Would Shelby Davis Buy Kinsale Today?

If Shelby Davis looked at Kinsale Capital today, he would love the plumbing but he would worry about the neighborhood, the softening property cycle.

New to The Atomic Moat? This Titan Test of Kinsale ($KNSL) is a prime example of how we dissect high-quality compounders. If you want these ‘Titan Tests’ sent to your inbox, join 900+ other investors below.

I’ve always had a fascination with insurance. As far as I know, it is the only business model on earth where the customer hands you the cash before you even manufacture the product.

Everyone knows the Warren Buffett story: the textile mill that morphed into a float-eating dragon. But the real purists worship at the altar of Shelby Davis.

Davis wasn’t a conglomerate builder; he was a sniper. He took $50,000 in 1947 and turned it into $900 million by the time he died in 1994. His strategy wasn’t complex: buy boring, invisible insurers with disciplined underwriting, then let the float do the heavy lifting for 47 years.

(If you want to learn more about Shelby Cullom Davis, read this in-depth article about him, where I go through his strategy, bio and philosophy)

He didn’t get rich chasing tech or timing oil. He got rich because he understood that a well-run insurer isn’t a casino: it’s a toll booth.

My question today is: Is Kinsale just another stock, or is it the kind of toll booth Shelby Davis would have mortgaged his house to buy?

Well, let’s check!

First, a little bit about the company:

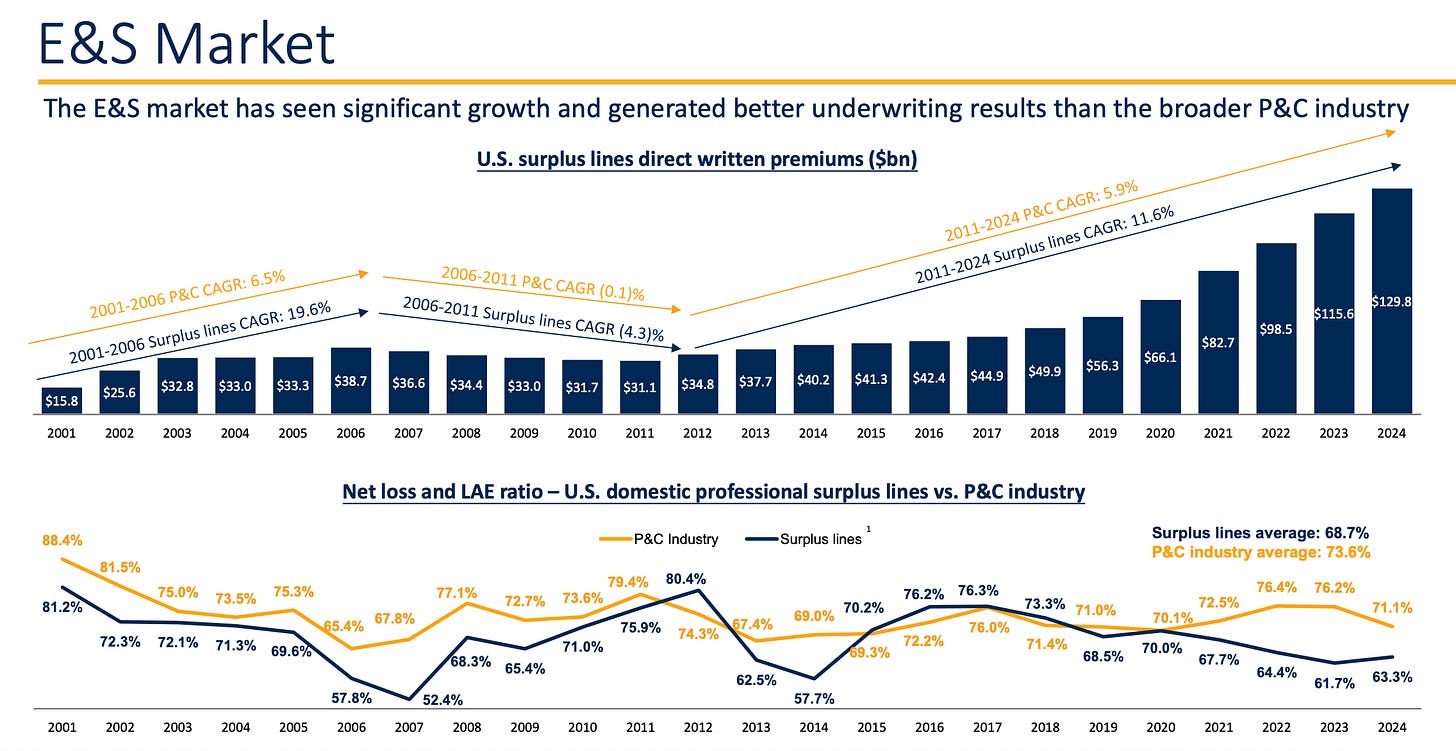

Kinsale plays in the Excess & Surplus (E&S) sandbox. In plain English: they insure the risks the standard carriers are too scared to touch. The axe-throwing bars, the cannabis dispensaries, the small construction outfits with spotty records.

