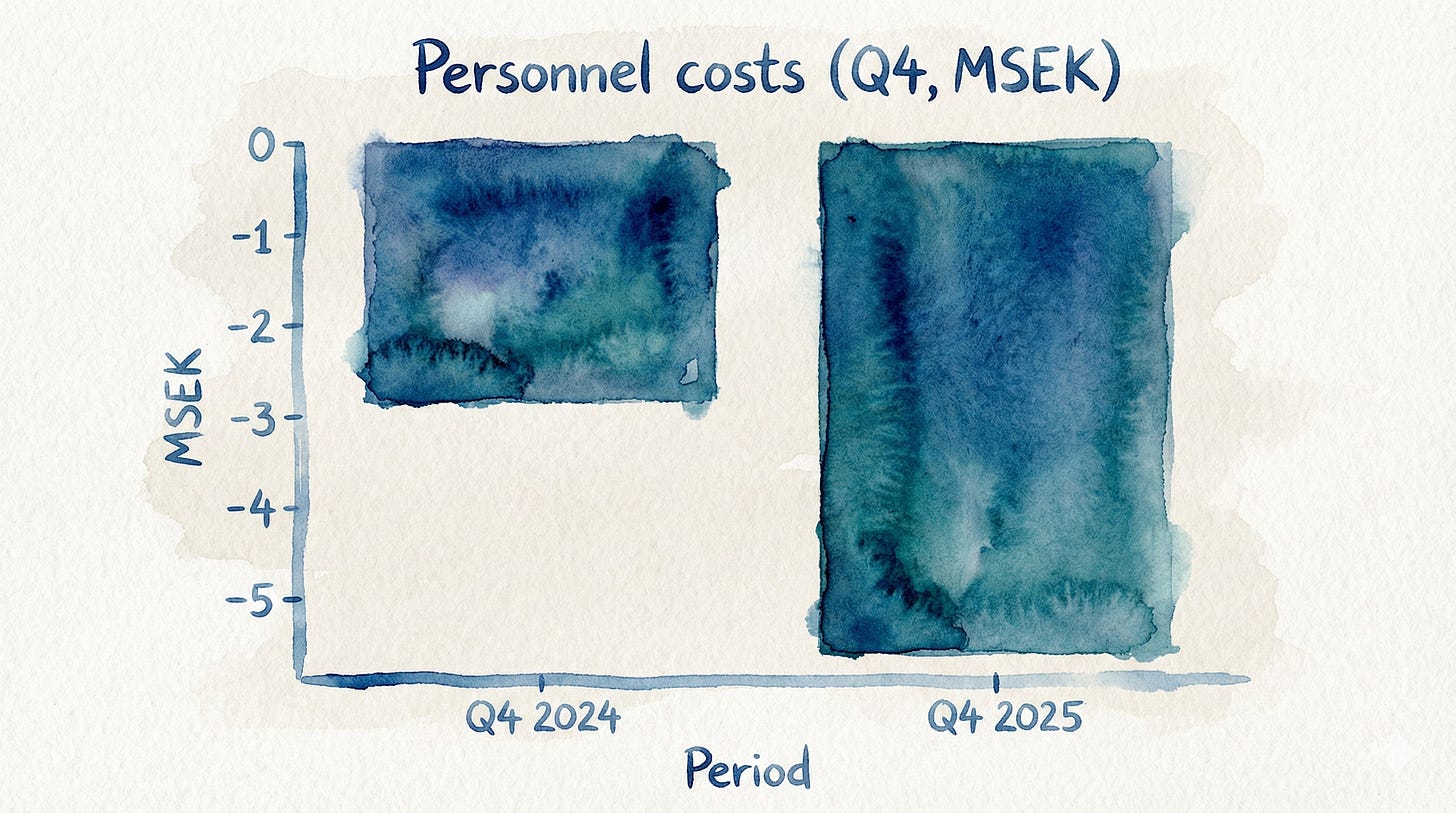

The Investment Bill: They spent more on people (personnel costs) and ate a ~MSEK 1.1 one-off expense for an R&D tax repayment. They’re appealing it in 2026, but for now, the cash is out the door.

Lumpy Cash: Q4 cash flow was positive but felt a bit thin because some customers were late with their checks.

This is a fork in the road. Management says they invested intentionally in sales and product development. In my book, spending money to make more money later isn’t a “miss”; it’s a strategy. But you have to make sure that “investment” doesn’t just become a permanent “expense.”

