The Simple Truth: Sea Ltd ($SE)

Three messy businesses, one simple truth. Get the full institutional breakdown of the Shopee-Garena flywheel in just 3 minutes.

I recently published an 18-page deep dive on Sea Ltd ($SE). What follows is a snack-sized 3-minute version of it.

For a long time, this company was a confusing mess of e-commerce, banking, and gaming. Wall Street didn’t know how to price it.

But recently, the numbers have changed. The mess has turned into a machine.

Let’s dive in.

1. The Napkin Pitch

The One-Liner:

Sea Limited is a cash-printing machine disguised as three separate businesses wearing one trench coat—and the market is finally realizing the disguise is the strategy.

The “Back of the Napkin” Thesis:

The “Mess” is Over: Sea used to be the poster child for “profitless tech,” burning cash to chase growth. That era is done. They just posted nearly $900 million in EBITDA and $375 million in real net income in a single quarter.

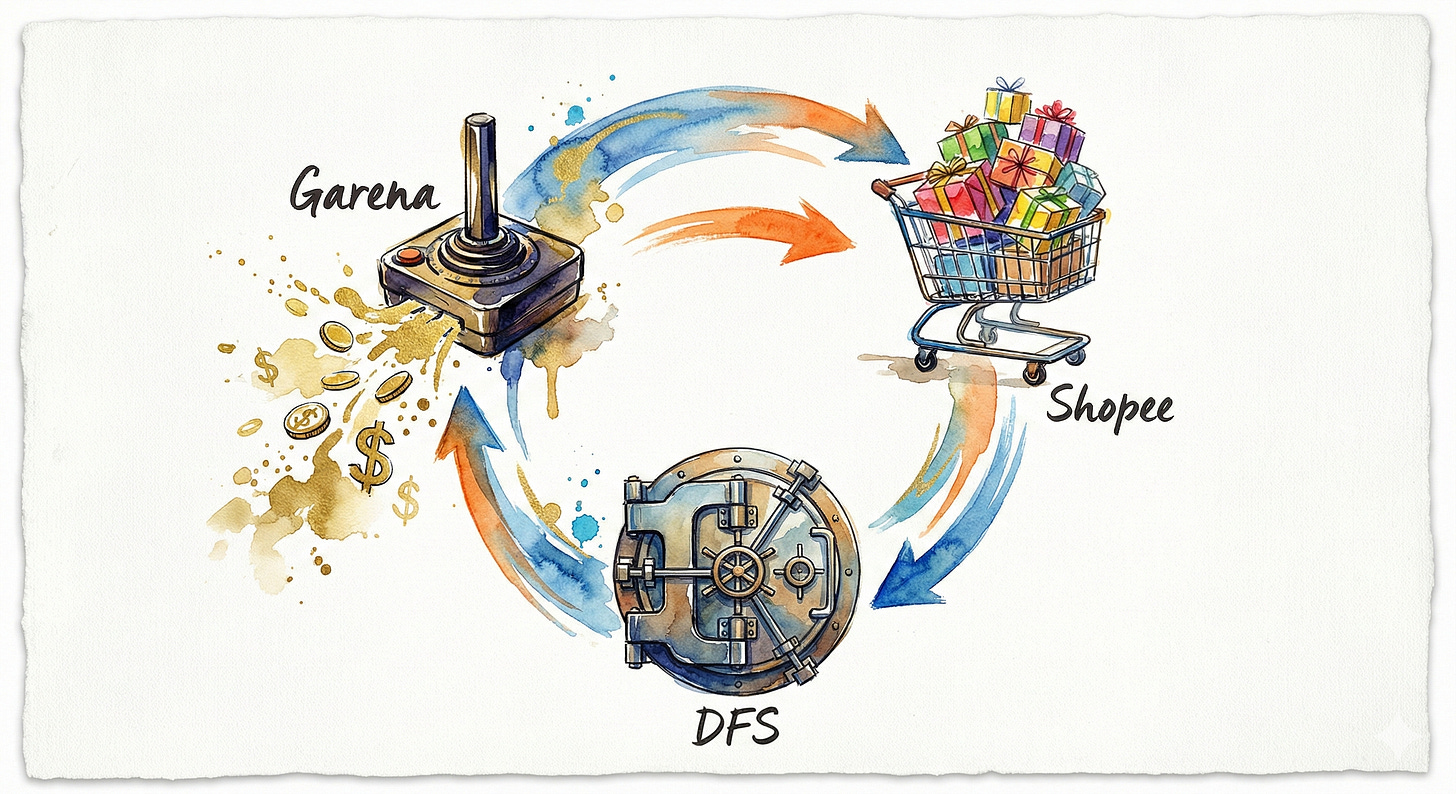

Three Engines, One Car: You aren’t buying one business. You are buying a digital mall (Shopee), a digital bank (DFS/Monee), and a gaming studio (Garena).

The Complexity Tax: Wall Street hates complicated stocks. They treat Sea like a headache because it’s hard to analyze. This creates a discount for investors willing to do the homework.

