The Atomic Moat Analysis: Transmedics (TMDX)

TransMedics is building the organ-transplant equivalent of FedEx: keep the payload alive, move it fast, and don’t miss the handoff.

The Setup: What this company actually does

TransMedics sells the Organ Care System (OCS), which keeps donor organs functioning outside the body, and pairs it with the National OCS Program (NOP), a turnkey procurement + perfusion + logistics service.

This is not “a device company.”

It’s a device + services + aviation operation that has to run on-time.

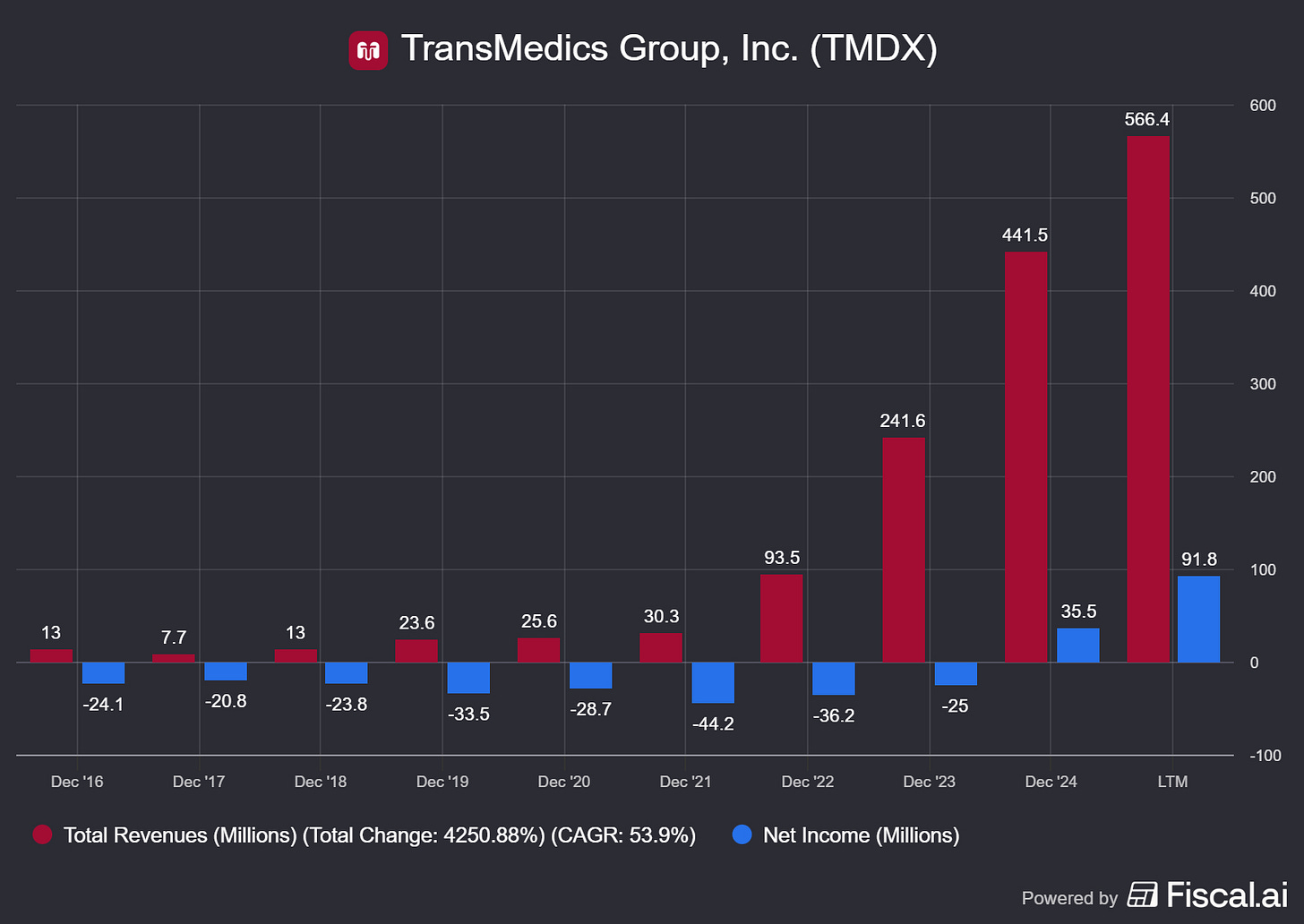

Q3 2025 total revenue was $143.8m (GAAP), split into $87.7m net product revenue and $56.1m service revenue.

