The Art of Doing Nothing: A Manifesto for “Sit-On-Your-Ass” Investing

Why the Laziest Investors Often Make the Most Money

There is a famous story about an internal audit conducted by Fidelity Investments. They wanted to know which of their client accounts had the best performance over a long period.

Was it the day traders? The hedge fund managers? The macro-economists?

No. The best performing accounts belonged to two groups of people:

People who had forgotten they had an account.

People who were dead.

Let that sink in. In a world obsessed with speed, algorithms, and 24/7 news cycles, the dead are beating the living.

Why? Because they didn’t sell. They didn’t tinker. They didn’t panic.

They mastered the hardest skill in finance: The Art of Doing Nothing.

The Munger Method: “Sit On Your Ass”

If there is a patron saint of Lazy Investing, it is the late, great Charlie Munger.

While Wall Street glorifies the “hustle”—the guy with six monitors screaming “BUY! SELL! BUY!”—Munger spent his life reading books and waiting.

He famously said:

“The big money is not in the buying and the selling, but in the waiting.”

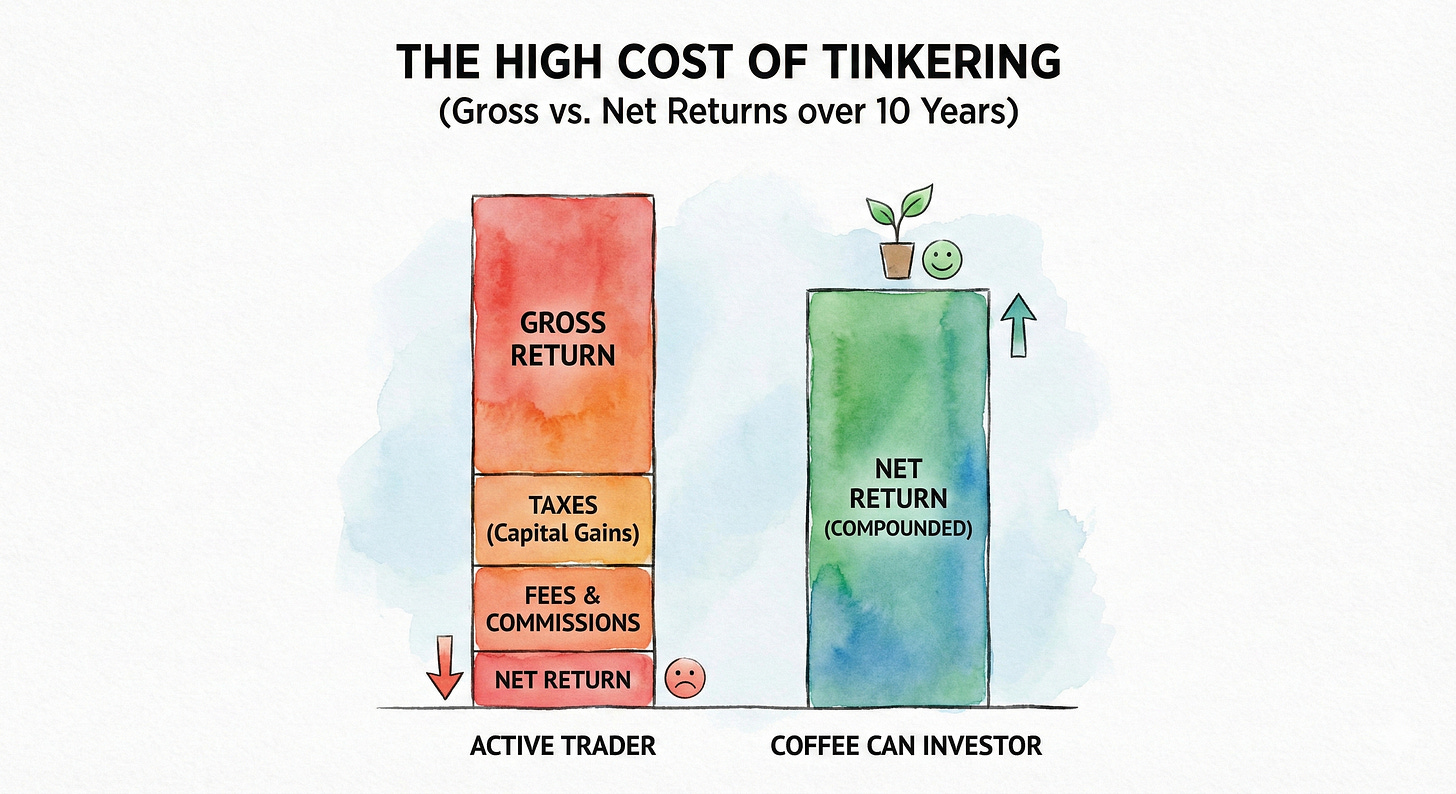

Munger realized early on that activity is the enemy of returns. Every time you trade, you trigger three wealth-killers:

Taxes: The government takes a cut of your compounding machine.

Fees: Even “free” trading has spreads and hidden costs.

Mistakes: The more decisions you make, the more likely you are to make a stupid one.

