The 4 Layers of a Moat: Your Guide to Financial Invincibility

Why "Brand" Is Overrated and "Pain" Is Underrated

Let’s be honest. The finance industry loves to make simple things complicated.

Warren Buffett gave us the term “Moat.”

Morningstar defined 5 types of it.

Hamilton Helmer wrote an entire book (7 Powers) to explain it.

But if you need to analyze a stock in 5 quick minutes, you don’t have time for academic dissertations. You need a model that tells you if the castle is going to withstand the siege, or if it will be burned to the ground.

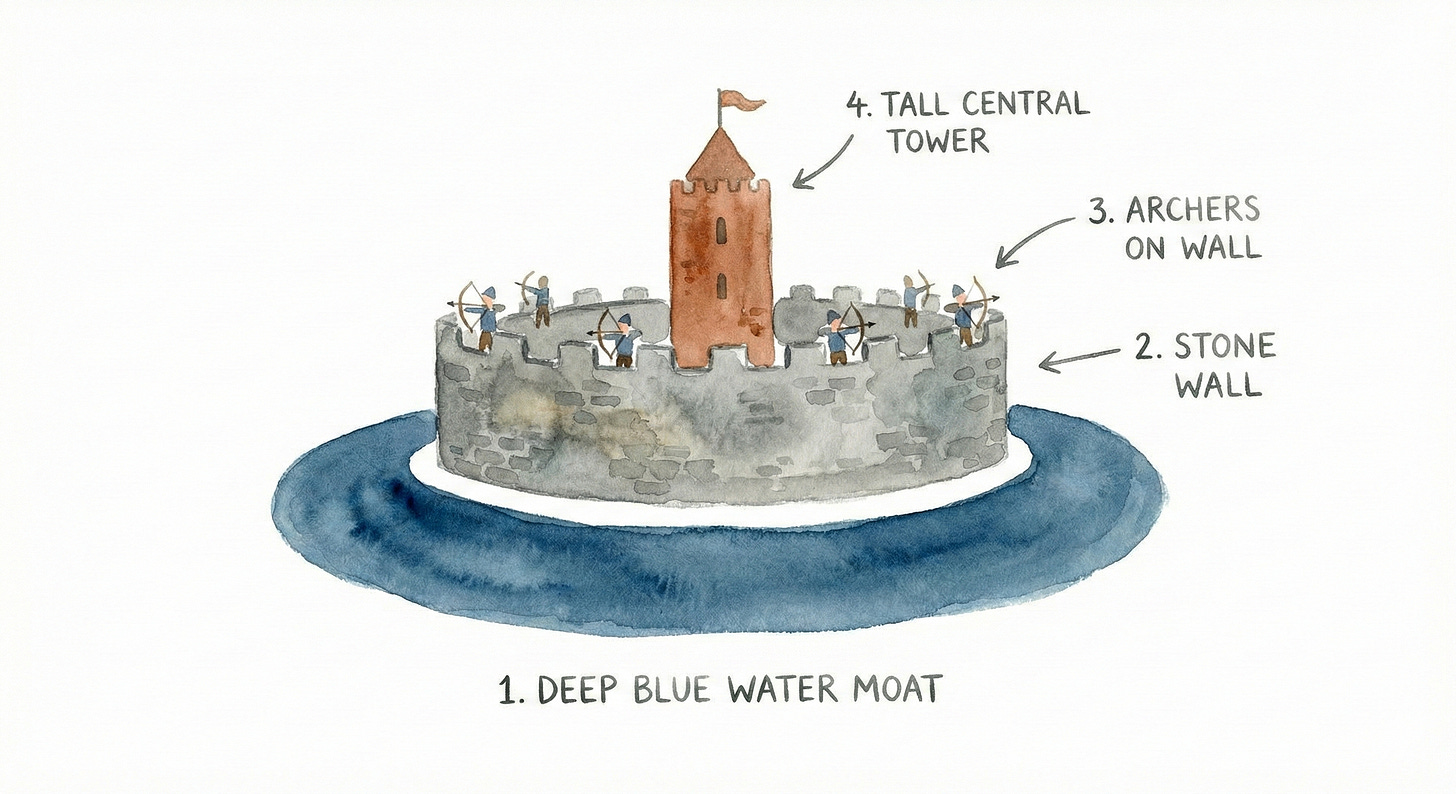

Let’s divide a competitive advantage into four layers. And here is the secret: They are not created equal.

