Would Peter Lynch Buy Evolution AB Today?

Wall Street hates the current narrative, but Peter Lynch built his career buying 'scary' stories with pristine balance sheets. Does this 10x P/E casino giant pass the Magellan test?

New to The Atomic Moat? This Titan Test of Evolution ($EVO $EVVTY) is a prime example of how we dissect high-quality compounders. If you want these ‘Titan Tests’ sent to your inbox, join 900+ other investors below.

There is a prevalent myth in modern finance that to beat the market, you need a Bloomberg terminal, an algorithm derived from quantum physics, and a direct line to a Swiss banker.

Peter Lynch, the man who ran the Fidelity Magellan Fund from 1977 to 1990, dispelled this myth with a simple, devastating track record. He didn’t use supercomputers. He used common sense, sixth-grade math, and a spiral-bound notebook.

During his tenure, Lynch compounded capital at 29.2% annually. To put that in perspective: if you had invested $10,000 with him on day one, you would have walked away with nearly $280,000 thirteen years later. He did this by ignoring macroeconomic noise and focusing entirely on the specific “story” of the company in front of him.

Today, we are taking the “Lynch Lens”—specifically his “Growth at a Reasonable Price” (GARP) framework—and applying it to Evolution AB ($EVO).

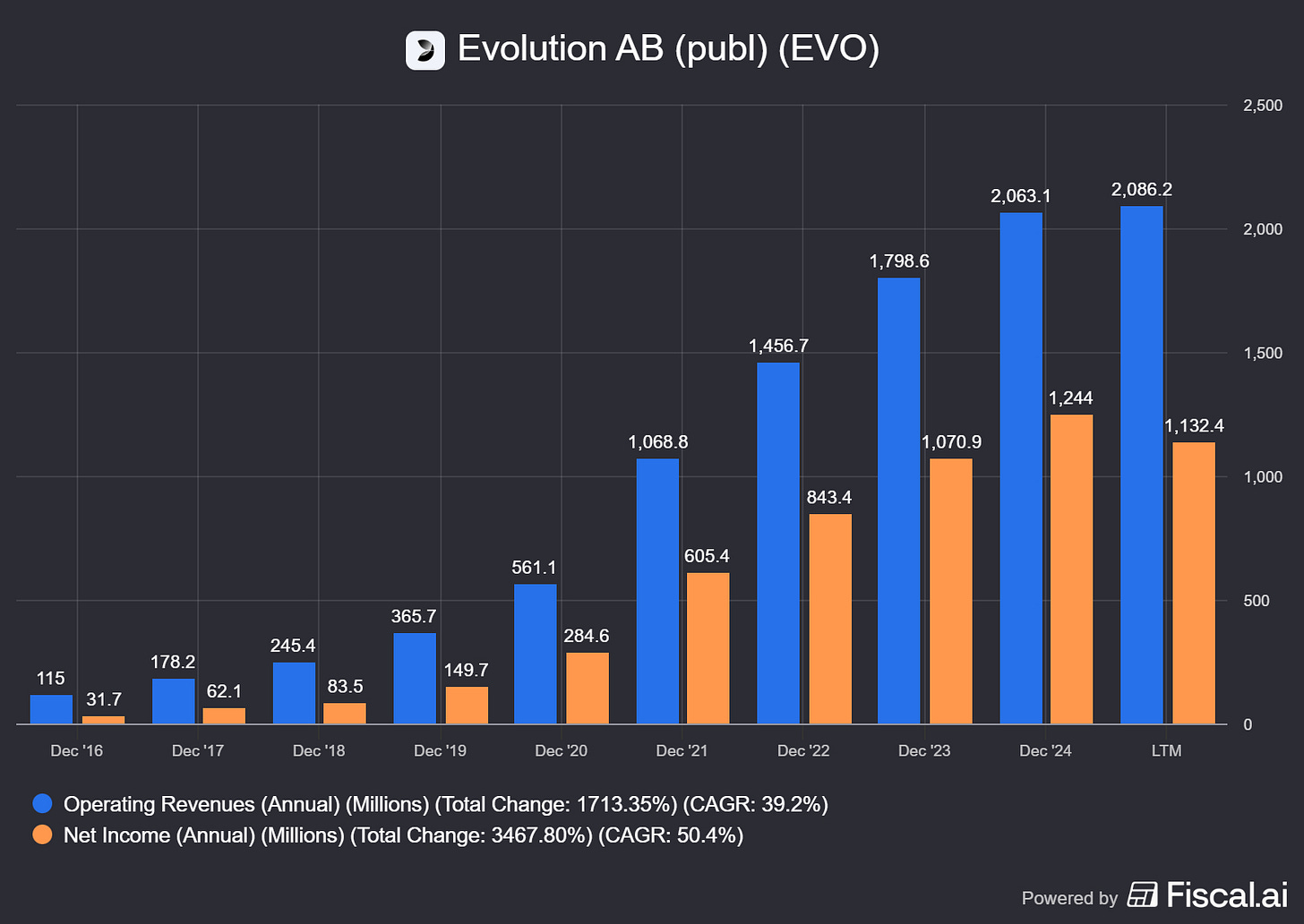

Evolution is a company that creates the digital infrastructure for online casinos. It is profitable, it is cash-rich, and it is currently suffering from a narrative crisis regarding growth in Asia.