Munger’s approach was aggressive patience. He called it “Sit-On-Your-Ass Investing.” You do the hard work of finding a great company once, and then you contribute absolutely nothing to the process for the next 20 years except silence.

As he put it:

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

The Concept: Coffee Can Investing

Before Munger, there was Robert Kirby. In 1984, he coined the term “The Coffee Can Portfolio.”

The idea came from the Old West. People would put their valuables in a coffee can and shove it under their mattress for decades. They didn’t take it out to count it. They didn’t trade it for a slightly shinier coin. They let it sit.

In the stock market, the Coffee Can strategy is simple:

Buy a basket of high-quality companies.

Commit to not selling them for 10 years.

Do nothing.

Why Laziness is a Superpower (The Math)

The reason this works isn’t just psychological; it’s mathematical. It comes down to Asymmetry.

If you buy a stock, the most you can lose is 100% (it goes to zero).

The most you can make is Infinite (1,000%, 10,000%, etc.).

When you trade actively, you usually cut your winners (”I made 20%, time to lock it in!”) and keep your losers. You pull the flowers and water the weeds.

When you use the Coffee Can method (or the Munger Method), you are forced to hold your winners. Imagine you bought Amazon in 2005.

The Active Trader sold it in 2006 because it looked “overvalued.” They made 30%.

The Lazy Investor forgot their password. They made 15,000%.

One massive winner like that pays for 50 losers. But you only catch the “100-baggers” if you possess the laziness to let them run.

