The Atomic Moat FINS Analysis: Root.inc (ROOT)

Root is trying to be a software company wearing an insurance balance sheet—and the balance sheet doesn’t care about your vibes.

The Setup: What Root actually is

Root is a personal lines insurer (mainly auto) that sells through Direct and Partnership channels, with a heavy “data science + telematics” identity baked into pricing and marketing.

Q3 2025 reads like: growth is back, underwriting is still solid, and reported profit got kneecapped by a very specific non-cash item tied to Carvana warrants.

This is a carrier with a tech brain and a claims stomach.

[ROOT][REPORTED (GAAP)][Q3 2025] KEY STATS

TOTAL REVENUES (USDm)...........387.8

NET PREMIUMS EARNED (USDm)......360.1

POLICIES IN FORCE (COUNT).......466,320

NET COMBINED RATIO (%)..........102.1

ADJUSTED EBITDA (USDm)..........33.7 (NON-GAAP)Personal Stake: I own shares in this company.

What the market thinks right now (Bulls vs Bears)

Market: “If underwriting stays disciplined and distribution scales, this can be a real insurer again.”

Bull: “Policies-in-force hit 466,320 and net premiums earned grew, with gross loss ratio still around Root’s long-term range.”

Bear: “Net combined ratio drifted to 102.1%, and reported earnings are noisy because partnership economics include non-cash warrant expense.”

Atomic Take: Root’s thesis is getting re-tested at higher scale, and Q3 shows both the power and the messiness of that rerun.

What breaks this: If the net combined ratio stays above 100% while policies-in-force growth continues, then growth is buying revenue, not building value.

Balance Sheet (The Geiger Test): This is a regulated vault, not a startup wallet

As of September 30, 2025, Root reported $653.3m cash and cash equivalents and $362.2m of investments (GAAP).

But the “other side of the scale” is real insurance liabilities: loss and LAE reserves were $462.9m and unearned premiums were $409.3m (GAAP).

Also: long-term debt was $200.4m (GAAP), and there is redeemable convertible preferred stock carried at $112.0m (GAAP).

In insurance, assets exist to back promises.

[ROOT][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

CASH & CASH EQUIV (USDm).........653.3

TOTAL INVESTMENTS (USDm).........362.2

PREMIUMS RECEIVABLE (USDm).......352.5

LOSS & LAE RESERVES (USDm).......462.9

UNEARNED PREMIUMS (USDm).........409.3The Audit:

Optical illusion #1 — “cash” isn’t all optional, because regulators and claims timing decide how free it really is.

Optical illusion #2 — premiums receivable is big ($352.5m), which is fine until collections and credit losses get weird.

Atomic Take: The balance sheet looks sturdy, but it’s built for underwriting scale, not for mistakes.

What breaks this: A material jump in loss and LAE reserves ($462.9m as of Sep 30, 2025) without a matching improvement in the combined ratio.