The question we must answer is simple: Would Peter Lynch see a “Tenbagger” in disguise, or a “Fast Grower” that has run out of steam?

Disclaimer: I own shares in Evolution at the time of writing.

Part I: The Category Check

“Know what you own, and know why you own it.”

Before looking at a single number, Lynch insisted on categorizing a stock. He posited that you cannot judge a utility company by the same standards as a biotech startup. He offered six categories. Evolution AB sits precariously between two of them.

The “Fast Grower” Argument:

For years, Evolution was the quintessential Fast Grower—Lynch’s favorite category. These are small to mid-sized aggressive enterprises growing earnings at 20-25% a year. Lynch notes that you buy these for the explosion in earnings, but you must watch them like a hawk for the moment that growth decelerates.

The “Stalwart” Argument:

Looking at the Q3 2025 data, Evolution is showing signs of maturing into a “Stalwart.”

Net Revenue: €507.1m (Down 2.4% reported; +3.9% constant currency).

Adjusted EBITDA Margin: 66.4%.

Lynch defined Stalwarts as large, solid companies with 10-12% earnings growth. They are the “Old Faithfuls.” They won’t make you rich overnight, but they offer protection during recessions.

The Lynch Analysis:

Lynch would look at the 3.9% constant currency growth and immediately strip Evolution of its “Fast Grower” badge. A company growing at barely 4% is not a growth stock; it is a mature industrial paying a dividend.

However, he would be intrigued by the margin. A 66.4% EBITDA margin is an anomaly. Lynch loved companies with a niche that was difficult to replicate. Evolution supplies the live dealers, the studios, and the tech to operators who cannot afford to build it themselves.

The Lynch Question: “Is this a Fast Grower having a bad quarter, or a Stalwart that is priced like a Fast Grower?”

If the market is still pricing $EVO as if it will grow 20% forever, Lynch would walk away. But if the market has punished the stock enough to price it as a “Slow Grower,” he would open the balance sheet.

Part II: The Balance Sheet Test

“The balance sheet is the only lie detector on Wall Street.”

Peter Lynch had a profound distaste for bank debt. He famously said, “It’s very hard to go bankrupt if you don’t have any debt.”

When analyzing a company, Lynch looked for a specific metric: Net Cash per Share. He wanted to see a pile of cash that exceeded the long-term debt, which he viewed as a “hidden rebate” on the stock price.

Let us run the “Geiger Test” on Evolution’s Q3 2025 balance sheet through Lynch’s eyes:

Cash & Equivalents: €656.4m

Bond Portfolio: €103.2m

Total Liquidity: ~€759.6m

Long-Term Debt: The analysis indicates a bond portfolio, but explicitly mentions the company is “cash-rich” with no alarming debt figures cited in the summary.

The Lynch Verdict on Solvency:

Evolution passes the solvency test with flying colors. Lynch would love the Equity/Assets ratio of 73.8%. This suggests a conservative management team that isn’t leveraging the farm to chase growth.

However, Lynch would pause at one line item: Goodwill.

Goodwill: €2,336.2m

Total Equity: €3,819.6m

Goodwill makes up over 60% of the company’s equity. Lynch was generally skeptical of serial acquirers who padded their books with “Goodwill” (the premium paid for an acquisition). He preferred organic growth. He would view this €2.3bn as “soft assets”—if the acquisitions don’t perform, that equity evaporates in a writedown.

The Capital Allocation Check:

Lynch loved companies that bought back their own shares—but only if they did it cheaply.

Buybacks (9M 2025): €406.5m

Dividends (9M 2025): €572.5m

Evolution is returning nearly €1 billion to shareholders in nine months. Lynch would classify this behavior as typical of a “Stalwart.” A Fast Grower should be reinvesting every penny into expansion. The fact that Evolution is handing cash back suggests they may not have enough high-return places to deploy capital internally. This reinforces the “maturing company” thesis.

Part III: The PEG Ratio & The Valuation

“If you can’t explain it to a 10-year-old in two minutes, don’t own it.”

This is where the rubber meets the road. Lynch popularized the PEG Ratio (Price/Earnings to Growth) to find bargains.

The Numbers (as of January 2026):

Share Price: 620 SEK (Stockholm) or $67.45 (ADR).

