Sea Ltd: The Digital Empire of the Islands

If you look at Sea Ltd (SE) through a standard lens, it looks like a hallucination. Is it a gaming studio? A logistics giant? A digital bank? The answer is...

Welcome back to the Bunker.

In the brutal war for Southeast Asia, everyone else brought a knife. Sea Ltd brought a cheat code.

While competitors like Lazada were begging Alibaba for allowance and new entrants were burning Venture Capital just to keep the lights on, Sea Ltd did something diabolical. They didn’t ask Wall Street for money. They asked teenagers.

By using the massive, infinite cash flows from a global gaming monopoly (Free Fire), they funded a logistics empire that covers 17,000 islands and a bank that serves the unbanked. They built a war machine that pays for itself.

What is Sea Ltd, exactly?

If you look at Sea Ltd (SE) through a standard Wall Street lens, it looks like a mess. Is it a gaming company? An e-commerce site? A bank?

The answer is… yes.

Think of Sea Ltd as “Three Businesses in a Trench Coat.”

A profitable gaming monopoly (Garena).

An empire-building retailer (Shopee).

A high-margin digital bank (SeaMoney).

Most competitors in “The Wasteland” of Southeast Asia rely on Venture Capital to survive. Sea Ltd relies on gamers. They use the cash flow from a single hit video game (Free Fire) to fund a logistics war against Alibaba and a banking war against legacy finance.

This is the only “Self-Funding Empire” in the emerging markets.

THE PLAIN ENGLISH CASE

Let’s strip away the jargon. Sea Ltd is a “Digital Conglomerate” running a Strategy of Three Engines. Each engine fuels the next in a perpetual loop:

1. The Sugar Daddy (Garena) This is the original cash cow. Free Fire is a global gaming monopoly. Historically, Sea took the massive profits from this game and, instead of paying dividends, poured them into subsidizing free shipping for Shopee.

The Logic: Gamers funded the customer acquisition for the store.

2. The Scale Monster (Shopee) Shopee is now the dominant mall of Southeast Asia and Brazil. It operates on “Scale Economies Shared.”

The Moat: Delivering packages across the 17,000 islands of Indonesia is a logistical nightmare. Shopee built its own delivery network (Shopee Xpress) because no one else could. This “Logistics Density” is a physical moat that asset-light competitors like TikTok Shop struggle to match.

3. The Toll Road (SeaMoney/Monee) This is the new secret weapon. Because Shopee processes millions of transactions, they know exactly which merchants are making money.

The Trick: They use this data to offer instant loans to the “unbanked” masses that traditional banks ignore.

The Lock: Once a user relies on SeaMoney for shopping, they start using it for everything. It becomes the “Default Wallet.”

The three engines.

THE NUMBERS (ON A NAPKIN)