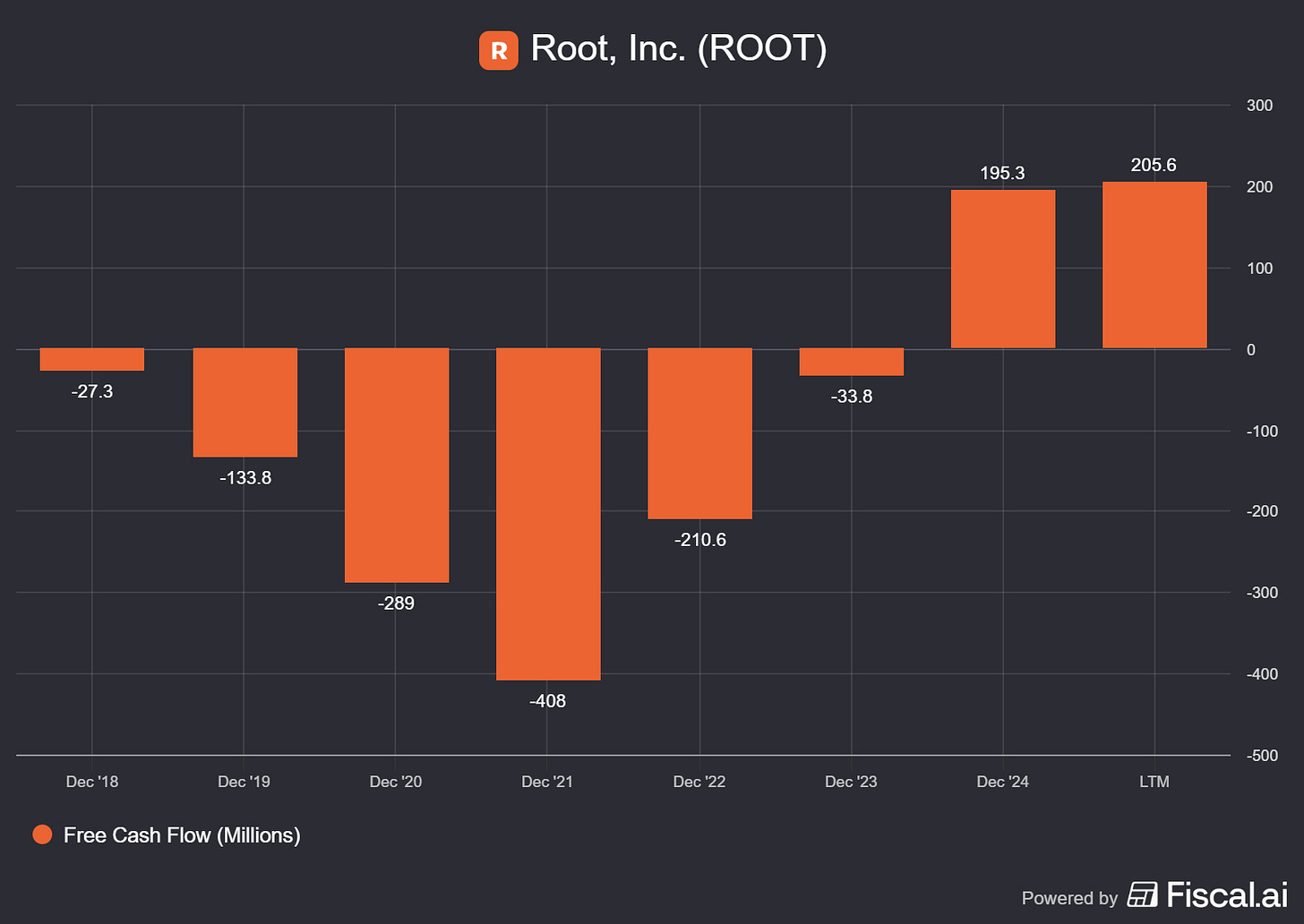

Cash Flow (Energy Output): The “boring” win is operating cash

For the nine months ended September 30, 2025, net cash provided by operating activities was $136.4m (GAAP).

Investing cash flow is mostly the investment portfolio moving around, which is normal for an insurer and not the same thing as capex.

Capex-like spend in the cash flow statement is mainly internal software capitalization of $9.9m (GAAP).

Cash flow is where the “carrier” part shows up.

[ROOT][REPORTED (GAAP)][9M 2025] KEY STATS

CASH FROM OPS (USDm).............136.4

CAPEX-LIKE (USDm)................9.9 (INTERNAL SOFTWARE)

CASH AFTER CAPEX-LIKE (USDm).....126.5 (CFO - 9.9)

NET CASH USED IN INVESTING (USDm).(59.2) (PORTFOLIO + SOFTWARE)

NET CHANGE IN CASH (USDm)........54.1The Audit: Working-capital timing is the hidden lever—premiums receivable rose while unearned premiums and reserves also moved, and those shifts can flatter or punish cash quarter-to-quarter.

Atomic Take: Positive operating cash is a real milestone, but insurers can still look “cash rich” right before a bad loss year shows up.

What breaks this: If operating cash flow turns negative over a multi-quarter stretch while premium growth continues, the book is getting more expensive to carry.

Share Capital & Insiders (Nucleus Check)

The Carvana warrant machine is the loudest moving part

As of October 29, 2025, Root had 13,702,725 Class A shares and 1,806,236 Class B shares outstanding (GAAP filing detail).

The headline overhang is the Carvana warrant structure: up to 7.2m shares across long-term warrant tranches, with vesting tied to policy origination milestones.

In Q3 2025, Root recognized $17.2m of warrant compensation expense, including a $15.5m cumulative catch-up after short-term warrants expired and certain long-term tranches became probable (GAAP).

This is what “partner economics” looks like when the partner gets equity-shaped upside.

