The Atomic Analysis: Nodebis Applications (NODE)

Sweden seems to have a national mandate to produce two things: flat-pack furniture and serial acquirers that turn into shareholder gold. This one is still small enough to fit in the trunk of a Volvo.

Disclaimer: Nodebis is a small company with thinly trades shares. Do your own due diligence. This article is not investment advice.

The Setup

We are looking at Nodebis Applications (listed in Sweden), a micro-cap attempting to replicate the holy scripture of “The Outsiders.” The pitch is simple: act as a “serial acquirer” (a “Roll-up”) of profitable, niche software companies. Think of them as a baby Constellation Software or a toddler Vitec, but with a market cap that wouldn’t buy a decent apartment in Stockholm.

The company is run by Lars Save, a veteran dealmaker who founded Bisnode. This isn’t his first rodeo; it’s just a much smaller horse.

Atomic Stake: I own shares at the time of the analysis.

Balance Sheet (The Geiger Test)

Let’s see if this thing glows in the dark.

Liquidity: The financial data shows a solid footing. The company maintains a healthy Equity Ratio, often hovering around the 50-60% range in recent years.

Cash Position: They aren’t sitting on a mountain of cash because they spend it on acquisitions. However, the balance sheet isn’t leveraged to the hilt like a drunken private equity fund.

The Debt: Net debt is manageable. They use a mix of cash and reasonable leverage to fund deals. The “Net Cash” or low leverage position mentioned in the thesis suggests they aren’t playing Russian Roulette with interest rates.

Atomic Take: The Geiger counter is clicking steadily, not screaming. They have the balance sheet capacity to do more deals without imploding. It’s stable.

Cash Flow (Energy Output)

Software is supposed to print money. Is the printer plugged in?

Operational Cash Flow (OCF): The business model is inherently cash-generative. The acquired companies (SaaS/Software) usually have high recurring revenue and low capex.

