Some companies mine Bitcoin. This company appears to be mining its own shareholders, extracting capital from their wallets with the efficiency of an industrial vacuum cleaner. The revenue chart looks like a rocket launch, but the share count chart looks like a hyperinflationary currency.

The Setup

Welcome to Iren (IREN) (formerly Iris Energy). They are a Bitcoin miner that prides itself on using 100% renewable energy, which is great because their share issuance schedule is creating enough heat to warm the planet on its own. We are looking at their Q1 2026 data (their fiscal calendar is in the future, don’t ask, it’s finance time travel). The numbers are massive, volatile, and confusing—just like the asset they mine.

Balance Sheet (The Geiger Test)

Liquidity Check: Okay, I have to admit, the vault is full.

Cash on Hand: They are sitting on a staggering $1.03 Billion in cash. A year ago, this was $98M. That is a 10x increase in liquidity.

Current Ratio: With $1.1B in Current Assets vs $203M in Current Liabilities, they are liquid enough to swim in.

Total Assets: exploded from $1.3B to $4.3B.

Atomic Take: This is a fortress balance sheet, but it feels like a fortress built on a very specific foundation: selling paper. (See Section 5).

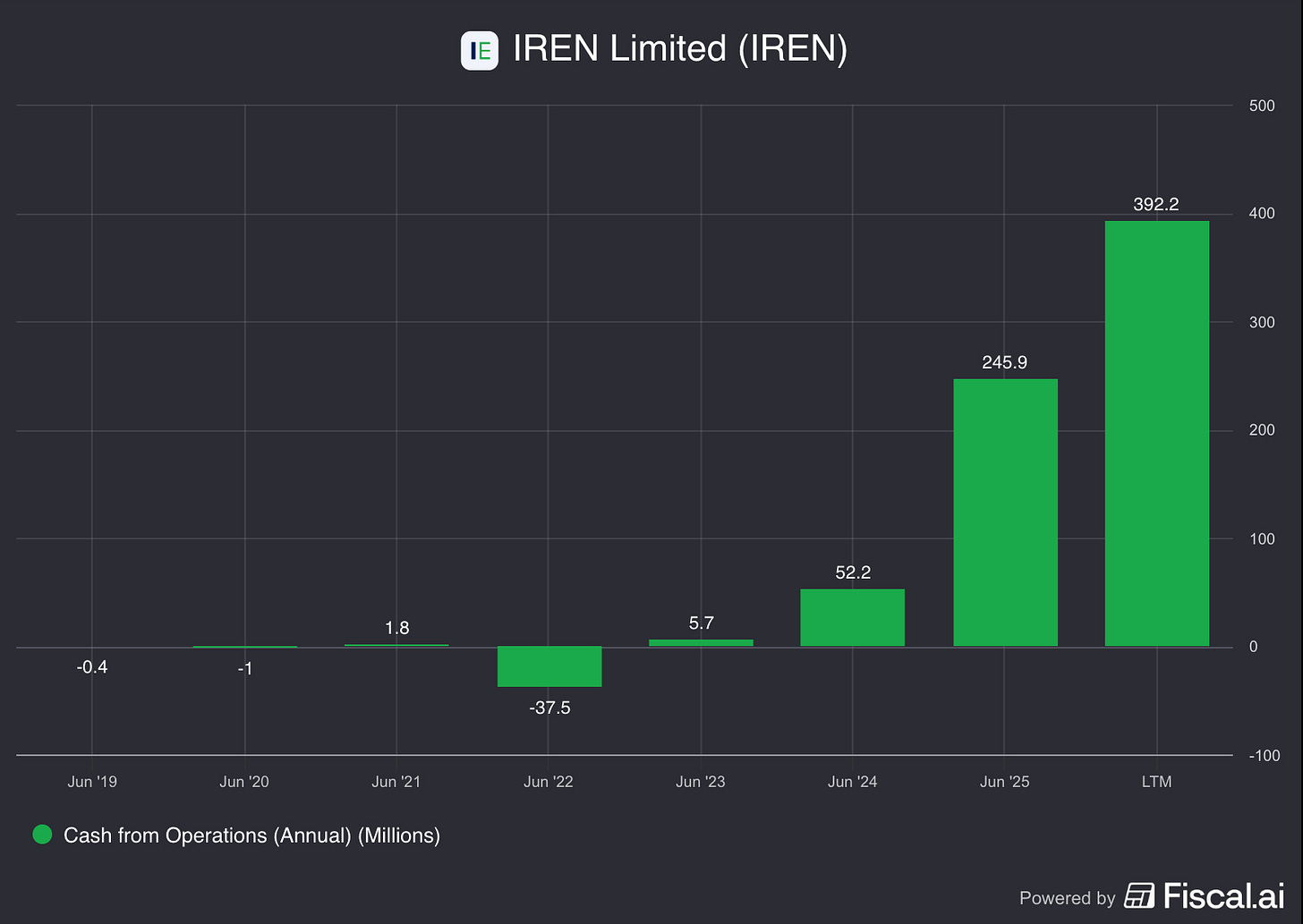

Cash Flow (Energy Output)

Finally, a pulse!

Operating Cash Flow (OCF): For the first time in a while, they are generating serious cash from operations: +$142M in the quarter. This is a massive pivot from the cash burn of previous years.

Free Cash Flow (FCF): Still negative at -$138M. Why? Because they spent $280M on new toys (mining rigs and infrastructure).

Financing: They brought in $606M from financing in a single quarter.

Atomic Take: The core engine is finally running (OCF Positive), but they are addicted to expansion. They are spending every dollar they earn (plus dollars they raise) to build more capacity.

(Iren is capital intensive. If you are looking for other ways to play the AI boom, TSS Inc (TSSI) offers a different risk profile with similar exposure to the infrastructure build-out.)

Share Capital & Insiders (Nucleus Check)