Stop & Think: If a store owner hires two new clerks, his profits might drop that month. But if those clerks help him sell 50% more inventory next month, he’s a genius. We’re waiting to see if AVTECH’s new hires are sellers or just sitters.

The Atomic Take: Nothing broke. But Q4 is a reminder that when a company is accelerating and reinvesting at the same time, the road is going to have some potholes.

The Rebound Catalysts: A Checklist for 2026

Management hasn’t just given us excuses; they’ve given us a checklist. Now we get to sit back and watch them try to tick the boxes.

New Blood in Sales: Philip Nordfeldt took over as Chief Commercial Officer (CCO) on January 19, 2026. His one job? Turn that tech into more ARR.

The Need for Speed: They’ve promised faster deployment. In aviation, “fast” is relative, but if they can get software onto planes quicker, the cash flows faster.

The “Full Meal” Strategy: Remember, many of those 2,200 aircraft are only using some of AVTECH’s tools. Selling a current customer a second or third product is way cheaper than finding a brand-new airline.

Spring Training: New functions for “on-time” and “dispatch” are hitting the market this spring. This is a near-term “put up or shut up” moment for the product team.

The Wizz Air Blueprint: Expanding from 20 to 200 planes with Wizz Air proved they can handle a fleet-wide rollout. Now, can they do it again with someone else?

The Atomic Take: These catalysts aren’t about the economy or the price of jet fuel. They are about execution. Either they do it, or they don’t. It’s that simple.

The Financial Quality Rubric

I like to grade companies on a scale of 1 to 5. Here’s how AVTECH stacks up:

Growth Quality: 4/5 — Annual sales jumped from MSEK 34.3 to MSEK 47.4. That’s not a fluke; it’s momentum.

Profitability Durability: 4/5 — They’re sporting a 34.7% operating margin for the year. That’s a massive cushion.