[ROOT][REPORTED (GAAP)][AS OF 29 OCT 2025] KEY STATS

CLASS A SHARES OUTSTANDING (COUNT)...........13,702,725

CLASS B SHARES OUTSTANDING (COUNT)...........1,806,236

CARVANA WARRANTS (MAX SHARES, m).............7.2

WARRANT COMP EXPENSE (USDm).................17.2 (Q3 2025)

SHARE-BASED COMP EXPENSE (USDm)..............11.6 (Q3 2025)Atomic Take: Root’s dilution risk isn’t “mystery SBC”—it’s a very explicit partner-linked warrant staircase.

What breaks this: If warrant expense keeps spiking while net combined ratio stays elevated, shareholders get a double hit: weaker underwriting plus partner dilution economics.

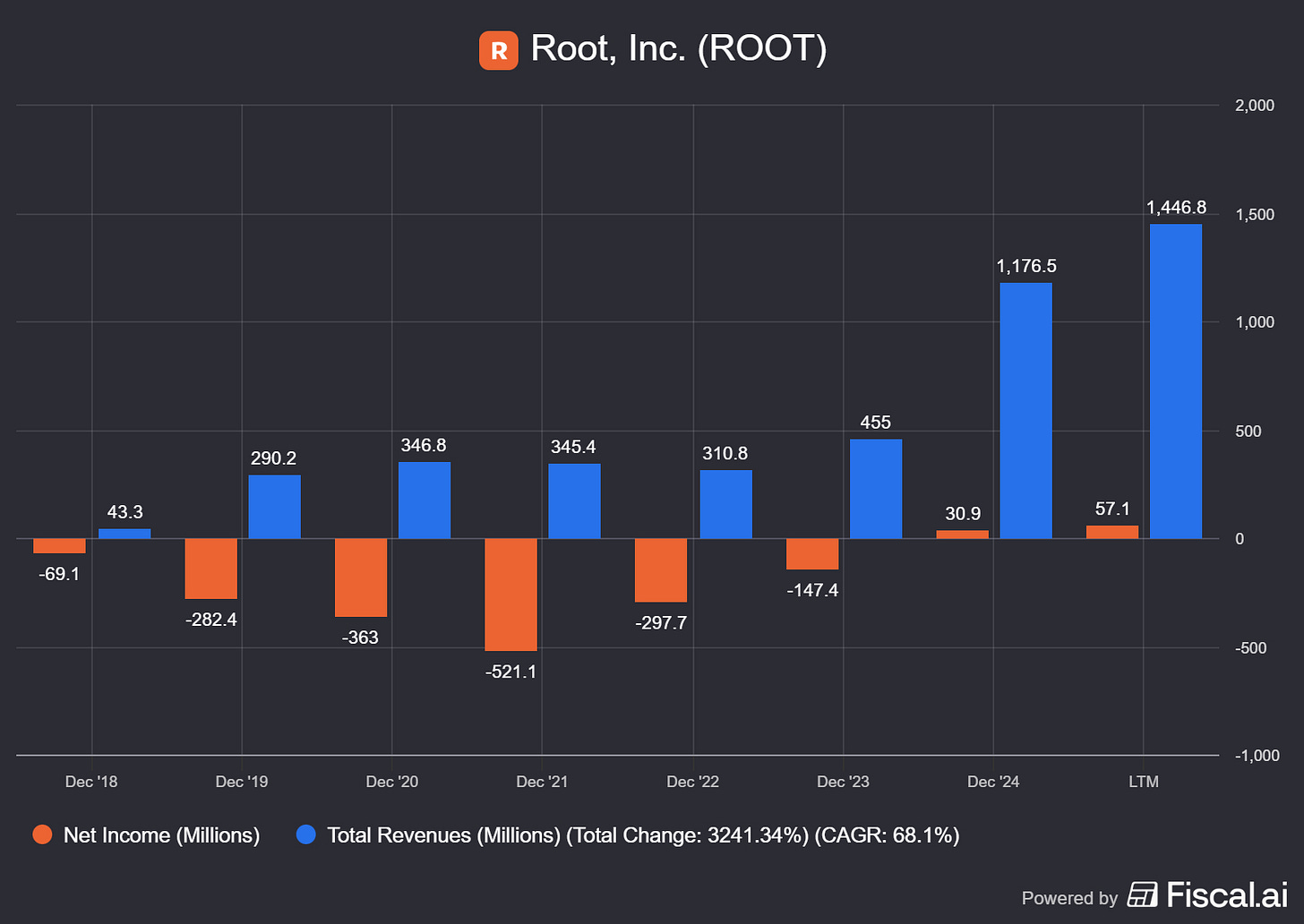

Income Statement (Reaction Chamber)

Underwriting is good, but Q3 shows the difference between “gross” and “net”

In Q3 2025, total revenues were $387.8m (GAAP), driven by net premiums earned of $360.1m plus fee income of $19.8m.