Profit showed up too: Q3 income from operations was $23.3m and net income was $24.3m (GAAP).

[TMDX][REPORTED (GAAP)][Q3 2025] KEY STATS

TOTAL REVENUE (USDm)...........143.8

GROSS PROFIT (USDm)............84.6

INCOME FROM OPS (USDm).........23.3

NET INCOME (USDm)..............24.3

DILUTED EPS (USD)..............0.66Personal Stake: I own shares here

What the market thinks right now (Bulls vs Bears)

Market: “High-growth medtech… but with planes.”

Bull: The model is scaling: Q3 gross margin 58.8% and cash up to $466.2m.

Bear: Owning the logistics stack adds operational and regulatory risk (FDA + aviation + reimbursement).

Atomic Take: TransMedics is executing like a scaled operator, but the “services + aviation” layer means complexity is now part of the moat.

What breaks this: If operating margin keeps sliding from Q3’s 16.2% level while revenue still grows, the model is getting harder—not better—at scale.

Balance Sheet (The Geiger Test)

Cashy, but not debt-free

As of September 30, 2025, cash was $466.2m (GAAP).

Total assets were $946.0m, and stockholders’ equity was $355.2m (GAAP).

The big anchor is the convertible notes: $452.1m net on the balance sheet (GAAP).

There’s also term debt: $54.6m long-term debt, net, plus $5.0m current portion (GAAP).

This is a strong balance sheet that still has a capital structure.

[TMDX][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

CASH (USDm)...........466.2

TOTAL ASSETS (USDm)...........946.0

PPE, NET (USDm)...........313.0

CONVERTIBLE NOTES, NET (USDm)...........452.1

LONG-TERM DEBT, NET (USDm)...........54.6The Audit:

Optical illusion #1 — “net cash vibes” fade once you remember the convert stack is basically a shadow equity raise with a coupon.

Optical illusion #2 — PPE includes a lot of aircraft value, which means maintenance and utilization are financial variables, not footnotes.

Atomic Take: The balance sheet can fund growth, but it also reflects a company choosing to own infrastructure.

What breaks this: If cash falls materially from $466.2m without a clear step-up in operating cash generation, the “scale story” becomes “spend story.”