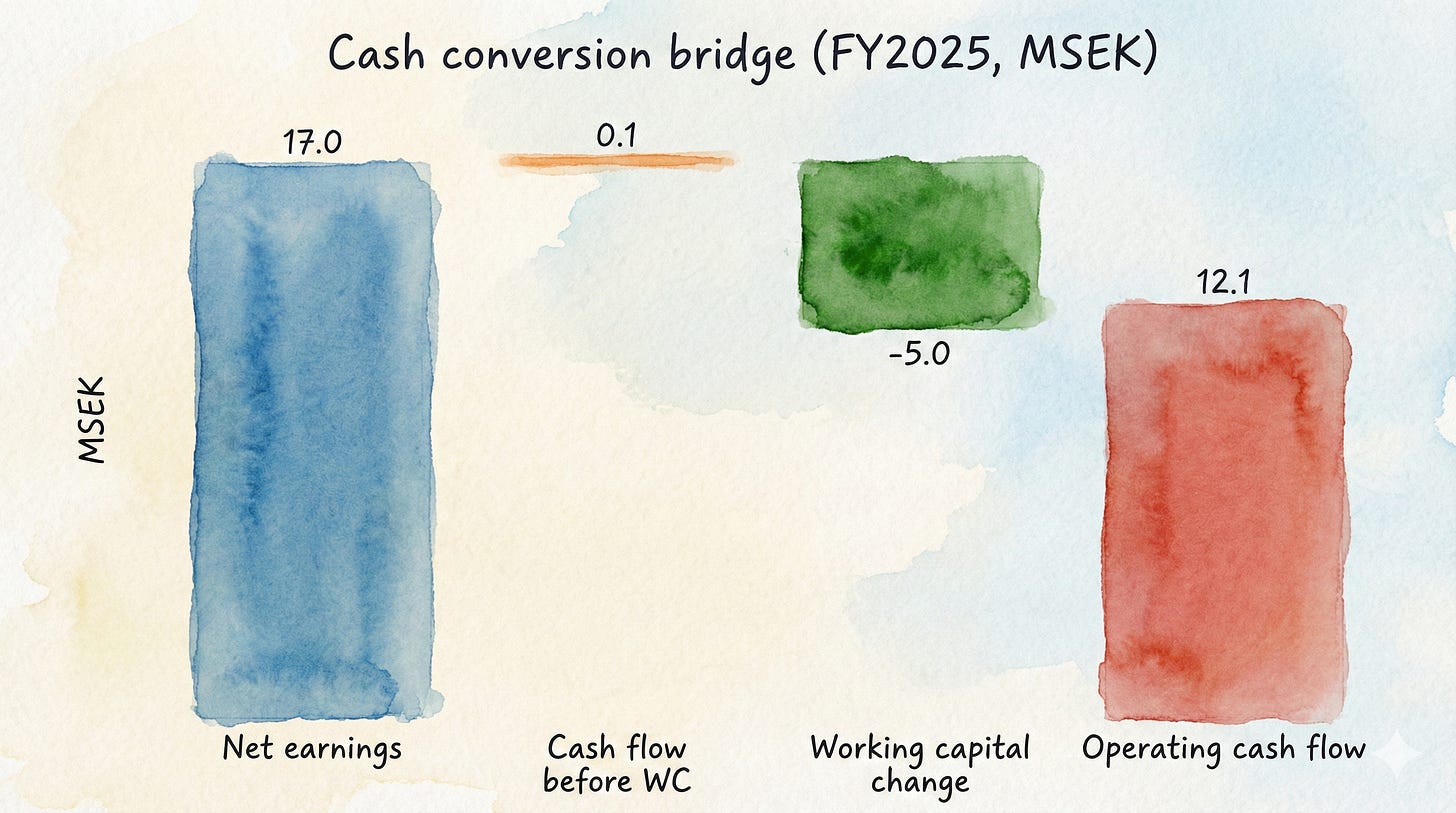

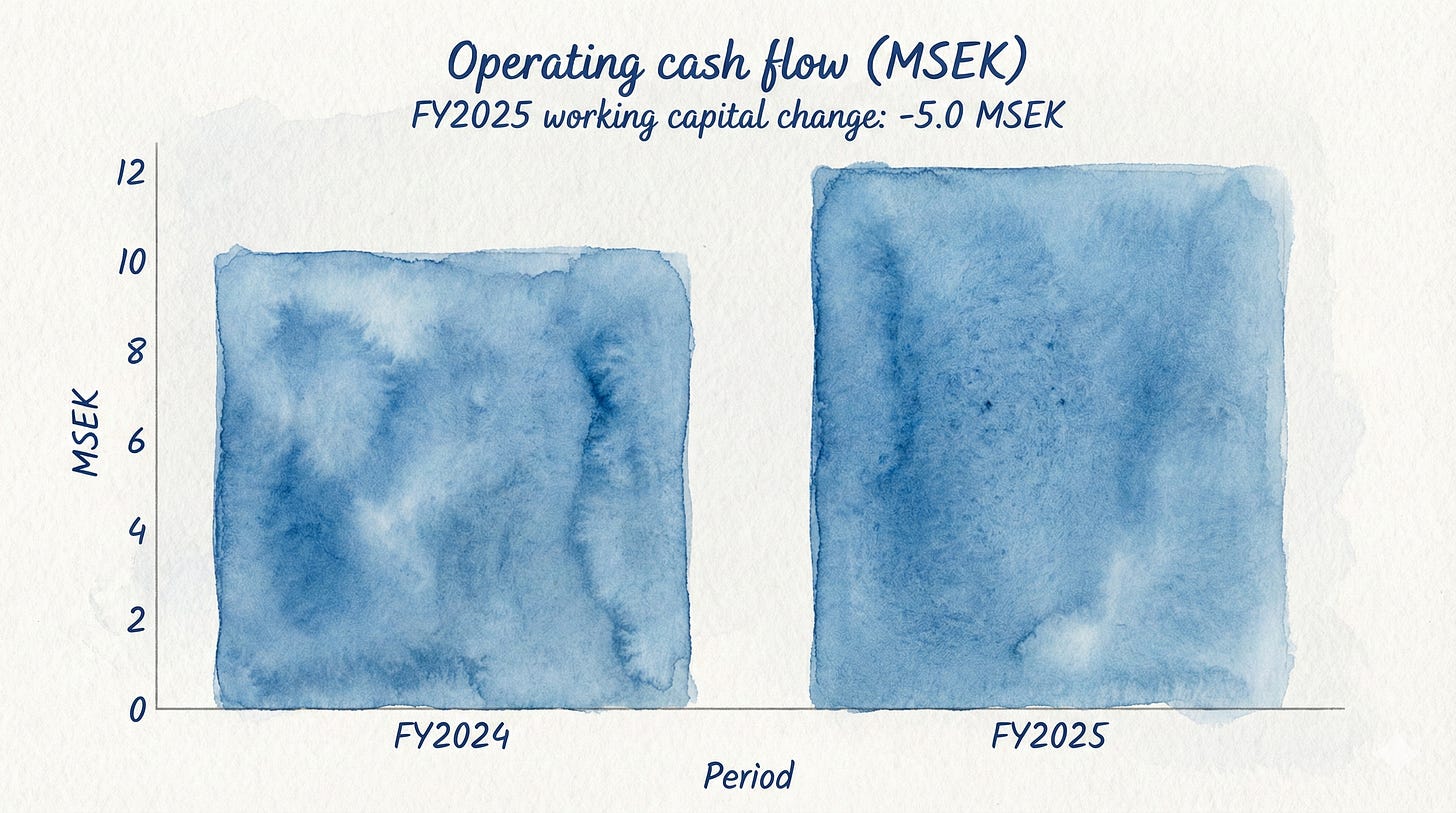

Cash Conversion: 3/5 — Net earnings were MSEK 17.0, but operating cash flow was MSEK 12.1. It’s positive, but there’s a gap we need to watch.