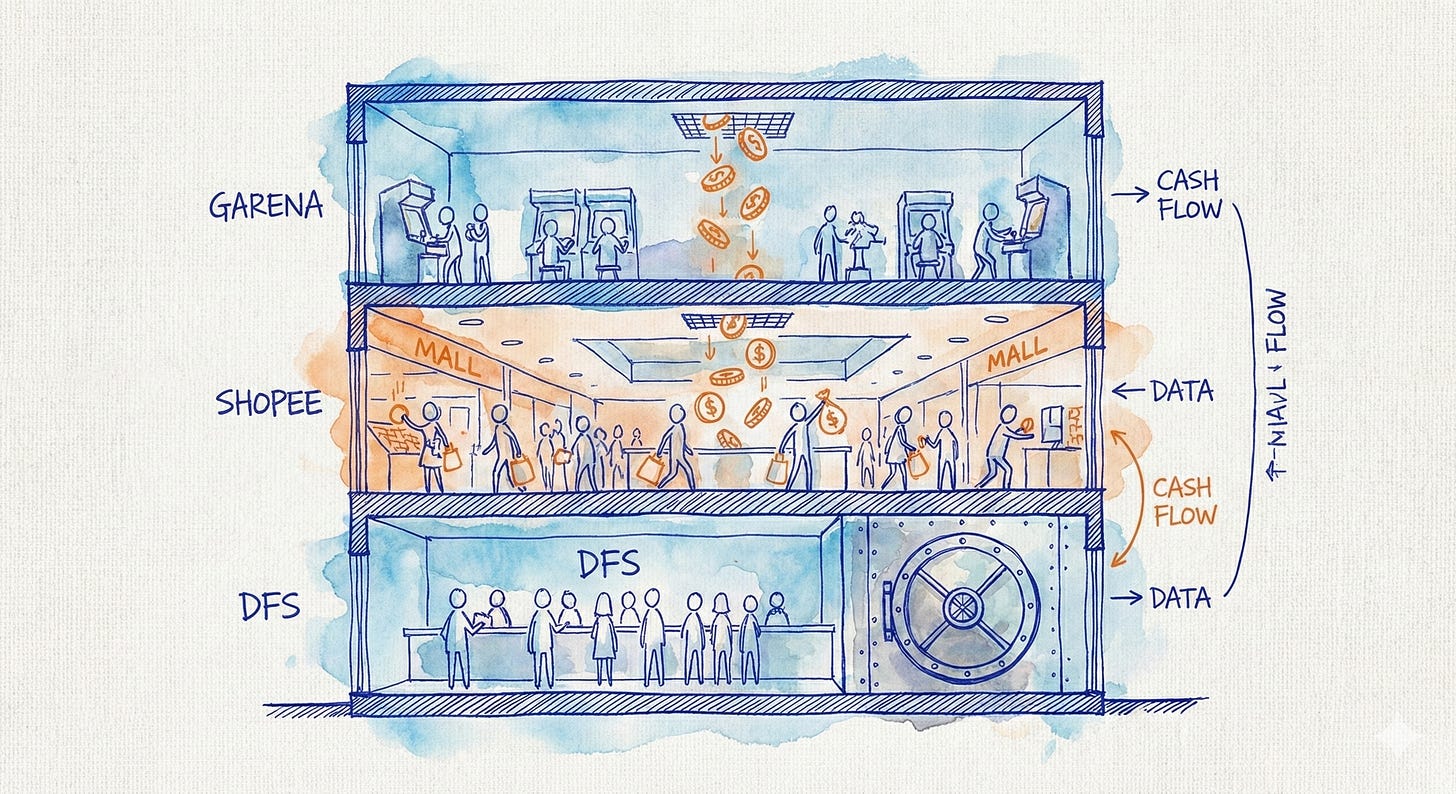

The Secret Sauce: The complexity isn’t a bug; it’s the moat. The game studio prints cash to fund the mall; the mall brings the people; the bank lends money to the people.

2. Business Model

To understand Sea, imagine a giant building with three distinct floors. Here is how cash enters each one:

Floor 1: The Shopping Mall (Shopee)

What they sell: Everything. It’s a massive online marketplace, similar to Amazon or Alibaba, for Southeast Asia and Brazil.

The Customer: Millions of daily shoppers. In Q3, they processed 3.6 billion orders.

How they make money: They charge a “take rate” (a tax) on every transaction and sell advertising slots to sellers. They successfully raised their ad revenue by over 70% this year, proving sellers are willing to pay up to reach you.

Floor 2: The Bank (DFS / Monee)

What they sell: Money. They offer loans to the shoppers and sellers on Shopee.

The Customer: Consumers and small businesses who need cash.

How they make money: Interest. They have a loan book of $7.9 billion. As long as people pay them back, this is a quiet gold mine.

Floor 3: The Arcade (Garena)

What they sell: Digital fun (specifically mobile games like Free Fire).

The Customer: Gamers who pay real money for digital skins, weapons, and season passes.

How they make money: Pure cash flow. They brought in $840.7 million in bookings this quarter. This is the “cash cannon” that funds the battles on the other two floors.

3. The Moat (Why They Win)

Why can’t a competitor just steal their customers?

The Ecosystem Lock: Sea has built a self-feeding system. Shopee builds the traffic density. DFS uses that shopper data to lend money safely (they know if you pay your bills). Garena provides the raw cash to fund it all. It is very hard for a competitor to replicate all three engines at once.

