Fairfax Financial: The Berkshire of the Tundra

They call Prem Watsa the "Canadian Warren Buffett," but for the last decade, that felt more like a punchline than a compliment.

In the “Wasteland” of the markets, everyone is looking for the next NVIDIA. They are digging for gold in a minefield. Meanwhile, up North, there is a man sitting on a pile of cash, quietly compounding at 20% while everyone ignores him.

They call Prem Watsa the “Canadian Warren Buffett.” For a decade, that was an insult. While the market roared, Fairfax Financial (FFH) went sideways. Watsa was too bearish, hedging against a crash that never came. He was the guy wearing a life vest in a hot tub.

But in 2021, the music changed. Watsa stopped fighting the Fed, sold the hedges, and realized that in a world of 5% interest rates, an insurance company is a money printer.

Fairfax isn’t just an insurance company; it is a leveraged bond fund disguised as a boring conglomerate. And right now, it is the cheapest money-printing machine in North America.

THE PLAIN ENGLISH CASE

Here in the Bunker, we like simple machines. Fairfax is a classic “Float Machine,” but with a twist.

1. The Engine (The Float) You pay an insurance premium today to insure your factory. Fairfax keeps that cash (The Float) and maybe pays you back in five years if the factory burns down. In the meantime, that money belongs to them.

The Moat: Unlike a standard insurer, Fairfax is decentralized. It owns a collection of “ferocious” operators like Odyssey, Brit, and Northbridge. They write profitable insurance (Combined Ratio < 100%), which means they are effectively getting paid to hold the float.

2. The Fuel (The Yield) For years, this engine sputtered because interest rates were 0%. If you have $60 billion in float earning 0%, you have $0.

The Pivot: Now that rates are 4-5%, that same $60 billion generates ~\ $3 billion in risk-free income annually. They don’t need to be smart anymore; they just need to buy T-Bills. The “Treasury Yield Gift” has supercharged their earnings power.

3. The kicker (The “Bad” Assets) Fairfax owns a portfolio of “ugly” businesses that Wall Street hates: a Greek Bank (Eurobank), a recipe box company, and huge stakes in India.

The Reality: These “ugly” assets are crushing it. Eurobank is printing cash, and the Indian portfolio gives them exposure to the fastest-growing major economy.

Fairfax uses insurance float to invest. In the tech world, Sea Ltd (SE) uses a similar 'internal bank' strategy, using gaming profits to fund its fintech lending arm.

THE NUMBERS (ON A NAPKIN)

Let’s look at the scorecard. We are buying dollar bills for 80 cents.

The Compounding Machine:

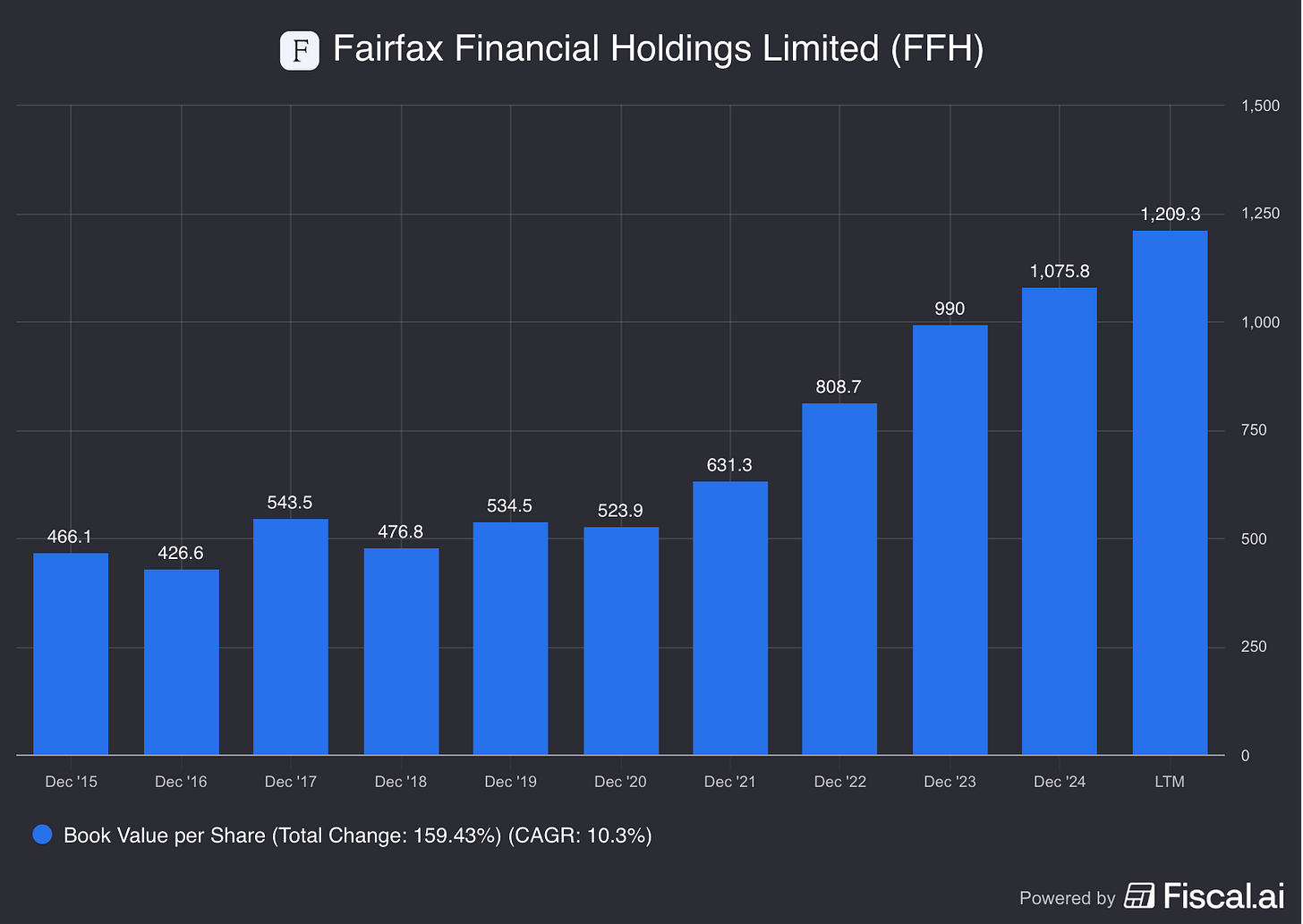

Book Value Per Share (BVPS): This is the holy grail. In 2020, BVPS was ~$478. Today, it is approaching $1,000+. They have doubled the intrinsic value of the company in roughly four years.

Note: The growth is accelerating because of the interest rate tailwind.

The Valuation Anomaly:

P/E Ratio: ~7x.

Price to Book: ~1.0x - 1.2x.

The Logic: You are paying roughly “Par” for the assets. You get the operating businesses for a fair price, and you get the “investment genius” of Watsa and the “float leverage” for free.