Here is the hierarchy, ranked from what I think is the weakest to the strongest.

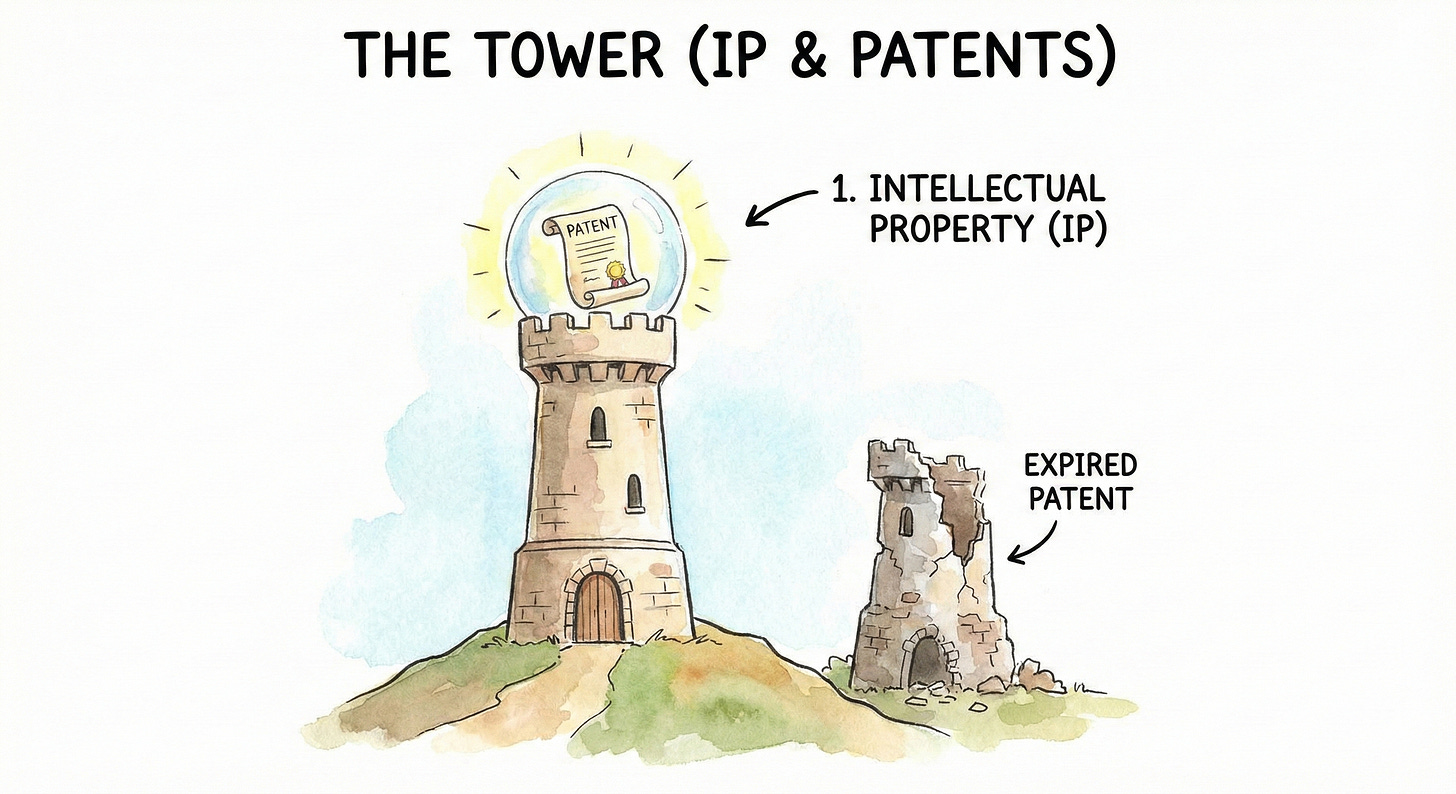

1. The Tower: Intellectual Property (IP & Patents)

Function: Gives you a high vantage point and exclusivity. No one else is allowed to build a tower here.