The “Boring” Bank Advantage: While many digital banks blow up by lending to risky borrowers, Sea has kept their “Non-Performing Loans” (bad debt) at a remarkably low 1.1%. In banking, boring is beautiful.

Monetization Power: They are currently subsidizing shipping (paying for your delivery) to keep you happy, but they are making it back on ads. The fact that ad revenue is growing faster than costs proves the “Tax” they charge is sticky.

4. The Price Tag (Valuation)

Is the stock cheap? It depends on which metric you trust. You are paying a premium price tag for a high-growth engine.

The Sticker Price (Market Cap): ~$75.5 Billion

1. Run-Rate P/E: ~50x

The Number: ~50 Years to Break Even.

Translation: If the company never grows another dime, it would take 50 years of current earnings to pay back your purchase price. You are betting heavily on growth here.

2. EV / EBITDA: ~22x

The Number: ~22 Years (Adjusted).

Translation: If you accept their definition of profit (ignoring some non-cash costs like stock compensation), the price drops to 22x earnings. This is the “optimistic” view.

3. P/FCF (Price to Free Cash Flow): ~17.7x

The Number: ~18 Years of Cash.

Translation: This is the most interesting metric. The business generates massive cash ($3.5B operating cash flow in 9 months). If you annualize that and subtract the small amount they spend on equipment (Capex), the business is actually printing cash very efficiently.

4. FCF Yield: ~5.6%

The Number: The “Interest Rate.”

Translation: If you bought the whole company today, this is the cash return you’d get annually (based on annualized estimates). Compare this to a savings account (4-5%). It’s actually quite healthy for a high-growth tech stock.

The Verdict: You are buying a luxury vehicle, not a used sedan. The P/E of 50x looks expensive, but the Free Cash Flow (P/FCF of ~17.7x) tells a different story: this business generates a massive amount of cash, but they are currently choosing to reinvest it into their loan book rather than showing it as “profit.”