Most insurers treat these risks like toxic waste.

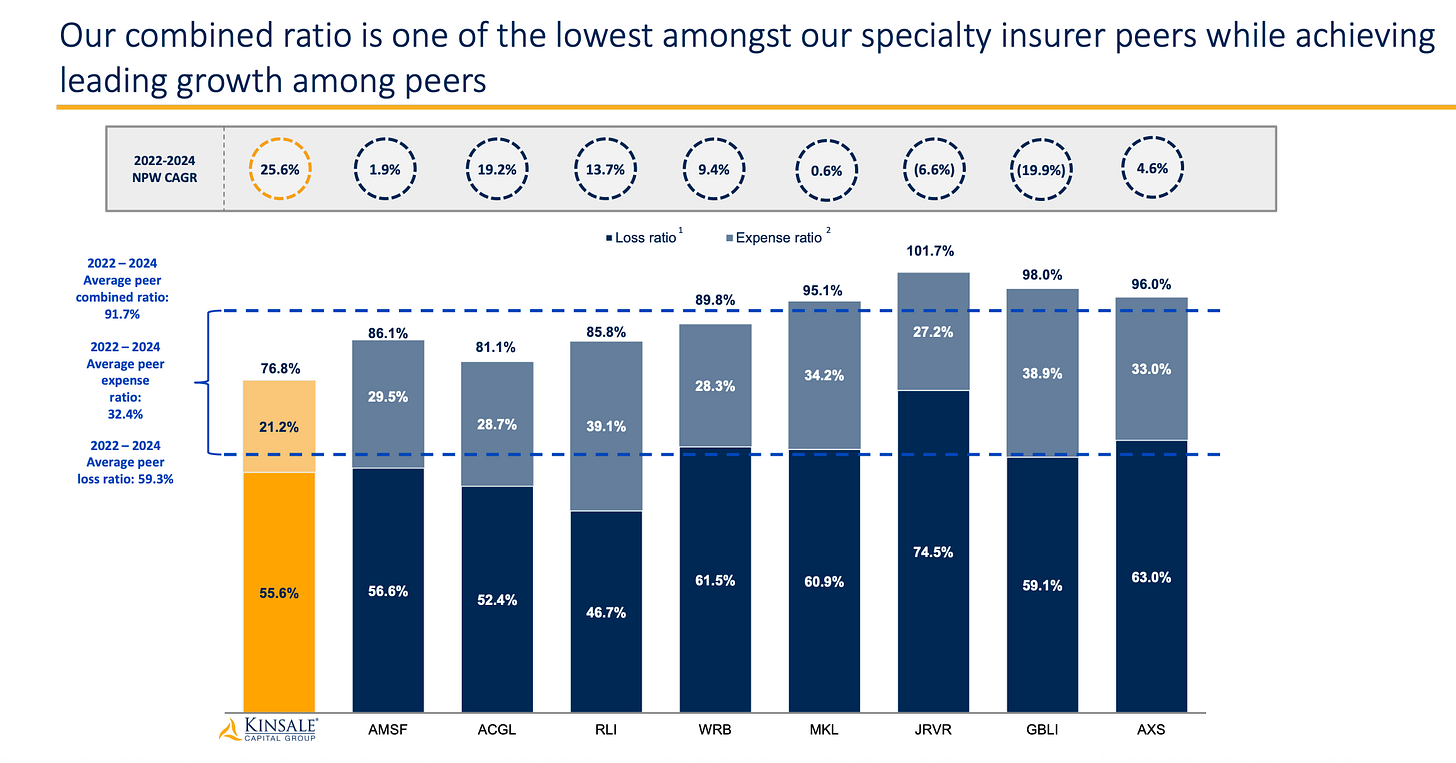

Kinsale are the only pure-play carrier that built its own tech stack to ruthlessly automate the “boring” back-office work. While the industry giants are busy feeding legacy mainframes and paying brokers to play golf, Kinsale uses its tech to strangle the expense ratio down to the low 20s (the industry average is often bloated in the 30s).