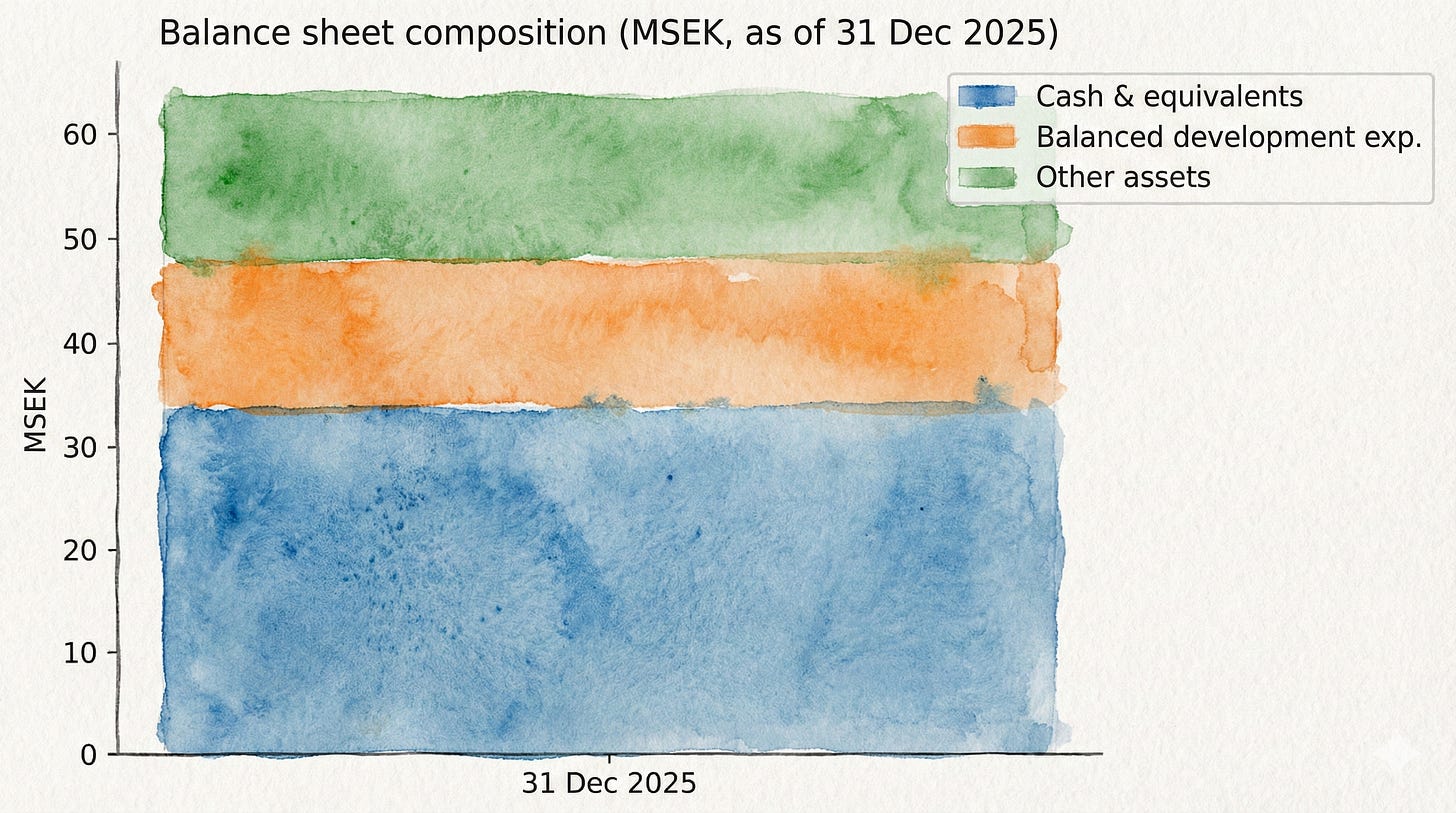

Balance Sheet: 5/5 — They have zero long-term debt and MSEK 33.9 in cash. This is a fortress. They aren’t going broke anytime soon.

