The Titan Test: Would Peter Lynch Buy Duolingo Today?

Legendary investor Peter Lynch said to 'invest in what you know,' and everyone knows Duolingo. But does the math back up the meme? Let's put the 'Fast Grower' to the test.

New to The Atomic Moat? This Titan Test of Duolingo ($DUOL) is a prime example of how we dissect high-quality compounders. If you want these ‘Titan Tests’ sent to your inbox, join 900+ other investors below.

If you have ridden a subway in New York, a tube in London, or a tram in Oslo recently, you have likely heard the “ding.” It is a distinct, Pavlovian sound—a chirpy, gamified affirmation that someone, somewhere, just correctly translated “The cat eats the bread.”

Peter Lynch, the legendary manager of the Fidelity Magellan Fund, famously said that the best investment ideas aren’t found on Bloomberg terminals. They are found at the mall, in the grocery store, or in the hands of your commute neighbor.

Lynch called this “Investing in What You Know.”

But Lynch was also a ruthless mathematician. He didn’t buy Dunkin’ Donuts just because he liked the coffee; he bought it because the store economics were elite and the balance sheet was pristine. He combined the observational skills of a sociologist with the skepticism of an accountant.

Today, we apply the “Lynch Test” to Duolingo ($DUOL). We are looking at a company that has permeated global culture, but does it possess the financial “story” to back up the ubiquity?

Let’s walk through the Magellan lens.

Disclaimer: I own shares in Duolingo at the time of writing this. The Titan Test” is for informational and educational purposes only. It represents my opinions and should not be construed as professional financial, legal, or tax advice. I am analyzing businesses, not providing personal investment recommendations.

The Titan: Peter Lynch

The Strategy: Growth at a Reasonable Price (GARP)

From 1977 to 1990, Peter Lynch achieved a 29.2% average annual return, crushing the S&P 500. His philosophy was deceptively simple: categorize the stock, check the “story” (the qualitative moat), and then run the math to ensure you aren’t overpaying for growth.

Lynch avoided complex tech he didn’t understand. He preferred businesses with:

A Niche: A product people have to keep buying (or using).

Growth: Specifically, earnings growth.

A Clean Balance Sheet: “Net Cash” was his safety net.

A Low PEG Ratio: He wanted growth to be higher than the P/E ratio.