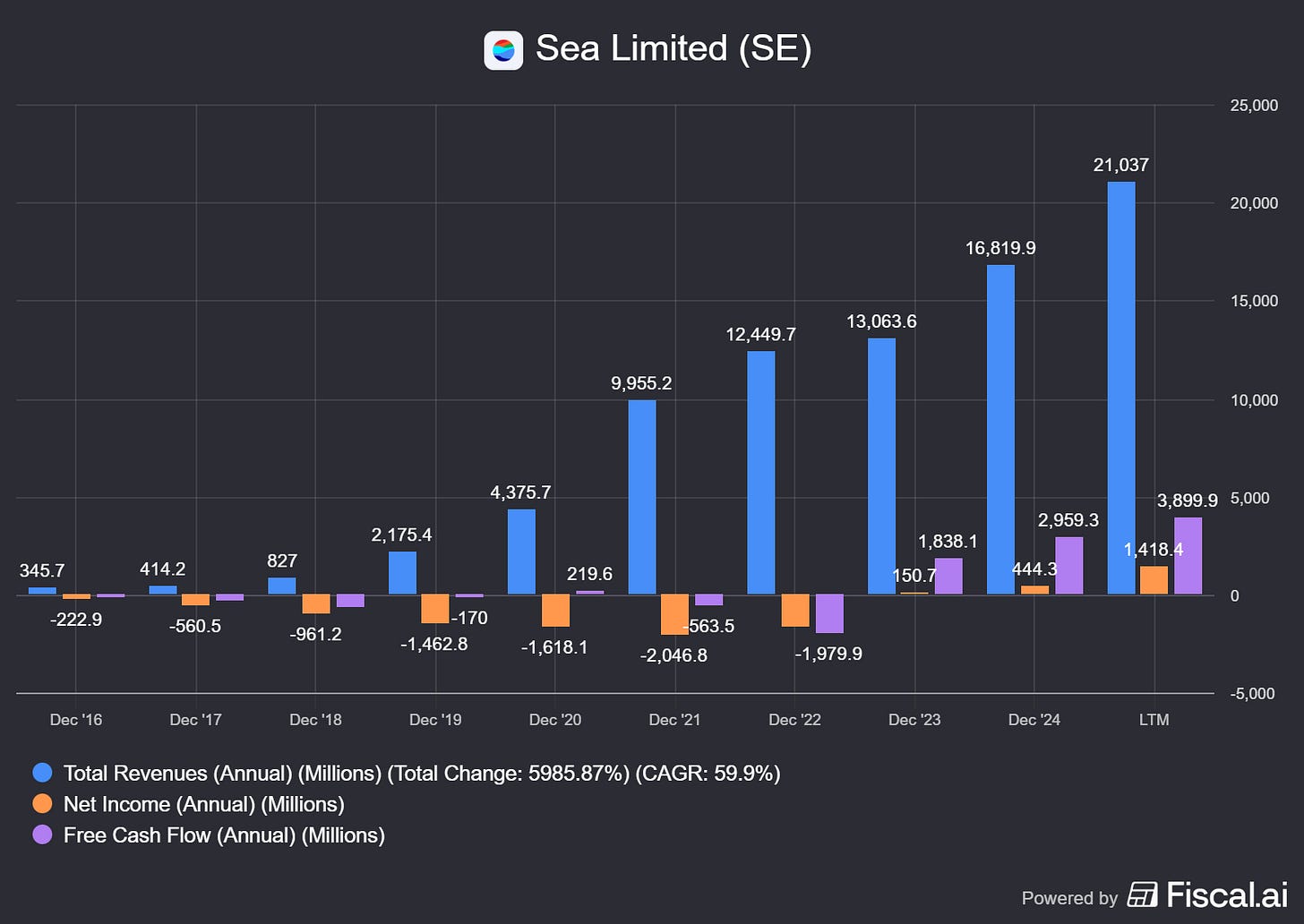

The financials here tell the story of “The Great Pivot.”

1. The Turnaround (The Switch) In 2022, the market thought Sea was going to burn cash until it died. Operating Loss was -$1.13B. Management flipped a switch. They cut costs, exited lazy markets, and optimized logistics. The Result: In the last 12 months (TTM Q3 2025), Operating Income surged to +$1.73B. They proved the machine works.

2. The Cash Flow Anomaly (The Float) We love this part.

Accounting Profit (TTM): ~$1.73B

Operating Cash Flow (TTM): ~$4.57B

The Logic: Sea generates 2.5x more cash than profit. Why?

Gamers pay upfront (Deferred Revenue).

Shoppers pay instantly, but merchants get paid later (Negative Working Capital). This creates a massive “Float” of interest-free capital they can use to build more warehouses without asking banks for a dime.

The Great Pivot. As you can see in the chart above, cash started to turn up in 22-23.

THE PRE-MORTEM (INVERSION)

How does this blow up in our faces?

The TikTok Threat: TikTok Shop is eating the “impulse buy” market. If social commerce replaces search-based commerce, Shopee’s moat erodes, and they get dragged into a margin-killing price war.

The “One Hit Wonder” Risk: If Free Fire dies before the other two engines are fully self-sustaining, the “Sugar Daddy” disappears. The cash fountain dries up.

The Credit Bomb: SeaMoney is lending to people with no credit history. If a recession hits Southeast Asia, that loan book could turn toxic very fast.

THE VERDICT

Sea Ltd has “Graduated.” It is no longer a speculative cash-incinerator.

It is a cash-generating machine with a fortress balance sheet (~$10B in cash). It fits our mold perfectly: A “Scale Economies Shared” business that has built a localized moat (logistics in the islands) in a hard-to-serve market.

Our decision: This is an “Emerging Market Compounder.” It’s high variance, but if the win the “Super App” war, the upside is asymmetric.

Stay rational.

"Sea Ltd isn't the only 'Turnaround' story we are tracking. Root Inc (ROOT) similarly proved the skeptics wrong this year by flipping to GAAP profitability after years of losses

DISCLAIMER

The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author (Rob H.) is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

Disclosure: The author may hold positions in the securities discussed in this transmission. Specific holdings will be disclosed in the “Portfolio” section for paid subscribers. By reading this, you agree to do your own due diligence before deploying capital.