Reinvestment Discipline: 3/5 — They capitalize their R&D (turning expenses into “assets” on the balance sheet). It’s legal, but it can make profits look prettier than they are. We’ll keep an eye on it.

Capital Efficiency: Getting More “Bang” for Your Buck

To me, AVTECH’s best hidden feature is that it doesn’t need a lot of “stuff” to make money. This isn’t just a feeling; it’s baked into the math. When you look at how little capital and how few people are required to keep this reactor humming, the efficiency is actually quite startling.

The “Per Head” Math:

Sales Productivity: With MSEK 47.4 in sales and only 17 employees, they’re pulling in roughly ~MSEK 2.8 per person.

Profit Productivity: Net earnings hit MSEK 17.0, which means each employee is essentially generating ~MSEK 1.0 in pure profit.

The Cash Reality: Operating cash flow was MSEK 12.1, or roughly ~MSEK 0.7 per employee.

The Asset-Light Engine: Now, look at what they actually “own.” As of December 31, 2025, they had MSEK 63.7 in total assets. But here’s the kicker: MSEK 33.9 of that is just cold, hard cash sitting in the bank.

This means the business isn’t trapped in heavy machinery or expensive real estate. In Peter Lynch terms, it’s an “asset-light” dream. Their sales-to-assets ratio is roughly 0.74x. It tells us one thing loud and clear: this is not a hungry machine that needs constant infusions of cash to stay alive.

Stop & Think: Most companies need to build a new factory to double their sales. AVTECH just needs to send a software update. Which one would you rather own?

The Audit: The only place this efficiency can look a little “polished” is in the MSEK 14.1 of balanced development expenses. Because they capitalize some of their work (turning salary costs into an asset on the balance sheet), it can make the efficiency look slightly better than a pure cash-expense model.

The Atomic Take: The model is incredibly lean. The only catch? That capitalized development “asset” has to keep paying rent. If it doesn’t lead to more ARR and more cash, then the efficiency is just an accounting trick. So far, the gauges say it’s real.

The “Show Me” Metric (Falsifier): If operating cash flow starts to drop significantly below MSEK 12.1 while capitalized development stays high, we’ll know the efficiency is turning into “accounting-backed optimism” rather than real-world results.

The Statements (The Geiger Counter Test)

The Balance Sheet: A Bunker

AVTECH is sitting on MSEK 63.7 in total assets and almost no liabilities. Their equity ratio is 91.8%. In plain English: they own almost everything outright.

The Risk: The only “isotope” to watch is the MSEK 14.1 in “balanced development expenses.” That’s money they’ve spent developing software that they expect to pay off later. If the software doesn’t sell, that “asset” vanishes.

The Cash Flow: The Turbine

Operating cash flow for the year was MSEK 12.1. What’s impressive? They’re paying a dividend of SEK 0.10 per share (~MSEK 5.6).

A microcap paying a dividend while growing sales at this rate is like finding a teenager who actually saves their allowance. It shows a level of discipline you don’t often see in the small-cap world.