Status: The weakest defense.

Many investors love patents. “Look! They have a patent on the molecule!” shout the biotech investors.

The problem with The Tower is that it has an expiration date. A patent is just a temporary ceasefire. As soon as the patent expires (The Patent Cliff), generic competitors storm the gates.

Even worse: In the tech world, the ground moves. You might have the tallest tower (best patent) on DVD technology, but that doesn’t help when Netflix changes the landscape to streaming.

Example: Pfizer (PFE). During the pandemic, they minted billions on Paxlovid and vaccines. But patents don’t last forever, and viruses mutate. As soon as the “exclusivity” vanished or the need shifted, revenue plummeted. The Tower offered a great view for a while, but no lasting protection.

Example: GoPro (GPRO). They had the best technology (IP) first. But it is easy to reverse-engineer a camera. Soon, cheap competitors arrived, and GoPro had no real moat to stop them.

IP is great for a sprint, but rarely enough for a marathon.

Even though IP Moat is the weakest of the 4, does not make it useless at all. You can read about Dr. Herbie Wertheim, who turned his working class income into $2.3 billion looking for companies with great patents.

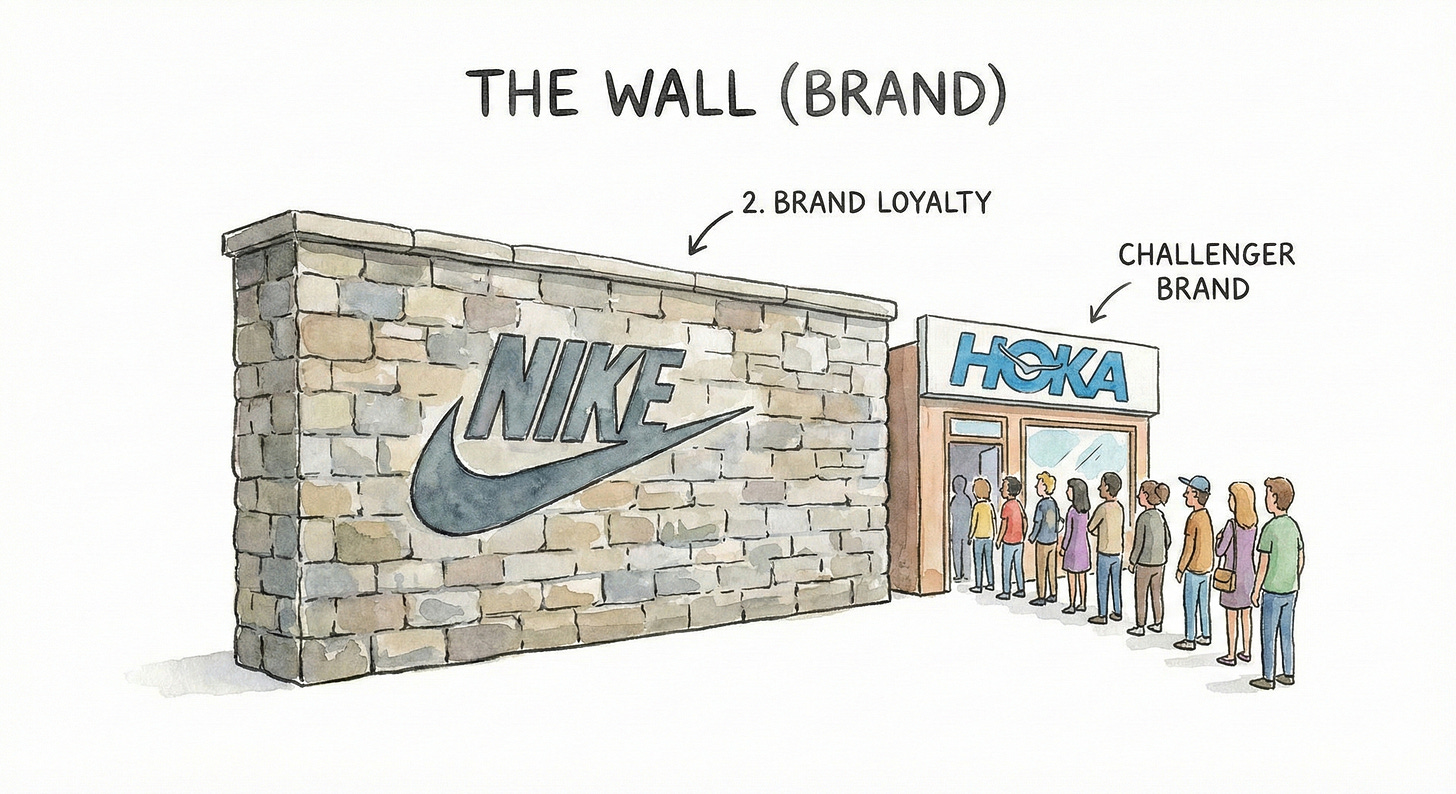

2. The Wall: Brand

Function: Looks impressive. Creates trust. Keeps unknown intruders out.

Status: An illusion that is constantly cracking.

Warren Buffett built his fortune on The Wall. The theory is that humans are creatures of habit who will pay extra for safety and status. But the internet has weakened the walls. Historically, you had to buy Gillette because it was the only razor on the shelf. Today, you can buy “Dollar Shave Club” or a Korean skincare brand that is half the price and twice as good, delivered to your door.

Brand is a “Soft Moat.” It is psychological. And psychology can change fast if the price gap gets wide enough.

Example: Nike (NKE). The world’s strongest sports brand? Maybe. But in recent years, smaller, technically focused brands like Hoka and On Running have stolen massive market share. Nike thought the “Swoosh” logo was enough (The Wall), but customers cared more about comfort. A wall cannot stop innovation.

Example: Starbucks (SBUX). They don’t sell coffee; they sell “The Third Place.” But when inflation hits and competitors sell equally good coffee cheaper and faster, the wall begins to crumble.

A Wall is good, but it cannot stop an army of cheaper, better products.