5. The Money (Financial Health)

Profitability: The Switch Has Flipped

Sea has stopped “lighting money on fire.”

Revenue: $5.98 billion.

Real Profit (Operating Income): $475.9 million.

Bottom Line (Net Income): $375.0 million.

They have proven the model works even while fighting off competitors.

The Balance Sheet: Strong but Complex

They report about $5 billion in liquidity (cash + restricted cash).

The Catch: Because they run a bank, they have “plumbing” liabilities. They hold $3.48 billion in customer deposits and $2.77 billion in escrow. This means they are solvent, but you can’t treat their cash pile like a piggy bank—a lot of it belongs to their depositors.

Cash Flow: The Turbine is Spinning

They generated $3.5 billion in operating cash flow in the first 9 months of the year.

Where did it go? It looks like they spent it, but not on fancy offices. They put $3.3 billion into “loans receivable”.

Translation: They are taking their cash and lending it out to customers to make more money. This is inventory for a bank, not wasted spending. The turbine is working perfectly.

6. Skin in the Game (Management)

The Drivers:

Management has shifted gears from “growth at all costs” to “sustainable profit.”

The Discipline: They explicitly allowed “value-added services” revenue (logistics) to decline year-over-year because they increased shipping subsidies to drive volume.

Why this is smart: They took a short-term hit to revenue optics to boost the long-term health of the ecosystem. At the same time, they grew high-margin ad revenue by 70%. This is a sophisticated maneuver, not a panic move.

This is a “High Conviction” setup because the management team is finally putting numbers on the scoreboard that silence the critics. They have kept the bank’s risk incredibly low (1.1% bad loans) despite growing the loan book to nearly $8 billion, proving they aren’t getting reckless just to show growth.

7. The Bear Case (Risks)

The Kill Switch: Bad Loans (Credit Blowup)

This is the biggest risk. Sea is now a bank. If a recession hits and people stop paying back their loans, that low 1.1% bad loan rate could spike.

The Danger: If the “bad loan” ratio jumps to 3% or 4%, the market will stop treating Sea like a tech company and start pricing it like a failing subprime lender. The stock price would collapse.

The Worry List:

Subsidy Addiction: Shopee is currently “eating” shipping costs to keep customers happy. If they try to stop these subsidies and customers leave for a competitor (like TikTok or Temu), the mall empties out.

Garena Fatigue: The gaming business is volatile. It’s currently having a great run (”Best quarter since 2021”), but games can fade. If gamers get bored, the “cash cannon” that funds the whole company runs dry.

The “Accounting Gap”: There is a massive difference between their Operating Income ($476M) and their Adjusted EBITDA ($874M). That ~$400M gap consists of real costs like stock-based compensation. Skeptics argue the “adjusted” number is fake profit.

8. The Summary

I like this stock because the “complexity discount” is real. The market is scared of the moving parts, but the parts are finally working in harmony. You have a dominant e-commerce platform, a disciplined bank, and a profitable gaming studio all feeding each other. As long as the loan book stays “boring” and safe, this is a compounding machine.

There is a critical nuance in the Cash Flow Statement regarding “Investment Outflows.” Most investors see negative investing cash flow and panic, thinking it’s heavy Capex (spending on factories/machines).

In Sea’s case, nearly all of that outflow is Capital Allocation into Loans ($3.3B). They aren’t burning cash; they are investing in their own inventory. If you miss this detail, you will think the company is bleeding money when it is actually building assets.

This was just the appetizer. For the full breakdown of how Sea’s “Optics Bruise” strategy is actually a genius move for long-term monetization, read the full deep dive here.

Do you enjoy complex Deep Dives distilled into a simple 3-minute read? ⏳

Do a friend (and me) a huge favor: Forward this to a busy investor who values quality over quantity.

Disclaimer:

I Am Not Your Financial Advisor: I am a researcher sharing my homework, not a wealth manager giving you a plan. This is for education, not a recommendation to buy or sell.

I Am Biased: $SE is one of the largest positions in my personal portfolio. I have skin in the game and I want this company to win. Read this with that in mind.

The Golden Rule: It is your money. Do your own due diligence, read the actual filings, and never invest money you cannot afford to lose.