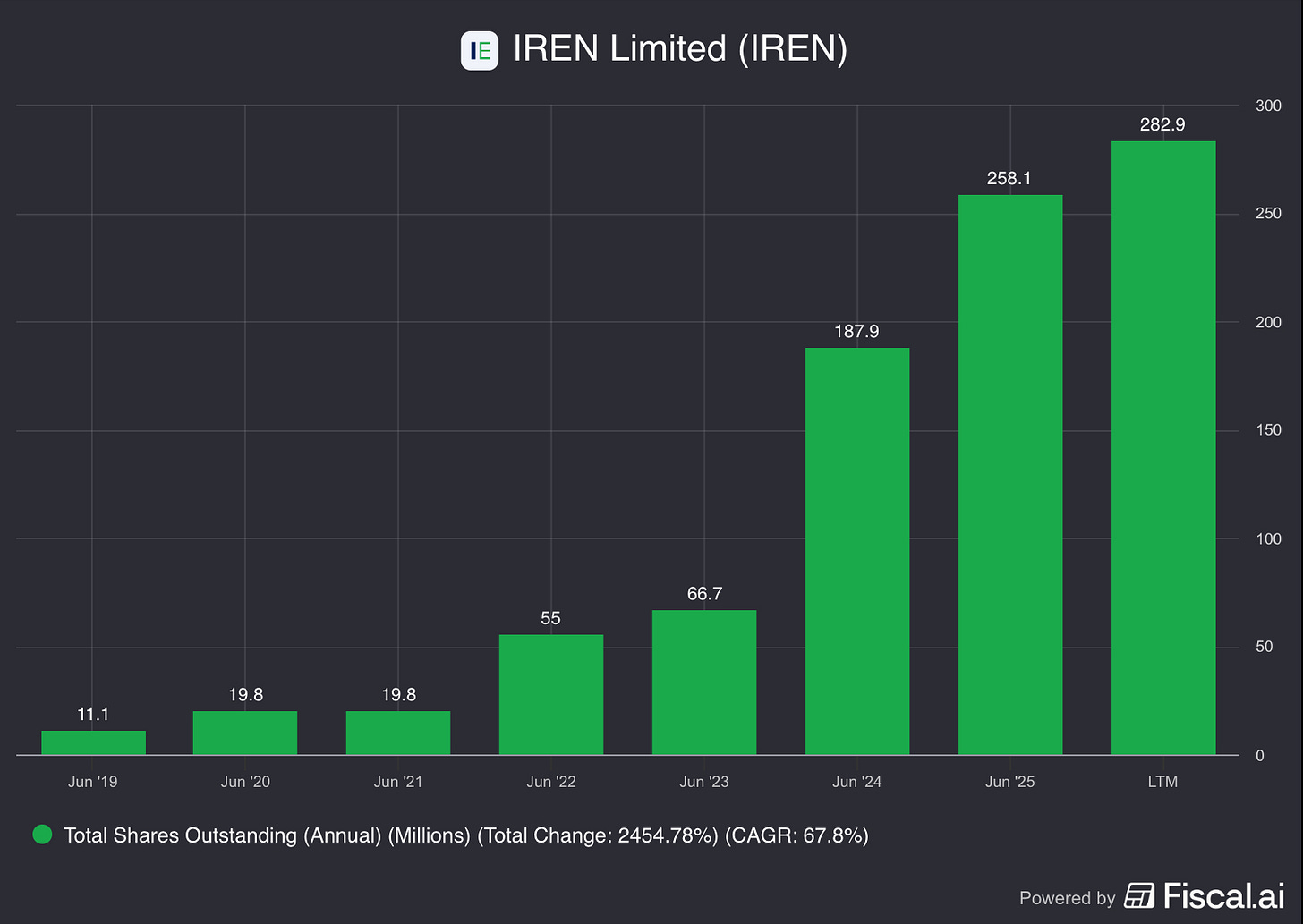

The Dilution Disaster. If you are a long-term holder, look away now. This is gruesome.

Q4 2022 Shares: ~53 Million

Q4 2025 Shares: ~280 Million

The Audit: That is a 5x increase in share count in roughly three years. They have diluted the absolute living daylights out of early investors to fund this growth. That $1B cash pile? It didn’t come from mining Bitcoin; it came from printing stock.

Atomic Take: The nucleus is rapidly expanding, and your ownership percentage is decaying. This is aggressive, unapologetic dilution.

Income Statement (Reaction Chamber)

Revenue:

Q1 2025: $52.7M

Q1 2026: $240.3M Revenue is up ~350%. This is hyper-growth, fueled by more machines and likely a higher BTC price.

Profitability:

Operating Income: Still negative at -$60M. They have high depreciation and operating costs that exceed the raw revenue from mining.

Net Profit: A confusing $575M. Wait, how do you lose $60M on operations and make $575M profit? Crypto Accounting: This is likely a massive “Mark-to-Market” gain on their Bitcoin holdings. If BTC goes up, they book a profit on paper. Do not mistake this for operating efficiency.

Atomic Take: The top line is exploding, but the core operation is still technically operating at a loss before the crypto-asset magic kicks in.

The Atomic Verdict

Iren is a high-speed centrifuge. It is spinning incredibly fast, generating massive revenue growth and hoarding a billion dollars in cash. But the cost of this velocity is your equity. They are financing this empire by selling shares faster than they mine blocks.

If you believe Bitcoin is going to $1M, this is a leveraged bet on that future, backed by a lot of hardware. If you care about “shareholder value” in the traditional sense, the dilution here is a dealbreaker.

Status: RADIOACTIVE ☢️ High growth, high cash, but toxic dilution levels. The balance sheet is safe, but your ownership stake is melting.

Rating: ⭐⭐ (2/5 Stars) (Two stars for the $1B cash pile and revenue growth. Three stars deducted for diluting shareholders 5x in 3 years.)

Disclaimer

The content within Atomic Moat Research is designed to be a “bolt-on” intelligence layer to your own due diligence, not a replacement for it. I conduct these deep dives to decode financial statements and valuation models for the rational retail investor.

Independence: I do not accept compensation of any kind from the companies I review. My research is driven solely by my personal search for high-quality compounders.

Skin in the Game: Unless otherwise stated, assume the author holds long positions in the assets discussed. I invest my own real capital alongside my analysis. This creates a bias you should be aware of. While I strive for institutional-grade depth based on the most recent filings, my opinions are my own. I am not a financial advisor. All readers are encouraged to perform their own due diligence prior to deploying capital.