They focus on small accounts and they retain absolute control over the data. This isn’t just an insurer; it is a margin extraction machine operating in a muddy field.

The Setup

So, Kinsale deals in “weird risk.” They price the unlovable, take the premium, invest it, and wait for the claims. Sounds dull.

Until you check the mechanics.

A combined ratio under 100% means the engine generates profit before they even touch the investment portfolio.

This quarter wasn’t divine intervention. It was… routine. But there is a crack in the windshield: growth looks fine on the surface, but the heavy lifter, Commercial Propert, is fighting a much tougher tape.

[KNSL][REPORTED (GAAP)][Q3 2025] KEY STATS

GROSS WRITTEN PREMIUMS (USD)...........486,251,000

NET EARNED PREMIUMS (USD)..............410,957,000

UNDERWRITING INCOME (USD)..............105,672,000 (NON-GAAP)

NET INVESTMENT INCOME (USD)............49,604,000

NET INCOME (USD).......................141,646,000Personal Stake: No position. Watching from the sidelines.

What the market thinks right now (Bulls vs Bears)

Market: “Great underwriter. Now prove you don’t melt when the property backdrop gets soft.”

Bull: “Pure compounding. The product isn’t insurance; it’s discipline.”

Bear: “You mistook luck for skill. Peak conditions plus a reinsurance tailwind.”

We are here to see if the underwriting gears grind or glide as commercial property cools off and retention rises.

Atomic Take: Kinsale prints underwriting profit. But the growth mix is shifting. The “easy” money is getting harder to keep.

What breaks this? The combined ratio cracks above 85% and stays there (vs 77.5% for 9M 2025, reported).

Balance Sheet: The Geiger Test

Insurers run on scary-looking liabilities. That’s the business model. Loss reserves are future claims; unearned premiums are cash they haven’t earned yet.