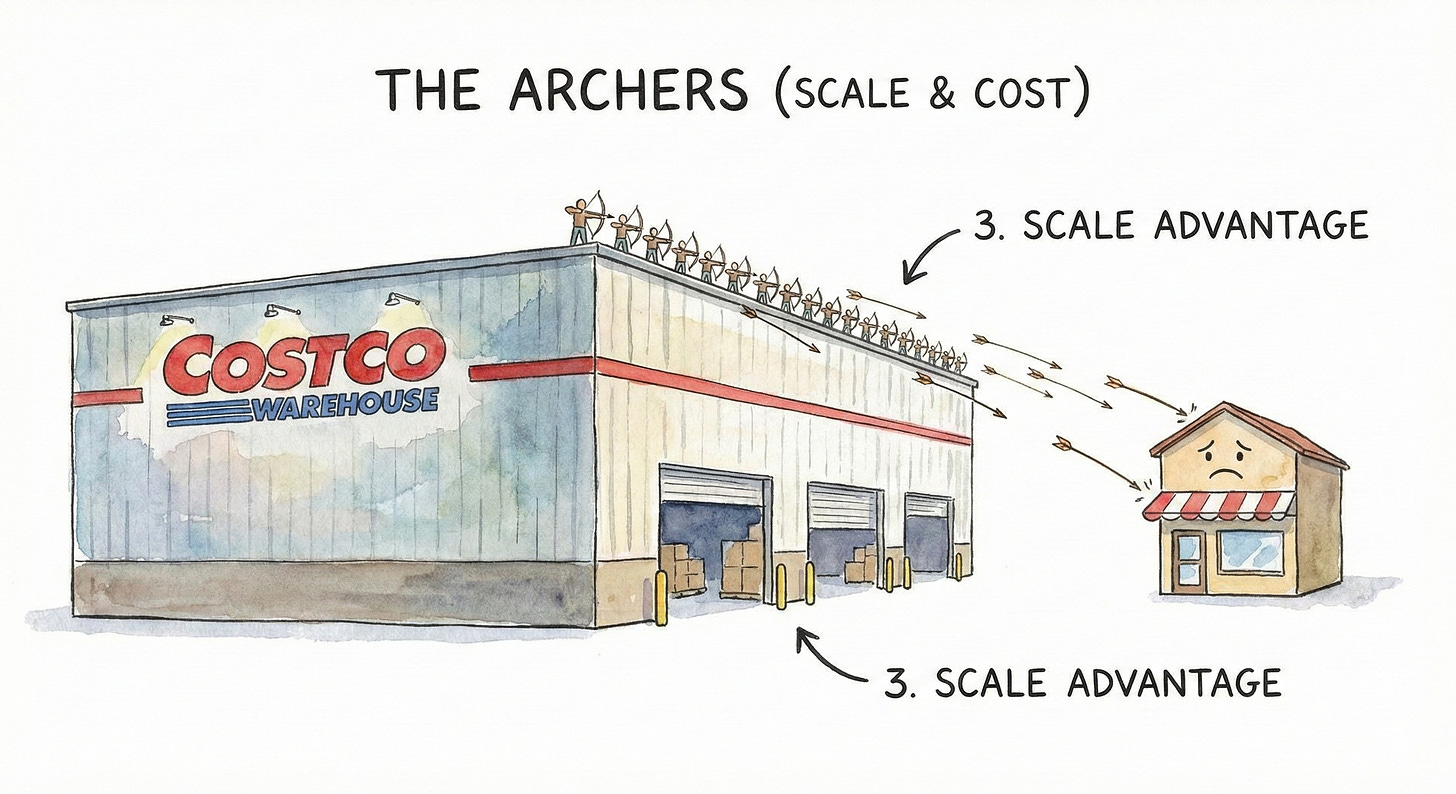

3. The Archers: Scale & Cost Advantage

Function: The offensive defense. You shoot the enemy before they even reach the water.

Status: Brutally effective.

These are companies that weaponize their size. If you are the biggest, you negotiate the lowest prices. If you have the lowest prices, you get more customers. If you get more customers, you get even bigger. It is a virtuous cycle (”Scale Economies Shared”).

Your Archers have a longer range than the enemy’s. If a competitor tries to attack, you lower your prices until they bleed out, while you remain profitable.

Example: Costco (COST). They make almost zero profit on the actual goods they sell. They use their purchasing power to crush prices so low that no one—absolutely no one—can compete with them mathematically. If Amazon tries to attack, Costco lowers prices further.

Example: InPost (INPST). In Poland, they have so many parcel lockers that no competitor can afford to build a rival network. The “Capital Intensity” required to catch up is too high.

This is a “Hard Moat.” It is math, not magic.