The Income Statement: The Reactor

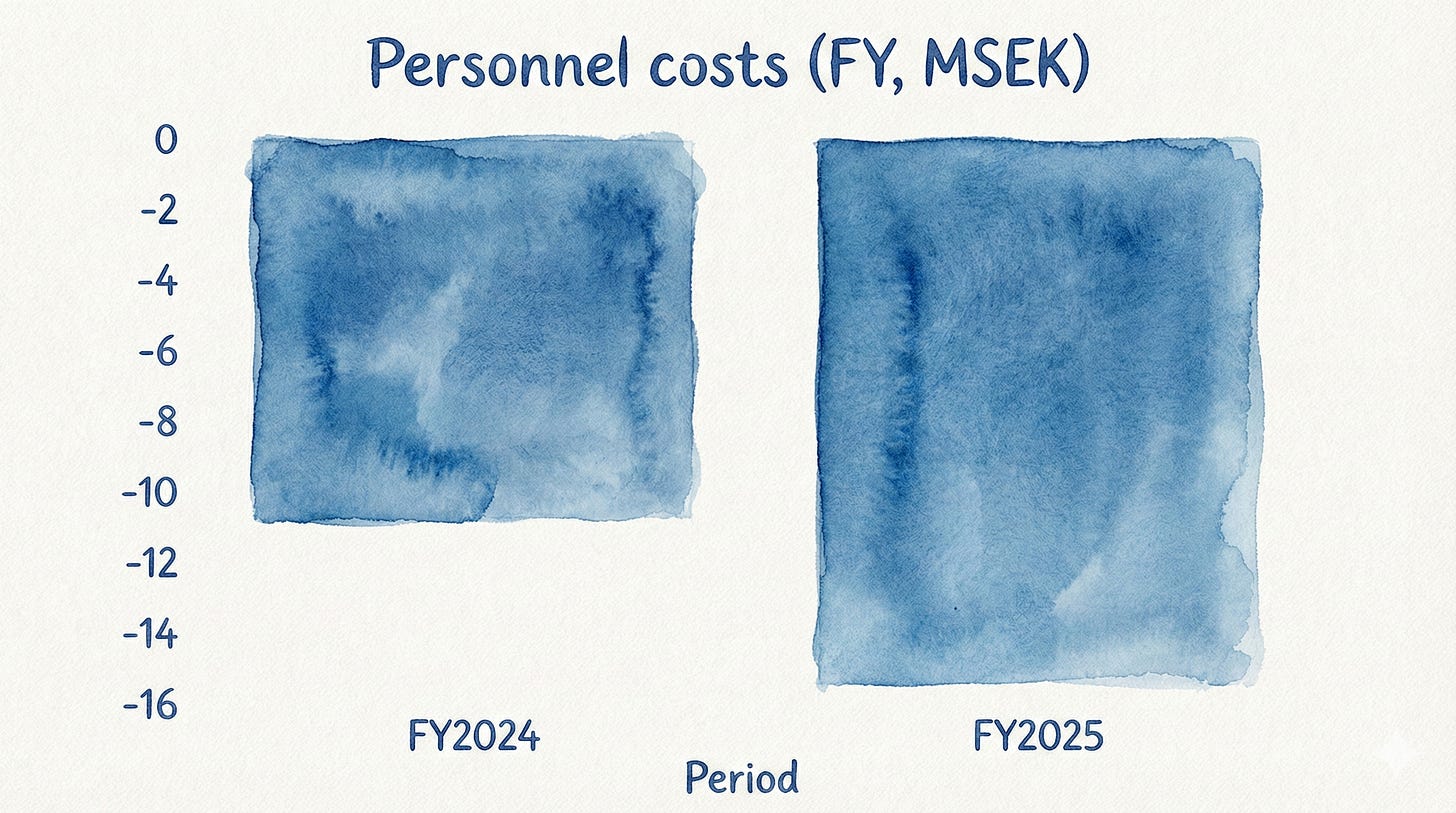

Sales are up, but personnel costs rose from MSEK 10.7 to MSEK 15.4 for the year.

The Audit: Management is betting on people. They are fueling the reactor. In 2026, we need to see that extra fuel turn into more “output” (sales), not just more “heat” (expenses).

The Atomic Take: The financials are rock solid, but the “truth serum” will be whether the cash flow keeps pace with the earnings report in the next six months.

The “Show Me” Metric (Falsifier): If operating cash flow (CFO) stays below MSEK 12.1 while they claim they are “thriving,” something is leaking in the pipes.

Valuation: When the Market Starts Charging Rent

This is the part of the story where the market stops patting you on the back for a “nice year” and starts asking for the rent.