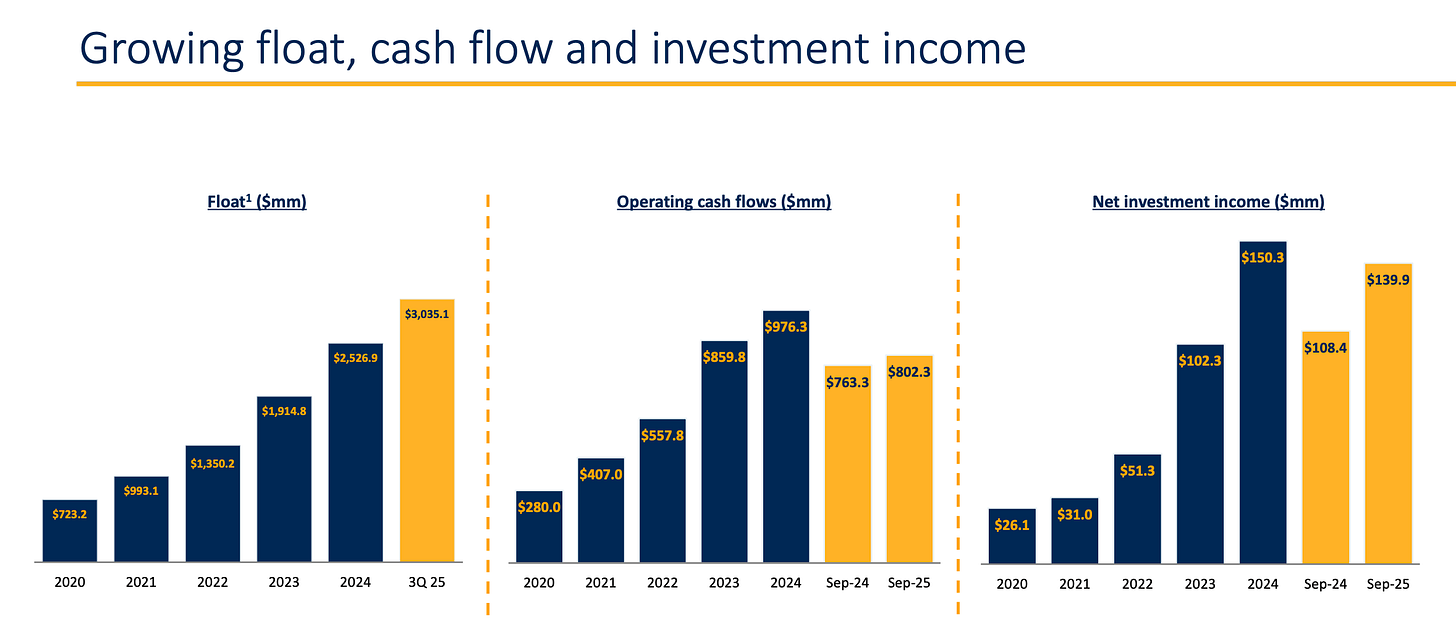

As of 30 Sep 2025, Kinsale sat on $2.77b of reserves for unpaid losses and LAE and $909.6m of unearned premiums.

The asset side backs those promises. Management listed cash and invested assets of $4.9b at 30 Sep 2025, anchored by $4.2b of fixed-maturity securities.

The number-free truth: This balance sheet is engineered to induce sleep.

[KNSL][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

TOTAL ASSETS (USD).....................5,833,305,000

CASH & CASH EQUIVALENTS (USD)..........170,162,000

FIXED-MATURITY SECURITIES FV (USD).....4,171,238,000

EQUITY SECURITIES (USD)................571,100,000

TOTAL STOCKHOLDERS’ EQUITY (USD).......1,865,217,000The Audit

Optical Illusion #1: Don’t let “low debt” fool you. The real leverage isn’t the $199.3m of debt (GAAP). It’s the massive promise embedded in $2.77b of loss reserves.

Optical Illusion #2: Accumulated other comprehensive loss isn’t a mysterious leak. It’s bond math. AOCI hit $(36.2m) at 30 Sep 2025 (GAAP), an improvement from year-end.

Atomic Take: The balance sheet signals an insurer expecting to keep the privilege of holding a mountain of other people’s money.

What breaks this? Reserve volatility spikes. Specifically, prior-year development turns ugly (vs $(45.9m) favorable in 9M 2025, reported).

Cash Flow: Energy Output

In this game, “cash from operations” is a mix of underwriting skill and timing—when the check clears vs. when the claim hits.

Kinsale reported $802.3m of net cash provided by operating activities for 9M ended 30 Sep 2025.

Ignore standard “investing cash flow” logic. Here, that’s just the portfolio breathing (securities trading). The real Capex is just property and equipment.

The number-free truth: Cash timing is a feature. It is also a trap.

[KNSL][REPORTED (GAAP)][9M 2025] KEY STATS

CASH FROM OPS (USD)....................802,344,000

PURCHASE OF PPE (USD)..................43,083,000

CASH-AFTER-INVESTMENTS (USD)...........759,261,000 (CFO - PPE)

CASH & CASH EQUIVALENTS END (USD)......170,162,000The Audit

Management warns the plumbing is noisy: claim payments and reinsurance receipts shake the pipes from quarter to quarter.

Also: financing outflows aren’t just dividends. They include buybacks and payroll taxes on equity awards. “Cash returned” is messy.

Atomic Take: The engine hums, but the odometer twitches. Claims don’t respect office hours.

What breaks this?

Operating cash flow starts dragging behind underwriting profit for multiple periods.

Share Capital & Insiders: Nucleus Check

Kinsale returns capital while growing equity. That is the cleanest signal of confidence in the insurance game.

During 9M 2025, they shipped $0.51 per share in dividends and bought back $40.0m of stock.

Shares outstanding sat at 23.26m at quarter-end.

The number-free truth: Buybacks are easy when the core engine leaks cash in the right direction.

[KNSL][REPORTED (GAAP)][AS OF 30 SEP 2025] KEY STATS

SHARES OUTSTANDING (SHARES)............23,261,360

TREASURY STOCK COST (USD)..............49,999,000

DIVIDENDS DECLARED (USD/SHARE).........0.17 (Q3 2025)

DIVIDENDS PAID (USD/SHARE).............0.51 (9M 2025)

SHARE REPURCHASES (USD)................39,999,000 (9M 2025)Atomic Take: Shareholder returns look calculated, not desperate. Small enough to remain optional.

What breaks this?

Payouts rise while the debt load climbs (baseline: total debt $199.3m as of 30 Sep 2025).