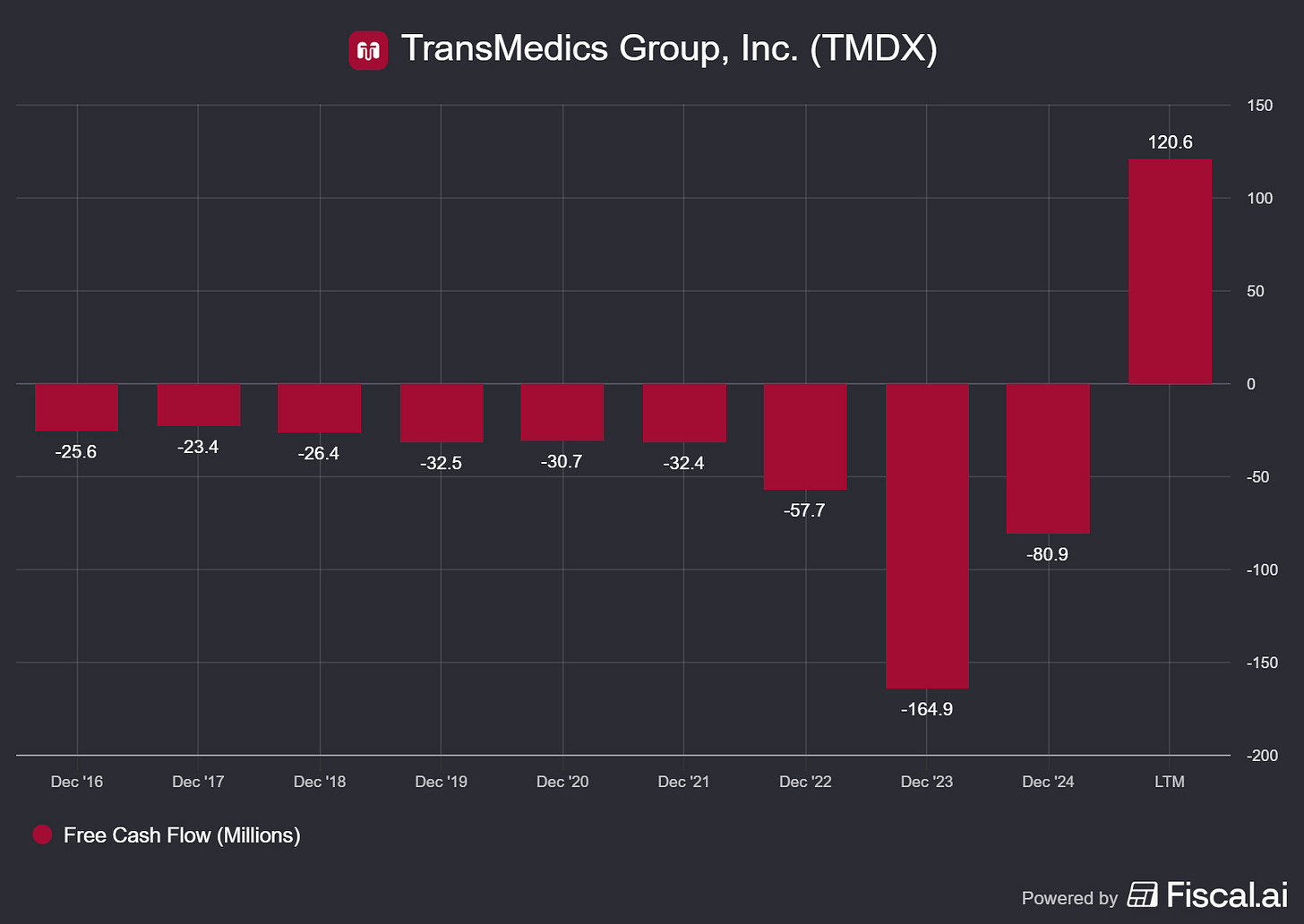

Cash Flow (Energy Output)

This quarter’s profits convert to cash

For the nine months ended September 30, 2025, cash from operating activities was $158.3m (GAAP).

That’s the number that matters, because logistics-heavy models love to hide timing gremlins.

Capex-like investment (proxy) was purchases of property, plant and equipment of $43.7m (GAAP).

Using the clean proxy (CFO minus PPE purchases), cash after investments was $114.6m.

The engine is producing energy, not just heat.

[TMDX][REPORTED (GAAP)][9M 2025] KEY STATS

CASH FROM OPS (USDm)...........158.3

PPE PURCHASES (USDm)...........43.7

CASH AFTER INVESTMENTS (USDm)...114.6 (CFO - PPE)

STOCK-BASED COMP (USDm)........27.5

DEPRECIATION & AMORT (USDm)....19.7The Audit: Working capital helped in 9M 2025 via accounts receivable improvement ($17.5m source of cash), which is good—but not guaranteed every year.

Atomic Take: Cash flow is now strong enough that the growth plan looks self-propelled.

What breaks this: If purchases of PPE stay heavy while cash from ops stalls, you’re looking at an infrastructure build that’s outrunning demand.

Share Capital & Insiders (Nucleus Check)

Dilution is mostly “employee-shaped,” not “panic-shaped”

As of October 17, 2025, TransMedics had 34,174,325 shares outstanding (per the 10-Q cover).

As of September 30, 2025, shares issued and outstanding were 34,144,977 (GAAP).

Stock-based compensation expense was $9.1m in Q3 2025 and $27.5m for 9M 2025 (GAAP).

Option exercises and the employee stock purchase plan contributed cash proceeds in 9M 2025.

This is dilution with a name tag and a badge.

[TMDX][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

SHARES OUTSTANDING (COUNT)...........34,144,977

COMMON STOCK (USDk)...........738,432

ACCUMULATED DEFICIT (USDk)...........(383,333)

TOTAL EQUITY (USDk)...........355,200[TMDX][REPORTED (GAAP)][9M 2025] KEY STATS

STOCK-BASED COMP (USDm)...........27.5

OPTION EXERCISE PROCEEDS (USDm)...10.6

ESPP PROCEEDS (USDm)..............3.2Insider activity:

Nov 17, 2025: The CEO, Waleed H. Hassanein, bought 8,775 shares at $114.00. The purchase was reported as indirect, meaning it was made through the Waleed H. Hassanein Revocable Trust. After the buy, the filing shows he owned 121,424 shares directly and 495,009 shares indirectly (total 616,433 shares).