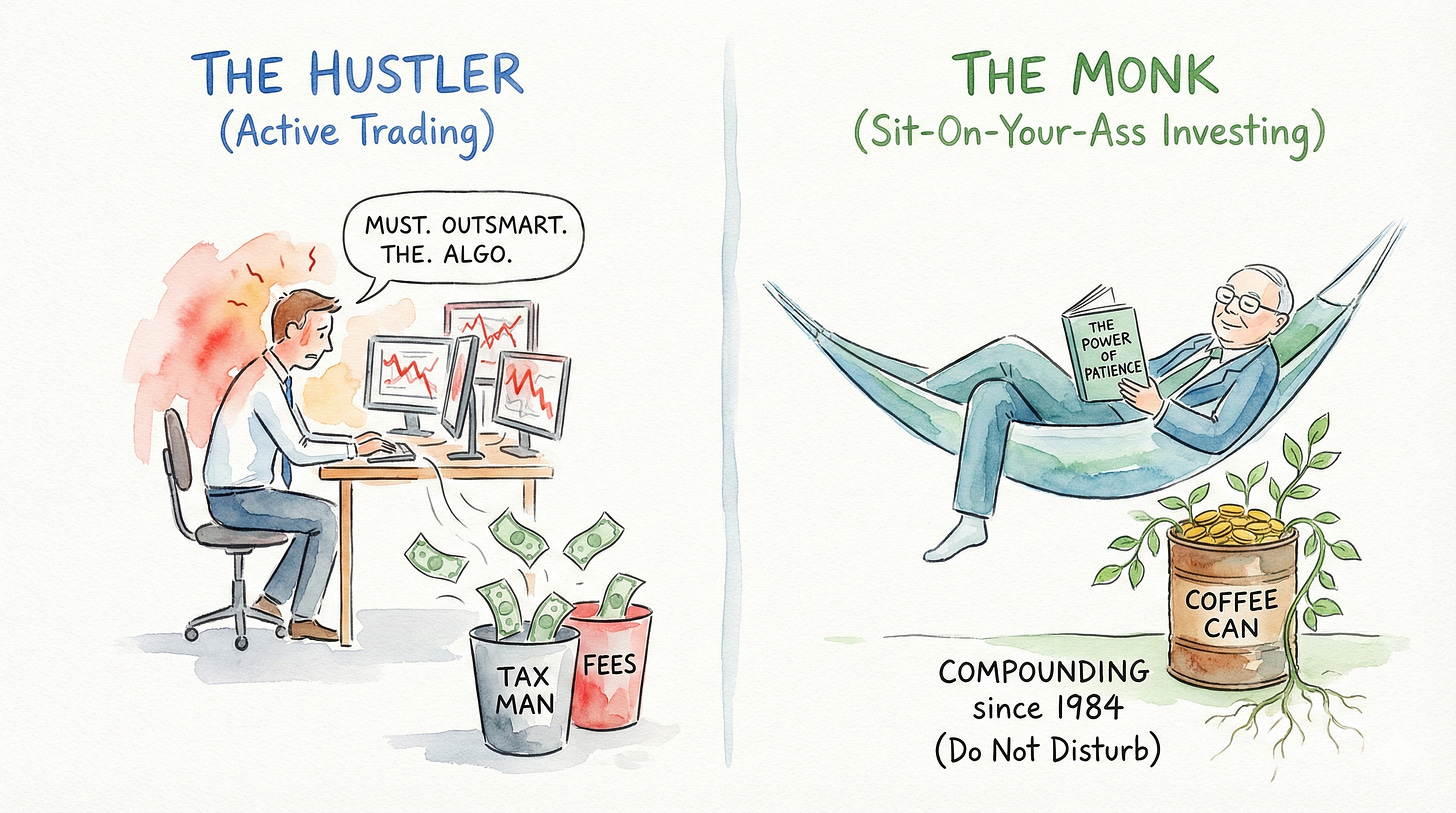

The Visual: The Hustler vs. The Monk

The Hustler/Active trader (Left):

Staring at 6 screens.

High cortisol.

Paying short-term capital gains tax (30%+).

Trying to outsmart high-frequency trading bots.

Result: Likely underperforms the index.

The Monk/Coffee Can investor (Right):

Sitting in a hammock reading a biography of Benjamin Franklin.

Checking the portfolio once a year.

Paying zero taxes (deferred indefinitely).

Letting the CEO of the company do the work.

Result: Compounds wealth efficiently.

How to Practice “Strategic Laziness”

Doing nothing is surprisingly hard. We are wired to act. When the market crashes, our “fight or flight” brain screams “DO SOMETHING!”

Here is how to channel your inner Munger:

1. Be Picky on the Buy

You can’t “sit on your ass” if you buy garbage. You can’t Coffee Can a risky penny stock or a dying retailer. You need Compounders. Companies with:

High Return on Invested Capital (ROIC).

Pricing power (can they raise prices without losing customers?).

A “Moat” (is it hard to compete with them?).

Think Microsoft, Costco, LVMH, or Hermès. Businesses that will likely be bigger in 10 years than they are today.

2. Delete the App

If you have a gambling addiction, you don’t live inside a casino. If you have a trading addiction, get the app off your phone. The less you look at the price, the less likely you are to interrupt the compounding process.

The hardest part of 'doing nothing' is the middle years of a cycle, right before the compounding effect of a Shelby Cullom Davis 'Double Play' begins to accelerate your net worth.

3. Embrace JOMO (The Joy of Missing Out)

Let your friends brag about the quick 50% they made on a crypto-coin. Smile, nod, and go back to doing nothing.

Investing is one of the only areas in life where effort does not equal reward. In fact, effort often correlates with failure.

Charlie Munger didn’t become a billionaire by trading in and out of stocks. He became a billionaire by buying great businesses and then... waiting.

So, take a break. Go for a walk. Read a book. Get wiser. Your portfolio doesn’t need your help today.

You make money by sitting, not trading.