Income Statement: Reaction Chamber

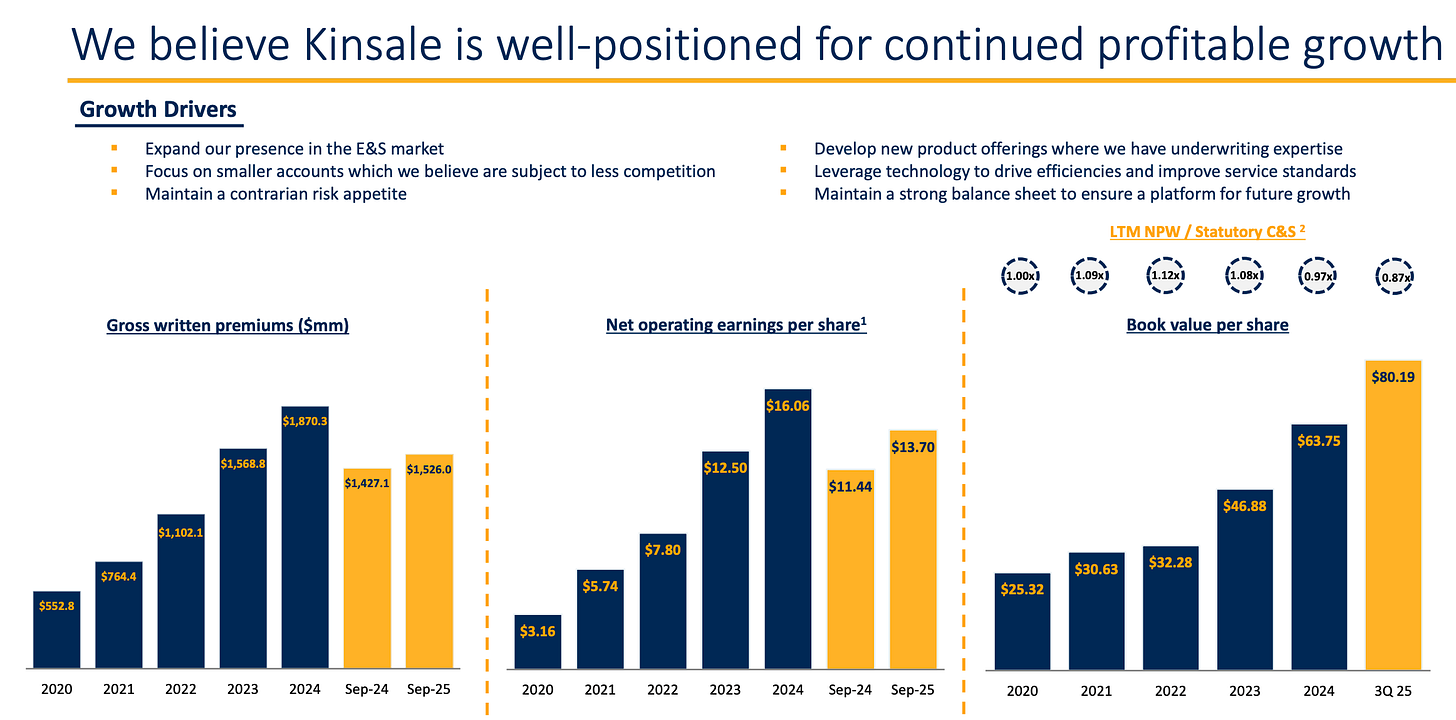

For 9M ended 30 Sep 2025, gross written premiums hit $1.53b. Net earned premiums landed at $1.16b.

The underwriting room stayed profitable. Combined ratio was 77.5%, driving underwriting income of $268.6m.

The growth plot has a twist. Commercial Property (the biggest division) saw gross written premiums shrink 15.2% in 9M 2025. The rest of the business grew 14.4%.

The number-free truth: Pricing power is the only scene that matters.

[KNSL][REPORTED (GAAP)][9M 2025] KEY STATS

GROSS WRITTEN PREMIUMS (USD)...........1,526,048,000

NET EARNED PREMIUMS (USD)..............1,160,360,000

UNDERWRITING INCOME (USD)..............268,586,000 (NON-GAAP)

COMBINED RATIO (PCT)...................77.5

NET INVESTMENT INCOME (USD)............139,896,000Quick Hits

Prior-year reserve development was $(45.9m) favorable in 9M 2025.

Catastrophe losses hit $27.5m in 9M 2025.

Net retention ratio climbed to 81.6%.

Expense ratio clocked in at 20.6%.

Investment portfolio gross investment return ran at 4.3% annualized for 9M 2025.

Holding more risk (retention) boosts future profit but spikes the expense ratio as ceding commissions vanish. Management blames lower ceding commissions for the expense pressure.