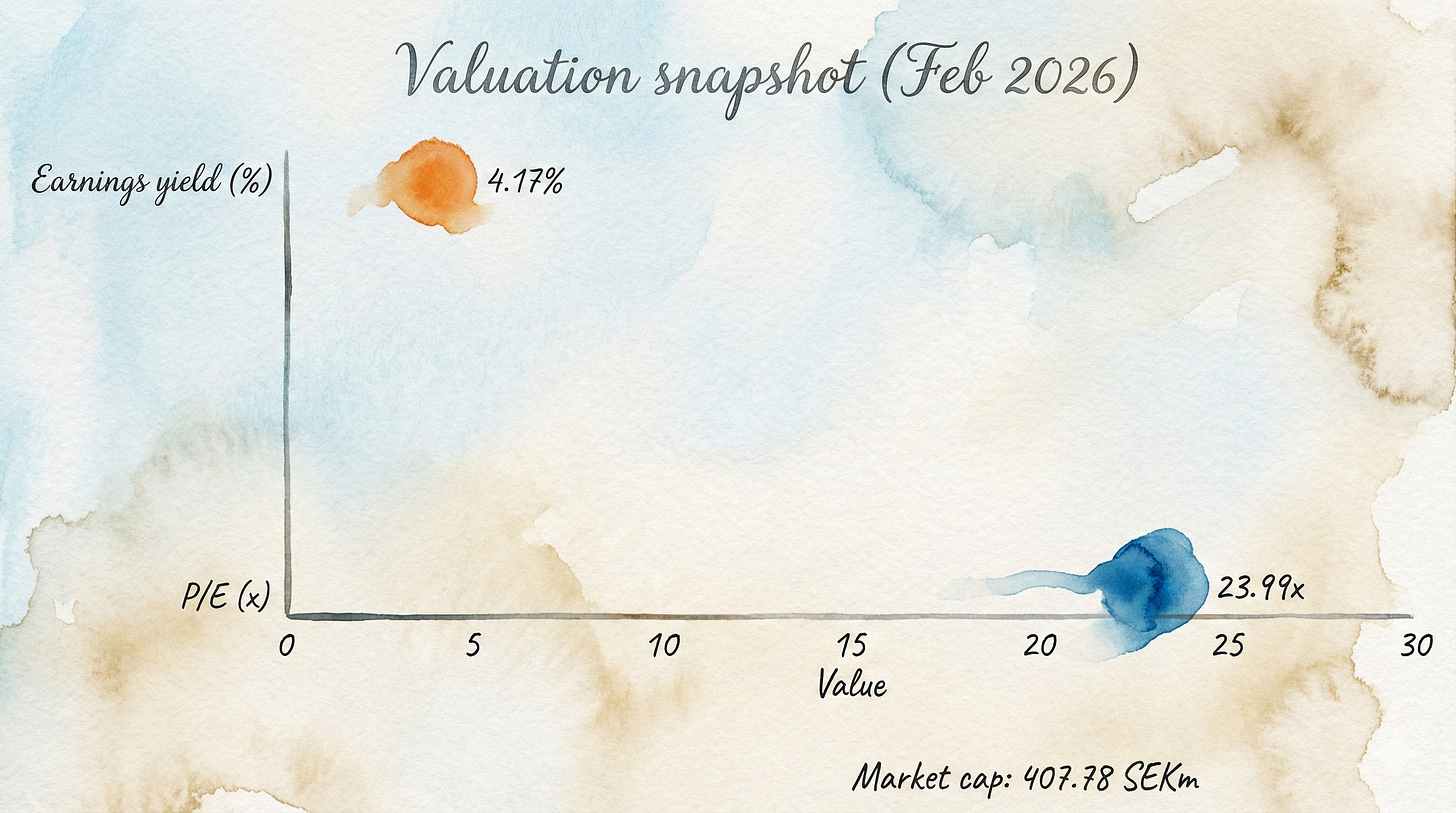

On February 6, 2026, the tape showed AVTECH at a share price of SEK 7.22, giving it a market cap of SEK 407.78m.

That gives:

P/E Ratio: 23.99x.

Earnings Yield: ~4.17%

At a ~24x P/E, the market isn’t treating this like a dying cigar butt. It’s pricing AVTECH like a real, recurring software business.

Based on my metrics, the price today is fair, but it’s not “dirt cheap.”

To justify this multiple, the cash reality eventually has to give the earnings reality a big, warm hug. If the earnings stay high but the cash stays “lumpy” for too long, the market will lose patience.

Stop & Think: A 24x multiple means investors expect this company to be significantly bigger in five years. They aren’t buying it for what it did yesterday; they’re buying it for that ARR staircase.

The Atomic Take: At a SEK 408m market cap, the durability test is simple: do the cash-based metrics improve, or are we just living on a pretty narrative?

The Meltdown List (Risks to Watch)

We DO need to have the risks in mind when we analyze, because every investment has a “self-destruct” button.

Here’s where AVTECH’s is hidden:

The “One-Trick Pony” Risk: A huge chunk of revenue still comes from one core product. They’re diversifying, but for now, they are heavily dependent on that single engine.

The Waiting Room: Airlines take a long time to buy things. Management admits decision processes are getting longer. A “slow” sales cycle can kill a microcap’s momentum.