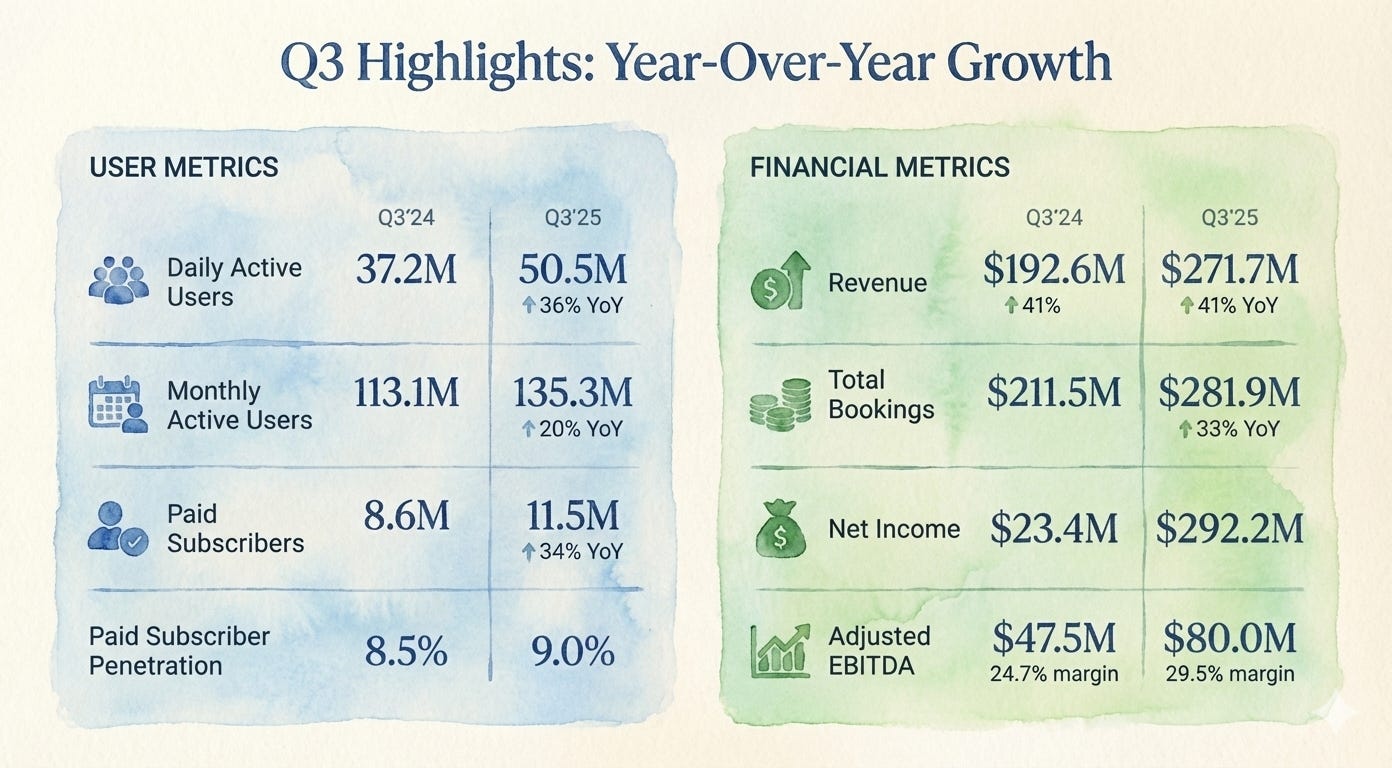

He divided stocks into categories like “Slow Growers,” “Stalwarts,” and “Fast Growers.” Duolingo, growing revenue at 41% (Q3 2025), squarely fits Lynch’s favorite category: The Fast Grower.

The question is: Is it a Fast Grower that will eventually hit a wall, or is it a “Tenbagger” in disguise?

Pillar 1: The “Mall Test” and The Story

Lynch’s Question: Does the product have a recurring habit loop, and can you explain the business to a fifth grader in two minutes?

If you tried to explain a semiconductor lithography machine to a child, you would fail. Duolingo passes the Lynch simplicity test with flying colors:

“It’s an app that teaches you languages like a game. People pay to remove ads and get extra lives.”

Lynch loved companies that didn’t rely on the economy to succeed. People learn languages regardless of interest rates. But what would truly pique Lynch’s interest here is the addiction metrics.

In Q3 2025, Duolingo reported 50.5 million Daily Active Users (DAUs). More importantly, the ratio of daily users to monthly users is ~37%. This is not an app people download and forget; it is a digital habit.

The “Unhinged” Moat

Lynch often looked for a company with a “niche” that was hard to dislodge. Duolingo’s moat is partially brand-driven. The “unhinged” social media strategy, where the owl mascot threatens users to keep their streaks alive, has created a cultural phenomenon that traditional advertising cannot buy.

However, Lynch would spot a risk here. He was wary of companies that relied heavily on a single supplier or customer. Duolingo lives on “rented land.”

The Landlords: Apple and Google process ~85% of revenues combined.

The Risk: If the landlord raises the rent (app store fees), the profit margin suffers.

The Lynch Verdict on “The Story”: Strong. It is a consumer staple in the digital age with high visibility. He would check this box but immediately pivot to the balance sheet to see if they can afford their rent.

Pillar 2: The Balance Sheet (The “Net Cash” Rule)

Lynch’s Question: How much cash is hidden in the share price?

Peter Lynch hated debt. He famously said, “It’s very hard to go bankrupt if you don’t have any debt.” He preferred to look at the “Net Cash” per share to see what he was really paying for the business.