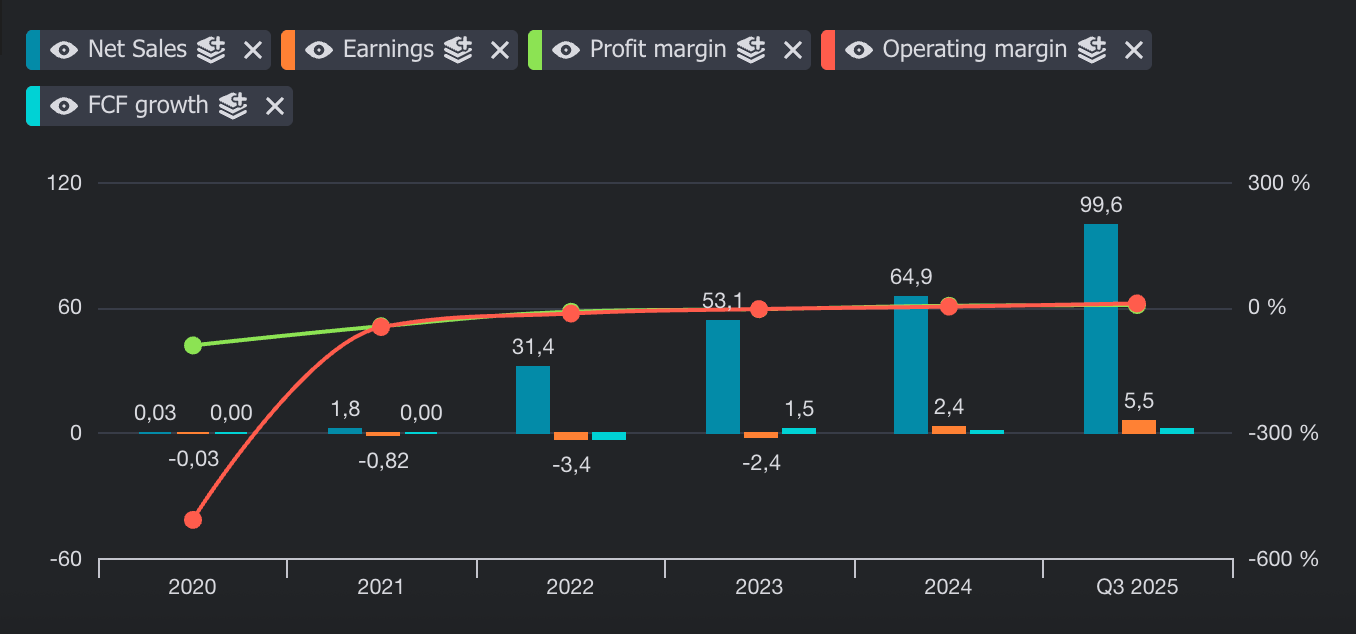

Free Cash Flow: We see positive cash flow generation, though it can be lumpy due to the timing of acquisitions. The goal here is “capital allocation”—taking the cash from Company A and using it to buy Company B.

Efficiency: The thesis highlights a focus on profitable growth, not growth at all costs. This is critical. They aren’t burning cash to chase vanity metrics.

Atomic Take: The energy output is positive. They are generating the fuel needed to power the acquisition engine. It’s not a roaring bonfire yet, but it’s a self-sustaining flame.

Share Capital & Insiders (Nucleus Check)

Who is flying the plane?

The Pilot: Lars Save (CEO/Chairman figures) and the management team have significant skin in the game. When the guy deciding on acquisitions owns a huge chunk of the equity, he’s less likely to overpay just to feel important.

Dilution: The share count has increased over time. This is the standard “serial acquirer” tax—issuing shares to fund growth. The key question is: Was it accretive? Given the earnings growth, the answer seems to be yes.

The “Lynch” Factor: The analysis flags high insider ownership as a key “Lynch” trait. They are building their own wealth, not just collecting a salary.

Atomic Take: The nucleus is strong. You are aligned with an “Outsider” CEO. Just keep an eye on the dilution—make sure they don’t start using stock like monopoly money.

Income Statement (Reaction Chamber)

Is the reaction becoming self-sustaining?

Revenue: The trend is up and to the right. Revenue has grown significantly, driven by the acquisition of new subsidiaries like Hyrlet and Nice.

Margins: Gross margins in this sector are typically high (software). The EBITDA margins are the number to watch. They are aiming for—and hitting—respectable profitability.

Growth: The “Fast Grower” tag fits. They are compounding top-line revenue through M&A. The “Lynch P/E” calculation suggests the valuation hasn’t fully caught up to the growth rate yet.

Atomic Take: The reaction chamber is expanding. They are successfully stacking new revenue streams on top of the old ones. As long as they don’t buy a lemon that sours the mix, this is a compounding machine.

The Atomic Verdict

Nodebis Applications is a textbook “Compounder” in the larval stage. It checks all the boxes for a “boring” winner: niche B2B software, high insider ownership, and a proven strategy of buying small, profitable competitors.

Nodebis is attempting to follow in the footsteps of Swedish giants. It’s essentially a 'baby' version of the industrial logic we see in Evolution AB (EVO)—high margins and dominant market position, just at a micro-cap scale

The risks are obvious: it’s tiny (Nano/Micro-cap), illiquid, and dependent on one man’s deal-making ability. But if Lars Save pulls off a “mini-Lagercrantz,” the future might be looking good.

Status:

CRITICAL MASS (Early Stage)

(Rating Justification: High insider alignment, profitable growth model, and a long runway for acquisitions. It’s volatile due to its size, but the “fission” process of turning capital into more earnings is working.)

The Bottom Line: You are betting on the jockey (Lars Save) and the Swedish tradition of rolling up tech companies. It’s not a “get rich quick” scheme; it’s a “get rich slowly while nobody pays attention” scheme.

DISCLAIMER

The Atomic Moat is a financial publisher, not an investment advisor. All content is for informational and entertainment purposes only and does not constitute financial advice. The author is not a licensed financial professional. Risk Warning: Investing in financial markets involves a high degree of risk. Disclosure: The author may hold positions in the securities discussed.