Currency Gremlins: They hit record revenue in Q4, but the USD/SEK exchange rate still took a bite out of them. If the dollar stays weak, the uphill climb gets steeper.

The “Check is in the Mail” Problem: Delayed customer payments dragged down Q4 cash flow. If “delayed” becomes “defaulted,” we have a problem.

The Paper Asset: They have MSEK 14.1 in “balanced development expenses.” That’s money spent that hasn’t been “expensed” yet. We need to see that turn into actual sales.

The Atomic Take: The biggest danger isn’t a spectacular crash, but a “slow leak” where the KPIs look great, but the bank account doesn’t grow.

The Atomic Verdict: Trust the Gauges, Not the Vibe

★★★★☆ (4/5)

(IMPORTANT: Star system is not a buy recommendation, only a judgement for the quality of the business based on my parameters. DYOR)

I own shares of AVETCH at the time of writing this. And I intend to hold them for a very long time, unless the fundamentals crack.

And to me, the fundamentals are not showing any cracks to fear as of now:

Sales Momentum: MSEK 47.4 (FY2025) vs MSEK 34.3 (FY2024). That’s real growth.

The Bottom Line: MSEK 17.0 in net earnings. The reactor is producing power.

The War Chest: MSEK 33.9 in cash and a 91.8% equity ratio. This company is built like a tank.

The Speedometer: MSEK 51.2 ARR. This is the number that dictates the share price.

What would make me buy more (The Upgrades):

ARR keeps climbing above that MSEK 51.2 baseline through mid-2026.

Operating cash flow stays healthy and consistent compared to the MSEK 12.1 full-year figure.

Margins stay resilient (targeting that 34.7% FY average) even as they hire more people.

What makes me walk away (The Downgrades):

ARR stalls or drops for two quarters in a row.

Cash flow (CFO) falls way behind reported profits. If the profit is “real,” the cash should follow.

Hiring keeps going up, but sales stay flat. That means the “investment” was actually just “bloat.”

The Atomic Take: This looks like a compounding machine in the making; as long as the ARR staircase keeps going up and the cash conversion doesn’t start to rot.

What do you think? Does AVTECH’s 91% equity ratio make you feel safe, or does the “capitalized development” make you nervous? Let’s talk about it in the comments.

References

Company disclosures and investor materials

AVTECH Sweden AB (publ). “Year-End Report January–December 2025.” (Full-year report / financial statements). Dated 2026.

AVTECH Sweden AB (publ). “Q4 2025” (Quarterly results presentation/report). Dated 2026.

AVTECH Sweden AB (publ). “AVT B – Avtech” (Financial model / compiled financials workbook). Excel file.

Market data and third-party screeners (7 Feb 2026)

StockAnalysis. “AVT.B (Avtech Sweden AB) — Market Cap / Valuation snapshot” (price, market cap, P/E).

TipRanks. “AVTECH Sweden — Statistics” (screen-level cash flow, capex, derived free cash flow).

TipRanks. “AVTECH Sweden — Financial Ratios” (screen-level FCF yield and ratio series).

Simply Wall St. “AVTECH Sweden — Valuation”.

Yahoo Finance. “AVT-B.ST — Quote”

Disclaimer

This Deep Dive is an educational breakdown of a public company based on information available in the materials provided (e.g., annual/quarterly reports, investor presentations, earnings transcripts) and my interpretation of that information. It is designed to be a “bolt-on” intelligence layer to your own due diligence — not a replacement for it.

Independence: I do not accept compensation of any kind from the companies discussed. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author may hold a long position in securities mentioned. Any position creates bias — treat this as commentary, not gospel.

Not Financial Advice: Nothing here is investment advice, a recommendation, or a solicitation. I am not a financial advisor. You are responsible for your own decisions. The stars rating is not a buy recommendation, but meant as a guide to understand the quality of the financial statement of the respective companies.

Error & Update Risk: Financial statements change, companies restate, guidance evolves, and I can be wrong. Verify key figures in the primary filings and consider reading the footnotes before deploying capital.

Great deep dive!

This company checks all my boxes, and I’m definitely going to dig deeper.

I’m not really a fan of dividends in cases like this, but it feels almost cultural in Sweden, so I’ll obviously live with it.

Thanks for sharing this with us!

Great article! I have one question, the competition in AVTECH industry must be fierce…are the competitors much bigger than AVTECH, so they can have much bigger economies of scale and much more clients (i assume this tech are mission critical so switching costs protects this companies) in a way that kills this microcap companies, because they cant compete with the big boys in the room?