Aug 6–7, 2025: The CEO made three open-market purchases totaling 16,875 shares, also indirectly via the revocable trust:

8,400 shares at $118.68

6,617 shares at $116.08

1,858 shares at $116.85

After these buys, the filing shows 486,234 shares held indirectly, plus 121,424 shares held directly (listed separately).

Income Statement (Reaction Chamber)

Growth plus profitability, with a quarter-to-quarter wobble

Q3 2025 revenue was $143.8m (GAAP), up from $108.8m in Q3 2024.

Gross profit was $84.6m, and income from operations was $23.3m (GAAP).

Management highlights Q3 gross margin of 58.8% and operating margin of 16.2%, with Q/Q softness in both.

The mechanics are simple: scaling services + running planes can make the model powerful, but not always smooth.

This is a high-growth business that still has “operational days.”

[TMDX][REPORTED (GAAP)][Q3 2025] KEY STATS

TOTAL REVENUE (USDm)...........143.8

GROSS MARGIN (%)...........58.8

OPERATING MARGIN (%)...........16.2

NET PRODUCT REVENUE (USDm)...........87.7

SERVICE REVENUE (USDm)...........56.1Quick Hits

• Q3 net income was $24.3m (GAAP).

• Owned aircraft were 21 and covered 78% of NOP flight missions in Q3 (company metric).

• Updated 2025 revenue guidance was $595m–$605m (company outlook).

This is the scorecard. Each card separates what’s true today from what could happen next, then names the one signal that will prove it either way.

Signal 1: Logistics ownership (moat or drag)

🔒 FACT: The company depends on OCS and the National OCS Program and faces regulatory dependencies spanning FDA and aviation-related approvals.

🧠 HYPOTHESIS: Owning more logistics improves reliability and economics, even if it adds fixed-cost pressure.

📈 MONITOR: Gross margin holds near Q3’s 58.8% while owned-fleet coverage remains high (Q3 was 78%).

Signal 2: Third-party reliance vs internal utilization

🔒 FACT: The company cites reliance on third parties for transport and a need to maintain/grow transplant logistics, including pilots and aircraft.

🧠 HYPOTHESIS: Internal fleet utilization and hubs reduce dependence on third parties without degrading service quality.

📈 MONITOR: Service revenue trajectory versus Q3’s $56.1m baseline alongside operating margin stability.

Atomic Take: The income statement says “scale is working,” but the Q/Q margin dip is your reminder this is a logistics business in scrubs.

What breaks this?: If revenue keeps growing but operating expenses rise fast enough to keep operating margin stuck in the mid-teens (Q3 was 16.2%).

The Atomic Verdict

A platform inside healthcare, with real operating muscle

• Quality: High growth with real profitability (Q3 net income $24.3m).

• Health: Strong liquidity ($466.2m cash) and positive operating cash flow (9M CFO $158.3m).

• Overhang: Convert-heavy capital structure plus execution risk from owning aviation/logistics.

• What must happen next: Keep expanding revenue while stabilizing margins and maintaining high fleet-coverage performance.

Status: High Conviction — STABLE ISOTOPE

Stars: ★★★★☆ — strong cash generation; operational complexity risk.

Upgrade Triggers

• 2025 revenue lands within $595m–$605m (company guidance).

• Operating margin holds above 16% while revenue continues to grow.

• Cash from operations stays strong on a YTD basis (9M CFO $158.3m) while PPE purchases do not spike.

Downgrade Triggers

• Gross margin falls materially below 58.8% without a clear temporary driver.

• Cash declines meaningfully from $466.2m while the company continues heavy infrastructure investment.

• Operating margin remains pressured despite revenue growth, implying logistics scale is adding cost faster than value.

(Crossing the ‘Valley of Death’ is rare in medtech, but we are seeing it happen elsewhere. BrainsWay (BWAY) recently pulled off a similar maneuver, flipping from cash burn to ‘software-like’ margins.)

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.