Investment income is morphing into a tailwind: net investment income hit $139.9m for 9M 2025 (GAAP), up from the prior year.

The Scorecard

This is the filter. We separate the noise from the signal, then name the metric that proves the thesis right or wrong.

Signal 1: Commercial property competitiveness

🔒 FACT: Commercial Property gross written premiums dropped 15.2% in 9M 2025.

🧠 HYPOTHESIS: The broader book outruns the property drag without cutting corners.

📈 MONITOR: Gross written premiums excluding Commercial Property stays above 14.4% growth.

Signal 2: Reserve “good news” durability

🔒 FACT: Prior accident years developed favorably by $45.9m in 9M 2025

🧠 HYPOTHESIS: This is a tailwind, not a lottery ticket.

📈 MONITOR: Prior-year development doesn’t turn ugly relative to the $45.9m favorable baseline (9M 2025).

Signal 3: Retention and reinsurance economics

🔒 FACT: Net retention ratio jumped to 81.6% in 9M 2025.

🧠 HYPOTHESIS: Profit rises faster than volatility.

📈 MONITOR: Combined ratio holds the 77.5% line while retention stays high (9M 2025 baseline).

Atomic Take: The underwriting is elite. But the mix is rotating toward lines that demand you prove it every quarter.

What breaks this?

Reserve development flips and cat losses shove the combined ratio meaningfully above the 77.5% baseline.

The Atomic Verdict

Quality: Underwriting profitability is exceptional at 77.5% combined ratio for 9M 2025.

Health: Balance sheet holds $1.87b stockholders’ equity as of 30 Sep 2025.

Overhang: Pricing pressure is visible. Commercial Property GWP fell 15.2% in 9M 2025.

What must happen next: Non-property lines keep scaling without losing the reserve discipline shown by $45.9m favorable development (9M 2025).

Status: STABLE ISOTOPE (Watchlist)

Stars: ★★★★☆ — underwriting machine stays cold; growth mix is getting harder.

Upgrade Triggers

Commercial Property returns to non-negative gross written premium growth (baseline: -15.2% in 9M 2025).

Combined ratio holds at or below the 77.5% 9M 2025 baseline while retention remains elevated.

Operating cash flow stays heavy versus the $802.3m 9M 2025 baseline.

Downgrade Triggers

Prior-year development turns adverse against the $45.9m favorable 9M 2025 baseline.

Catastrophe losses breach the $27.5m 9M 2025 level.

Credit Facility borrowing becomes a habit, not a bridge (baseline: $26.0m outstanding at 30 Sep 2025.

…So, what about Shelby?

Shelby Davis didn’t build a dynasty by betting on miracles. He bet on math. He bet on managers who refused to write a bad policy just to hit a quarterly target.

In my opinion, Kinsale is currently passing the Davis test, even though it does not currently fulfill the Davis Double Play. That 77.5% combined ratio is the kind of boring excellence he would have framed on his wall. The “alchemy” is working: the cash is coming in before the product goes out, and the float is building.

But even the best toll booth suffers when the traffic pattern changes. The machine is engineered correctly, but the road beneath it (commercial property) is getting rougher.

The question isn’t whether the engine works; we know it does. The question is whether you have the stomach to hold the “lab coat” while it gets splattered by a softening cycle.

Davis held for 47 years. If you have that kind of timeline, the current property drag is just noise. If you don’t, keep your eyes on the fenders.

What do you think? Is Kinsale a company Davis would have liked? or even more important, do YOU like it?

Comment below!

Disclaimer

Atomic Moat Research is a “bolt-on” intelligence layer. Use it to check your work, not replace it. I break down financial statements and models for the rational retail operator.

Independence: I take zero compensation from the companies I review. This research exists because I hunt high-quality compounders for myself.

Skin in the Game: Unless I say otherwise, assume I hold long positions in the assets discussed. I bet my own capital on my own analysis. That creates a bias. You should know that. I strive for institutional depth using the latest filings, but these are my opinions. I am not a financial advisor. Do your own homework before you deploy capital.

Kinsale is such a special business. I went pretty deep and wrote a ~100-page breakdown on it — if you feel like diving in, here you go 🙂

https://slowcompounding.substack.com/p/deep-dive-kinsale-capital-group-part

Shelby Davis also bought quality insurers cheap. Kinsale is by no measure cheap. There’s a term “the Davis double” coined since he relied on both fundamentals improving along with multiple expansion