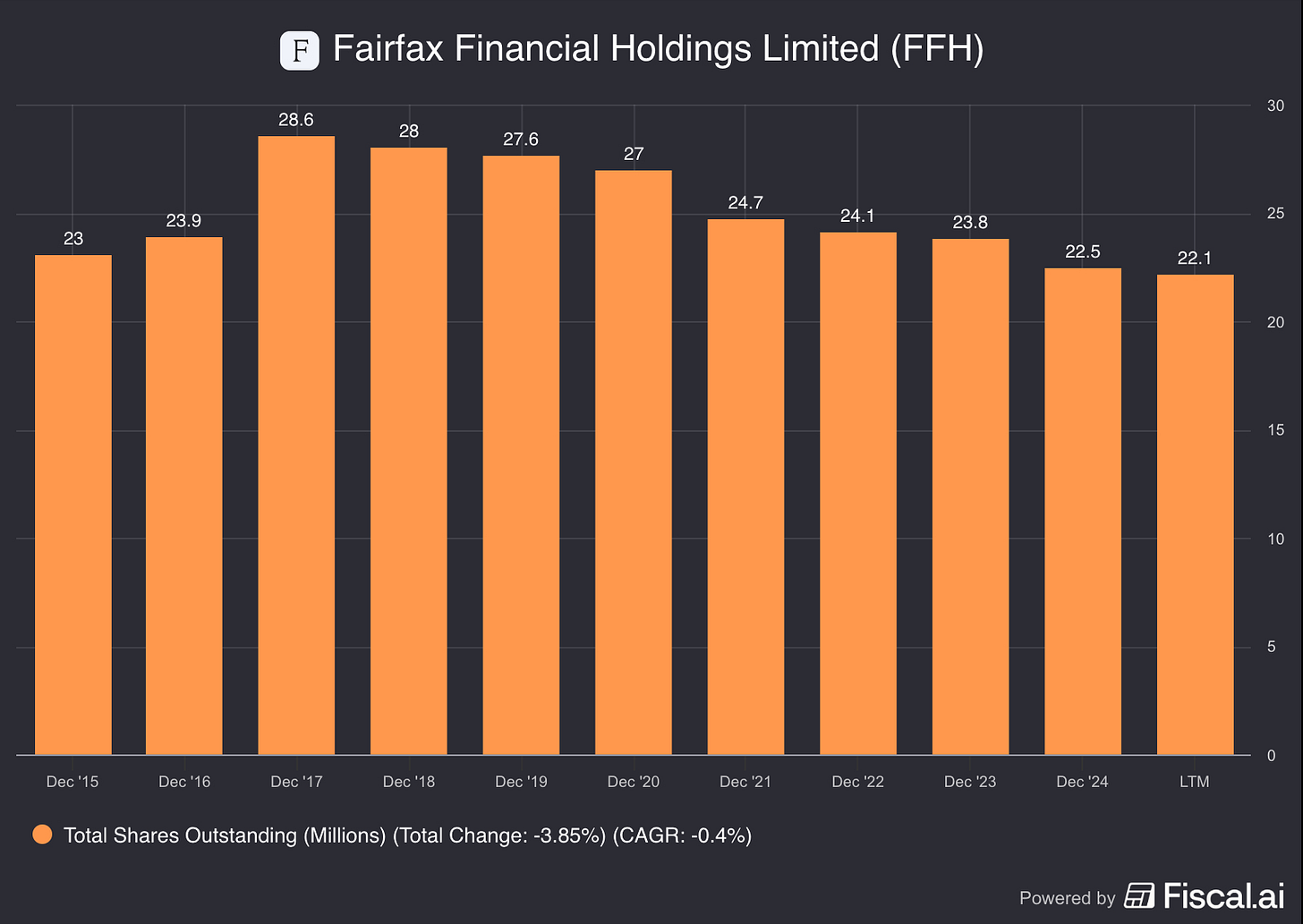

The Buybacks: Because the stock is cheap, Watsa is eating his own cooking. They are aggressively buying back shares, shrinking the denominator and boosting your slice of the pie.

Faifax is buying back their shares.

THE PRE-MORTEM (INVERSION)

How does this investment leave us freezing in the cold?

The “Prem’s Wager” Returns: Watsa has a history of macro-betting. If he decides a recession is coming and spends billions on hedges (shorting the S&P 500) that expire worthless, the compounding stops. We need him to stay “boring.”

The “Big One”: They insure catastrophes. A year with a massive Florida hurricane, a Japanese earthquake, and a cyber-attack could wipe out a year’s worth of underwriting profit.

Interest Rates Plunge: If rates go back to 0%, the $3B/year in free investment income evaporates. Fairfax is a massive beneficiary of “higher for longer.”

THE VERDICT

Fairfax Financial is the “Anti-Fragile” play.

It is a business that benefits from the chaos (hard insurance markets) and benefits from the cure (high interest rates). It is no longer the “hedged bunker” of 2015; it is an offensive compounding machine.

The Decision: This is a “Core Holding” for the value-oriented investor. We are buying a high-quality compounder at a single-digit PE.

Stay rational.

DISCLAIMER: The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

Disclosure: The author may hold positions in the securities discussed in this transmission. Specific holdings will be disclosed in the "Portfolio" section for paid subscribers. By reading this, you agree to do your own due diligence before deploying capital.