Operating income was $0.3m (GAAP) and net (loss) income was $(5.4)m (GAAP).

On underwriting quality, the shareholder letter shows a Q3 2025 gross loss ratio of 58.5% and a net combined ratio of 102.1%.

Insurance is a math business, and the math has multiple “truths.”

[ROOT][REPORTED (GAAP)][Q3 2025] KEY STATS

NET PREMIUMS EARNED (USDm).......360.1

LOSS & LAE EXPENSE (USDm)........239.4

SALES & MARKETING (USDm).........40.6

OTHER INSURANCE EXPENSE (USDm)...67.0

NET (LOSS) INCOME (USDm).........(5.4)Quick Hits

• Gross premiums written were $387.2m and gross premiums earned were $373.1m in Q3 2025 (reported).

• Net premiums earned were $360.1m in Q3 2025 (reported).

• Adjusted EBITDA was $33.7m in Q3 2025 (non-GAAP), with $17.2m warrant compensation expense included as an adjustment item.

• Net loss and LAE ratio was 66.5% and net expense ratio was 35.6% in Q3 2025 (company KPIs).

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Underwriting discipline at higher scale

🔒 FACT: Root is scaling policies-in-force (466,320) while reporting a gross loss ratio around ~59% in Q3 2025.

🧠 HYPOTHESIS: Scale plus pricing models keep the loss ratio inside the company’s cited long-term target band (60–65%).

📈 MONITOR: Gross accident period loss ratio stays inside 60–65% while the net combined ratio moves back below 100%.

Signal 2: Regulation vs loss-cost reality

🔒 FACT: Root operates under state-by-state insurance regulation and highlights ongoing state expansion and approvals in its shareholder materials.

🧠 HYPOTHESIS: Regulatory approvals and rate actions keep pace with loss-cost trends, avoiding “growing into unprofitable states.”

📈 MONITOR: Combined ratios and premium growth remain healthy as the footprint expands, while the net expense ratio does not creep higher.

Signal 3: Carvana partnership toll

🔒 FACT: Partnership economics include a Carvana warrant structure that created $17.2m of warrant compensation expense in Q3 2025.

🧠 HYPOTHESIS: Partnership distribution scales faster than the economic “toll” from warrant expense and related acquisition costs.

📈 MONITOR: Partnership mix rises without the net expense ratio staying stuck above ~35%.

Atomic Take: Root is proving it can grow again, but Q3 also proves that profitability still depends on the combined ratio—and on not letting partner economics eat the upside.

What breaks this: Net expense ratio stays near ~35% while loss and LAE ratio worsens, keeping net combined ratio above 100%.

The Atomic Verdict: A better insurer than the memes suggest, still not “boring”

• Quality: Strong reported underwriting indicators (gross loss ratio 58.5%) with growing scale in policies-in-force.

• Health: Large liquidity pool ($653.3m cash) and marketable securities alongside a functioning operating cash engine.

• Overhang: Net combined ratio 102.1%, plus Carvana warrant-linked economics creating earnings noise and dilution overhang.

• What must happen next: Underwriting stays in-range while expense discipline improves enough to pull the net combined ratio under 100%.

Status: Overhang-Heavy

STABLE ISOTOPE

Stars: ★★★☆☆

Reason 1: Real scale and underwriting performance are visible in the KPIs, not just in adjectives.

Reason 2: Partner-linked warrant expense and a net combined ratio above 100% keep the equity story structurally noisy.

Upgrade Triggers

• Net combined ratio sustained below 100% for multiple quarters.

• Policies-in-force continues growing above 466,320 without net expense ratio rising above 35.6%.

• Operating income stays positive (Q3 2025 was $0.3m) while premium growth continues.

Downgrade Triggers

• Gross accident period loss ratio breaks above the company’s cited 60–65% range.

• Operating cash flow reverses (9M 2025 was $136.4m) while premiums receivable keeps climbing.

• Another quarter of large warrant compensation expense (Q3 was $17.2m) without a clear lift in net combined ratio.

This might also be of interest to you: analysis of TransMedics (TMDX).

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.