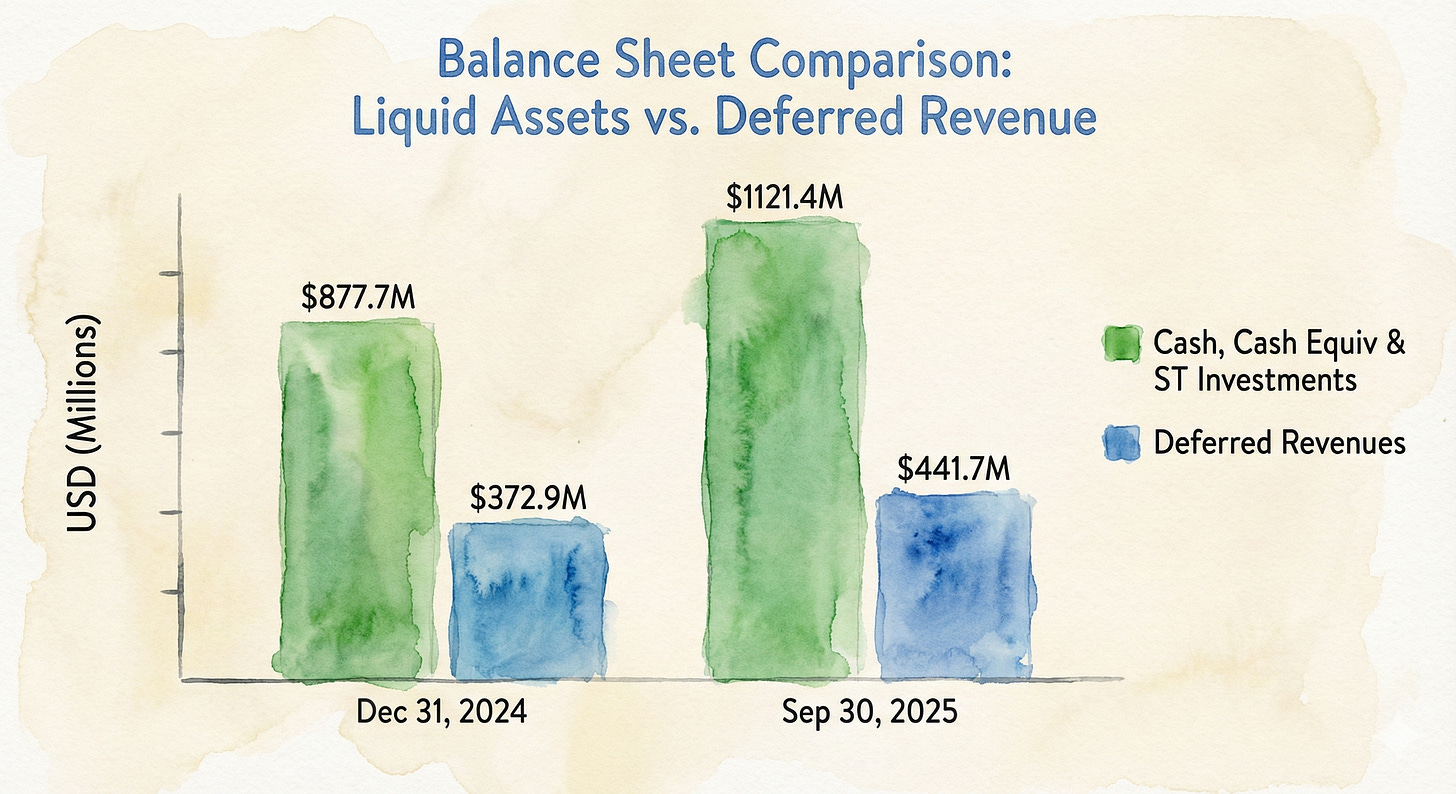

Let’s look at Duolingo’s Q3 2025 numbers through Lynch’s eyes:

Cash & Investments: $1.12 Billion.

Debt: Negligible (mostly operating leases for offices).

Shares Outstanding: ~49.9 million.

The Calculation: $1,120,000,000 Cash ÷ 49,900,000 Shares = ~$22.44 per share in CashWith the stock trading at around $173, Lynch would mentally strip out that cash. And adjusting for cash, the market is effectively valuing the operating business at ~$151 per share.

Lynch viewed a high cash position as two things:

Insurance: Protection against bad times.

A War Chest: Ability to expand without borrowing at high rates.

Furthermore, he would love the Deferred Revenue of $441.7 million. Lynch understood that in subscription businesses, cash often comes in before the earnings are recognized. Duolingo is collecting cash faster than it reports income—a dynamic that often confuses novice investors but delights seasoned ones.

Stop & Think: Duolingo has more cash on hand than it has liabilities of any kind. This is exactly the kind of “Fortress Balance Sheet” that allows a Fast Grower to survive mistakes.