Earnings (EPS): With Q3 EPS at €1.25, we can estimate an annualized EPS of roughly €5.00.

Currency Check: At current exchange rates (~11.6 SEK/EUR), €5.00 is roughly 58 SEK.

The P/E Ratio: 10.7x.

The Lynch Verdict on Valuation:

A P/E of roughly 11x is undeniably cheap for a company with 66% margins. The market is pricing Evolution like a dying newspaper business.

However, the “G” (Growth) is the problem.

Current Growth: ~4% (Constant Currency).

The PEG Calculation: 2.6.

The Logic:

Even at a rock-bottom P/E of 11, the stock is still expensive if it only grows at 4%. A PEG of 2.6 is typically considered overvalued in Lynch’s book.

However, this creates the asymmetry Lynch loved. If Evolution solves the Asian cyber-issue and growth returns to just 15%:

New PEG Calculation if this happens: 0.7.

A PEG of 0.7 suggests the stock is undervalued relative to its growth. The entire investment thesis rests on this pivot.

The “Diworsification” or “Distraction” Factor:

Lynch often warned about “The Whisper Stock” or distractions. For Evolution, the distraction is Asia.

The Fact: Asia revenue is down (or flat at €189.1m) due to “cybercriminality.”

Lynch’s Take: He would be highly skeptical of an external excuse like “cybercrime” lasting more than a quarter. He preferred simple businesses. Selling casino games is simple. Fighting a cyber-war in unregulated Asian markets is complex.

The Verdict:

So, would the sage of the Magellan Fund buy Evolution AB today at 620 SEK?

We must separate the company from the stock.

As a company, Evolution is a fortress. It has Lynch’s favorite traits: a high profit margin (66%), a strong net cash position, and a product that is habit-forming for its customers (casinos).

However, as a stock investment under the GARP framework, it sits in “Purgatory.”

The Decision: WAIT (Watchlist)

Lynch would likely not buy Evolution AB at 620 SEK today for the “Fast Grower” bucket, because the growth has temporarily evaporated. He would not buy it for the “Asset Play” bucket, because too much asset value is tied up in Goodwill.

He might, however, keep it at the very top of his watchlist for one specific trigger: The return of earnings growth to the 15%+ range.

Lynch was never afraid to pay up for quality, but he demanded the “G” in GARP. Until Evolution proves that the Asian “cyber drag” is solved and growth re-accelerates, the math of the PEG ratio simply doesn’t work—even at 11x earnings.

Lynch famously said, “People lose more money waiting for corrections than in the corrections themselves.” Conversely, in this case, waiting for clarity on the Asian market isn’t market timing—it’s verifying the business model.

My personal assessment aligns with the Lynch framework: Evolution is a Stalwart currently being audited by the market. If the growth engine reignites, it becomes a “Tenbagger” candidate again. Until then, enjoy the dividend, but do not expect a rocket ship.

The Editor’s Note: Why I Am Buying When Lynch Says “Wait”

You might notice a contradiction here. The Lynch Test concludes with a “Wait” rating because the growth rate has temporarily stalled, yet I disclosed that I own shares.

Why am I deviating from the master?

Because Lynch’s “PEG Ratio” is a backward-looking metric, but investing is a forward-looking art. The math says Evolution is expensive relative to its current 4% growth. But my thesis is that the “Asian cyber drag” is a solvable operational headache, not a terminal cancer.

I am betting that the 4% growth is the floor, not the ceiling. You can read more about my take on Evolution here.

When you can buy a monopoly-like business with 66% margins at a P/E of 10x, you don’t need “Tenbagger” growth to make money—you just need the business not to implode. I view the current price as a “mispriced option.” If growth stays low, I collect a healthy yield from a cash machine. If growth returns to 15%? I am holding a quality company bought at a garage sale price.

— Rob H.

Disclaimer & Disclosure

The “Atomic Moat” Standard The content provided in “The Titan Test” is designed to be a bolt-on intelligence layer to your own due diligence process, not a replacement for it. This analysis uses historical frameworks (like Peter Lynch’s) to stress-test modern companies; it is not a crystal ball.

Positions At the time of writing, the author of this report holds a long position in Evolution AB ($EVO). This creates an inherent bias in favor of the company’s success, which readers should weigh against the arguments presented.

No Advice I am not a financial advisor, and this is not financial advice. All investment strategies and investments involve risk of loss. Nothing contained in this newsletter should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Independence The Atomic Moat does not accept compensation from the companies we analyze. We answer only to the truth of the balance sheet.

Excellent write up - loved the creativity in approach along with solid analysis. I'm a fellow shareholder!

Interesting post. I literally just commented about sin stocks on @Eugene Ng's note 10 mins ago. There are always better opportunities out there but it's certainly an interesting case study.