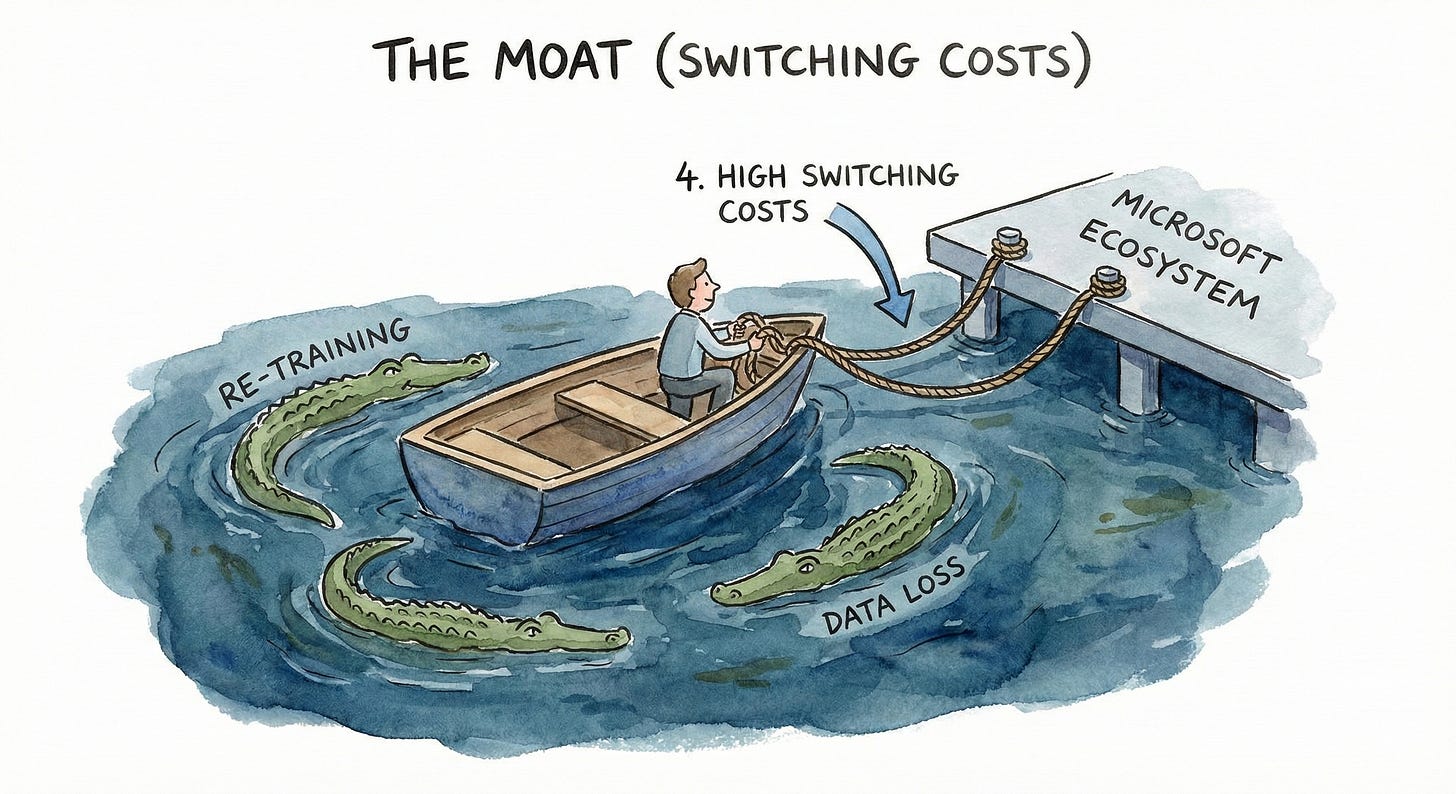

4. The Moat: Switching Costs

Function: The deep water that traps your customers. If they try to leave, they drown (or at least, it hurts a lot).

Status: The Holy Grail. The strongest force in capitalism.

This is my favorite. Switching costs are not about the customer loving the product (like Brand). It is about them fearing the alternative. Pain is a stronger motivator than pleasure.

Example: Microsoft (MSFT). Businesses run on Excel and Outlook. Switching to a different system would require retraining thousands of employees, risking data loss, and halting production for weeks. It simply doesn’t happen. Microsoft can raise prices, and companies will complain, but they will pay.

Example: Intuitive Surgical (ISRG). They make the Da Vinci robots used by surgeons. Surgeons spend years training on this specific machine. Hospitals pay millions for it. Switching vendors means the surgeon has to relearn how to operate. That is the ultimate moat.

Example: Otis (OTIS). Once an elevator is installed in a skyscraper, who do you call for service? Otis. You don’t rip out the elevator shaft to save a few dollars. You are trapped in the building (in a good way for the investor).

Switching Costs give you “Pricing Power.” You can raise prices annually, and the customer stays. That is the definition of a money machine.

You can read more about the Switching Cost Moat in this article.

How to Analyze the Castle

Next time you look at a stock, draw the castle in your head.

Don’t be blinded by The Tower (hype and patents that expire).

Be skeptical of The Wall (legacy brands like Nike that are being challenged).

Look for The Archers (the Costco model that kills competition with volume).

But above all, seek the deep, dark water of The Moat (Microsoft/Otis).

If a company can raise prices without customers leaving (not because they are loyal, but because they are locked in) you have found gold.