Pillar 3: The PEG Ratio (Valuation)

Lynch’s Question: Is the growth free, or are we paying too much for it?

This is the most critical part of the Titan Test. Lynch popularized the PEG Ratio (Price/Earnings-to-Growth).4 His rule of thumb:

PEG < 1.0: The stock is cheap (Growth rate > P/E ratio).

PEG = 1.0: Fairly valued.

PEG > 2.0: Expensive.

The Earnings Trap

Lynch would be very careful with Duolingo’s Q3 2025 Net Income. The reported GAAP net income was $292.2 million, but this included a one-time tax benefit of $222.7 million. Lynch warned repeatedly about “diworsification” and one-time earnings spikes. He would strip that tax benefit out immediately to find the real earnings power.

Instead of the distorted Net Income, Lynch would likely look at the Adjusted EBITDA or Operating Cash Flow to gauge the engine’s power.

Running the Numbers:

Current EV/EBITDA (FY2025 Guide): ~25.3x.

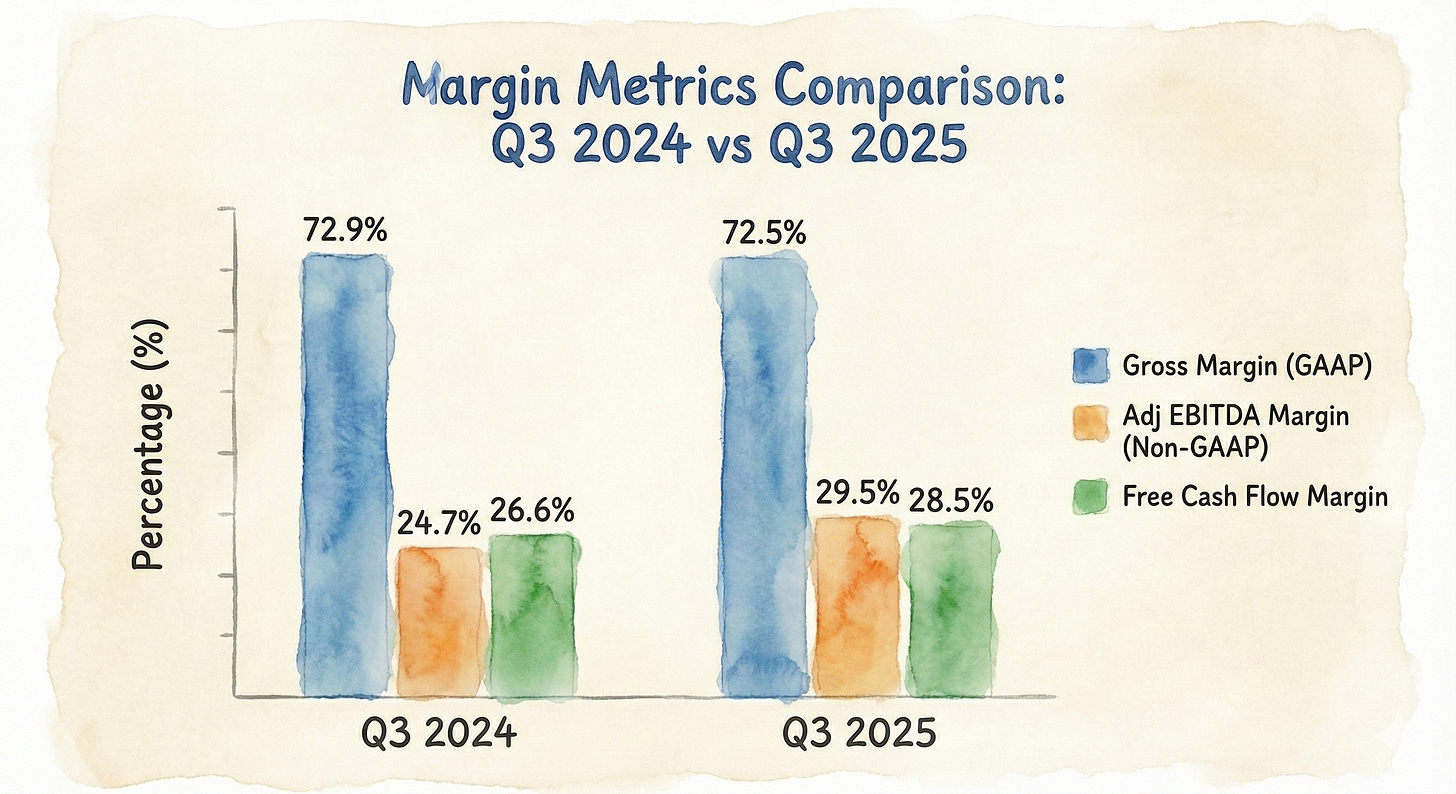

Growth Rate: Revenue grew 41%, and Bookings grew 33%. Adjusted EBITDA is scaling rapidly.

If we use the EBITDA multiple (25x) as a proxy for P/E in a high-growth phase, and compare it to the growth rate (~30-35% conservative sustainable growth):

PEG Proxy = 25 (Multiple) ÷ 33 (Growth Rate) = 0.75

The Lynch Interpretation:

A ratio of 0.75 suggests the stock is undervalued relative to its growth. Lynch would argue that the market is pricing Duolingo as a “Stalwart” (10-12% growth), but it is still behaving like a “Fast Grower” (30%+ growth).

However, he would have one major reservation: Margins vs. The “Next Thing.”

Gross margins declined slightly to 72.5% due to AI costs. Lynch was hawkish on inventory; for a software company, “inventory” is headcount and server costs. If the cost to service each user (AI compute) rises faster than the subscription price, the growth becomes “empty.”

He would closely monitor if the company is spending too much on “diworsification”—trying to teach Math and Music—before fully monetizing the Language core.

The Verdict: Would Lynch Buy?

We have applied the lens of the Magellan Fund to the Owl of Pittsburgh.

The Positives:

Category: Classic “Fast Grower” with visible consumer habit (”Invest in what you know”).

Balance Sheet: $22+ per share in net cash; zero structural debt.

Valuation: Trading at a PEG proxy of < 1.0, assuming 30% growth persists.

Cash Flow: Free Cash Flow margin is elite at 28.5%.

The Negatives:

Platform Risk: Lynch disliked relying on a single buyer/supplier. Apple and Google hold the keys to the castle.

AI Costs: Rising “inventory” costs (compute) are pressuring gross margins.

The Titan’s Decision: Lynch would probably like it at todays price - based on the framework used in this analysis.

Peter Lynch would likely view Duolingo as a classic “Fast Grower” in the second inning. The company is profitable, cash-rich, and growing faster than its earnings multiple implies.

He would, however, apply his famous dictum: “You marry the girl, you don’t marry the stock.”

I do think he would watch the Daily Active User (DAU) count religiously. For Lynch, the moment the “story” (user addiction) breaks, or the balance sheet deteriorates (spending cash on foolish acquisitions), he would be out.

‘Buying what you know’ is a cornerstone of Peter Lynch’s framework, but it’s only the first step. After finding a company you understand, you must analyze its fundamentals. Duolingo is an excellent candidate for this approach. To see the framework in action, read my analysis of Jack in the Box here.

The Atomic Takeaway

We often overcomplicate investing with complex macro-theses. Lynch reminds us to keep it simple. Duolingo is a company with a product people use daily, a balance sheet that lets them sleep at night, and a price tag that—for the first time in years—offers a more attractive entry point relative to its growth rate

Compounding is the eighth wonder of the world. But it only works if you don’t overpay for the machine.

Rob H.

Disclaimer

Not Financial Advice: The content provided in “The Atomic Moat” and “The Titan Test” is for informational and educational purposes only. It represents the opinions of the author and should not be construed as professional financial, legal, or tax advice. We are analyzing businesses, not providing personal investment recommendations.

Do Your Own Research: Financial markets are inherently risky. The strategies and frameworks discussed (including those of Peter Lynch) may not be suitable for your specific risk tolerance or time horizon. Always conduct your own due diligence or consult with a licensed financial advisor before making any investment decisions.

Disclosure: At the time of writing, the author (Rob H.) holds a long position in Duolingo ($DUOL). We believe in eating our own cooking, but this creates an inherent bias. Please read the analysis with that context in mind.

No Guarantees: Past performance is not indicative of future results. The numbers, figures, and “falsifiers” presented are based on current data and management guidance, which are subject to change without notice.